Category Archive: 5.) The United States

The Next Financial Crisis Is Right on Schedule (2019)

Neither small business nor the bottom 90% of households can afford this "best economy ever." After 10 years of unprecedented goosing, some of the real economy is finally overheating: costs are heating up, unemployment is at historic lows, small business optimism is high, and so on--all classic indicators that the top of this cycle is in.

Read More »

Read More »

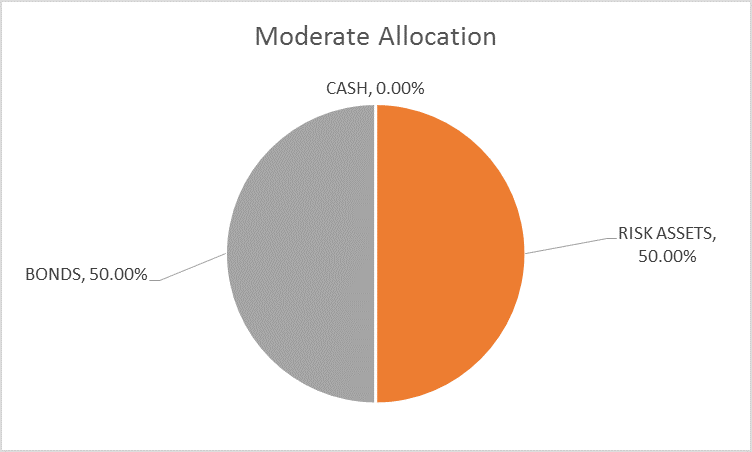

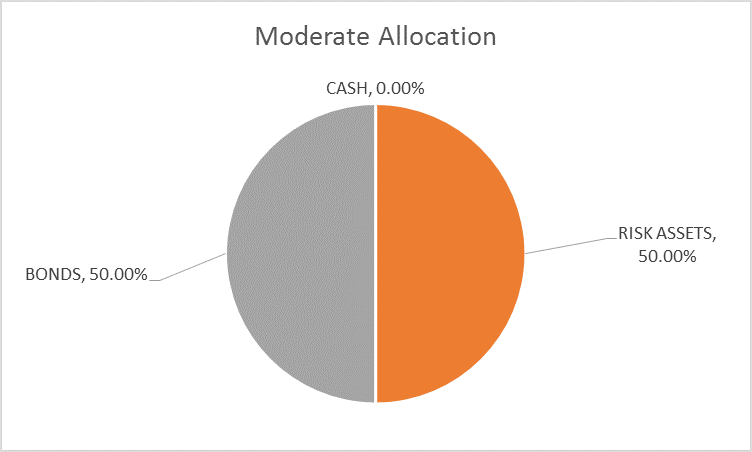

Global Asset Allocation Update – September 2018

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is 50/50. Decoupling anyone? That’s what the market is whispering right now, that the recent troubles in foreign economies is contained and won’t affect the US. The most obvious example of that trend is the performance of US stocks versus the rest of the world.

Read More »

Read More »

