Category Archive: 5.) The United States

Here’s What We’ve Lost in the Past Decade

The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of "recovery" and "growth" has actually been a decade of catastrophic losses for our society and nation. Here's a short list of what we've lost: 1. Functioning markets. Free markets discover price and assess risk.

Read More »

Read More »

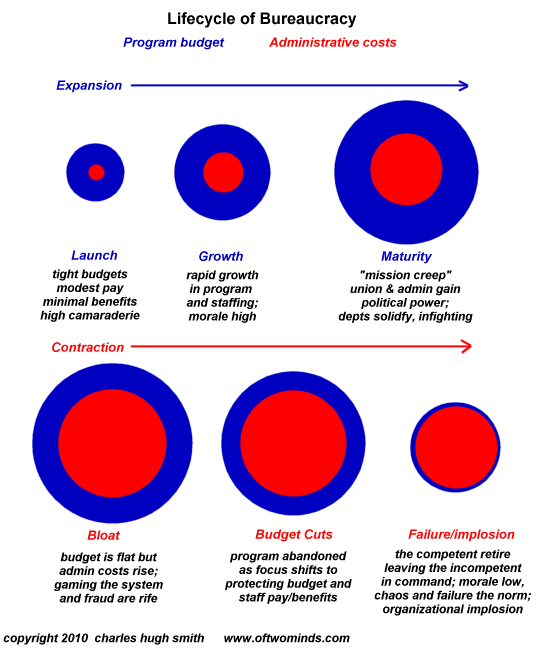

Here’s How Systems (and Nations) Fail

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America's broken healthcare system over a cheaper, more effective alternative?

Read More »

Read More »

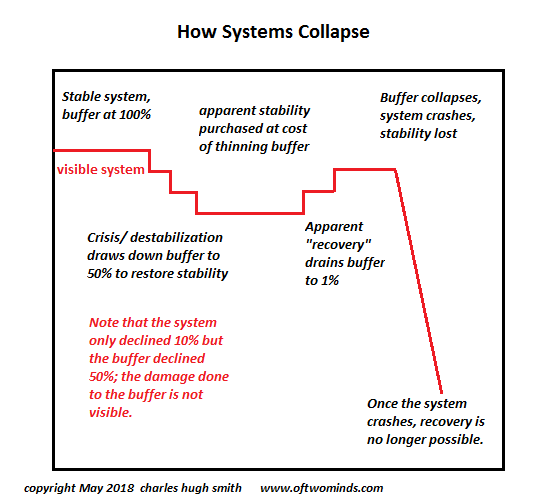

When Long-Brewing Instability Finally Reaches Crisis

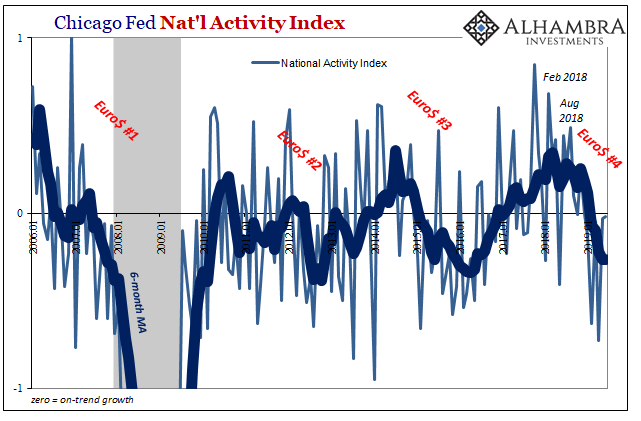

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Read More »

Read More »

