Category Archive: 5) Global Macro

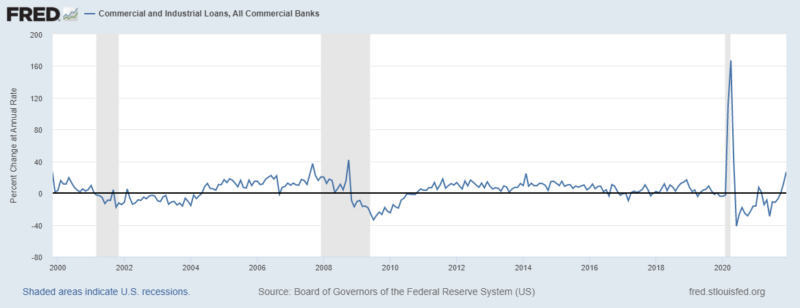

FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

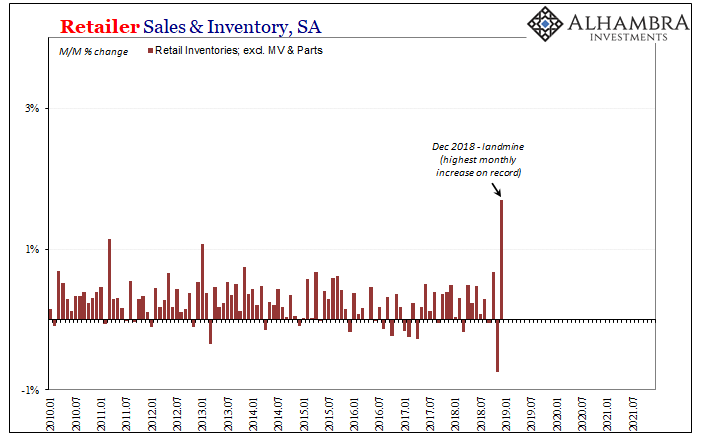

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters.

Read More »

Read More »

After Today’s FOMC, Yield Curve Is Already As Flat As It Was In Mar ’18 **Without A Single Rate Hike Yet**

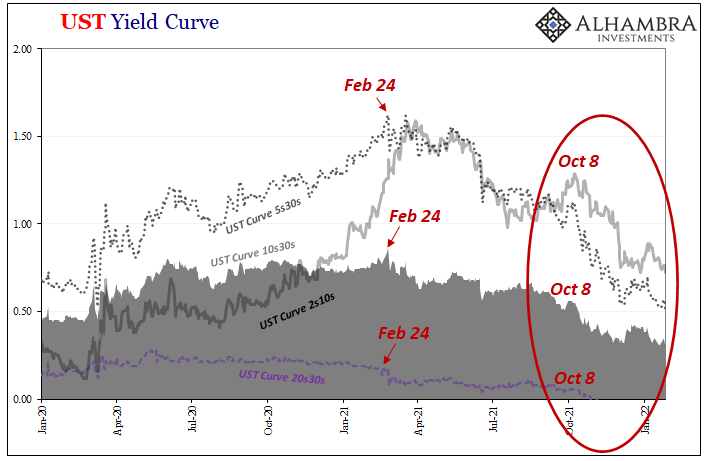

It’s not hard to reason why there continues to be this conflict of interest (rates). On the one hand, impacting the short end of the yield curve, the unemployment rate has taken a tight grip on the FOMC’s limited imagination. The rate hikes are coming and the markets like all mainstream commentary agree that as it stands there’s nothing on the horizon to stop Jay Powell’s hawkishness.

Read More »

Read More »

Keeping warm, without warming the planet | The Economist

Humans are cranking up their thermostats at the expense of the planet. With the majority of global heating still powered by dirty fuels, are there greener solutions that won't cost the earth? Read more: https://econ.st/3g3GNeq

Film supported by @Infosys

00:00 - Heating the planet with domestic heating

01:06 - South Africa’s energy supply

02:59 - What is a heat pump and how does it work?

05:58 - The first step to decarbonising heating is...

Read More »

Read More »

Rückläufige US-Erdölvorräte lassen Ölpreise steigen

Die Vereinigten Staaten weisen sinkende Ölreserven auf. Dies führt zu einem Druck auf die Preise. Trotz eines Anstiegs der Rohölvorräte im jüngsten EIA-Bericht sind die kommerziellen Erdölvorräte in den USA in den meisten Wochen der letzten anderthalb Jahre zurückgegangen und liegen unter dem saisonalen Durchschnitt der letzten fünf Jahre und sogar unter dem Fünfjahresdurchschnitt vor der Pandemie.

