Category Archive: 5) Global Macro

Bi-Weekly Economic Review: Maximum Optimism?

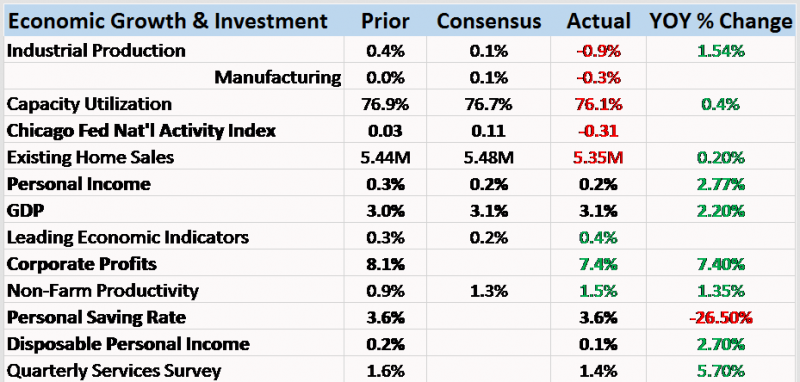

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, China (+4.1%), South Africa (+3.2%), and Hungary (+2.4%) have outperformed this week, while Egypt (-2.8%), Qatar (-2.7%), and Mexico (-1.7%) have underperformed. To put this in better context, MSCI EM rose 1.9% this week while MSCI DM rose 0.6%.

Read More »

Read More »

Catalonia’s independence referendum, cartooned | The Economist

Catalonia’s independence referendum has ended with the Catalan president, Carles Puigdemont, stuck in a quagmire. Our cartoonist KAL talks through how he expressed those difficulties for his latest cartoon. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

Surprise! The Rules Will Change (But Not to Your Benefit)

These expedient fixes end up crippling the mechanisms that are needed to actually solve the systemic sources of the crisis. We can add a third certainty to the two standard ones (death and taxes): The rules will suddenly change when a financial crisis strikes. Why is this a certainty? The answer is complex, as it draws on human nature, politics and the structure of societies/economies ruled by centralized states (governments).

The Core Imperative...

Read More »

Read More »

Run On The Pound? Jeremy Corbyn Says Should Plan For

Run On The Pound ? Jeremy Corbyn Says Should Plan For. Right to plan for ‘run on pound’ if Labour wins says Corbyn and Labour party . British pound already down 20% since Brexit, collapse already in play. Run on the pound likely due to Labour’s ‘command economy’ approach. Collapse in Sterling would undermine UK financial system. Portfolios holding sterling and related assets would be significantly affected. Pension funds and property the most...

Read More »

Read More »

♞ Charles Hugh Smith – TBuried In The Fed’s Report It Reveals The Truth About The Economy ♘

‘News Brief’ Report date: 10.05.2017 Guest: Charles Hugh Smith Books: Why Our Status Quo Failed and Is Beyond Reform Get a Job, Build a Real Career… Why Things Are Falling Apart and What We Can Do About It A Radically Beneficial World Most of artwork that are included with these videos have been created by …

Read More »

Read More »

US: Reflation Check

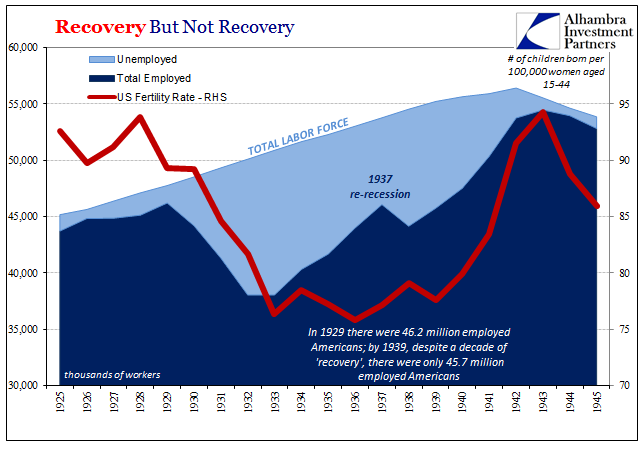

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply.