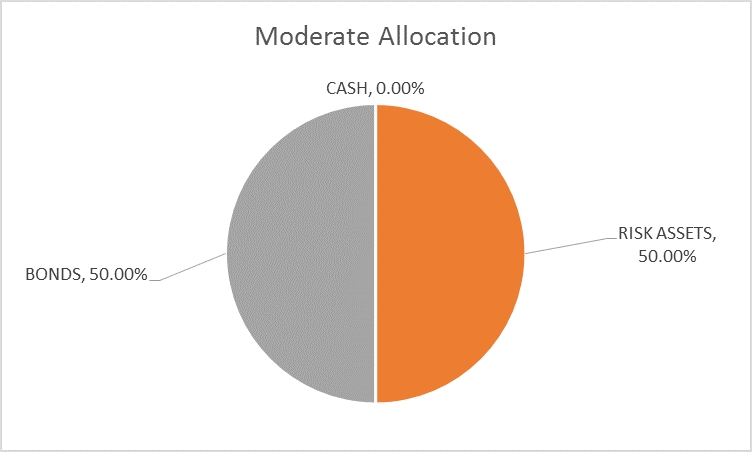

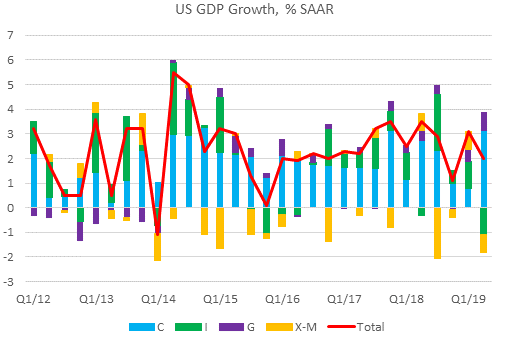

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

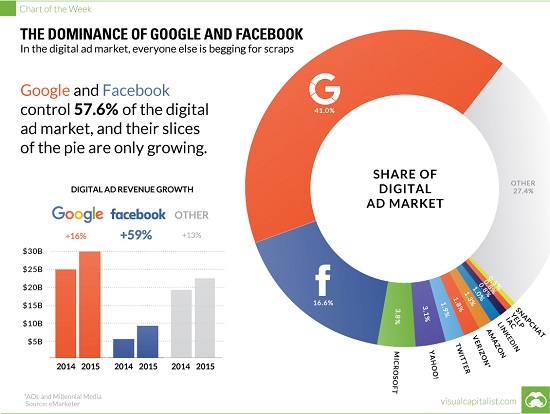

The Imperial Naivete of the American Public

The nation's premier corporate profit engines / social media giants are the ideal platforms for undermining the U.S. via the sowing of disintegration. Whether it's stated or not, one source of the inchoate outrage triggered by Russian-sourced purchases of adverts on Facebook in 2016 (i.e. "meddling in our election") is the sense that the U.S. is sacrosanct due to our innate moral goodness and our Imperial Project.

Read More »

Read More »

