Category Archive: 5) Global Macro

The Economy / Market Look “Healthy” Until They Have a Seizure and Collapse

So one index or asset or another hits a new high, wow, more proof everything is so robust and healthy, we never had it so good--right up to the seizure and collapse.

Read More »

Read More »

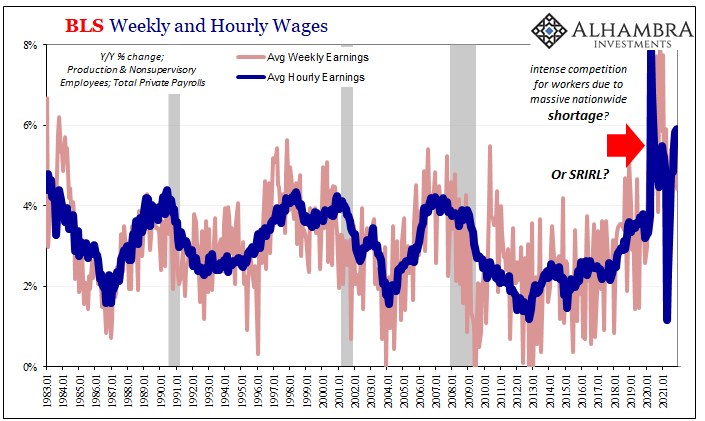

As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation.

Read More »

Read More »

What Will Surprise Us in 2022

What seemed so permanent for 13 long years will be revealed as shifting sand and what seemed so real for 13 long years will be revealed as illusion. Magical thinking isn't optimism, it is folly. Predictions are hard, especially about the future, but let's look at what we already know about 2022.

Read More »

Read More »

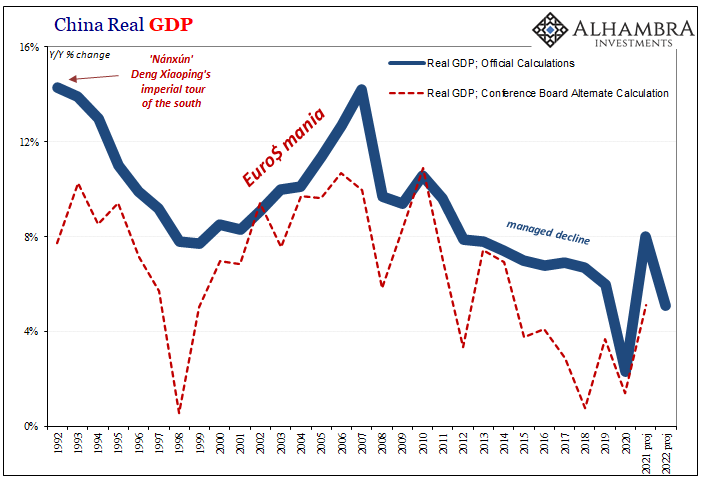

What will China do in 2022?

China’s Xi Jinping seems likely to have his third term in office ratified by the Communist Party Congress in 2022. What could that mean for China, and for the rest of the world?

00:00 What will China do in 2022?

02:38 Chinese nationalism is at an all time high

03:39 The death of private enterprise in China?

04:15 China’s relationship with the United States

05:50 Will China invade Taiwan?

07:12 Understanding China is our most important job.

Read...

Read More »

Read More »

Taper Rejection: Mao Back On China’s Front Page

Chinese run media, the Global Times, blatantly tweeted an homage to China’s late leader Mao Zedong commemorating his 128th birthday. Fully understanding the storm of controversy this would create, with the Communist government’s full approval, such a provocation has been taken in the West as if just one more chess piece played in its geopolitical game against the United States in particular.No. The Communists really mean it. Mao’s their guy again....

Read More »

Read More »

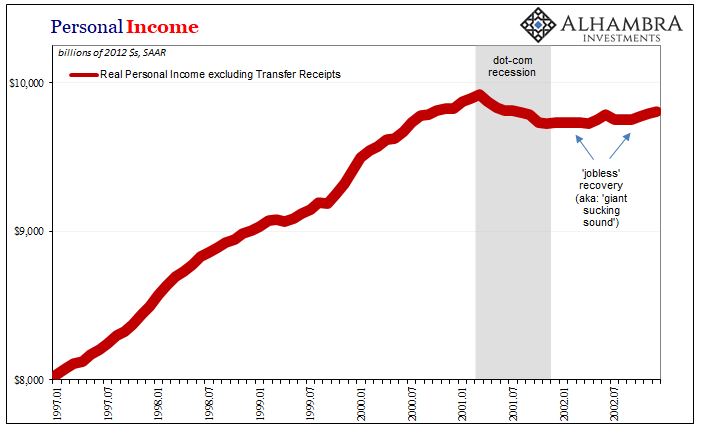

White-Hot Cycles of Silence

We’re only ever given the two options: the economy is either in recession, or it isn’t. And if “not”, then we’re led to believe it must be in recovery if not outright booming already. These are what Economics says is the business cycle. A full absence of unit roots. No gray areas to explore the sudden arrival of only deeply unsatisfactory “booms.”

Read More »

Read More »

The World Ahead 2022: five stories to watch out for | The Economist

What will be the biggest stories of 2022? As the pandemic continues to wreak havoc across the globe, President Xi will cement his power as leader of China, tech giants will coax more of us into virtual worlds and the space race reaches new heights. The Economist is back with its annual look at the top stories of the year ahead. Film supported by @TeneoCEOAdvisory

00:00 The World Ahead 2022

00:40 China revels in democracy’s failings

04:11 Hybrid...

Read More »

Read More »

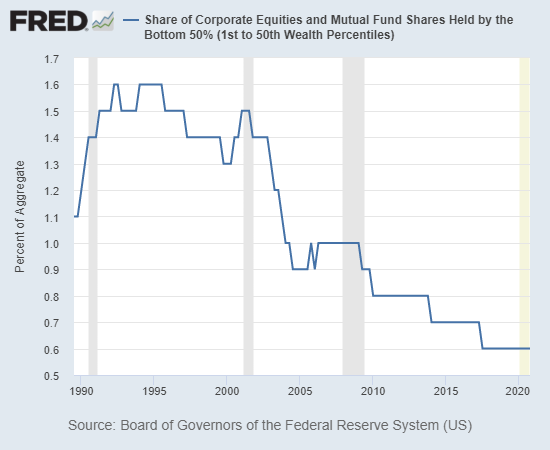

Watch the Top 5percent – They’re the Key to the Whole Economy

Go ahead and become dependent on asset bubbles and the free spending of the top 5%, and optimize your economy to serve this "growth," but be prepared for the consequences when the costs of this optimization and dependency come due.

Read More »

Read More »

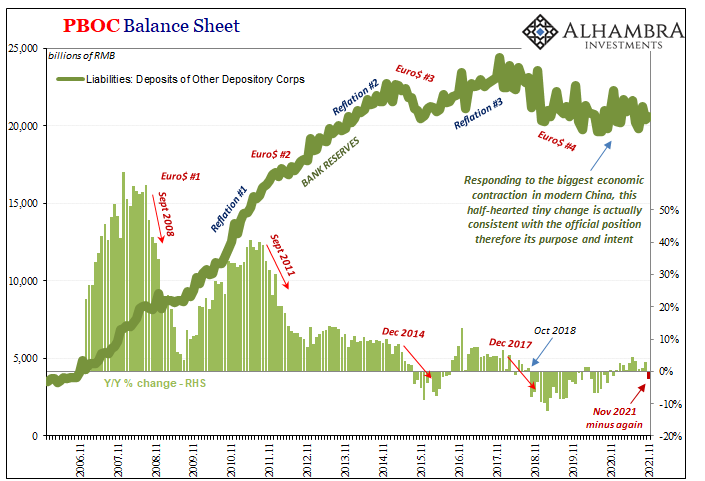

The Historical Monetary Chinese Checklist You Didn’t Know You Needed For Christmas (or the Chinese New Year)

If there is a better, more fitting way to head into the Christmas holiday in the United States than by digging into the finances and monetary flows of the People’s Bank of China, then I just don’t want to know what it is. Contrary to maybe anyone’s rational first impression that this is somehow insane, there’s much we can tell about the state of the world, the whole world and its “dollars”, right from this one key data source.

