Category Archive: 5) Global Macro

Weekly Market Pulse: Inflation Scare?

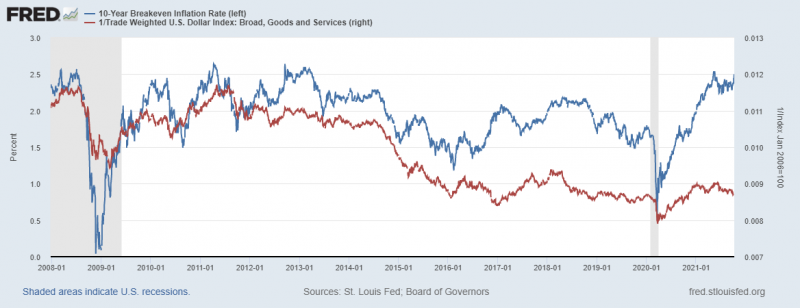

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it.

Read More »

Read More »

The challenges facing Germany’s new leader | The Economist

Germany’s election marks the end of an era of stability and stagnation. What international challenges will Angela Merkel's successor face?

00:00 The coalition negotiations

01:00 Who are the kingmakers?

02:09: Who is Olaf Scholz?

03:09 Germany’s future global role

04:57 Germany’s relationship with Russia & China

Like our video content? Take our survey to tell us why: https://econ.st/3oYeC61

Find The Economist’s most recent coverage on the...

Read More »

Read More »

Is higher inflation cause for concern? | The Economist

Inflation rates have been rising all over the world, surprising many economists. While the rich world is paying higher prices for durable goods such as cars, in emerging markets soaring food prices are a greater worry. What is causing this unexpected bout of inflation, and will it last?

00:00 - What’s happening with inflation?

00:53 - What is inflation?

01:42 - Inflation rates are rising

02:47 - How much is too much inflation?

03:13 - Inflation in...

Read More »

Read More »

Why Shortages Are Permanent: Global Supply Shortages Make Fantastic Financial Sense

The era of abundance was only a short-lived artifact of the initial boost phase of globalization and financialization. Global corporations didn't go to all the effort to establish quasi-monopolies and cartels for our convenience--they did it to ensure reliably large profits from control and scarcity.

Read More »

Read More »

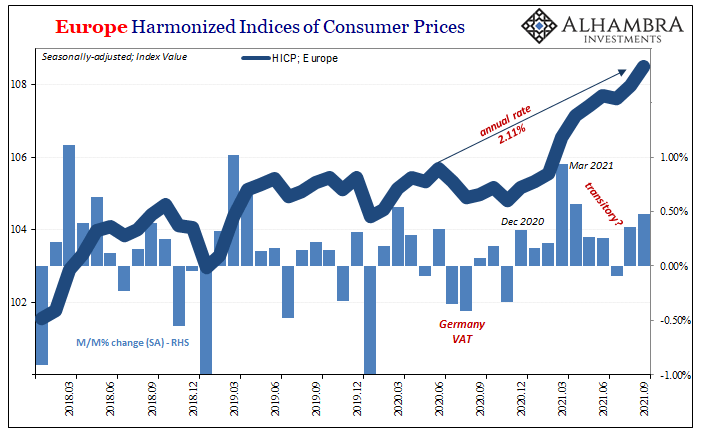

Tapering Or Calibrating, The Lady’s Not Inflating

We’ve got one central bank over here in America which appears as if its members can’t wait to “taper”, bringing up both the topic and using that particular word as much as possible. Jay Powell’s Federal Reserve obviously intends to buoy confidence by projecting as much when it does cut back on the pace of its (irrelevant) QE6.

Read More »

Read More »

What’s The Real Downside To Some of These Key Commodities?

