Category Archive: 5.) The United States

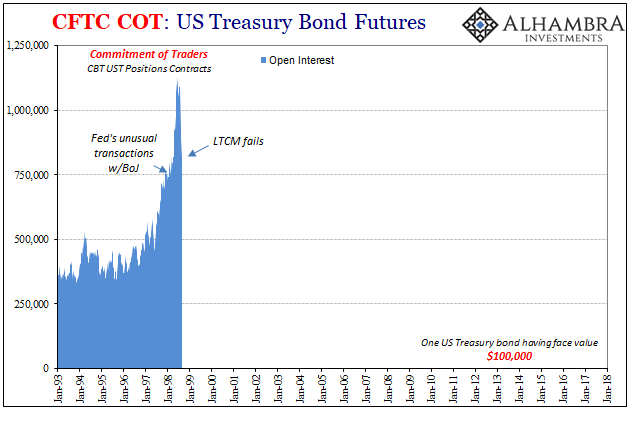

COT Blue: Interest In Open Interest

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders.

Read More »

Read More »

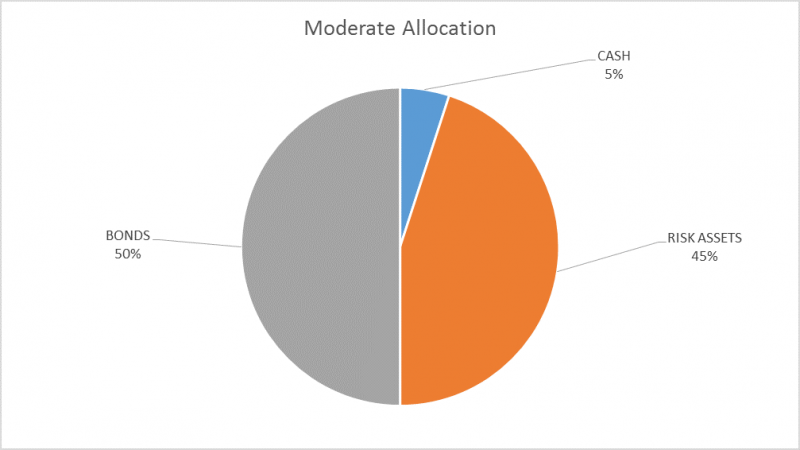

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »