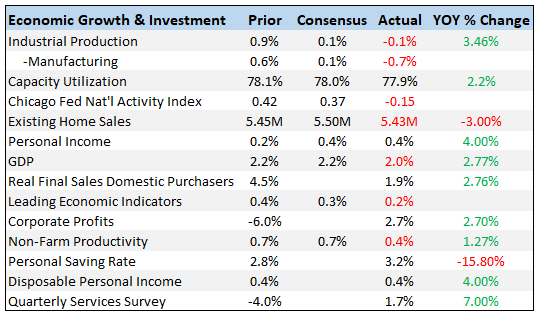

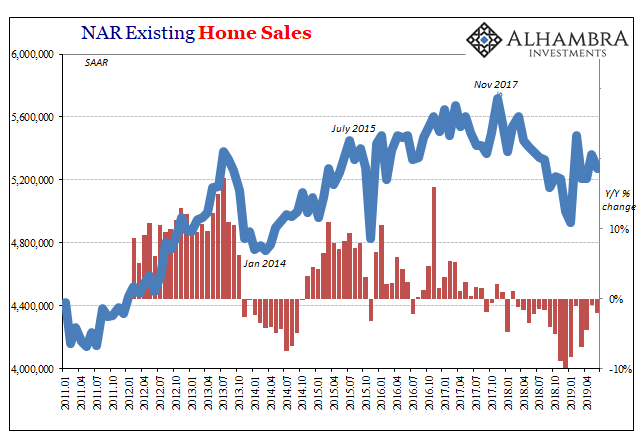

Bi-Weekly Economic Review

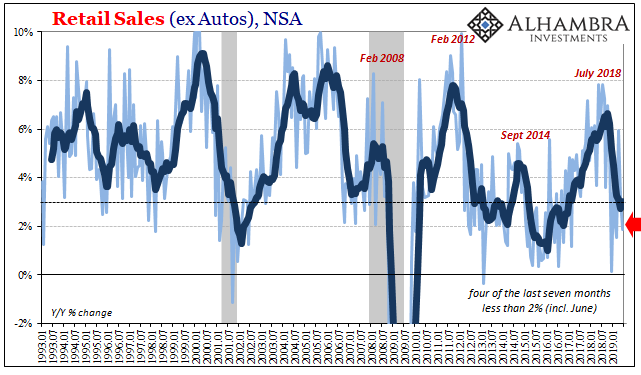

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to the tariffs.

Read More »

Read More »

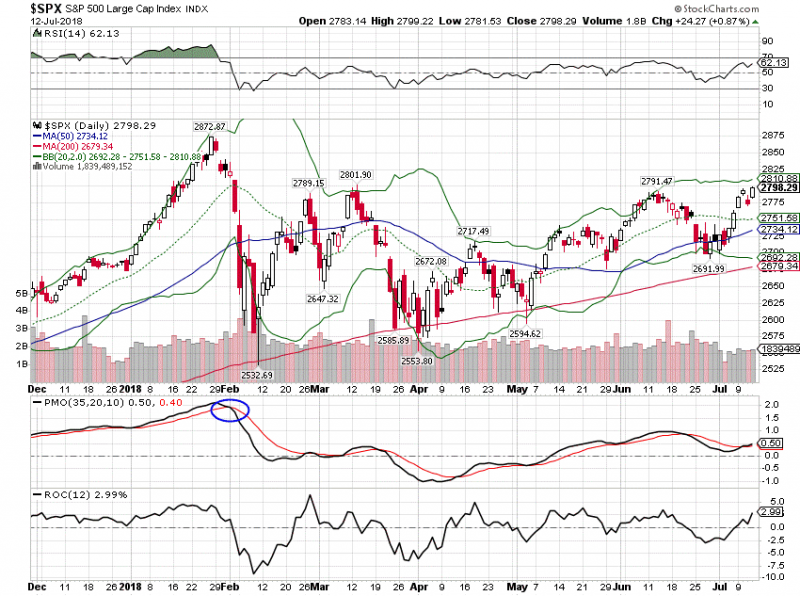

Mid-Year Global Markets Update

Volatility returned to markets with a vengeance in the first half of this year. 2018 started off as an extension of last year when volatility was almost wholly absent. Stocks roared out of the starting gate, up almost every day until January 26th. And then – whoosh. What took nearly a month to gain took just 6 trading days to give back and then some.

Read More »

Read More »

Our Institutions Are Failing

Our institutional failure reminds me of the phantom legions of Rome's final days. The mainstream media and its well-paid army of "authorities" / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual.

Read More »

Read More »

Buybacks Get All The Macro Hate, But What About Dividends?

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true.

Read More »

Read More »

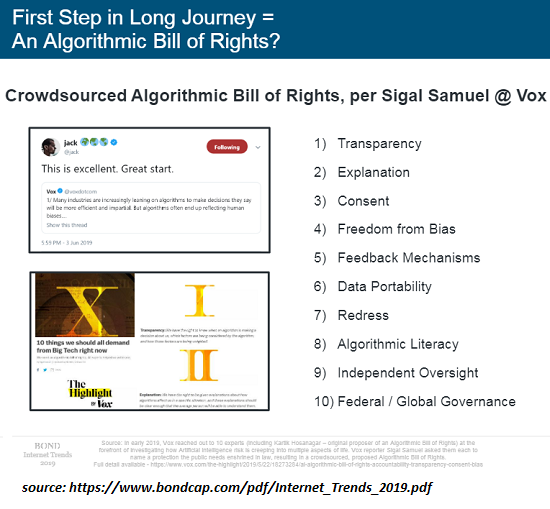

Will AI “Change the World” Or Simply Boost Profits?

