Category Archive: 5.) The United States

Good or Bad, But Surely Not Transitory

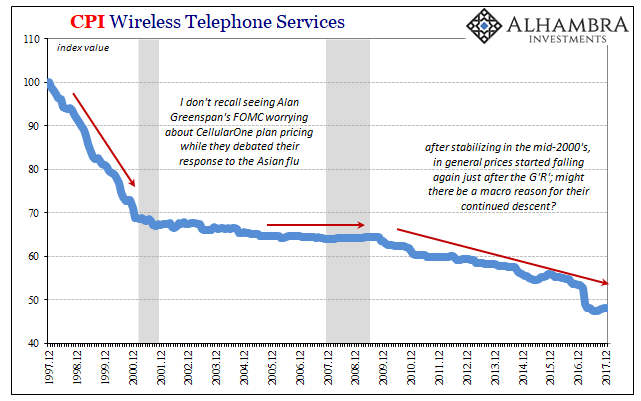

When Federal Reserve officials first started last year to mention wireless network data plans as a possible explanation for a fifth year of “transitory” factors holding back consumer price inflation, it seemed a bit transparent. One of the reasons for immediately doubting their sincerity was the history of that particular piece of the CPI (or PCE Deflator).

Read More »

Read More »

Is Un-Humming A Word? It Might Need To Become One

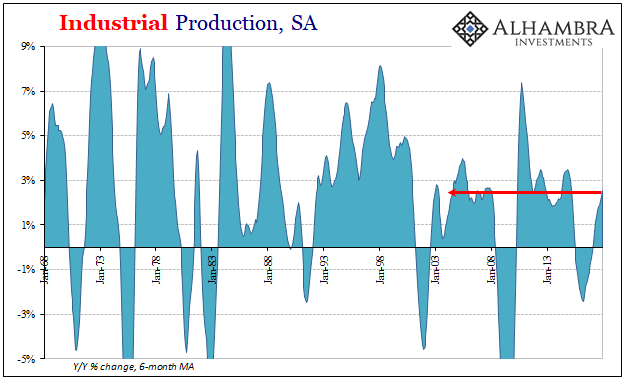

Industrial Production in the US was up 3.6% year-over-year in December 2017. That’s the best for American industry since November 2014 when annual IP growth was 3.7%. That’s ultimately the problem, though, given all that has happened this year. In other words, despite a clear boost the past few months from storm effects, as well as huge contributions from the mining (crude oil) sector, American production at its best can only manage to reflect...

Read More »

Read More »