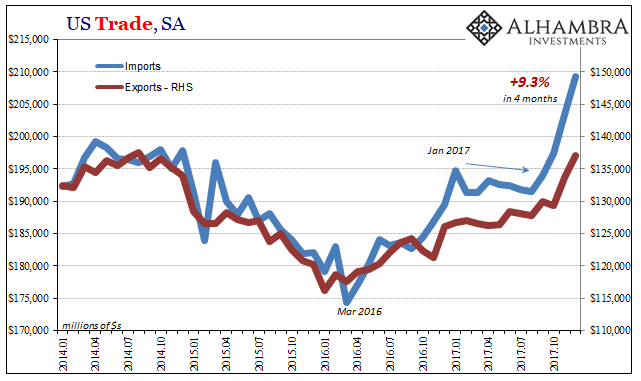

US Imports: A Little Inflation For Yellen, A Little More Bastiat

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

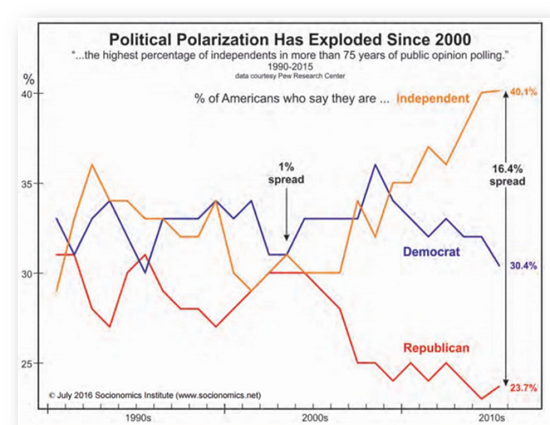

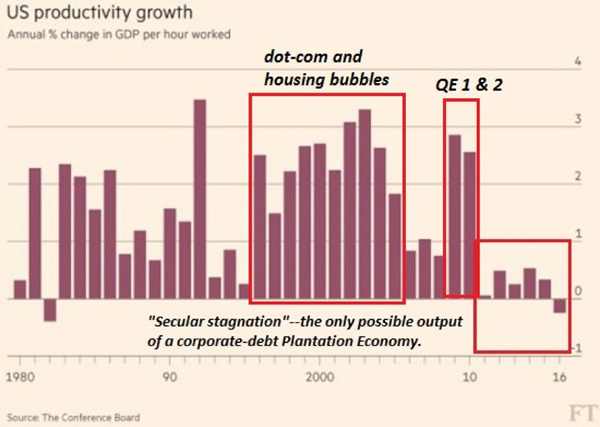

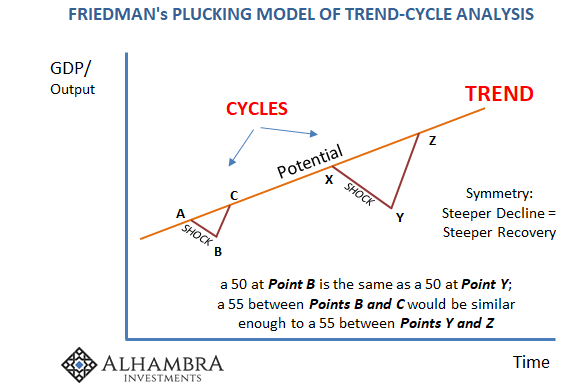

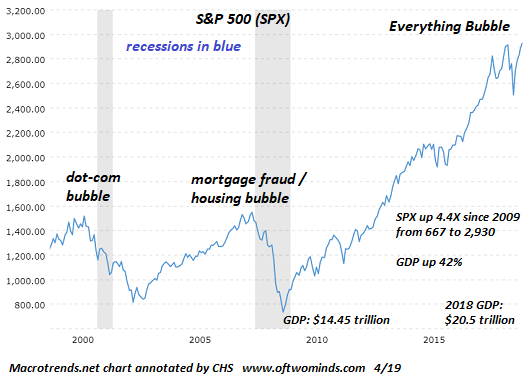

Is the 9-Year Long Dead Cat Bounce Finally Ending?

Ignoring or downplaying these fundamental forces has greatly increased the fragility of the status quo. The term dead cat bounce is market lingo for a "recovery" after markets decline due to fundamental reversals. Markets tend to bounce back after sharp declines as participants (human and digital) who have been trained to "buy the dips" once again buy the decline, and the financial media rushes to reassure everyone that nothing has actually...

Read More »

Read More »

Is Congress Finally Pushing Back Against Security Agencies’ Over-Reach?

The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation's Security Agencies was 43 years ago, in 1975. In response to the criminal over-reach of the Imperial Presidency (Watergate) and to the criminal over-reach of the security agencies (FBI, CIA, et al.), the Church Committee finally resusitated the constitutional powers of the Congress to serve the interests of the citizenry rather than the...

Read More »

Read More »

