Category Archive: 5) Global Macro

Ukraine Nuclear Chief warns over Russian activity at nuclear site | Latest World News | WION

Zaporizhzhia Nuclear Power Plant which is at the center of the Ukraine conflict continues to worry over a possible nuclear disaster. Reports now suggest that a detailed plan has been drawn up by Russia to disconnect Europe's largest nuclear plant from Ukraine's grid, citing concerns ahead of Ukraine's atomic energy.

Read More »

Read More »

Jeffrey Snider about US Dollar

Jeffrey Snider about US Dollar: How the global monetary system actually works. What really make the FED. What is QE and QT.

Read More »

Read More »

Rate Hikes Are Working

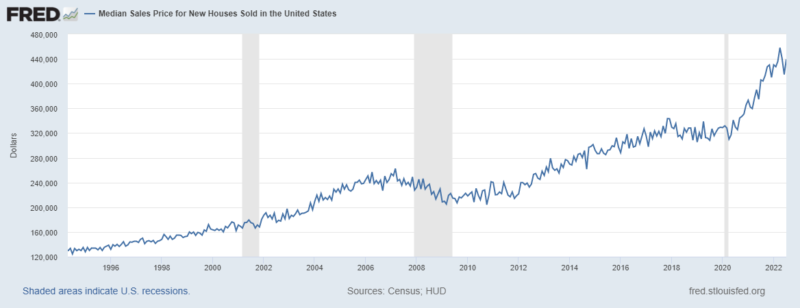

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%.

Read More »

Read More »

Gravitas LIVE | Six months of Ukraine war | What next in battleground Ukraine? | Putin’s big bet

Watch Gravitas LIVE with Palki Sharma Upadhyay:

- 6 months of Ukraine war: Takeaways & the road ahead

- Battleground Taiwan: China building more warships

- Pak army to provide FIFA World Cup security

- China’s big move in Iraq

- Europe can’t get over a train breakdown

#Gravitas #PalkiSharma #WION

Read More »

Read More »

War in Ukraine nears 6 months, braces itself for Russian intensified attacks | Latest News | WION

Ukraine is bracing itself for increased Russian attacks ahead of its Independence Day on August 24th which falls exactly six months after Russian President Vladimir Putin announced what he called a 'special operation' in the neighboring nation. WION in an exclusive interview with Dr. Lada L Roslycky, international security analyst from Kyiv.

Read More »

Read More »

WION Fineprint: How drones are shaping the Ukraine war

Drones have become the top focus in Ukraine as thousands are being used by both sides to hit targets behind the enemy lines. Molly Gambhir tells you how drones are shaping this war.

Read More »

Read More »

The Fed Can’t Stop Supply-Side Inflation

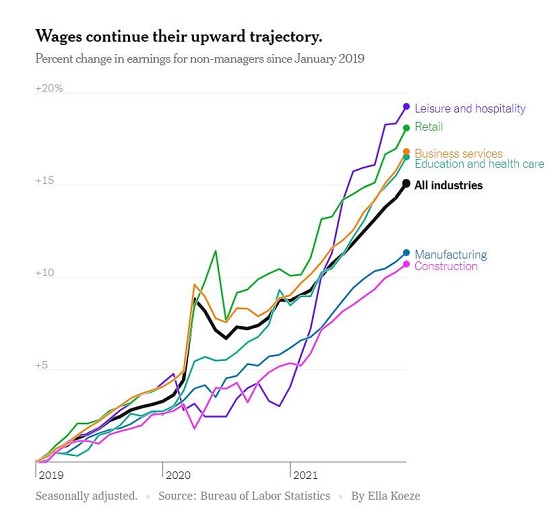

The Fed and other central banks have zero control of supply-driven inflation, period. America's financial punditry is bewitched by four fatal fantasies: 1. Inflation is demand-driven. If the Federal Reserve (or other central banks) reduce demand with monetary tools like raising interest rates, inflation will cool. 2. Substitution of high-cost goods with lower-cost goods reduces inflation, and substitution is infinite: there's always cheaper...

Read More »

Read More »

Gravitas: Russia thwarts terror plot against India, detains I-S operative

Russia has thwarted a terror plot against India. The FSB has apprehended an Islamic state operative who planned to carry out a 'suicide attack' in India over the blasphemy row.

Read More »

Read More »

Warning: Oil Moving Rapidly to “Contango” [Ep. 277, Eurodollar University]

The calendar spread (1- and 3-month) in the oil futures market (West Texas Intermediate) is compressing and is THIS close to being in contango. That would be the oil market saying, 'We don't see the demand. Keep your barrels—don't call us, we'll call you.'