Read More »

Read More »

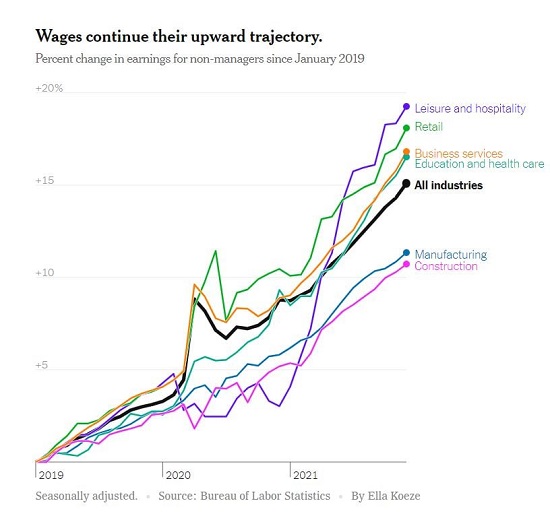

Inflation Winners and Losers

The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises. As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle.

Read More »

Read More »

The Hawks Circle Here, The Doves Win There

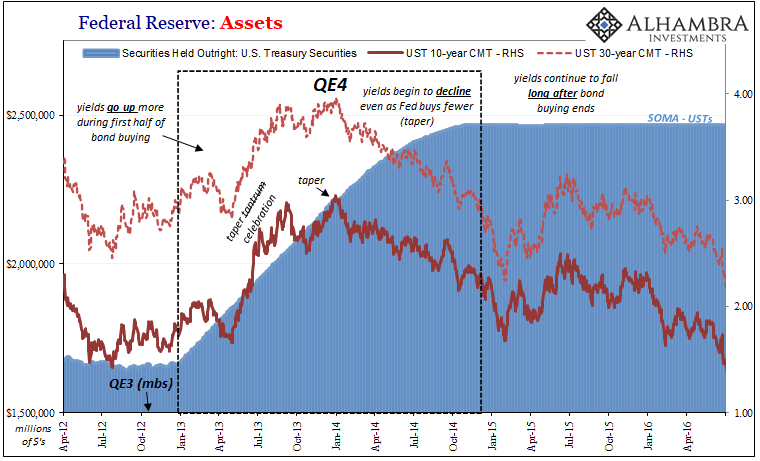

We’ve been here before, near exactly here. On this side of the Pacific Ocean, in the US particularly the situation was said to be just grand. The economy was responding nicely to QE’s 3 and 4 (yes, there were four of them by that point), Federal Reserve Chairman Ben Bernanke had said in the middle of 2013 it was becoming more than enough, creating for him and the FOMC coveted breathing space so as to begin tapering both of those ongoing programs.A...

Read More »

Read More »

Will you be eating insects soon? | The Economist

By 2050 there could be 10 billion human mouths to feed. Eating insects could help solve the global food-supply problem. Read more here: https://econ.st/3fTILxA

Film supported by @Maersk

00:00 - 00:47 How to feed our growing population

00:47 - 03:23 The potential of insects

03:23 - 05:31 Eating cricket powder in Madagascar

05:31- 06:30 Madagascar's climate change famine

06:30 - 08:00 Cricket farming in Africa

08:00 - 11:30 Expanding insect...

Read More »

Read More »

The Cult of Speculation Is a Cult of Doom

Surely the Fed gods will affirm the cult's most revered articles of faith. But false gods eventually fail, even the Fed. Every once in awhile the zeitgeist sets up an either / or: either the zeitgeist is crazy or I'm crazy. (OK, let's agree I'm crazy; see, it's not that hard to find something to agree on, is it?)

Read More »

Read More »

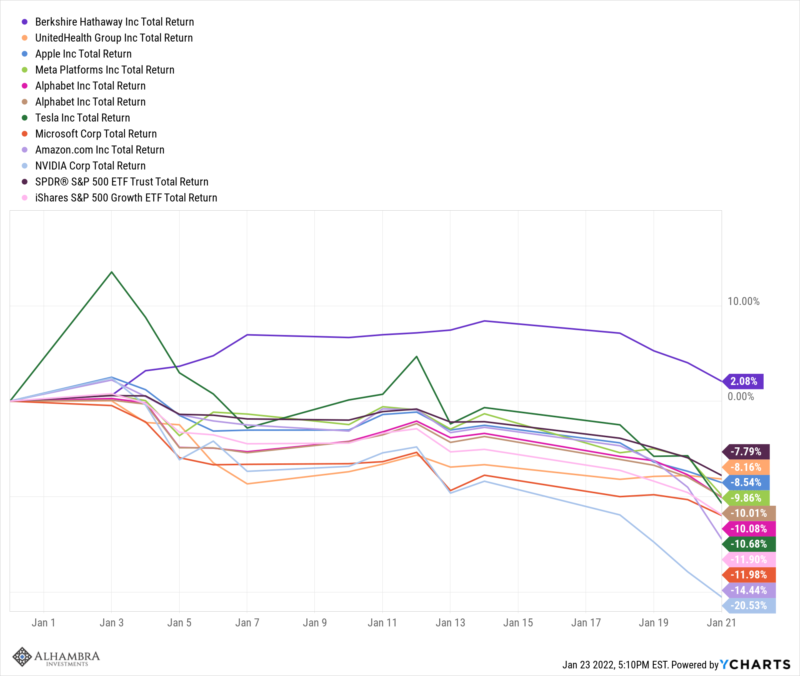

Weekly Market Pulse: Fear Makes A Comeback

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline.