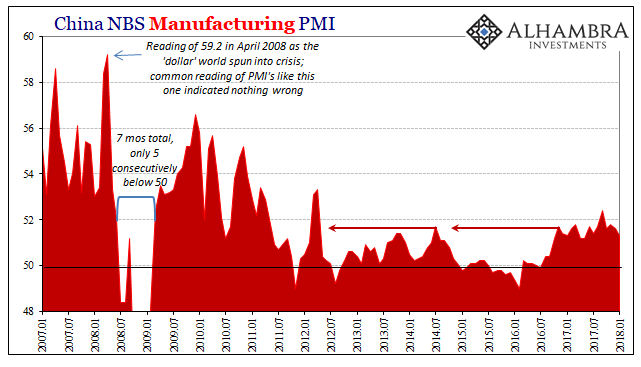

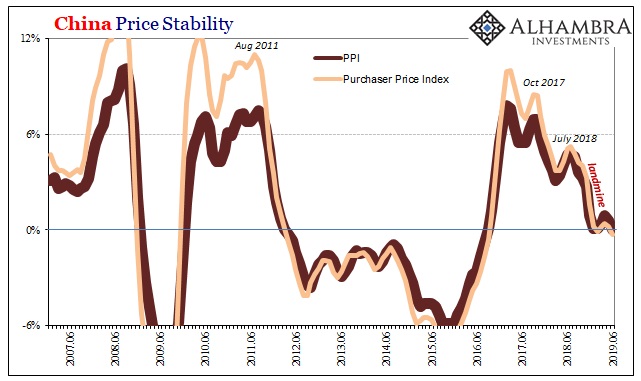

How Global And Synchronized Is A Boom Without China?

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already.

Read More »

Read More »

Political Correctness Serves the Ruling Elite

No wonder the Ruling Elites loves political correctness: all those furiously signaling their virtue are zero threat to the asymmetric plunder of the status quo. The Ruling Elites loves political correctness, for it serves the Elite so well. What is political correctness? Political correctness is the public pressure to conform to "progressive" speech acts by uttering the expected code words and phrases in public.

Read More »

Read More »

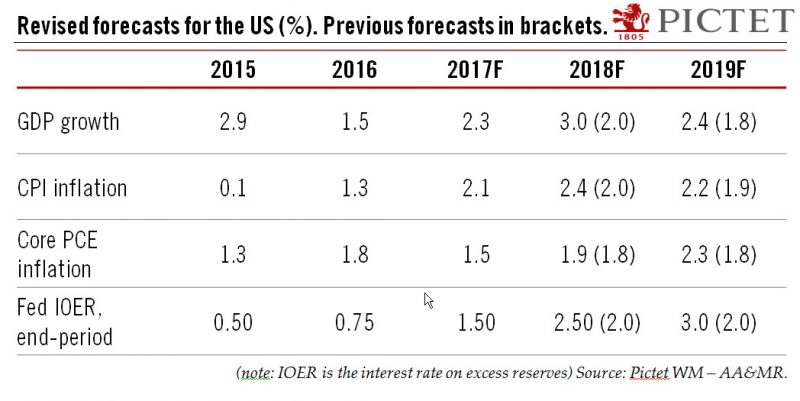

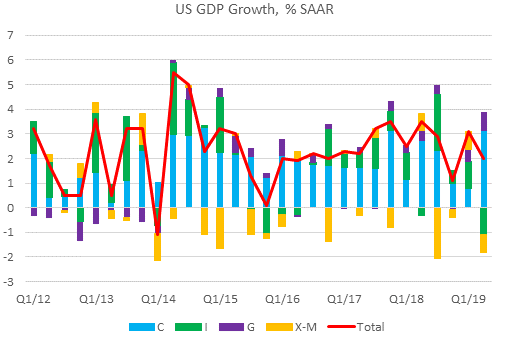

Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an estimated 4.6% in 2017. We...

Read More »

Read More »

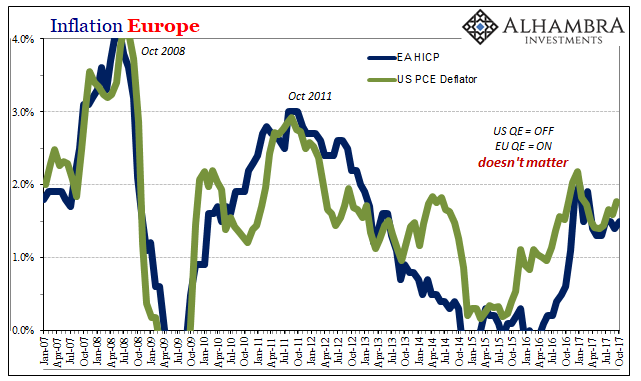

Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn.