The real battle isn't between a cartoonish vision or a dystopian nightmare--it's between decentralized ownership and control of these technologies and centralized ownership and control. The hype about artificial intelligence (AI) and its cousins Big Data and Machine Learning is ubiquitous, and largely unexamined. AI is going to change the world by freeing humankind from most of its labors, etc. etc. etc.

Read More »

Read More »

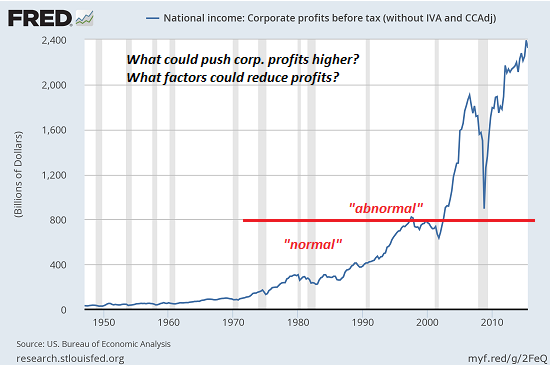

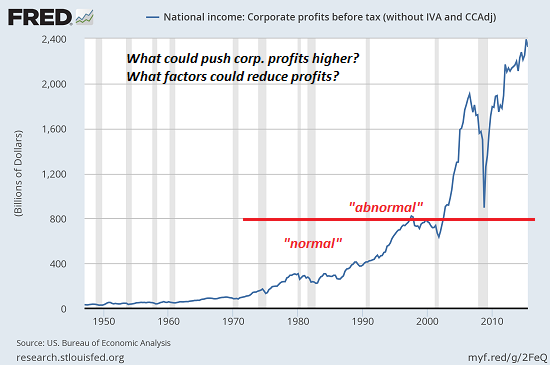

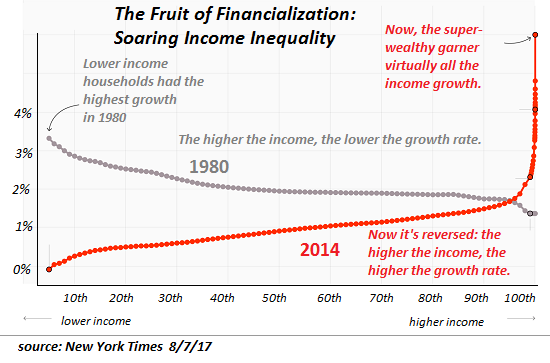

We Are All Hostages of Corporate Profits

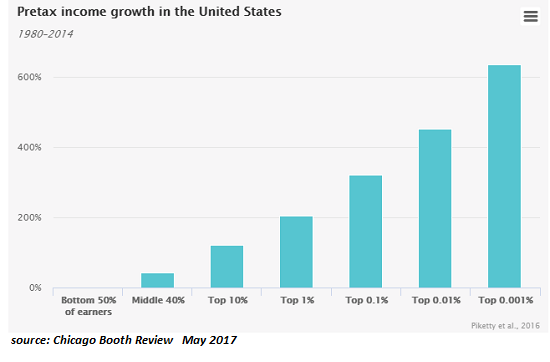

We're in the endgame of financialization and globalization, and it won't be pretty for all the hostages of corporate profits. Though you won't read about it in the mainstream corporate media, the nation is now hostage to outsized corporate profits. The economy and society at large are now totally dependent on soaring corporate profits and the speculative bubbles they fuel, and this renders us all hostages: Make a move to limit corporate profits or...

Read More »

Read More »

The USA Is Now a 3rd World Nation

I know it hurts, but the reality is painfully obvious: the USA is now a 3rd World nation. Dividing the Earth's nations into 1st, 2nd and 3rd world has fallen out of favor;apparently it offended sensibilities. It has been replaced by the politically correct developed and developing nations, a terminology which suggests all developing nations are on the pathway to developed-nation status.

Read More »

Read More »

The Gathering Storm

July 4th is an appropriate day to borrow Winston Churchill's the gathering storm to describe the existential crisis that will envelope America within the next decade. There is no single cause of the gathering storm; in complex systems, dynamics feed back into one another, and the sum of destabilizing disorder is greater than a simple sum of its parts.