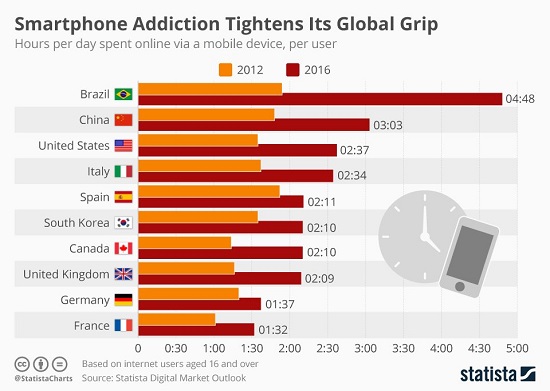

Nous sommes colonisés par le numérique des multinationales américaines

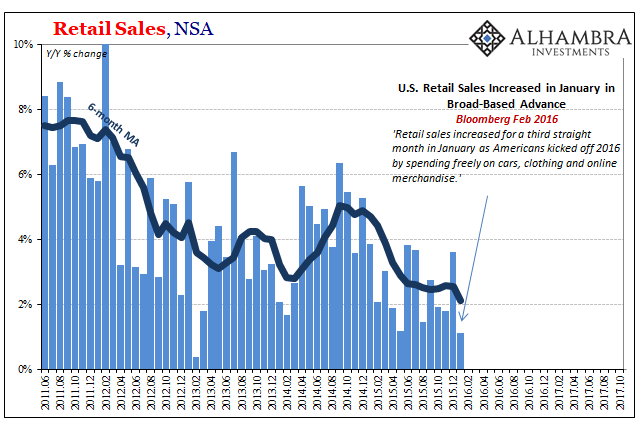

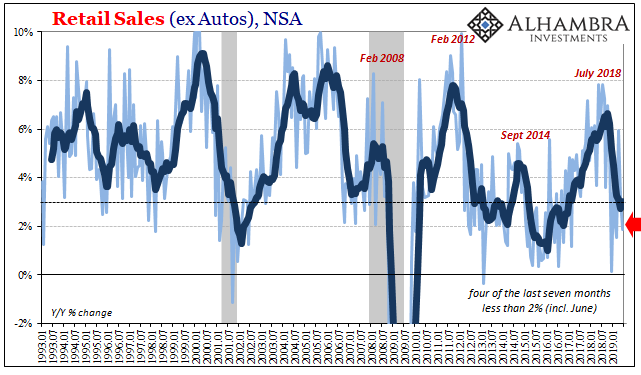

La révolution numérique est une réalité qui envahit tous les jours plus les sphères publiques et privées…. Qu’en est-il du commerce de détails? Les visuels ci-dessous nous montrent d’abord que certaines habitudes d’achats dans les commerces traditionnels sont maintenues.

Read More »

Read More »

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits.

Read More »

Read More »

The Fascinating Psychology of Blowoff Tops

The psychology of blowoff tops in asset bubbles is fascinating: let's start with the first requirement of a move qualifying as a blowoff top, which is the vast majority of participants deny the move is a blowoff top.

Read More »

Read More »

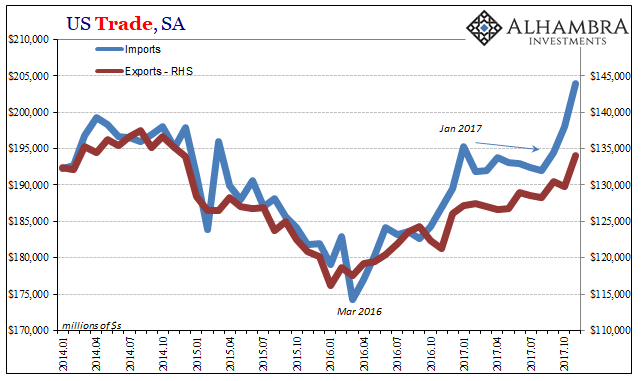

The Conspicuous Rush To Import

According to the Census Bureau, US companies have been importing foreign goods at a relentless pace. In estimates released last week, seasonally-adjusted US imports jumped to $204 billion in November 2017. That’s a record high finally surpassing the $200 billion mark for the first time, as well as the peaks for both 2014 and 2007.

Read More »

Read More »

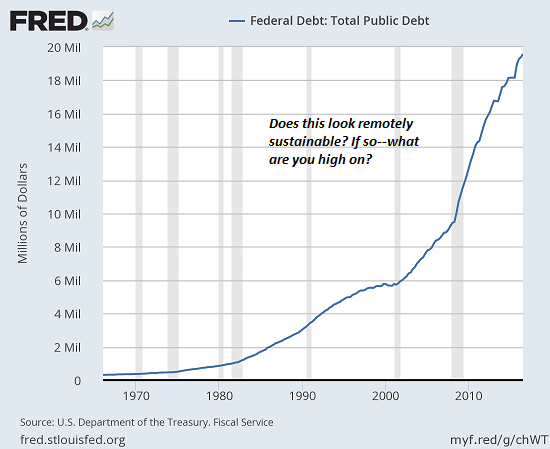

Yes, But at What Cost?

This is how our entire status quo maintains the illusion of normalcy: by avoiding a full accounting of the costs. The economy's going great--but at what cost? "Normalcy" has been restored, but at what cost? Profits are soaring, but at what cost? Our pain is being reduced--but at what cost? The status quo delights in celebrating gains, but the costs required to generate those gains are ignored for one simple reason: the costs exceed the gains by a...

