Category Archive: 5) Global Macro

The Moment Wall Street Has Been Waiting For: Retail Is All In

The ideal bagholder is one who

adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding

on for the inevitable Fed-fueled rally to new highs.

Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not

the Federal Reserve: the old hands have been waiting for retail--the individual investor--

to go all-in stocks. After 13 long years, this moment has finally arrived:

retail is...

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »

Weekly Market Pulse: Buy The Dip, If You Can

If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »

Read More »

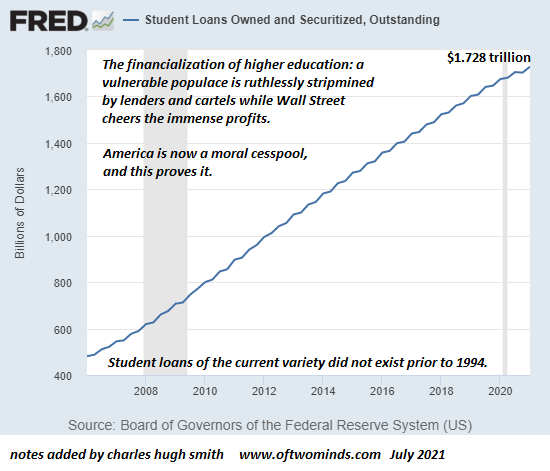

America Is a Moral Cesspool, and Student Loans Prove It

If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now "impossible" to do so, even as America's wealth and gross national product (GDP) have both rocketed higher over the past 27 years?

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

Read More »

Read More »

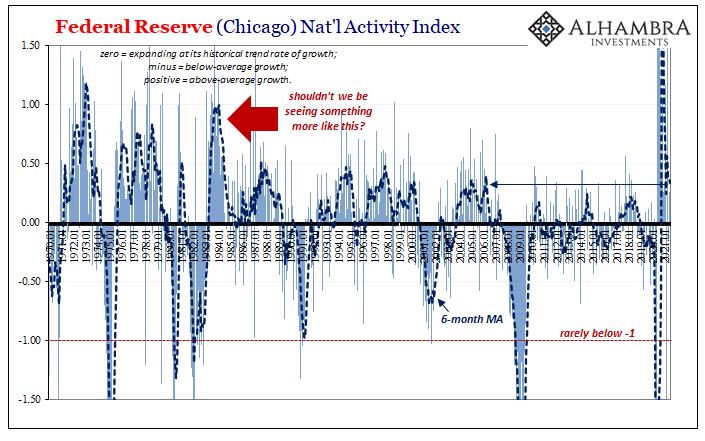

Do Rising ‘Global’ Growth Concerns Include An Already *Slowing* US Economy?

Global factors, meaning that the wave of significantly higher deflationary potential (therefore, diminishing inflationary chances which were never good to begin with) in global bond yields the past five months have seemingly focused on troubles brewing outside the US. Overseas turmoil, it was called back in 2015, leaving by default a picture of relative American strength and harmony.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 22 juillet 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Have We Reached “Peak Self-Glorifying Billionaire”?

Perhaps we should update Marie Antoinette's famous quip of cluelessness to: "Let them eat space tourism." As billionaires squander immense resources on self-glorifying space flights, the corporate media is nothing short of worshipful. Millions of average citizens, on the other hand, wish the self-glorifying billionaires had taken themselves and all the other parasitic, tax-avoiding, predatory billionaires with them on a one-way trip into space.

Read More »

Read More »

Lower Yields And (fewer) Bills

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines.

Read More »

Read More »

Big Tech: “Our Terms Have Changed”

So go ahead and say whatever you want around all your networked devices, but don't be surprised if bad things start happening. I received another "Our Terms Have Changed" email from a Big Tech quasi-monopoly, and for a change I actually read this one. It was a revelation on multiple fronts. I'm reprinting it here for your reading pleasure: We wanted to let you know that we recently updated our Conditions of Use.

Read More »

Read More »

Henry Kissinger: how Biden should handle China | The Economist

Henry Kissinger is a titan of US politics and one of the best-known veterans of foreign policy. He spoke to “The Economist Asks” podcast in April 2021 about current threats to the world order—and, in particular, rising tensions between America and China. Read more here: https://econ.st/3iq1OAM

Chapters

00:00 - Henry Kissinger: introduction

01:14 - Have US–China tensions risen?

02:28 - Can China and the US agree?

03:11 - What steps can Biden take?...

Read More »

Read More »

Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart.

Read More »

Read More »

Weekly Market Pulse: As Clear As Mud

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs.

Read More »

Read More »

How Breakdown Cascades Into Collapse

Maintaining the illusion of confidence, permanence and stability serves the interests of those benefiting from the bubbles and those who prefer the safety of the herd, even as the herd thunders toward the precipice.

Read More »

Read More »

Far right online: the rise of “extreme” gamers | The Economist

In America, the intelligence services deem far-right extremism a greater domestic threat than Islamist terrorism. The pandemic has exacerbated the spread of white supremacism and neo-Nazism.

Sign up to The Economist’s daily newsletter to keep up to date with our latest stories: https://econ.st/3gJBH8D

Find The Economist’s most recent coverage of what’s happening in the United States: https://econ.st/3thOHVJ

Read more about far-right extremism:...

Read More »

Read More »

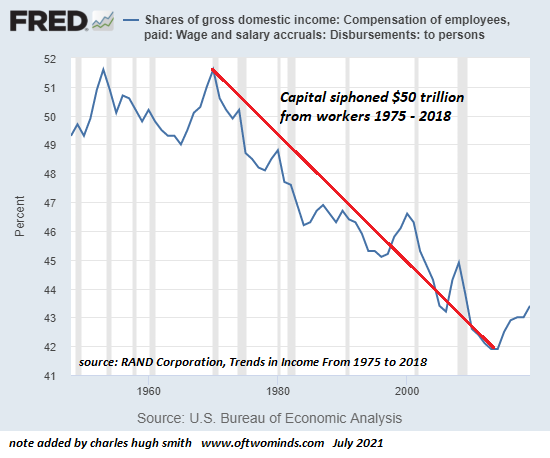

Here’s Why America’s Labor-Shortage Will Drive Inflation Higher

America's labor shortage is complex and doesn't lend itself to the simplistic expectations favored by media talking heads. The Wall Street cheerleaders extol the virtues of "getting America back to work" which is Wall-Street-speak for getting back to exploiting workers to maximize corporate profits.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 15 juillet 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »