Category Archive: 5) Global Macro

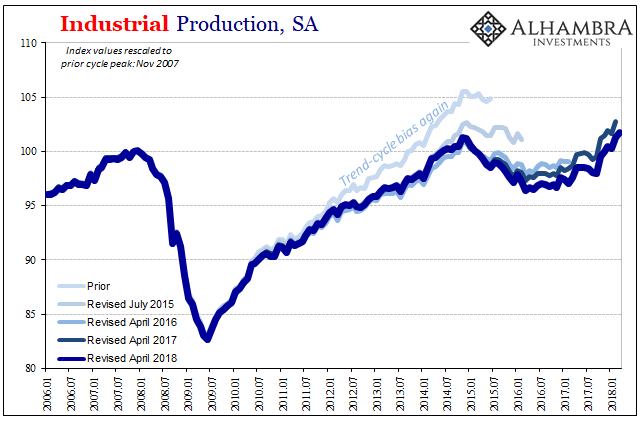

Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of operative history.

Read More »

Read More »

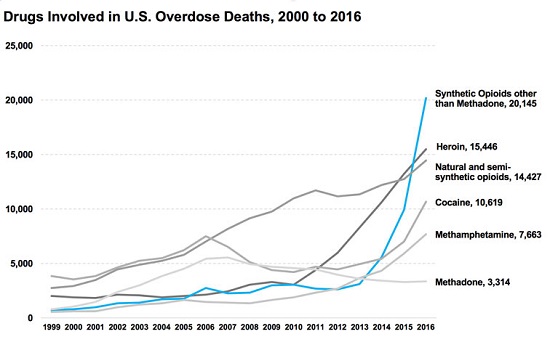

Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

Self-destruction isn't a bug, it's a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies.

Read More »

Read More »

Donald Trump’s attack on American justice | The Economist

President Trump is trying to influence what has traditionally been a non-partisan institution: the Department of Justice. In his first year in office he has appointed a record 18 federal judges and one supreme court justice. What does this mean for the future of the rule of law in the United States? Click here to …

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous.

Read More »

Read More »

Charles Hugh Smith On The Developing Trade Wars

Click here for the full transcript: http://financialrepressionauthority.com/2018/04/23/the-roundtable-insight-charles-hugh-smith-on-the-developing-trade-wars/

Read More »

Read More »

Emerging Markets: What Changed

The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections.

Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador.

Read More »

Read More »

The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

What Do We Know About Syria? Next to Nothing

Anyone accepting "facts" or narratives from any interested party is being played. About the only "fact" the public knows with any verifiable certainty about Syria is that much of that nation is in ruins. Virtually everything else presented as "fact" is propaganda intended to serve one of the competing narratives or discredit one or more competing narratives.

Read More »

Read More »

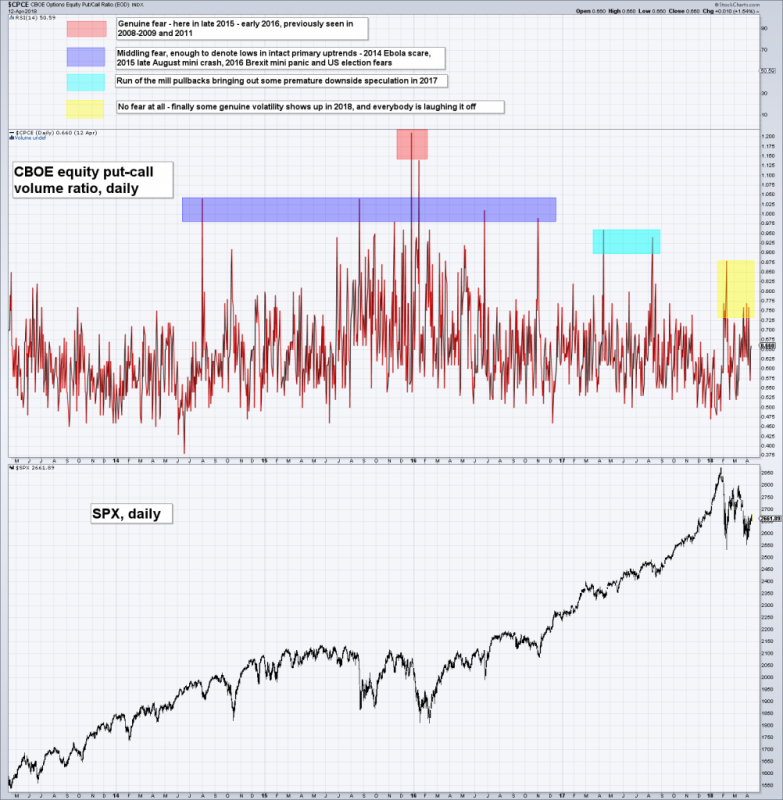

US Stock Market: Happy Days Are Here Again? Not so Fast…

Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when they have a higher probability than otherwise, and we will certainly point those out...

Read More »

Read More »

How to solve the refugee crisis | The Economist

The refugee crisis is one of the most pressing challenges for the world today: around 1 person in 100 is a refugee. David Miliband, a former British foreign secretary, offers his thoughts on how to solve it. Click here to subscribe to The Economist on YouTube: http://econ.st/2F3OBrG #openfuture Daily Watch: mind-stretching short films throughout the …

Read More »

Read More »

China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a trade war (but isn’t really,...