Read More »

Read More »

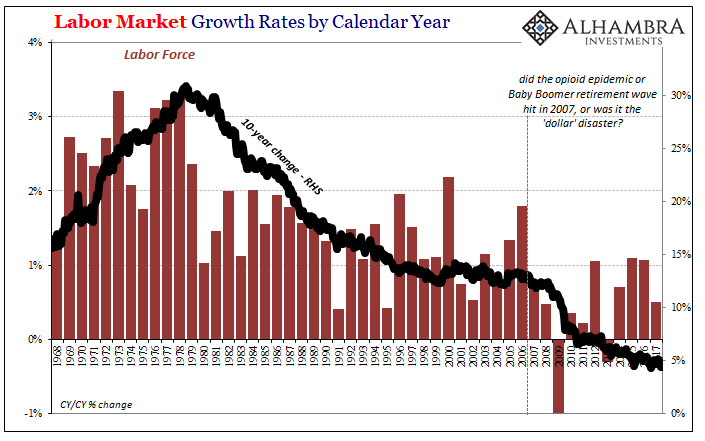

The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016.

Read More »

Read More »

The Great Risk of So Many Dinosaurs

The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals and leaders was one of the few...

Read More »

Read More »

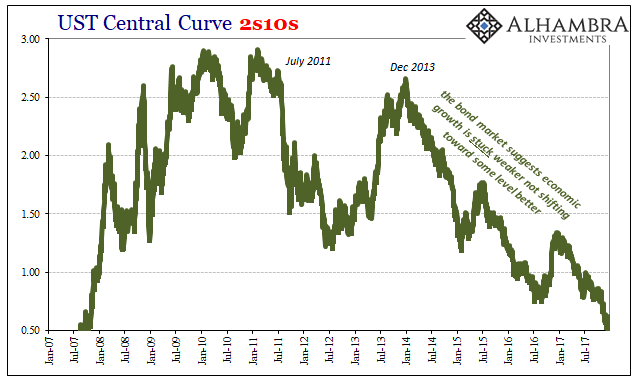

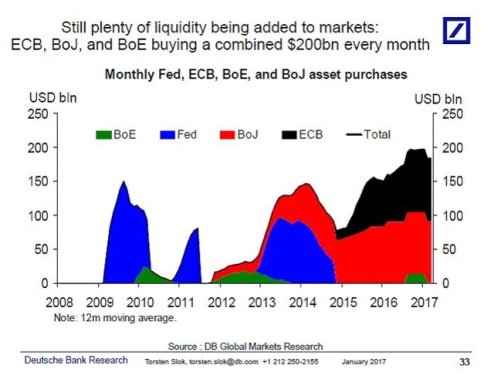

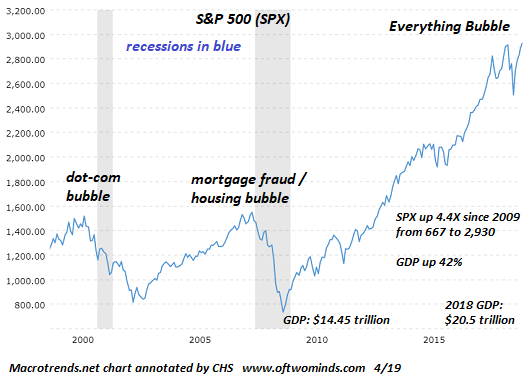

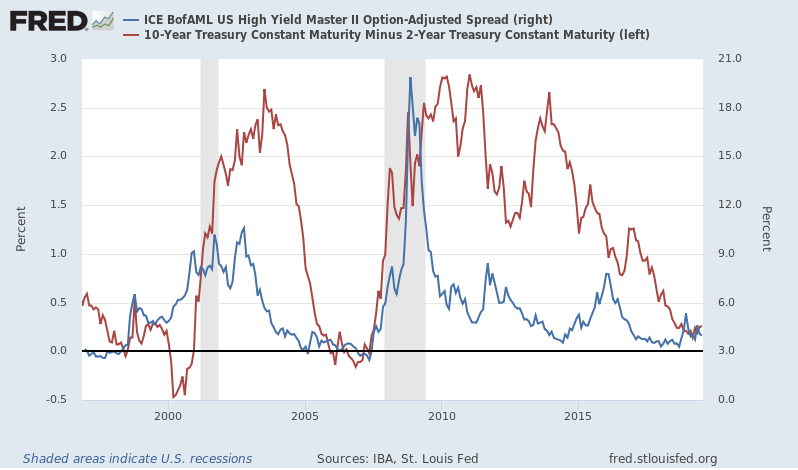

Why the Financial System Will Break: You Can’t “Normalize” Markets that Depend on Extreme Monetary Stimulus