Read More »

Read More »

Obsession

Obsession composition and first lead guitar by charles hugh smith, rhythm and second lead guitar by Jimi Juju.

Read More »

Read More »

You Owe Me

You Owe Me composition, vocals and lead guitar by charles hugh smith, rhythm guitar, bass, drums and recording engineering by Jimi Juju.

You tell me that you can't afford the rent

the student loan or your truck

I don't care about your problems pal

just do what it takes to get me the bucks

You owe me

You owe me and I'm gonna tell you how it's gonna be

You say that you did everything you were told

Got your degree and a gig

Now you lost your job...

Read More »

Read More »

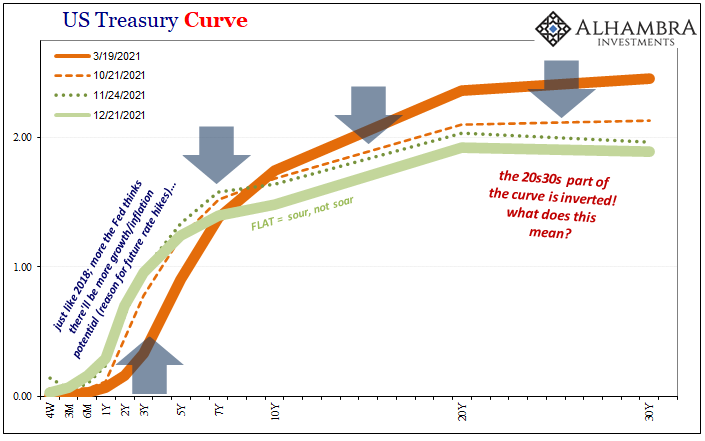

Start Long With The (long ago) End of Inflation

With the eurodollar futures curve slightly inverted, the implications of it are somewhat specific to the features of that particular market. And there’s more than enough reason to reasonably suspect this development is more specifically deflationary money than more general economic concerns.

Read More »

Read More »

Green energy: Which sources are the most sustainable? | The Economist

Fossil fuels still supply about 80% of the world’s power. How can energy be produced and used more sustainably to meet climate targets? We answer your questions. film supported by @Infosys

00:00 - Why energy needs to become more sustainable

00:33 - How much energy should come from renewables?

01:19 - Why isn’t nuclear power used more widely?

02:19 - How can solar power be made more efficient?

03:34 - Will biofuels become widely used?

04:30 - Do...

Read More »

Read More »

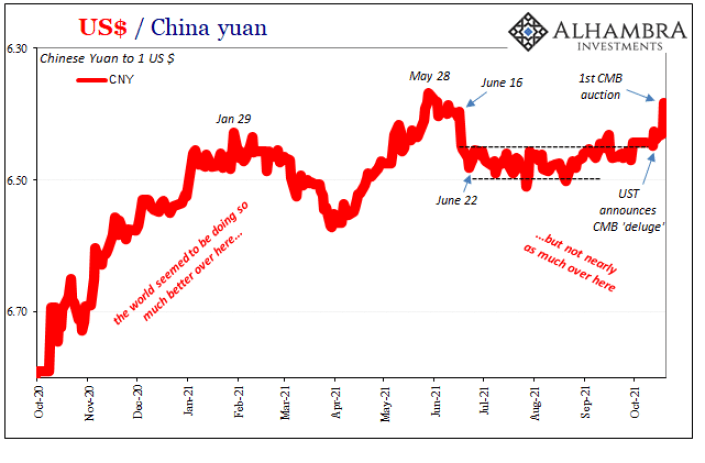

TIC October: The Deflationary ‘Dollars’ Behind The Flat, Inverting Curves

Seems like ancient history given all that’s happened since, but on October 13 Treasury Secretary Janet Yellen announced a planned deluge of cash management bills in the wake of the debt ceiling resolution (the first one). The next day, China’s currency, CNY, broke free from its previous and suspiciously narrow range.

