Category Archive: 5) Global Macro

Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider...

Read More »

Read More »

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

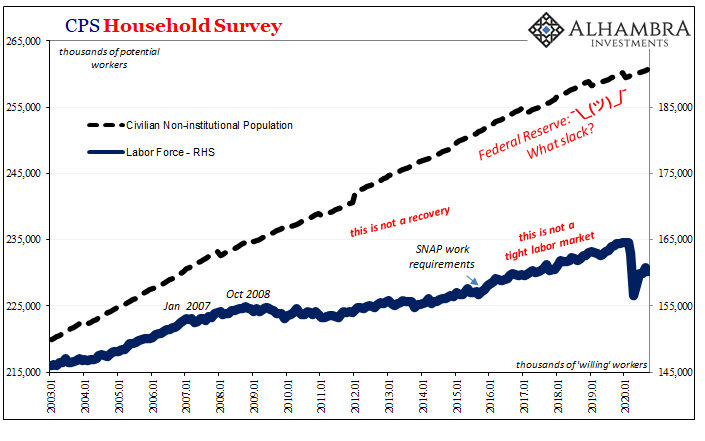

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »

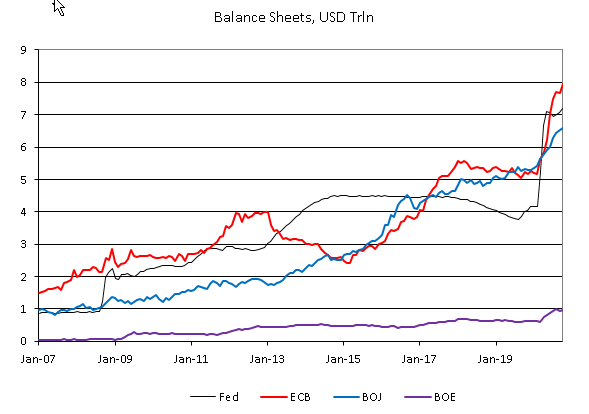

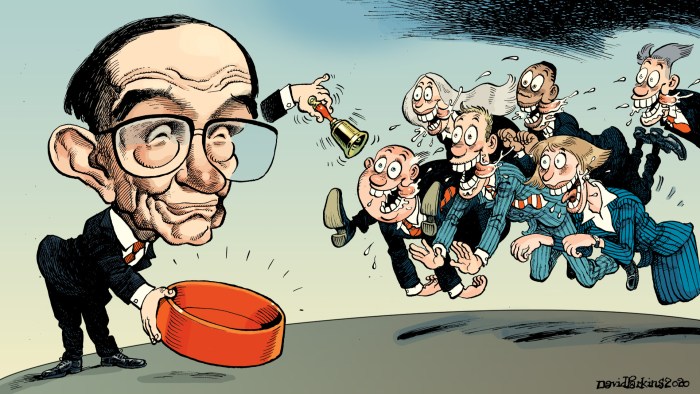

What We Don’t Elect Matters Most: Central Banking and the Permanent Government

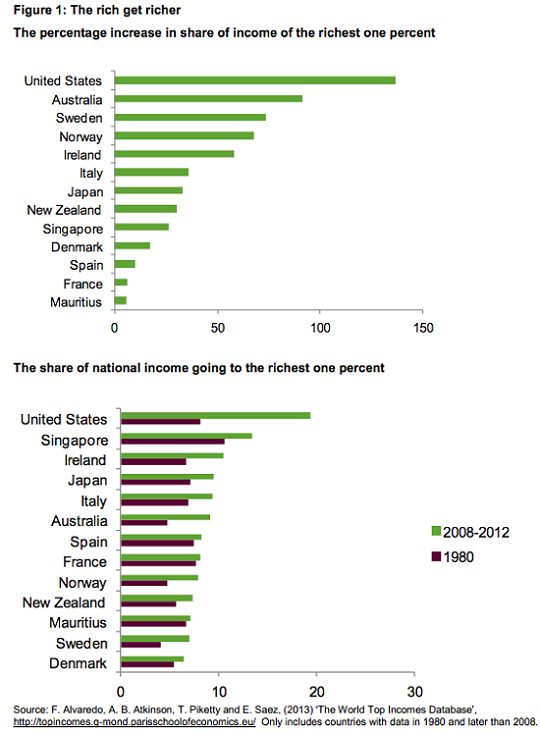

We're Number One in wealth, income and power inequality, yea for the Fed and the Empire! If we avert our eyes from the electoral battle on the blood-soaked sand of the Coliseum and look behind the screen, we find the powers that matter are not elected: our owned by a few big banks Federal Reserve, run by a handful of technocrats, and the immense National Security State, a.k.a. the Permanent Government.

Read More »

Read More »

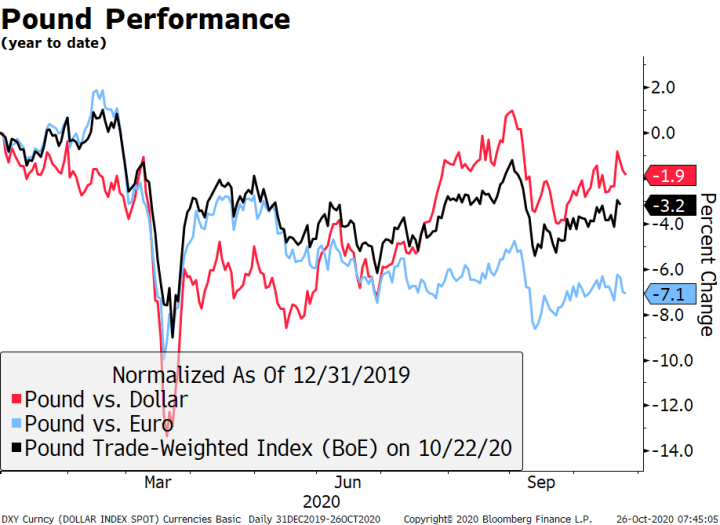

Meanwhile, Outside Today’s DC

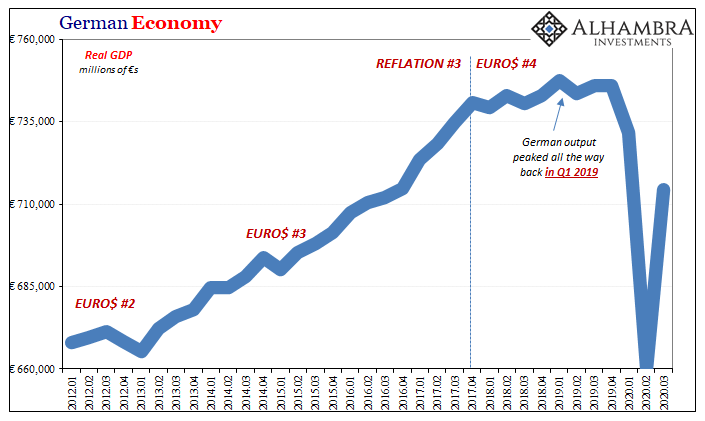

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

Our Imperial Presidency

Regardless of who holds the office, America's Imperial Project and its Imperial Presidency are due for a grand reckoning. While elections and party politics generate the emotions and headlines, the truly consequential change in American governance has been the ascendancy of the Imperial Presidency over the past 75 years, since the end of World War II.

Read More »

Read More »

FOMC Preview: Coronavirus Daily Change

The two-day FOMC meeting starts tomorrow and wraps up Thursday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in Q4.

Read More »

Read More »

