Category Archive: 5) Global Macro

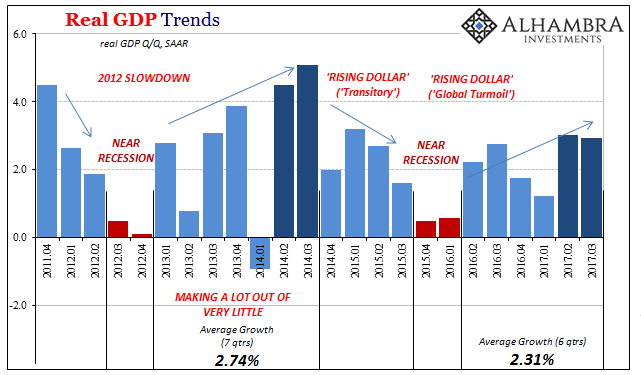

Strong Growth? Q3 GDP Only Shows How Weak 2017 Has Been

Baseball Hall of Famer Frank Robinson also had a long career as a manager after his playing days were done. He once said in that latter capacity that you have to have a short memory as a closer. Simple wisdom where it’s true, all that matters for that style of pitching is the very next out. You can forget about what just happened so as to give your full energy and concentration to the batter at the plate.

Read More »

Read More »

The Balfour Declaration’s impact, 100 years on | The Economist

The Balfour Declaration was penned 100 years ago, but its legacy still resonates in the Middle East today. How did a letter, only 67-words long, ignite 100 years of conflict? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 100 years ago this week Arthur Balfour, the British foreign secretary, penned a letter that …

Read More »

Read More »

Observations on Wealth-Income Inequality (from Federal Reserve Reports)

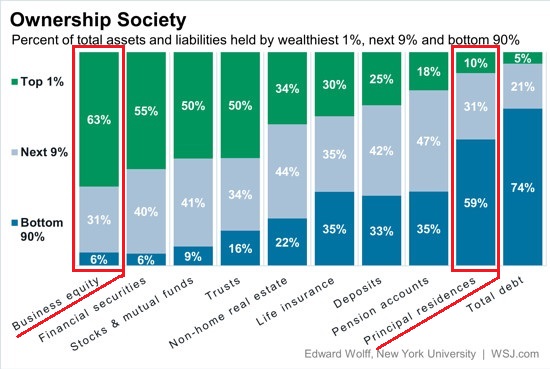

There's a profound difference between assets that produce no income and those that produce net income. To those of us nutty enough to pore over dozens of pages of data on wealth and income in the U.S., the Federal Reserve's quarterly Z.1 reports and annual Survey of Consumer Finances (SCF) are treasure troves, as are I.R.S. tax and income reports.

Read More »

Read More »