Central banks are now trapped. In a nutshell, central banks are promising to "normalize" their monetary policy extremes in 2018. Nice, but there's a problem: you can't "normalize" markets that are now entirely dependent on extremes of monetary stimulus. Attempts to "normalize" will break the markets and the financial system. Let's start with the core dynamic of the global economy and nosebleed-valuation markets: credit.

Read More »

Read More »

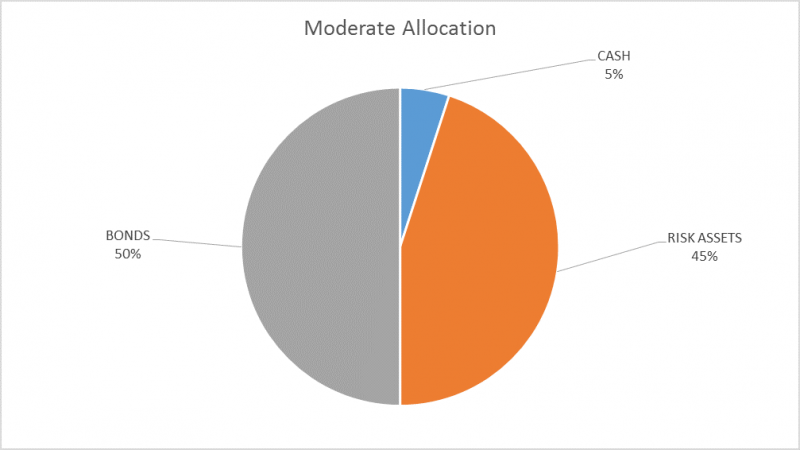

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged.

Read More »

Read More »