Read More »

Read More »

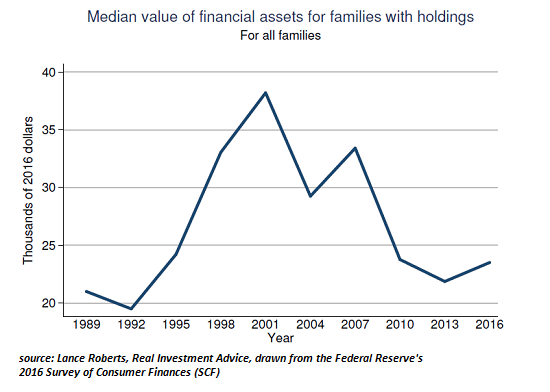

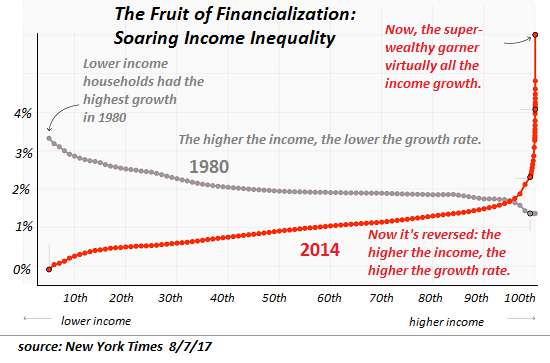

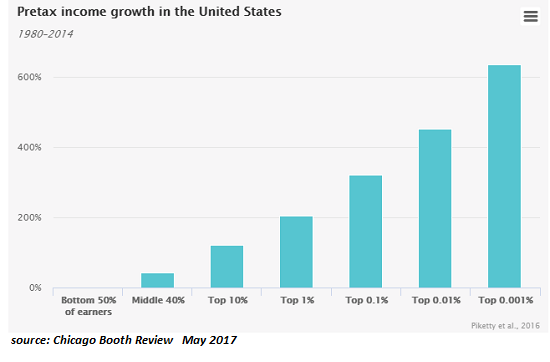

The Pie Is Shrinking for the 99 percent

The ensuing social disunity and disruption will be of the sort many alive today have never seen. Social movements arise to solve problems of inequality, injustice, exploitation and oppression. In other words, they are solutions to society-wide problems plaguing the many but not the few (i.e. the elites at the top of the wealth-power pyramid).

Read More »

Read More »

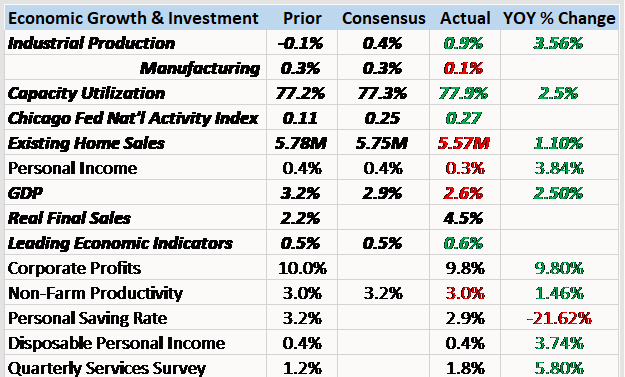

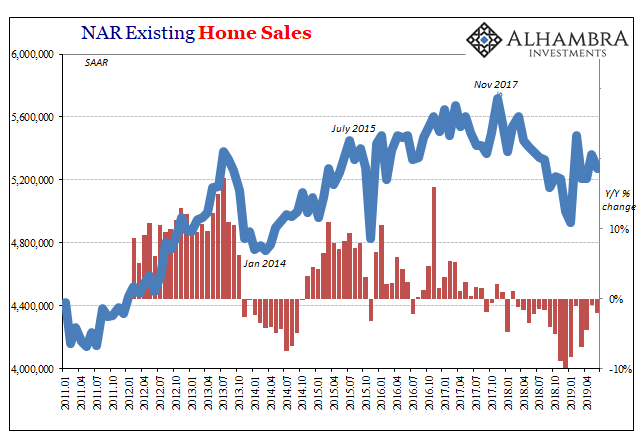

Bi-Weekly Economic Review: Markets At Extremes

Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on the price of oil but that is what we’ve become over the...