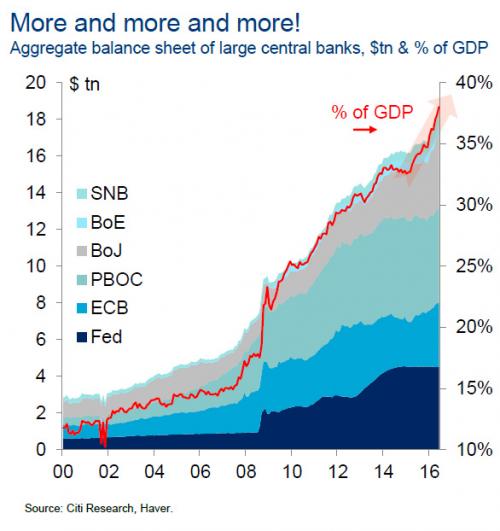

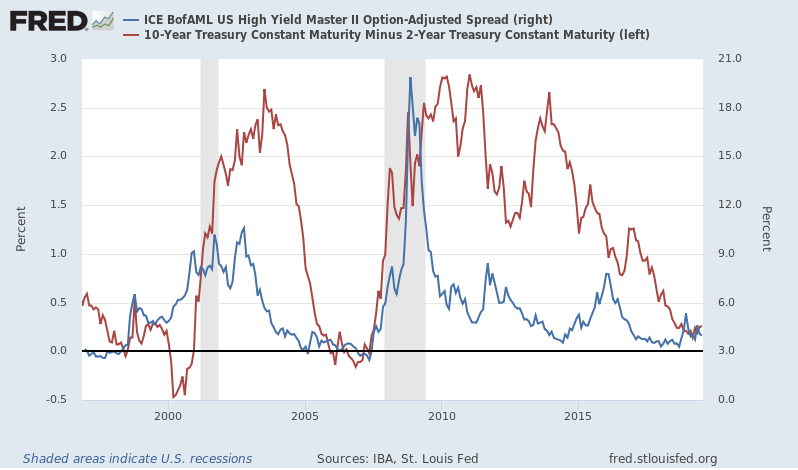

After 10 Years of “Recovery,” What Are Central Banks So Afraid Of?

If the world's economies still need central bank life support to survive, they aren't healthy--they're barely clinging to life. The "recovery"/Bull Market is in its 10th year, and yet central banks are still tiptoeing around as if the tiniest misstep will cause the whole shebang to shatter: what are they so afraid of?

Read More »

Read More »

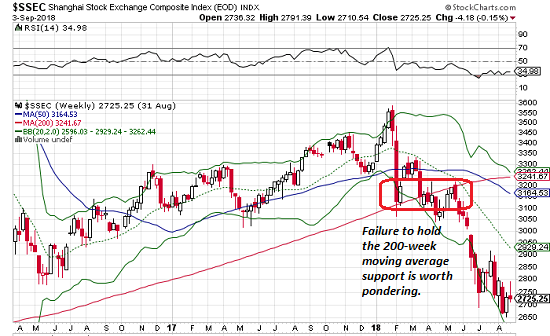

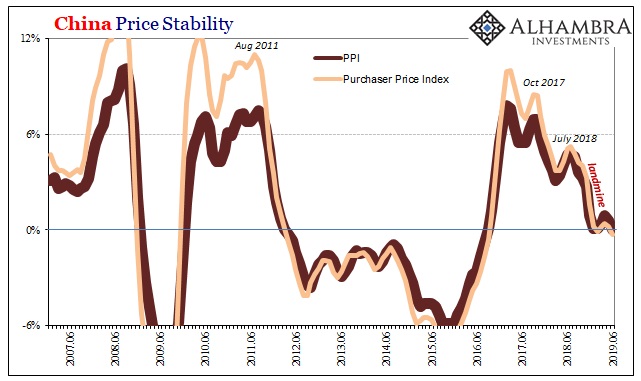

The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

Currencies don't melt down randomly. This is only the first stage of a complete re-ordering of the global financial system. Take a look at the Shanghai Stock Market (China) and tell me what you see: A complete meltdown, right? More specifically, a four-month battle to cling to the key technical support of the 200-week moving average (the red line). Once the support finally broke, the index crashed.

Read More »

Read More »

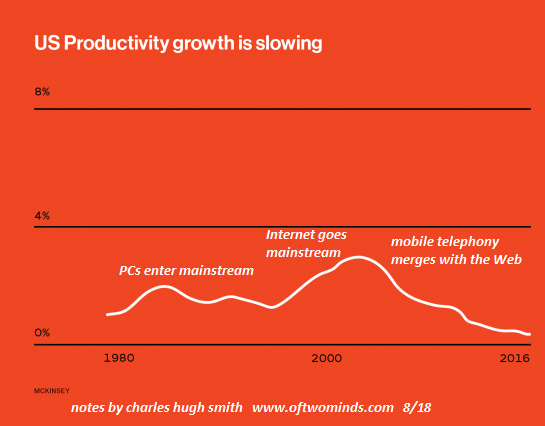

Why Is Productivity Dead in the Water?