Read More »

Read More »

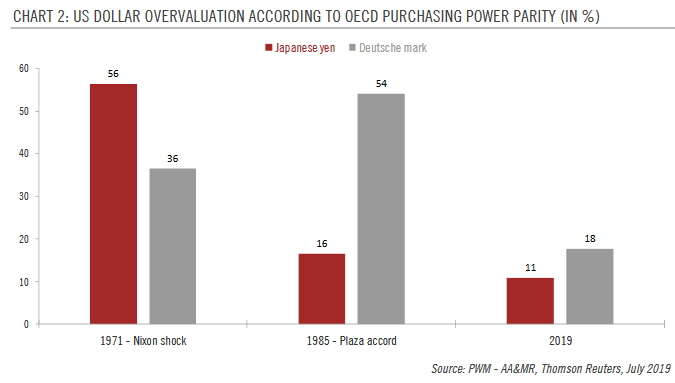

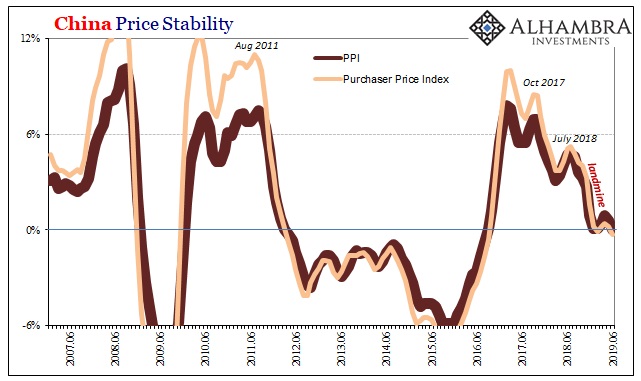

US Vs China – Is It ‘Art Of The Deal’ Or Economic Warfare?

While monetary tightening remains the main risk for global stock markets, the threat of a trade war continues to dominate the headlines...

Read More »

Read More »

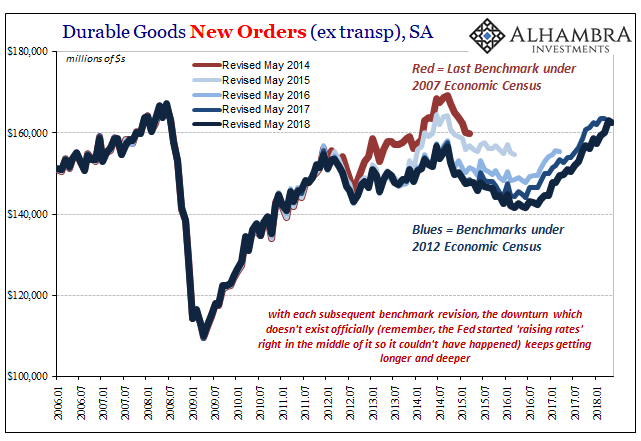

Revisiting The Revised Revisions

I missed durable goods last month for scheduling reasons, which was a shame given that May is the month each year for benchmark revisions to the series. Since new estimates under the latest revisions were released today, it seems an appropriate time to revisit the topic of data bias, and why that matters. What happens with durable goods (or any data for that matter, the process is largely the same) is that the Census Bureau conducts smaller surveys...

Read More »

Read More »

Make Capital Cheap and Labor Costly, and Guess What Happens?

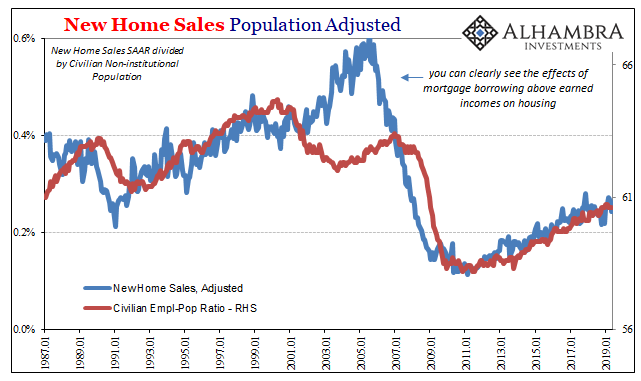

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap.