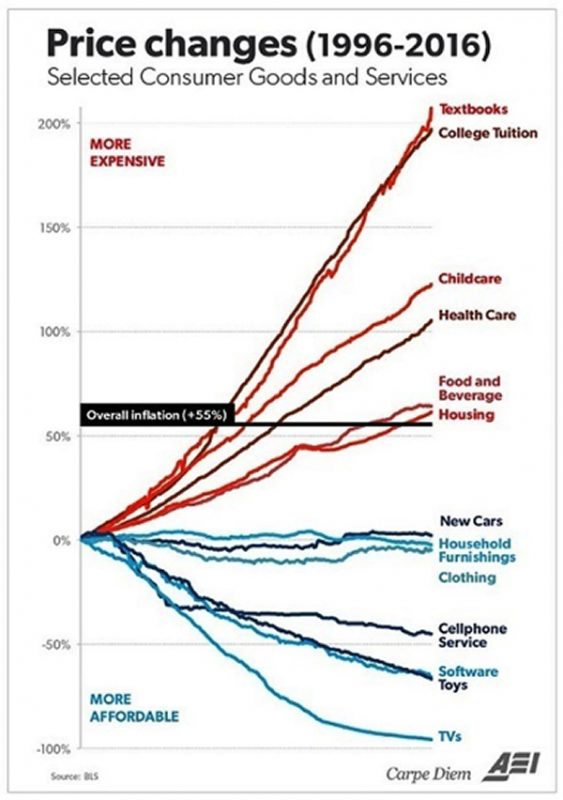

Where To Invest When (Almost) Everything’s in a Bubble

Many things that are scarce and thus valuable cannot be bought on the global marketplace. Now that almost every asset class is in a bubble, the question of where to invest one's capital has become particularly vexing. The ashes of wealth consumed by the 2008-09 Global Financial Meltdown are still warm, at least to those who never recovered, and so buying assets at nosebleed valuations in the hopes of earning another 5% aren't very compelling to...

Read More »

Read More »

Facial recognition technology will change the way we live | The Economist

Facial recognition technology will transform the way we live in 2018. Machines that can read and recognise our faces will go mainstream, opening up exciting possibilities and posing new dangers Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 In 2018 machines that can read your face will go mainstream, changing the way we …

Read More »

Read More »

What Could Pop The Everything Bubble?

As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop.

Read More »

Read More »

Urbanisation and the rise of the megacity | The Economist

Urbanisation is happening faster today than at any time in history. By 2030 nearly 9% of the global population will live in so-called megacities—cities with more than 10m inhabitants. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 In 1950 New York and Tokyo were the only so called megacities; cities with more than …

Read More »

Read More »

Transforming cities with technology | The Economist

Cities are growing faster than at any time in history, straining services and infrastructure. Technology-driven advances are at the forefront of solving this age-old problem Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 By 2050, two thirds of the world’s population will live in cities. Urbanisation is happening faster than at any time …

Read More »

Read More »

Subject To Gradation

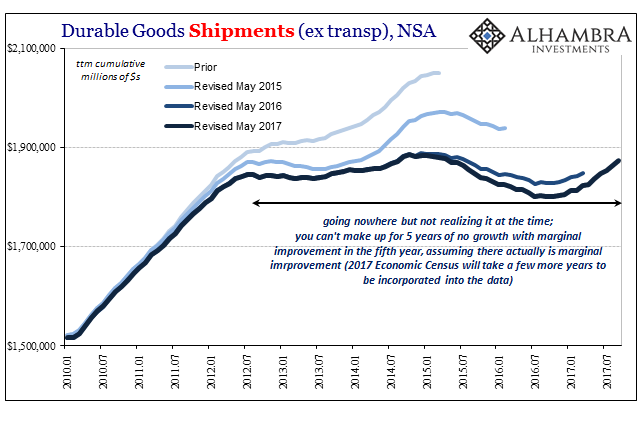

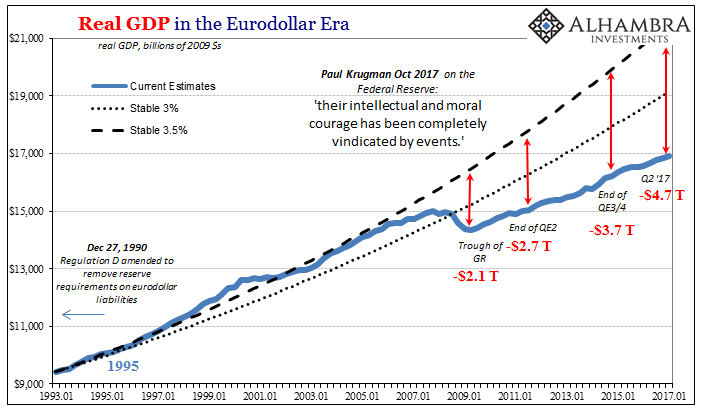

Economic growth is subject to gradation. There is almost no purpose in making such a declaration, for anyone with common sense knows intuitively that there is a difference between robust growth and just positive numbers. Yet, the biggest mistake economists and policymakers made in 2014 was to forget that differences exist between even statistics all residing on the plus side.

Read More »

Read More »

Emerging Markets: What has Changed

EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon.