As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value.

Read More »

Read More »

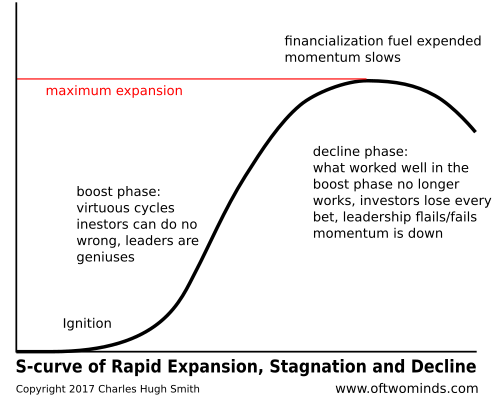

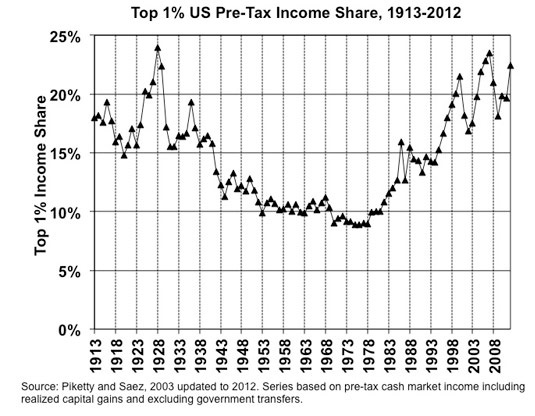

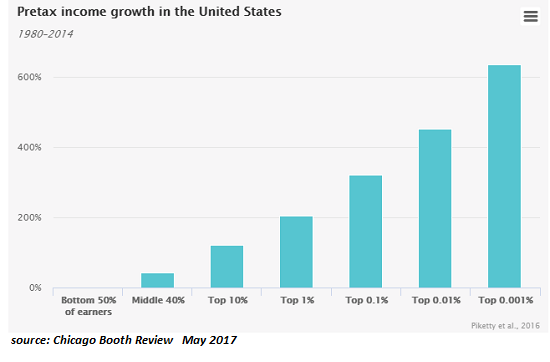

Here’s How We Ended Up with Predatory, Parasitic Elites

Combine financialization, neoliberalism and moral bankruptcy, and you end up with predatory, parasitic elites.

How did our financial and political elites become predatory parasites? Some will answer that elites have always been predatory parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.

Following in Ancient Rome's Footsteps: Moral Decay,...

Read More »

Read More »

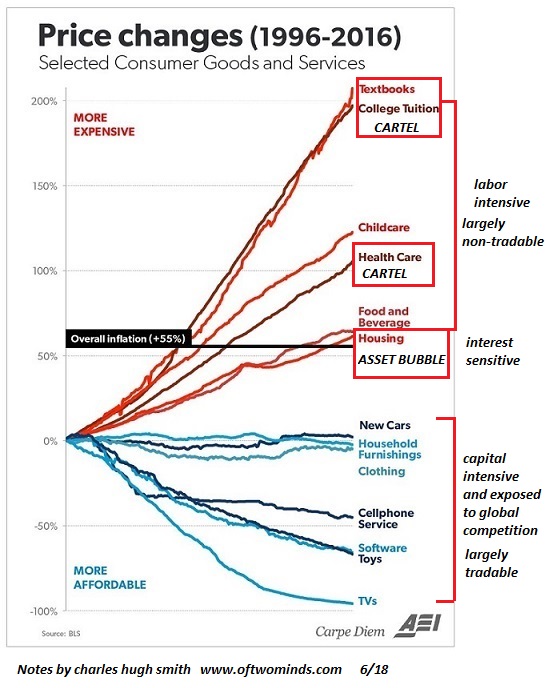

To Understand America’s Neofeudal Economy, Start with Extortion

Let's spin the time machine back to the late Middle Ages, at the height of feudalism, and imagine we're trying to get a boatload of goods to the nearest city to sell. As we drift down the river, we're constantly being stopped and charged a fee for transiting one small fiefdom after another. When we finally reach the city, there's an entry fee for bringing our goods to market.