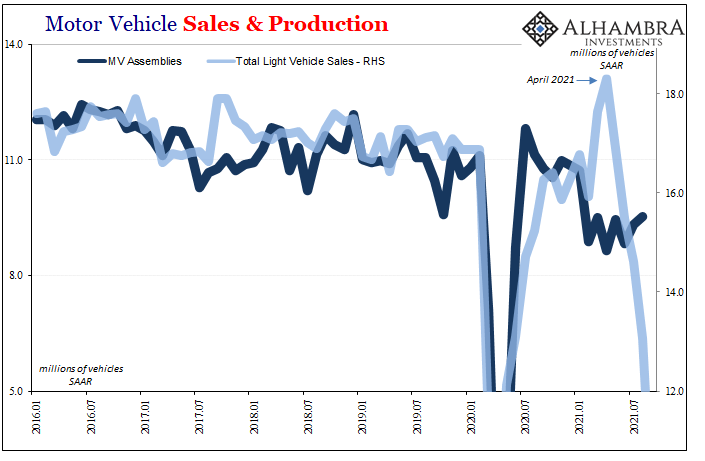

Last night, Autodata reported its first estimates for September auto sales in the US. According to its own as well as those compiled by the Bureau of Economic Analysis (the same government outfit which keeps track of GDP), vehicle sales have been sliding overall ever since April.

Read More »

Read More »

Risk Was Never Low, It Was Only Hidden

The vast majority of market participants are about as ready for a semi-random "volatility event" as the dinosaurs were for the meteor strike that doomed them to oblivion.

Read More »

Read More »

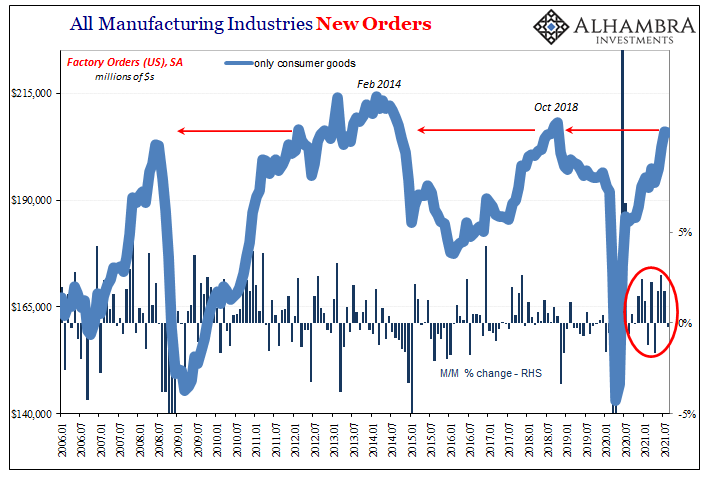

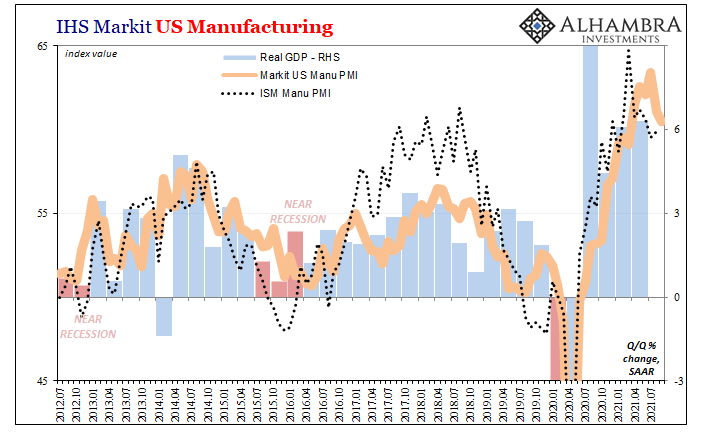

Surprise: It Isn’t Consumers Keeping American Factories Busy

US factories are humming along, constrained only by supply issues which might occasionally limit production. That’s the story, anyway. There’s too much business because of them, manufacturers taking in only more orders by the day leaving them struggling to catch up.But what kind of stuff is it that is being ordered from our nation’s factories?

Read More »

Read More »

Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion.

Read More »

Read More »

Jeff Snider: The Global Currency System that Really Matters

Tom welcomes an extremely thought provoking guest Jeff Snider to the show. Jeff flips the lid on the global shadow money system and shows us all the mechanisms and leavers that lie in the shadows.

Read More »

Read More »

More About Less New Orders

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”).