Read More »

Read More »

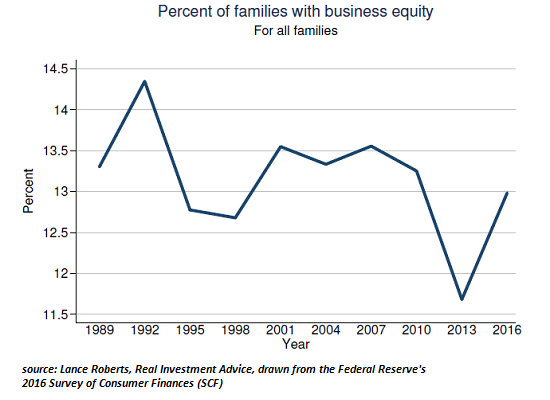

Stagnation Nation: Middle Class Wealth Is Locked Up in Housing and Retirement Funds

The majority of middle class wealth is locked up in unproductive assets or assets that only become available upon retirement or death. One of my points in Why Governments Will Not Ban Bitcoin was to highlight how few families had the financial wherewithal to invest in bitcoin or an alternative hedge such as precious metals.

Read More »

Read More »

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

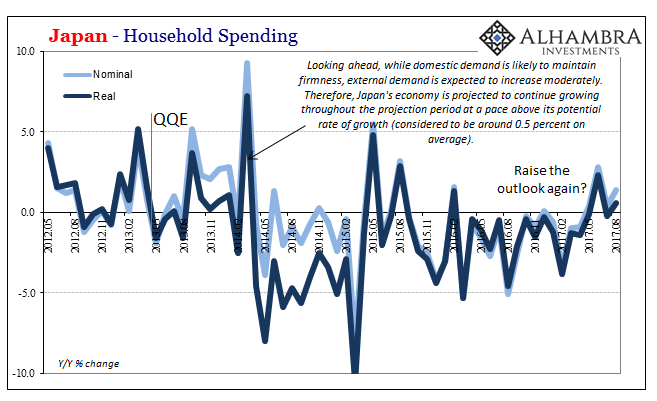

Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of investment research at SMBC Nikko...

Read More »

Read More »

Emerging Markets: What has Changed

President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa's mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to cut funding for Turkish banks.

Read More »

Read More »

Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class.

Read More »

Read More »

Political Economics

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t the usual R vs. D, left vs....

Read More »

Read More »

Charles Hugh Smith Will The Private Sector Grow Fast Enough To Meet The Demands Of The Public Sector

Click here for the full summary: http://financialrepressionauthority.com/2017/10/27/the-roundtable-insight-charles-hugh-smith-on-will-the-private-sector-be-able-to-grow-fast-enough-to-meet-the-demands-of-the-public-sector/

Read More »

Read More »

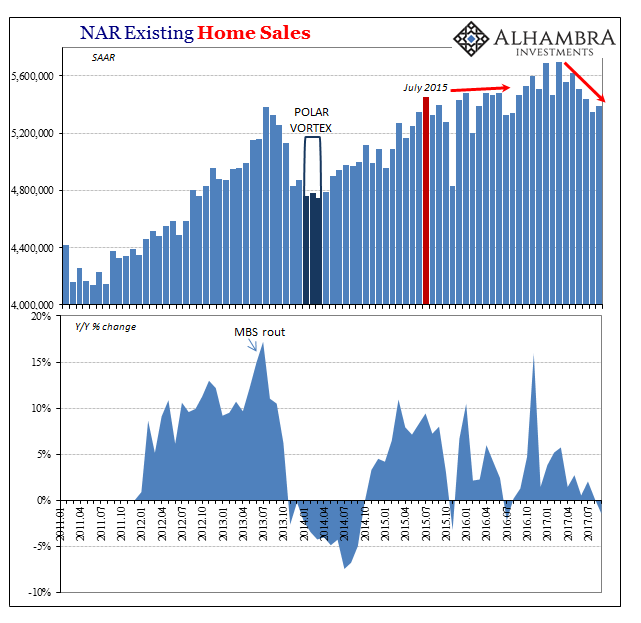

Housing Isn’t Just About Real Estate

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year.

Read More »

Read More »