Read More »

Read More »

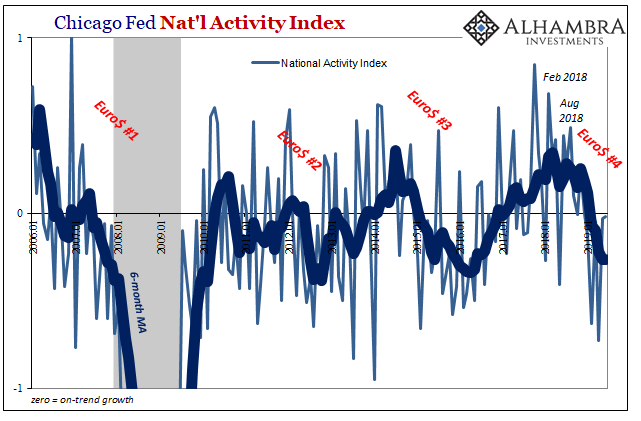

Global PMI’s Hang In There And That’s The Bad News

At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

Read More »

Read More »

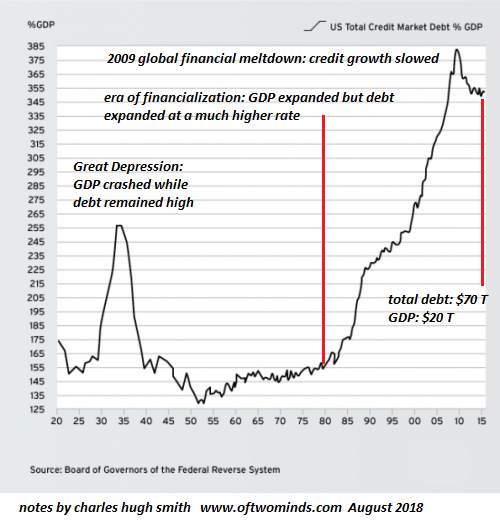

How “Wealthy” Would We Be If We Stopped Borrowing Trillions Every Year?

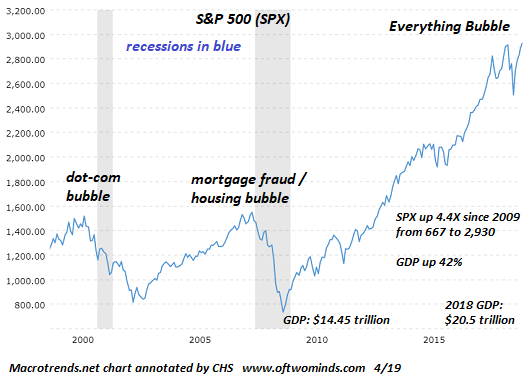

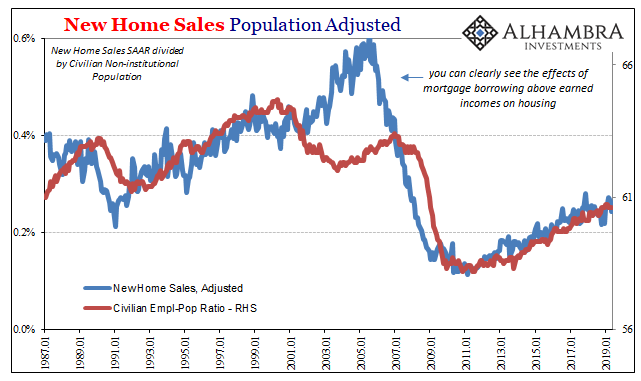

These charts reflect a linear system that is wobbling into the first stages of non-linear destabilization.