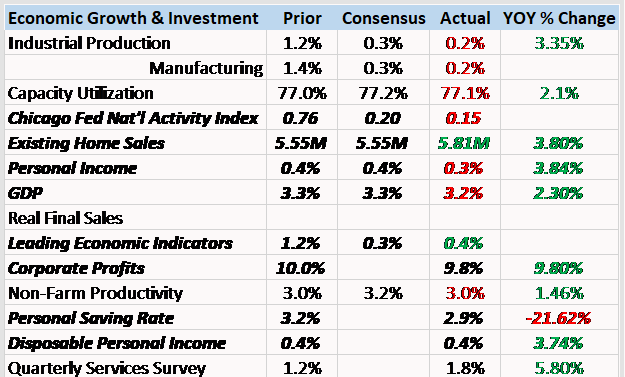

Bi-Weekly Economic Review: Housing Market Accelerates

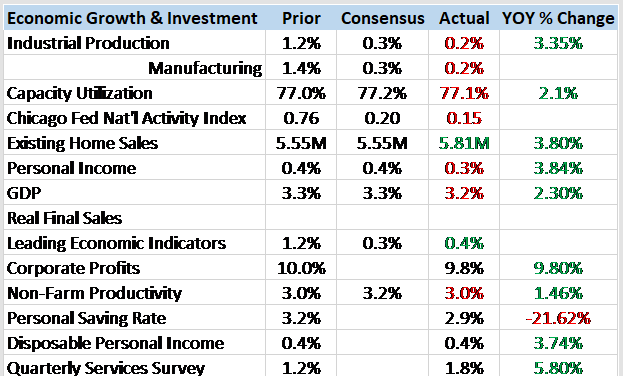

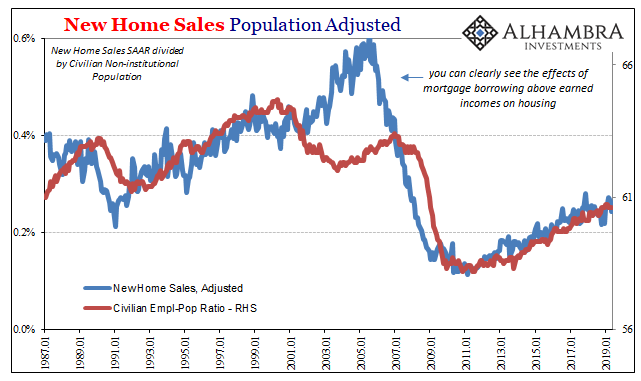

The economy ended 2017 with current growth just slightly above trend. In general the reports of the last two weeks of the year were pretty good with housing a standout performer going into the new year. We are still trying to get past the impact – positive and negative – from the hurricanes a few months ago though so it is probably prudent to wait for more evidence before making any definitive pronouncements about the economy.

Read More »

Read More »

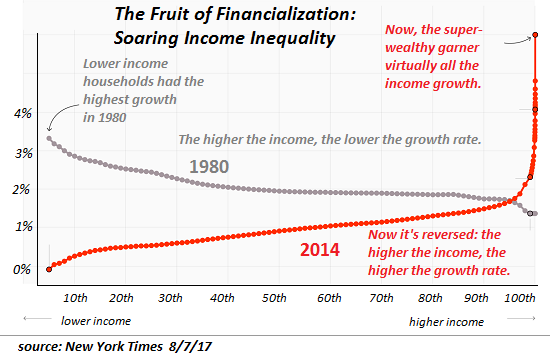

The Hidden-in-Plain-Sight Mechanism of the Super-Wealthy: Money-Laundering 2.0

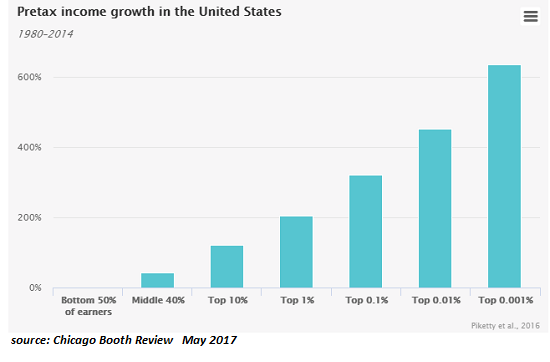

Financial and political power are two sides of one coin. We all know the rich are getting richer, and the super-rich are getting super-richer. This reality is illustrated in the chart of income gains, the vast majority of which have flowed to the top .01%--not the top 1%, or the top .1% -- to the very tippy top of the wealth-power pyramid.

Read More »

Read More »

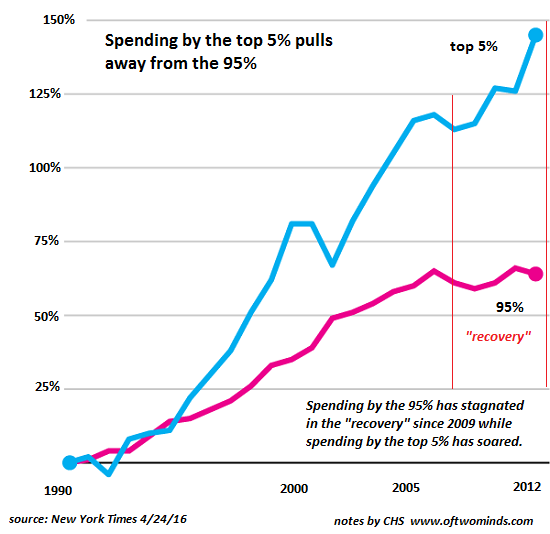

“Wealth Effect” = Widening Wealth Inequality

Note that widening wealth and income inequality is a non-partisan trend. One of the core goals of the Federal Reserve's monetary policies of the past 9 years is to generate the "wealth effect": by pushing the valuations of stocks and bonds higher, American households will feel wealthier, and hence be more willing to borrow and spend, even if they didn't actually reap any gains by selling stocks and bonds that gained value.

Read More »

Read More »

Christmas 2017: Why I’m Hopeful

A more human world lies just beyond the edge of the Status Quo. Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn't leave much to be happy about.

Read More »

Read More »

Santa’s Stock Market Rally: Tears of Joy, Or Just Tears?