Read More »

Read More »

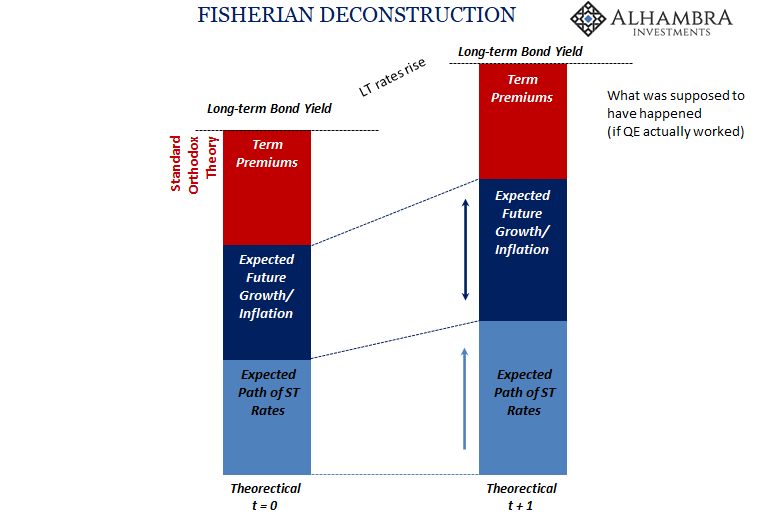

Good Time To Go Fish(er)ing Around The Yield Curve

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission.

Read More »

Read More »

China and Russia: MI6’s top concerns | The Economist

MI6 chief Richard Moore speaks to the “The Economist Asks” podcast about the world's biggest threats—from a possible Russian invasion of Ukraine to China’s increasing access to personal data

00:00 - 00:49 MI6 is stepping out of the shadows

00:49 - 02:55 Will Putin invade Ukraine?

02:55 - 03:49 China’s influence has grown

03:49 - 04:40 Our relationship with China

04:40 - 05:33 A new technological battleground

05:33 - 07:01 China’s data and...

Read More »

Read More »

Weekly Market Pulse: A Very Contrarian View

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace.

Read More »

Read More »

New technology: what do you have to fear? | The Economist

Managing the risks and rewards of emerging technologies is a tricky balancing act. How is it possible to maximise the upsides of innovation while minimising the potential downsides? Read more here: https://econ.st/327bXxU

Film supported by @Mission Winnow

00:00 - 01:03 Innovation and regulation in technology

01:03 - 01:51 How to keep innovation moving

01:51 - 03:48 The rise of autonomous cars

03:48 - 05:40 Are autonomous cars safe?

05:40 -...

Read More »

Read More »

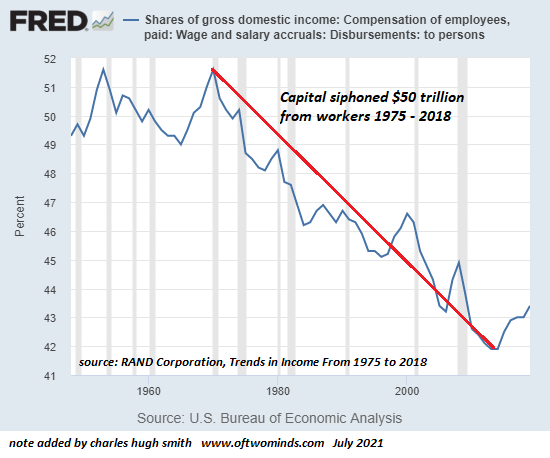

Politics Is Dead, Here’s What Killed It

Here's "politics" in America now: come with mega-millions or don't even bother to show up. Representational democracy--a.k.a. politics as a solution to social and economic problems--has passed away. It did not die a natural death. Politics developed a cancer very early in life (circa the early 1800s), caused by wealth outweighing public opinion.

Read More »

Read More »

US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation?

Read More »

Read More »

The Real Revolution Is Underway But Nobody Recognizes It

Revolutions have a funny characteristic: they're unpredictable. The general assumption is that revolutions are political. The revolution some foresee in the U.S. is the classic armed insurrection, or a coup or the fragmentation of the nation as states or regions declare their independence from the federal government.