Read More »

Read More »

Hackers will pose a greater threat in 2018 | The Economist

Hackers will affect our daily lives in 2018 like never before. As more elements of our daily lives are linked to the internet, hackers will have greater opportunity to scale up cybercrimes, leaving our homes and personal lives more vulnerable to attack Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 In 2018 cyber …

Read More »

Read More »

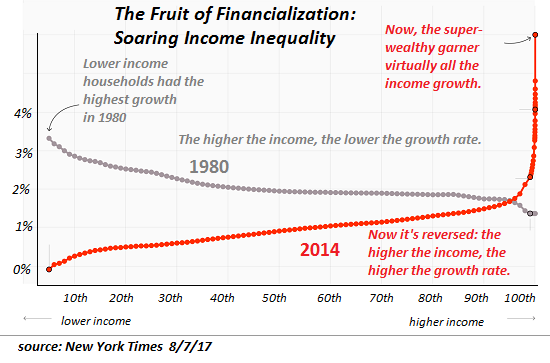

This Chart Defines the 21st Century Economy

There is nothing inevitable about such vast, fast-rising income-wealth inequality; it is the only possible output of our financial and pay-to-play political system. One chart defines the 21st century economy and thus its socio-political system: the chart of soaring wealth/income inequality. This chart doesn't show a modest widening in the gap between the super-wealthy (top 1/10th of 1%) and everyone else: there is a veritable Grand Canyon between...

Read More »

Read More »

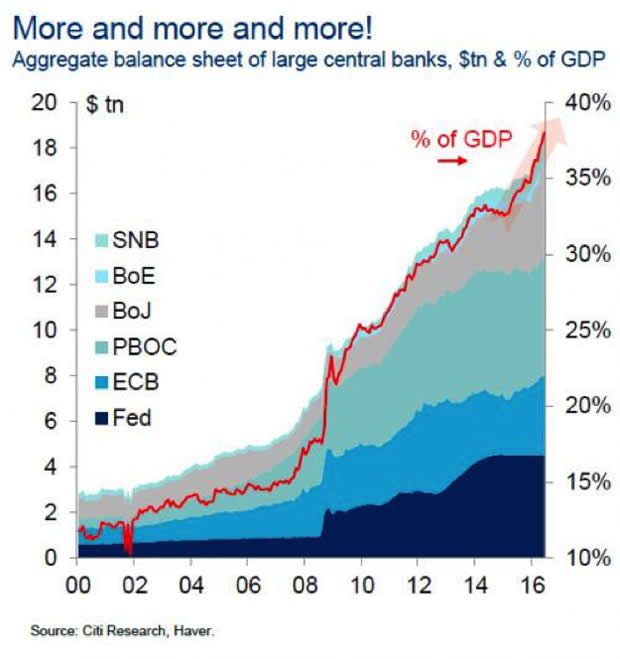

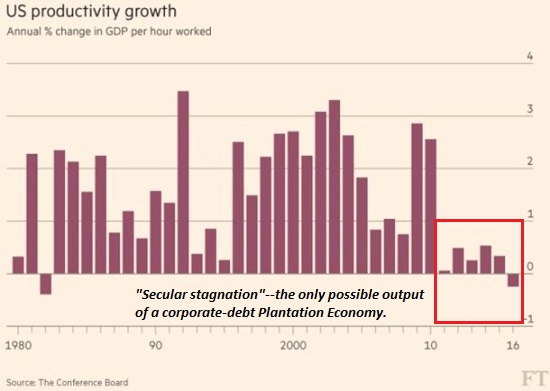

Stagnation Is Not Just the New Normal–It’s Official Policy

Japan is a global leader is how to gracefully manage stagnation. Although our leadership is too polite to say it out loud, they've embraced stagnation as the new quasi-official policy. The reason is tragi-comically obvious: any real reform would threaten the income streams gushing into untouchably powerful self-serving elites and fiefdoms.

Read More »

Read More »

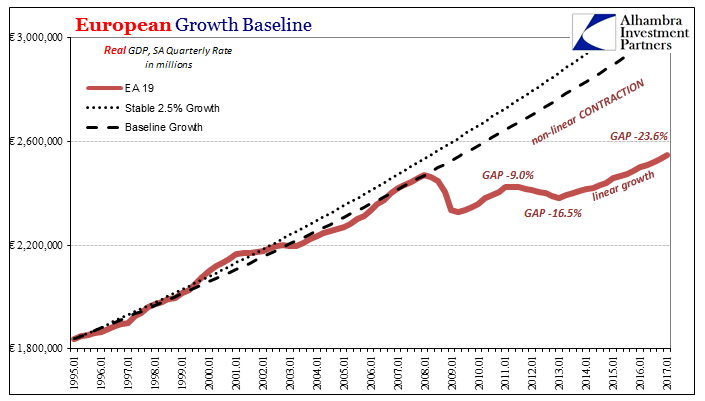

Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was continued denial especially on the...

Read More »

Read More »

Charles Hugh Smith On Why Wages Are Stagnant In The Developed World

Click here for the full transcript: http://financialrepressionauthority.com/2017/10/01/the-roundtable-insight-charles-hugh-smith-on-why-wages-are-stagnant-in-the-developed-world/

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX firmed Friday, but capped off a bad week overall. US jobs data this Friday is unlikely to provide much clarity on Fed policy, though we think it remains on track to hike again in December. The Fed’s balance sheet reduction will start this month. We remain negative on EM, and believe selling pressures are likely to persist in Q4.