Read More »

Read More »

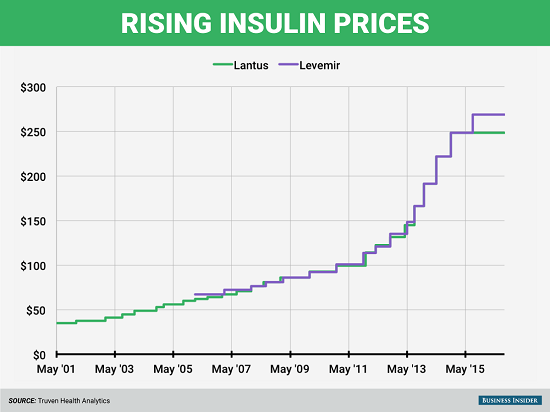

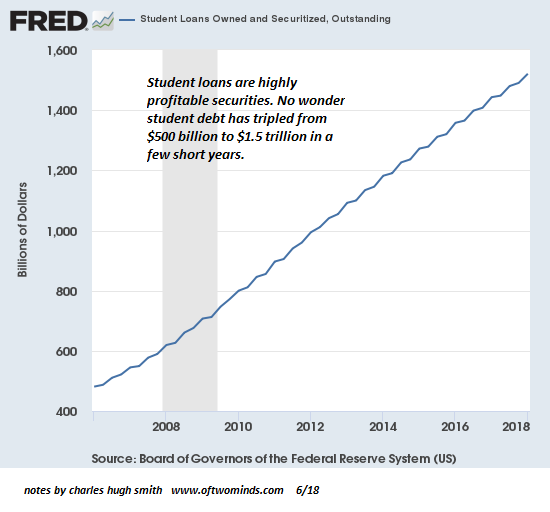

Dear High School Graduates: the Status Quo “Solutions” Enrich the Few at Your Expense

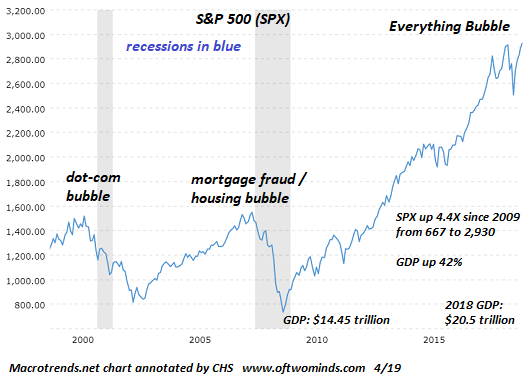

You deserve a realistic account of the economy you're joining. Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo. Here's the summary: the status quo is pressuring you to accept its "solutions": borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a "desirable" city, pay sky-high income and property...

Read More »

Read More »

Bi-Weekly Economic Review (VIDEO)

Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun.

Read More »

Read More »

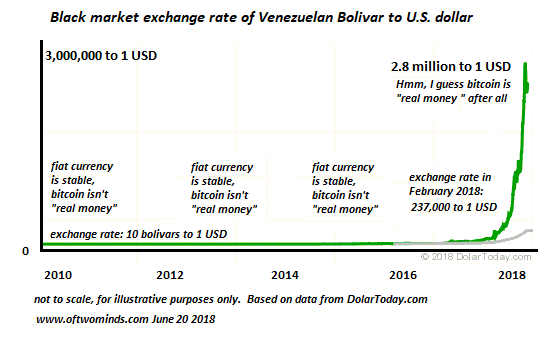

Gresham’s Law and Bitcoin

Rather suddenly, the state issued fiat currency bolivar lost 99% of its purchasing power. Gresham's law holds that "bad money drives out good money," meaning that given a choice of currencies (broadly speaking, "money" that serves as a store of value and a means of exchange), people use depreciating "bad" to buy goods and services and hoard "good" money that is appreciating or holding its value.

Read More »

Read More »