Judging by this year's version of Santa Claus's reliable year-end stock market rally, risk has vanished, not just in stocks but in bonds, junk bonds, housing, commercial real estate, collectible art--just about the entire spectrum of tradable assets (with precious metals and agricultural commodities among the few receiving coals rather than rallies).

Read More »

Read More »

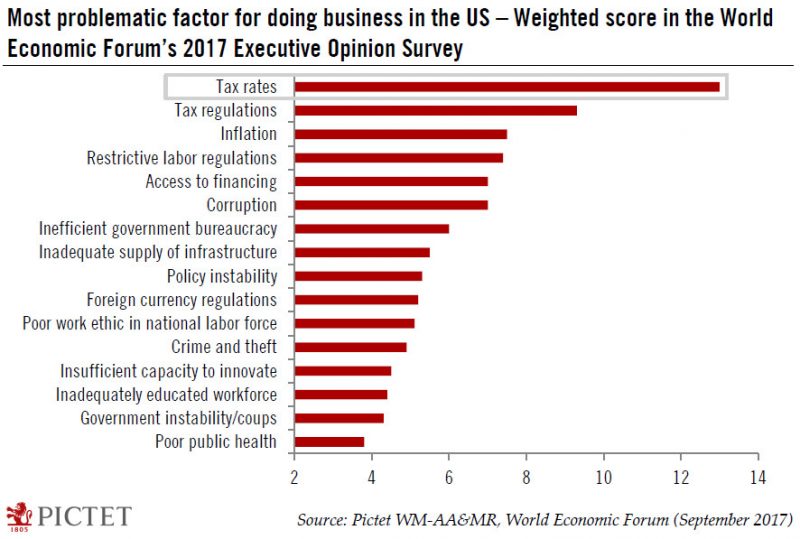

US to overtake Switzerland in WEF competitiveness survey?

The US is about to enact significant corporate tax cuts, and could therefore edge closer to the number 1 spot in the World Economic Forum’s ranking – currently held by Switzerland. The US is about to enact significant corporate tax cuts, that will see the federal statutory corporate tax rate drop to 21%, from 35%, starting in January (see our latest note ‘US tax cuts update – 19 December 2017’).

Read More »

Read More »

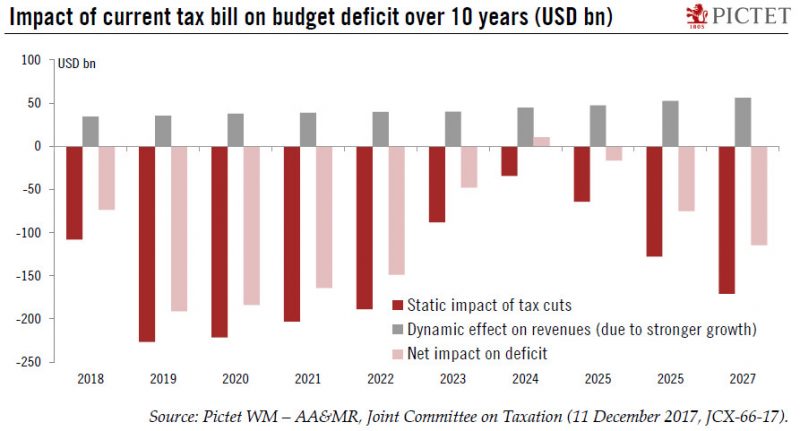

US tax bill looks set to pass

The tax bill continues to make its way through Congress at a swift pace, and now looks increasingly likely to be enacted into law this week, after clearing the conference committee hurdle (a compromise between the House and Senate versions). A few hesitating Republican Senators have eventually said they will vote in favour of the bill, which is key as the Republican majority in the Senate is slim at 52-48. It will shrink to 51-49 in January after...

Read More »

Read More »

Federal Council adopts measures to tackle high prices in Switzerland

On 20 December the Federal Council decided to unilaterally remove tariffs on imported industrial goods. Tariffs will also be reduced on selected agricultural goods not produced in Switzerland. Furthermore, the government wants to apply the Cassis de Dijon principle more widely by reducing the number of exceptions to it. These measures should lead to considerable savings of around CHF 900 million for businesses and consumers. Previously, on 8...

Read More »

Read More »