Read More »

Read More »

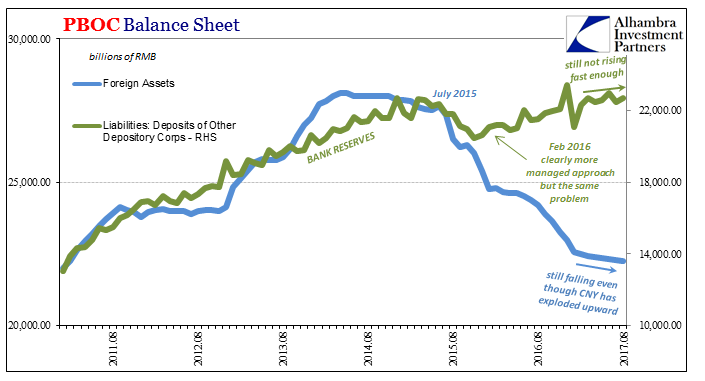

Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese reformer.

Read More »

Read More »

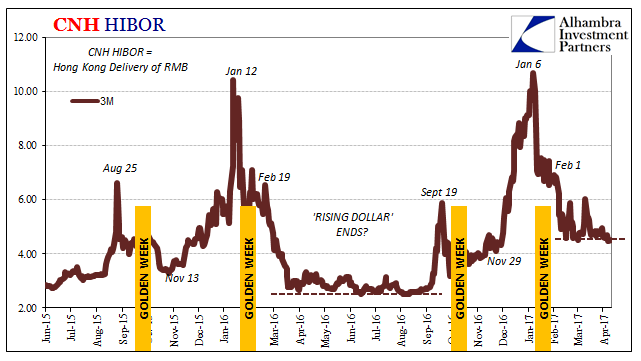

Location Transformation or HIBORMania

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first relates to the Chinese New Year...

Read More »

Read More »

Emerging Markets: What has Changed

India Prime Minister Modi announced an INR163.2 bln program to deliver electricity to all households. Poland’s President Duda is trying to reach a compromise on judicial reforms. Fitch raised the outlook on Russia’s BBB- rating from stable to positive. Saudi Arabia announced it will remove the ban on women driving. South Africa’s biggest labor organization stepped up its opposition to President Zuma.

Read More »

Read More »

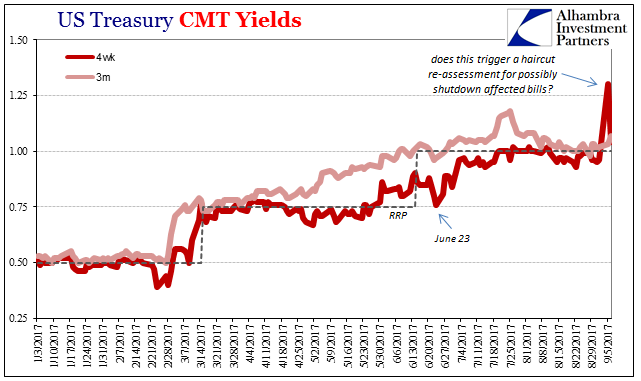

It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

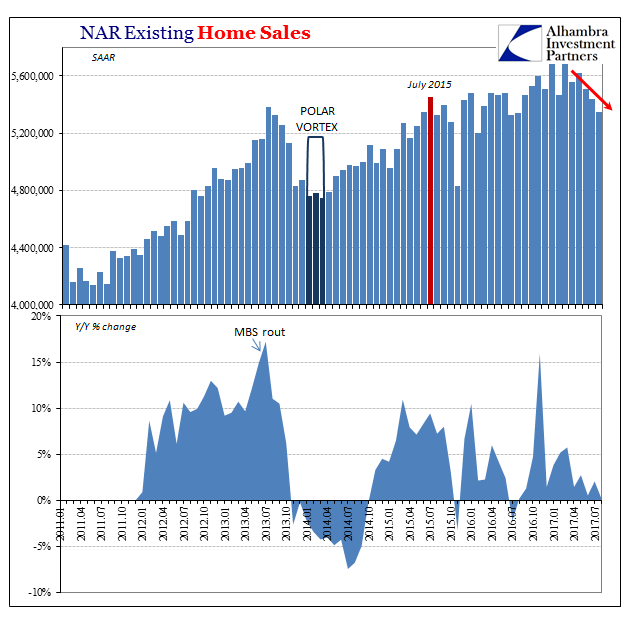

The Real Estate View For A Second Lost Decade

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense.

Read More »

Read More »