The widespread presumption is the U.S. is wealthy beyond words, and will remain so as far as the eye can see: wealthy enough to fund trillion-dollar weapons systems, trillion-dollar endless wars, multi-trillion dollar Medicare for all, multi-trillion dollar Universal Basic Income, and so on, in an endless profusion of endless trillions....

Read More »

Read More »

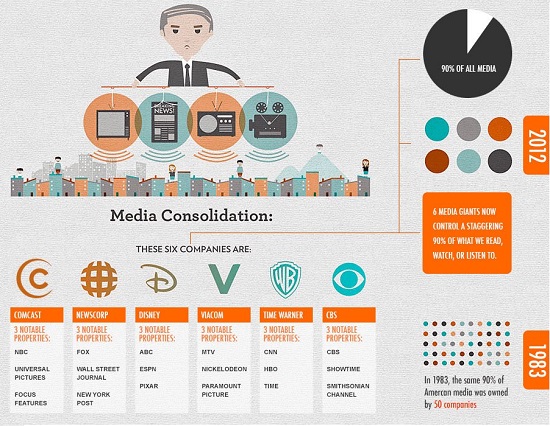

If You Want to Survive this Election with Your Mental Health Intact, Turn Off the “News” and Social Media Now

If you want to preserve your sanity and avoid unhappy derangement, turn off all corporate and social media from now to Thanksgiving. Since elections are extremely profitable for traditional media / social media corporations, your sanity will gleefully be sacrificed in the upcoming election--if you are gullible enough to watch the "news" and tune into social media.Elections are extremely profitable because candidates spend scads of cash on media...

Read More »

Read More »

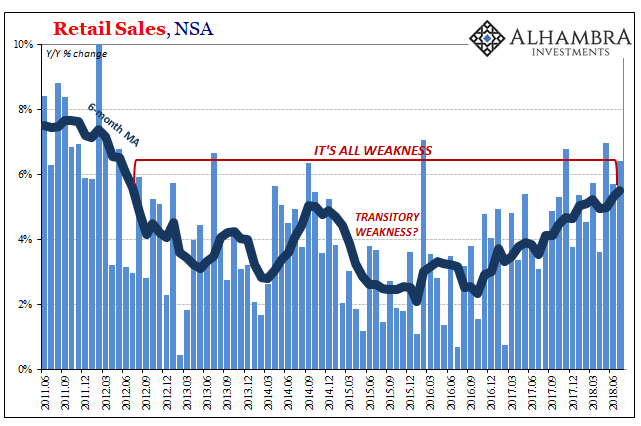

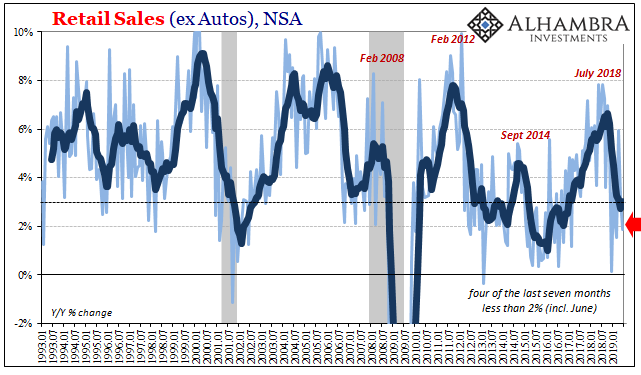

What’s Hot Isn’t Retail Sales Growth

Americans are spending more on filling up. A lot more. According the Census Bureau, retail sales at gasoline stations had increased by nearly 20% year-over-year (unadjusted) in both May and June 2018. In the latest figures for July, released today, gasoline station sales were up by more than 21%.