Read More »

Read More »

China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

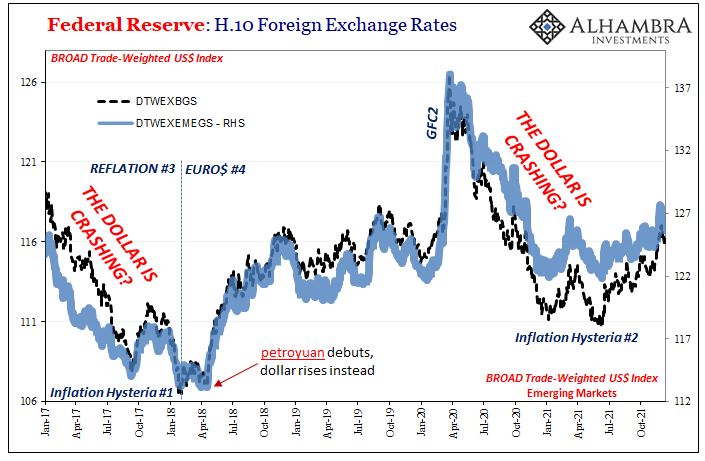

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike.

Read More »

Read More »

How to make black lives matter more | The Economist

The shocking murder of George Floyd by a police officer in 2020 sparked a wave of protests around the world and prompted promises to address structural racism. What actions could actually make black lives better? Film supported by @Mishcon de Reya LLP

00:00 - The legacy of George Floyd

01:20 - How can police reform help?

06:30 - Reallocating police resources

09:10 - The school-to-prison pipeline

12:33 - Reducing school exclusions

16:15 - Moving...

Read More »

Read More »

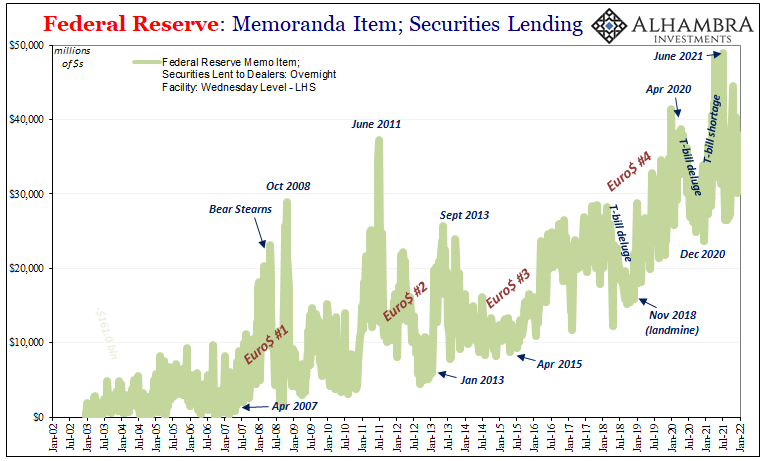

Sentiment v. Substance: Checking In On Collateral Via, Yes, The Fed

The Federal Reserve, like other central banks around the world, it does lend out the securities it owns and holds. Sophisticated modern wholesale money markets are highly collateralized, so much so that collateral itself takes on the properties of currency.

Read More »

Read More »

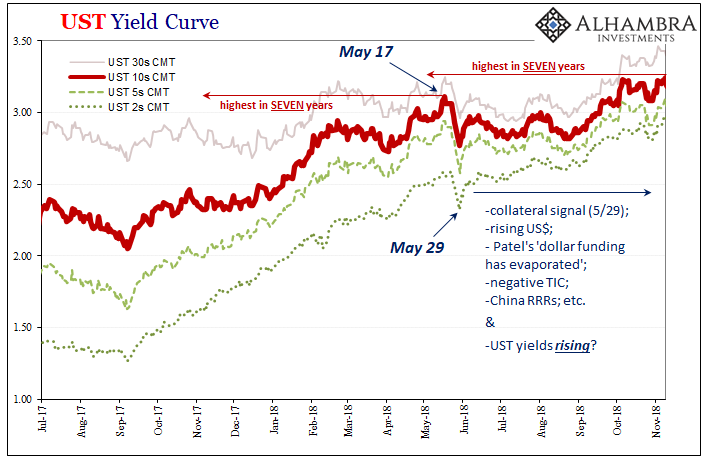

Conflict Of Interest (rates): 10-year Treasury Yield Highest in Almost Two Years

The dollar was high and going higher. Emerging markets had been seriously complaining. In one, the top central banker for India outright warned, “dollar funding has evaporated.” The TIC data supported his view, with full-blown negative months, net selling from afar that’s historically akin to what was coming out of India and the rest of the world.

Read More »

Read More »