Dollar Firm at Start of Very Eventful Week

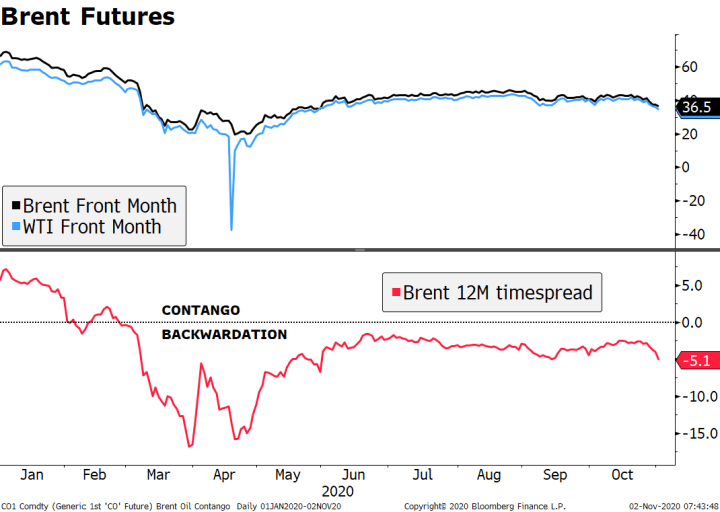

Oil prices continue their rapid decline due to both supply and demand concerns; the dollar is trading at the top end of recent trading ranges. This is one of the most eventful weeks for the markets in recent memory; one day ahead of the elections, the implied odds remain roughly at the same levels as they have been for the last few weeks; October ISM manufacturing PMI will start the ball rolling for a key US data week.

Read More »

Read More »

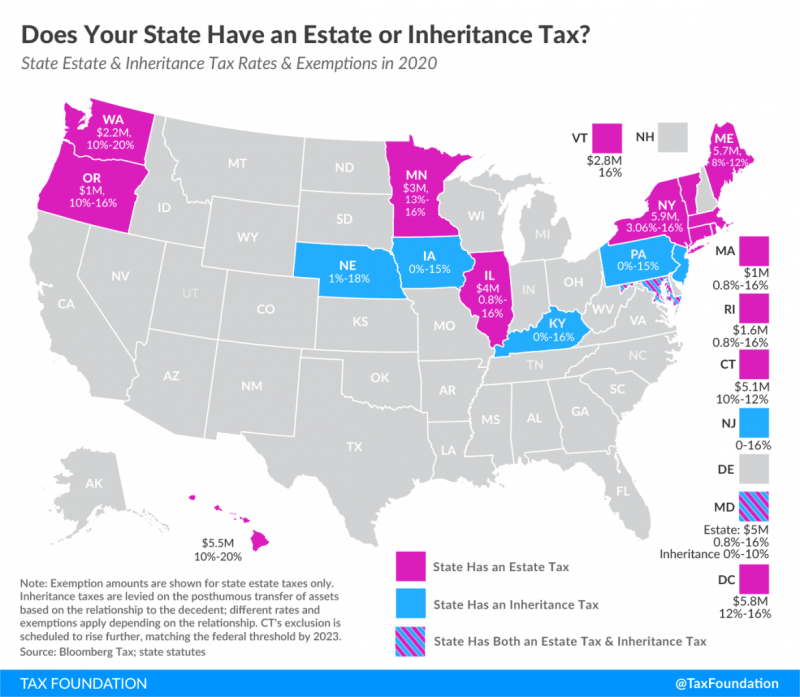

17 States that Charge Estate or Inheritance Taxes

Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise.

Read More »

Read More »

Election 2020: What has President Trump done to America? | The Economist

In the 2020 election, President Donald Trump will be judged on his handling of the covid-19 pandemic. But what else will be his legacy if he loses?

Further content:

Find The Economist’s coverage of the US elections: https://econ.st/3mwsMa4

Sign up to The Economist’s weekly “Checks and Balance” newsletter on American politics: https://econ.st/3l5C4dl

See The Economist’s 2020 presidential election forecast: https://econ.st/35JCkI2

Listen to...

Read More »

Read More »

Dollar Bid as Markets Steady Ahead of ECB Decision

Global equity markets are gaining limited traction today after yesterday’s bloodbath; that sell-off helped test a now prevalent hedging thesis for investors. The dollar remains bid; US Q3 GDP data will be the data highlight; weekly jobless claims will be reported.

Read More »

Read More »

ALICE Doesn’t Work Here Anymore

What the political class and the Financial Nobility don't yet grasp is that ALICE will never go back to her insecure, low-wage job, ever.

Read More »

Read More »

What’s Going On, And Why Late August?