Read More »

Read More »

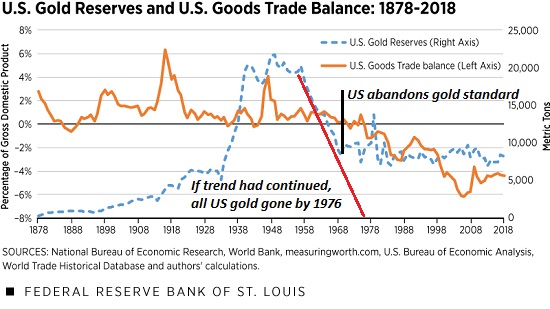

The Real Story of America Abandoning the Gold Standard

Even currencies maintaining convertibility to gold are still subject to bond yields, interest rates, trade and capital flows. It's widely held that all of our financial woes are the result of abandoning the discipline of the gold standard in 1971. The premise here is that if the U.S. had maintained the gold standard, the excesses of the fiat currencies regime could not have arisen.

Read More »

Read More »

The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

Read More »

Read More »

Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

Read More »

Read More »

Taiwan: will there be war?

The uneasy status-quo between China and Taiwan, which has existed for seven decades, is looking more fragile than ever. Is war inevitable?

00:00 - Threat to Taiwan’s peace

00:38 - Are we closer to war?

01:47 - China’s growing power

03:01 - Taiwan’s allies

03:45 - Taiwanese public opinion

04:45 - Rising threat of war

Read more about preventing a war in Taiwan: https://econ.st/3zX43UX

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

Gravitas LIVE | Crimea blast: Russia’s prestige on the line | Is Moscow raising the nuclear threat?

-Ukraine war escalates: Satellite images show destroyed Russian jets

-Unlike Biden, Xi to get grand welcome in Saudi Arabia

-China promises Aid, Nepal agrees to trans-Himalayan railway

-India debates freebie politics

-Japan’s male minister tried “pregnancy belly”

Read More »

Read More »

US Secretary of State Antony Blinken lands in Africa two weeks after Russian FM Lavrov’s visit

US top diplomat Antony Blinken is in Africa to woo the nations, which have largely steered clear of backing Washington against Moscow in the Ukraine war.

Read More »

Read More »

Tips for Buying a Medicare Supplement Policy

The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage. There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

Read More »

Read More »

A Tale of Two Recessions: One Excellent, One Tumultuous

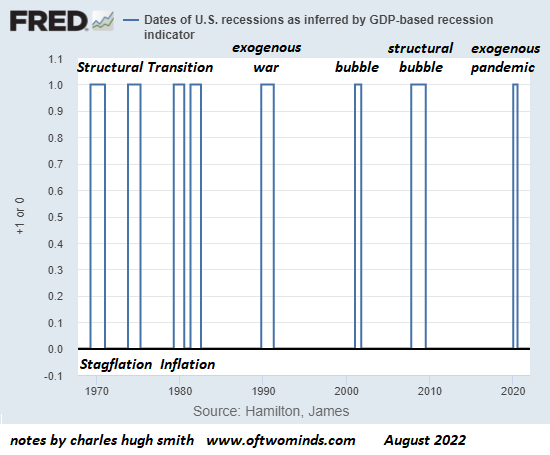

Events may show that there are no winners, only survivors and those who failed to adapt.Some recessions are brief, necessary cleansings in which extremes of leverage and speculation are unwound via painful defaults, reductions of risk and bear markets. Some are reactions to exogenous shocks such as war or pandemic.

Read More »

Read More »

Russia-Ukraine crisis: Fresh strikes at Zaporizhzhia nuke plant, UNSC convenes emergency meet

While the two neighbors are busy trading charges over shelling at Zaporizhzhia nuke plant, the world stands in fear of a possible catastrophe.

Read More »

Read More »

McDonald’s plans to reopen in Ukraine

McDonald's Corp said on Thursday it plans on reopening its restaurants in Ukraine over the next few months in an early sign of western businesses returning to the country, even as the conflict with Russia continues.

Read More »

Read More »

Nuclear power: the clean, green energy dream?

One of the keys to a smooth transition to a green economy is nuclear power. It's a proven alternative to fossil fuels—but the most important barriers to its adoption may not be what you think.

00:00 - The role of nuclear power

00:48 - The advantages of nuclear energy

01:41 - The problem with nuclear power

02:51 - Nuclear waste

03:58 - Storage options for nuclear waste

Read more about nuclear power’s newest appeal: https://econ.st/3SyNAP4

Sign...

Read More »

Read More »