Read More »

Read More »

One Shock Case For ‘Irrational Exuberance’ Reaching A Quarter-Century

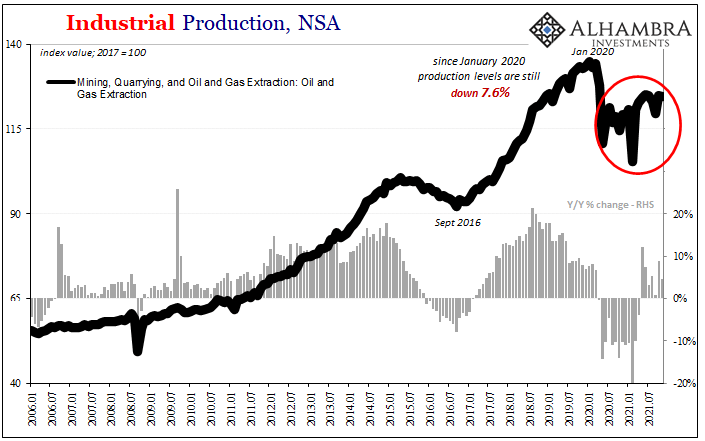

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts.

Read More »

Read More »

The World Ahead: the true costs of ageing | The Economist

The rich world is ageing fast. How can societies afford the looming costs of caring for their growing elderly populations? film supported by @Mission Winnow

00:00 The wealthy world is ageing

01:17 Japan’s elderly population

02:11 The problems of an ageing world

04:01 Reinventing old age

05:48 Unlocking the potential of older years

07:09 Reforming social care

08:20 A community-based approach

11:08 A fundamental shift is needed

Read our special...

Read More »

Read More »

One Chart Traders Might Want to Ponder

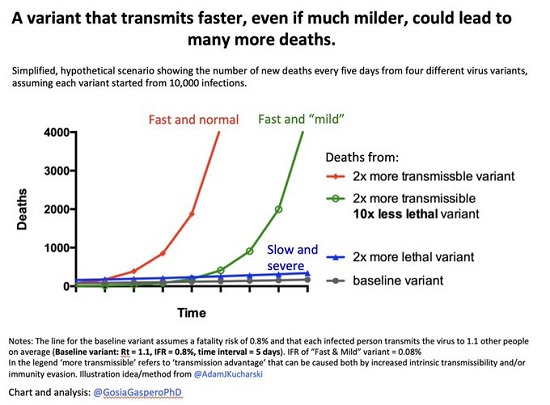

But when the Fed's fundamental powerlessness is revealed and the buy-the-dippers have been forced to liquidate, the true meaning of "mild" contagion will become apparent. Since I'd rather not be renditioned to a rat-infested, freezing cell in an unnamed 'stan, I'm circumspect about viruses in general.

Read More »

Read More »

How Vulnerable Is Your Personal Supply Chain?

How vulnerable is your personal supply chain? For the average American, the answer is: very. Americans consider abundance and ready availability as birthrights so basic they're like the air we breathe. The idea that shelves could become bare and stay bare is incomprehensible. yet that is the world we're entering, for a number of complex reasons.

Read More »

Read More »

Playing Dominoes

That was fast. Just yesterday I said watch out for when the oil curve flips from backwardation to contango. When it does, that’s not a good sign. Generally speaking, it means something has changed with regard to future expectations, at least one of demand, supply, or also money/liquidity.

Read More »

Read More »

Smart Enough to Get Rich, Not Smart Enough to Keep It

Are we smart enough to keep our oh-so-easily conjured riches? If we continue to believe that doing more of what's failed spectacularly will deliver permanently expanding riches, then the answer is no.

Read More »

Read More »