Read More »

Read More »

How do carbon markets work? | The Economist

In theory putting a price on carbon emissions should incentivise businesses to stop polluting. So why have carbon markets failed to achieve their goal of reducing global emissions? Read more here: https://econ.st/3mi51Eo

00:00 - Has putting a price on emissions worked?

00:27 - Where do carbon markets come from?

01:42 - How does ‘cap and trade’ work?

03:22 - Why aren’t carbon markets reducing emissions?

04:15 - What are the loopholes?

05:24 - What...

Read More »

Read More »

The Market Crash Nobody Thinks Is Possible Is Coming

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold. The ideal setup for a crash is a consensus that a crash is impossible--in other words, just like the present: sure, there are carefully measured murmurings about a "correction" but nobody with anything to lose in the way of public credibility is calling for an honest-to-goodness crash, a real crash, not a wimpy, limp-wristed dip that will...

Read More »

Read More »

An Economy Dividing By Inventory And Labor

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too.

Read More »

Read More »

Revisiting The Last Overhang

One reason why I still believe the US most likely would have entered a recession at some point in 2020 even without COVID wasn’t just the yield curve inversion that popped up several months before then. In August of 2019, the small part of the Treasury curve most people pay attention to (2s10s) did send out that dreaded signal, suggesting already to expect contraction in the intermediate term ahead of then.

Read More »

Read More »

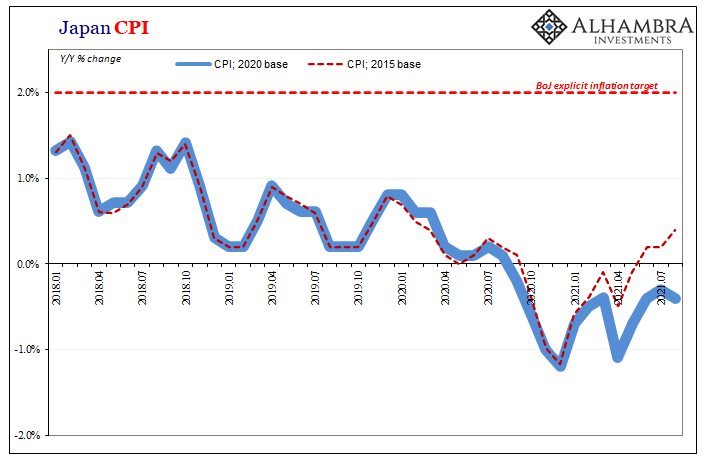

August Avoids Zero In JGB’s

Central banks and their staffs have long been accused of trying to hide inflation. This allegation had been a staple of their critics, those charging reckless monetary policies for creating “too much” money that had allegedly been causing price imbalances all over the financial map.

Read More »

Read More »

Are We Really So “Rich”? A New Way of Defining Wealth

What if our commoditized, financialized definition of wealth reflects a staggering poverty of culture, spirit, wisdom, practicality and common sense? The conventional definition of wealth is solely financial: ownership of money and assets.

The assumption is that money can buy anything the owner desires: power, access, land, shelter, energy, transport and if not love, then a facsimile of caring.

Read More »

Read More »

Weekly Market Pulse: Not So Evergrande

US stocks sold off last Monday due to fears over the potential – likely – failure of China Evergrande, a real estate developer that has suddenly discovered the perils of leverage. Well that and the perils of being in an industry not currently favored by Xi Jinping. He has declared that houses are for living in not speculating on and ordered the state controlled banks to lend accordingly.

Read More »

Read More »

To see Germany’s future, look at its cars | The Economist

As the election approaches, Germany's carmakers will face the same challenges as its new leaders: a need to innovate, tackle climate change and reassess its trade relationship with China. How this world-renowned motor industry navigates the road ahead could tell a lot about Germany’s future.

00:00 - Germany faces numerous challenges

00:49 - Can Germany’s cars reveal its future? (or whatever the title is) ...

Read More »

Read More »

All Eyes On Inventory

You’ve heard of the virtuous circle in the economy. Risk taking leads to spending/investment/hiring, which then leads to more spending/investment/hiring. Recovery, in other words. In the old days of the 20th century, quite a lot of the circle was rounded out by the inventory cycle. Both recession and recovery would depend upon how much additional product floated up and down the supply chain.

Read More »

Read More »