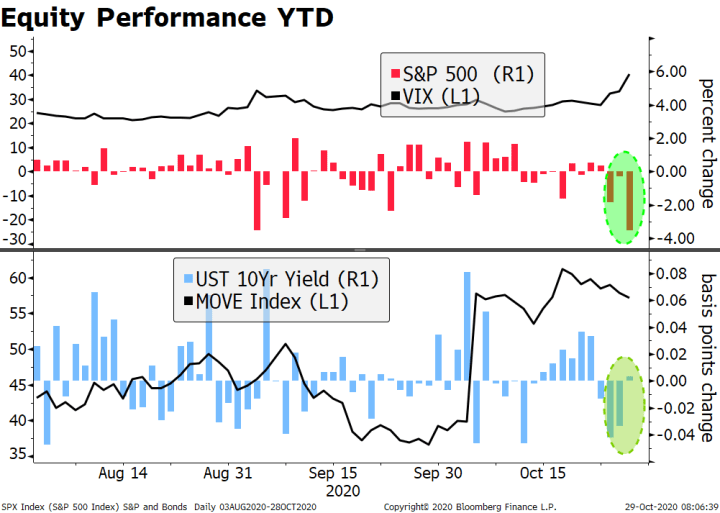

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

Flying Blind: Clueless about Risk, We’re Speeding Toward Systemic Failure

For all these reasons, the risks of systemic collapse are much higher than commonly

anticipated. There's an irony in discussing risk: since we all have an instinctive reaction

to visible risk, we think we understand it.

Read More »

Read More »

ECB Preview

The ECB meets Thursday and is widely expected to stand pat until the next meeting. Macro forecasts won’t be updated until the December 10 meeting, but the bank will have to acknowledge the deteriorating outlook now.

Read More »

Read More »

Dollar Bid as Markets Start the Week in Risk-Off Mode

Increasing virus numbers have pushed European governments to once again start imposing national measures; the week is starting off on a risk-off note. Today may see the official end of stimulus talks; odds for Biden victory are increasing again but is already mostly priced in.

Read More »

Read More »

How Systems Collapse: Reaping What We’ve Sown

Don't expect healthcare or any other hollowed-out, heavily optimized system to function as it once did. A great many Americans will be shocked when our healthcare systems start failing because

they believed the PR that "we have the finest healthcare system in the world.

Read More »

Read More »

Charitable Remainder Trusts

Alhambra's' Bob Williams describes Charitable Remainder Trusts and how they can be used as a planning tool to create a win-win for you and charities.

Read More »

Read More »

EM Preview for the Week Ahead

EM FX took advantage once again of broad dollar weakness. Most EM currencies were up last week against the dollar, with the only exceptions being ARS, TRY, INR, THB, PEN, and MYR. We expect the dollar to remain under pressure this week and so EM should remain bid.

Read More »

Read More »

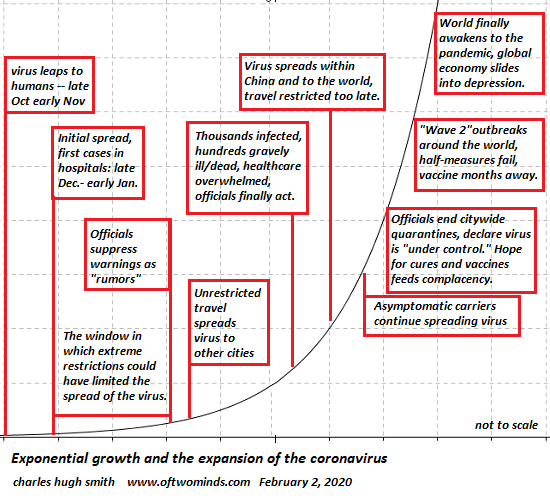

Next Up: Global Depression

The belief that central banks printing currency can "buy/fix" everything that's broken, lost or scarce is the ultimate in denial, fantasy and magical thinking. Let's revisit the pandemic projection chart I prepared on February 2, 2020, nine days after authorities publicly acknowledged the Covid virus outbreak in China.

Read More »

Read More »

Yep, There’s A New ‘V’ In Town And The Locals…Don’t Seem To Much Care For It

They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage.

Read More »

Read More »