Read More »

Read More »

Monthly Macro Monitor – August 2018

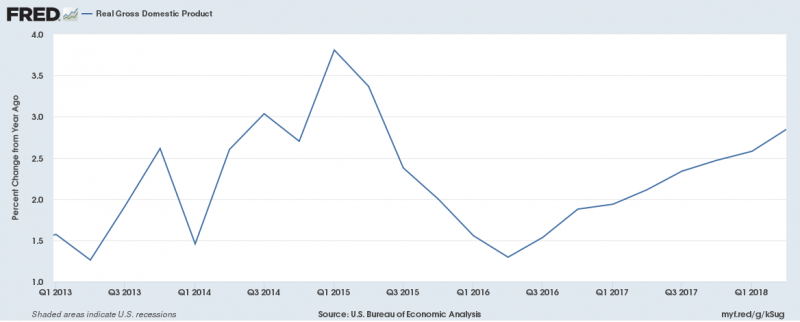

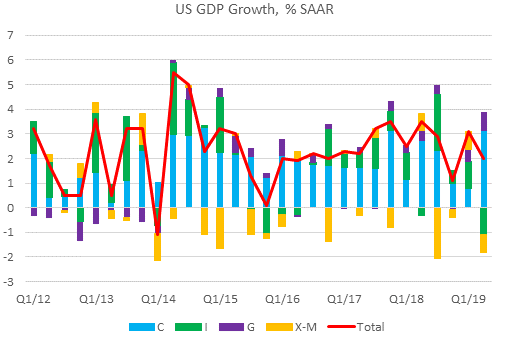

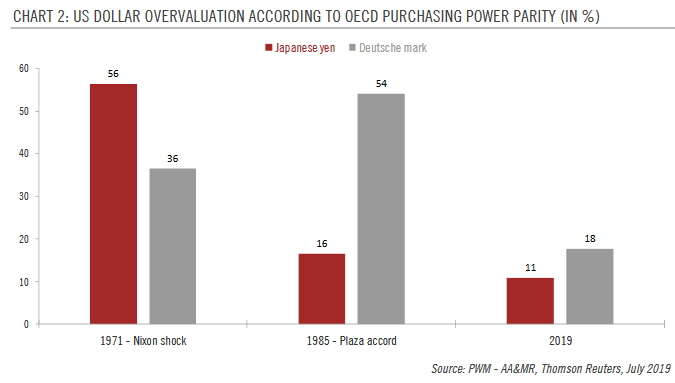

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%).

Read More »

Read More »

Our “Prosperity” Is Now Dependent on Predatory Globalization

Nowadays, trade and "prosperity" are dependent on currencies that are created out of thin air via borrowing or printing. So here's the story explaining why "free" trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost nation, and keep all the...

Read More »

Read More »

The Fantasy of “Balanced Returns” Funding Retirement

The fantasy that a "balanced portfolio" yielding "balanced returns" will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the individual or fund needs to do is maintain a "balanced portfolio" of various asset classes that yield "balanced returns," i.e. some safe "value"...

Read More »

Read More »

We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I've been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency.

Read More »

Read More »

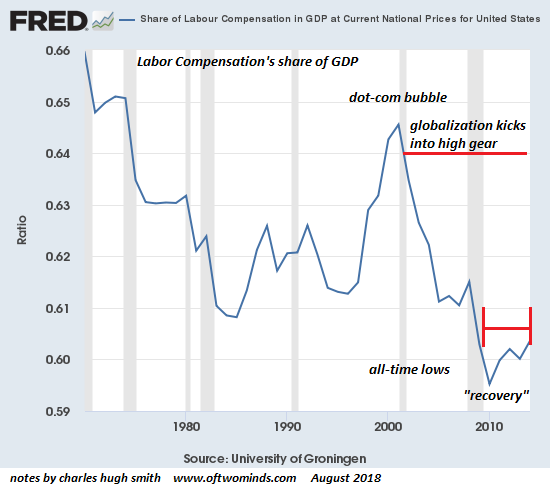

The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go, reaching levels not seen since the mid-1960s.

Read More »

Read More »

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Russia Sells 80 percent Of Its US Treasuries

Russia Sells 80% Of Its US Treasuries. Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months. – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion.

Read More »

Read More »