Read More »

Read More »

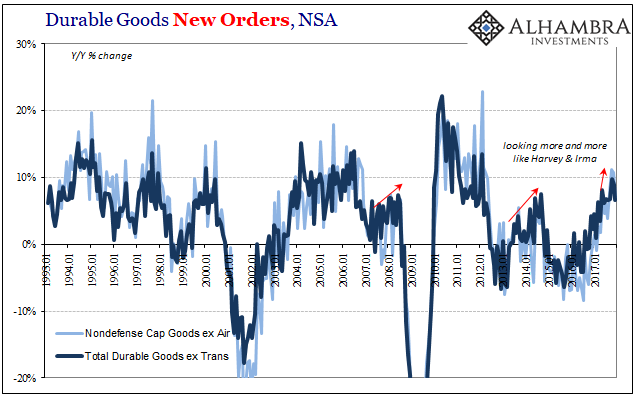

December Durable Goods

Durable and capital goods orders and shipments all increased in December by growth rates consistent with those registered in the months leading up to the big storms Harvey and Irma. We continue to find evidence that accelerated growth in October and November was nothing more than the anticipated after-effects cleaning up after those hurricanes.

Read More »

Read More »

Forget It, China’s Not Booming

Jeffrey Snider, head of global investment research at Alhambra Investments, says China is in fact not growing rapidly, which sounds disheartening for commodity investors. He reckons a crucial investment metric has weakened, pointing to slower economic expansion.

Read More »

Read More »

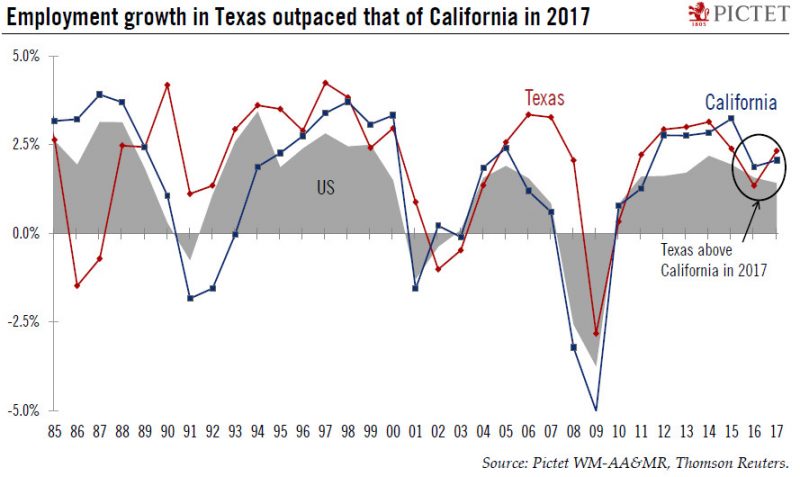

US chart of the week – Texas rebounds

One of the major rivalries in the US is that between California and Texas, the country’s biggest and second-biggest states respectively in GDP terms. They have different growth drivers (most notably Silicon Valley in California and the energy industry in Texas), and they also have different political landscapes – and local taxation regimes. But which one’s ahead when it comes to employment growth?

Read More »

Read More »

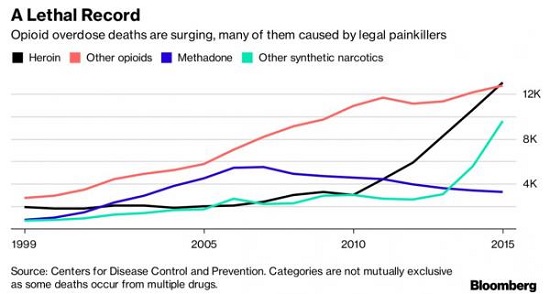

Can We Finally Have an Honest Discussion about the Opioid Crisis?

The economy no longer generates secure, purposeful jobs for the working class, and so millions of people live in a state of insecure despair. The opioid epidemic is generating a lot of media coverage and hand-wringing, but few if any solutions, and this is predictable: if you don't face up to the causes, then you can't solve the problem.