Read More »

Read More »

Global Asset Allocation Update: The Certainty of Uncertainty

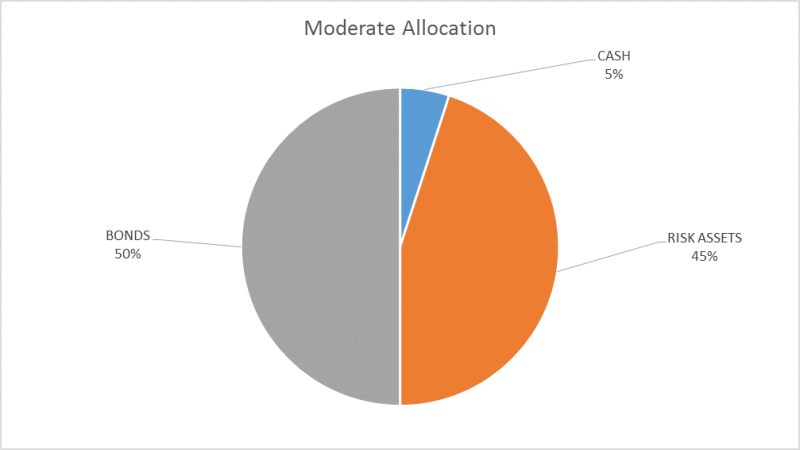

There is no change to the risk budget this month. For the moderate risk investor, the allocation to bonds is 50%, risk assets 45% and cash 5%. Stocks continued their erratic ways since the last update with another test of the February lows that are holding – for now. While we believe growth expectations are moderating somewhat (see the Bi-Weekly Economic Review) the change isn’t sufficient to warrant an asset allocation change.

Read More »

Read More »

Liberalism: where did it come from and are its days numbered? | The Economist

Liberalism has been the dominant political philosophy in the West for more than 200 years. Populists say liberals are too elite and are out of touch with ordinary people. Here’s what you need to know about liberalism and its place in modern society. Click here to subscribe to The Economist on YouTube: http://econ.st/2HbzON6 #openfuture Daily …

Read More »

Read More »

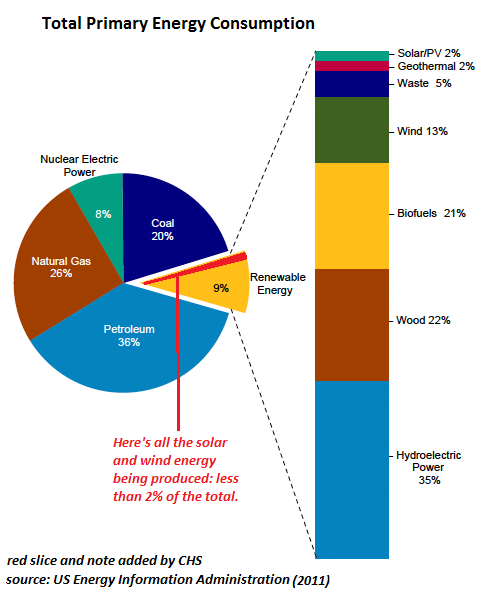

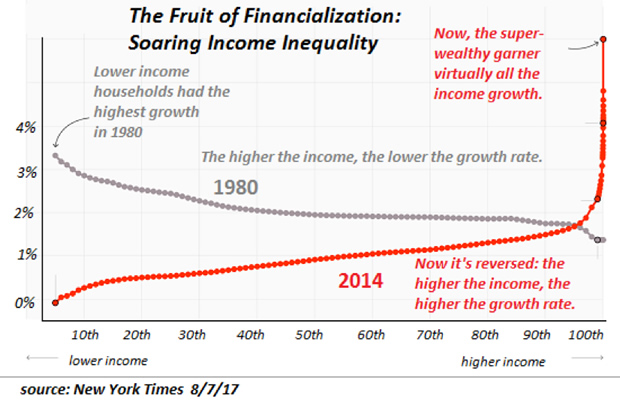

Why Trade Wars Ignite and Why They’re Spreading

What ignites trade wars? The oft-cited sources include unfair trade practices and big trade deficits. But since these have been in place for decades, they don't explain why trade wars are igniting now. To truly understand why trade wars are igniting and spreading, we need to start with financial repression, a catch-all for all the monetary stimulus programs launched after the Global Financial Meltdown/Crisis of 2008/09.

Read More »

Read More »

RMR: Special Guest – Charles Hugh Smith – Of Two Minds (04/16/2018)

“V” interviews returning guest Charles Hugh Smith editor and owner of the Of Two Minds Blog. “V” and Charles discuss the current challenge to control the narrative in the middle-east, the balance of trade between countries and epic failures of the economic system. We are political scientists, editorial engineers, and radio show developers drawn together …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed Friday, capping a mixed week as a whole. COP, CLP, and MXN were the best performers last week, while RUB, BRL, and TRY were the worst. While concerns about trade wars and Syrian missile strikes have ebbed, risks to EM remain elevated. US retail sales Monday and Fed Beige Book Wednesday are the economic highlights this week.

Read More »

Read More »

What is The Economist’s Open Future project?

For 175 years The Economist has been doing more than reporting news. It’s been championing values, promoting open societies, challenging special interests, making the case for decisions based on cold hard facts. #openfuture We set the agenda for free trade and globalization. We made the case for same-sex marriage and private space exploration. But in …

Read More »

Read More »

The Genie’s Out of the Bottle: Eight Defining Trends Are Reversing

Though the Powers That Be will attempt to placate or suppress the Revolt of the Powerless, the genies of political disunity and social disorder cannot be put back in the bottle. The saying "the worm has turned" refers to the moment when the downtrodden have finally had enough, and turn on their powerful oppressors.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential retaliatory measures in response to US...

Read More »

Read More »