Read More »

Read More »

The Dismal Boom

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction.

Read More »

Read More »

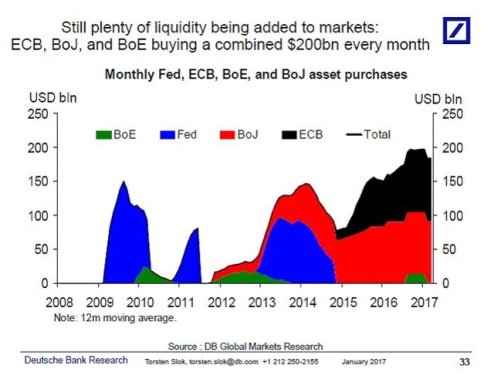

Central Banks: From Coordination to Competition

This is one reason why I anticipate "unexpected" disruptions in the global economy in 2018. The mere mention of "central banks" will likely turn off many readers who understandably have little interest in convoluted policies and arcane mumbo-jumbo, but bear with me for a few paragraphs while I make the case for something to happen in 2018 that will impact us all to some degree.

Read More »

Read More »

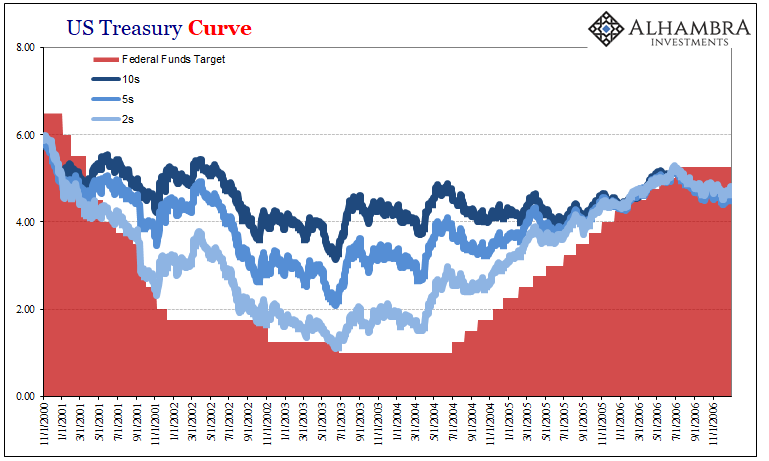

What About 2.62 percent?

There’s nothing especially special about 2.62%. It’s a level pretty much like any other, given significance by only one phrase: the highest since 2014. It sounds impressive, which is the point. But that only lasts until you remember the same thing was said not all that long ago.

Read More »

Read More »

It’s Time to Retire “Capitalism”

Our current socio-economic system is nothing but the application of force on the many to enforce the skims, scams and privileges of the self-serving few. I've placed the word capitalism in quotation marks to reflect the reality that this word now covers a wide spectrum of economic activities, very little of which is actually capitalism as classically defined.

Read More »

Read More »

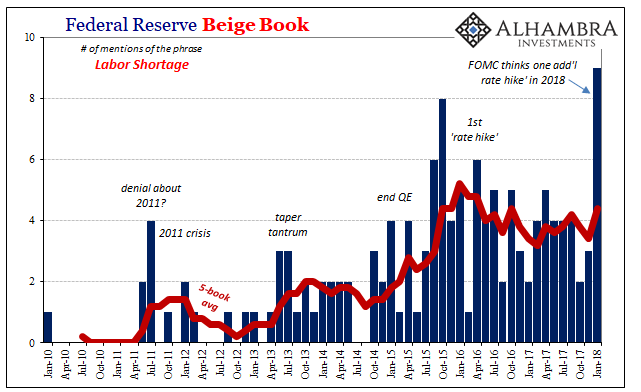

U.S. Unemployment: The Dissonance Book

I’ve found the word “dissonance” has become more common in regular usage beyond just my own. Whether that’s a function of my limited observational capacities or something more meaningful than personal bias isn’t at all clear. Still, the word does seem to fit in economic terms more and more as we carry on uncorrected by meaningful context.

Read More »

Read More »