Category Archive: 5) Global Macro

The Fed Can’t Reverse the Decline of Financialization and Globalization

The global economy and financial system are both running on the last toxic fumes of financialization and globalization. For two generations, globalization and financialization have been the two engines of global growth and soaring assets. Globalization can mean many things, but its beating heart is the arbitraging of the labor of the powerless, and commodity, environmental and tax costs by the powerful to increase their profits and wealth.

Read More »

Read More »

Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction. The North American session is quiet in terms of US data. Mexico reports December CPI; Peru is expected to keep rates steady at 2.25%. German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney.

Read More »

Read More »

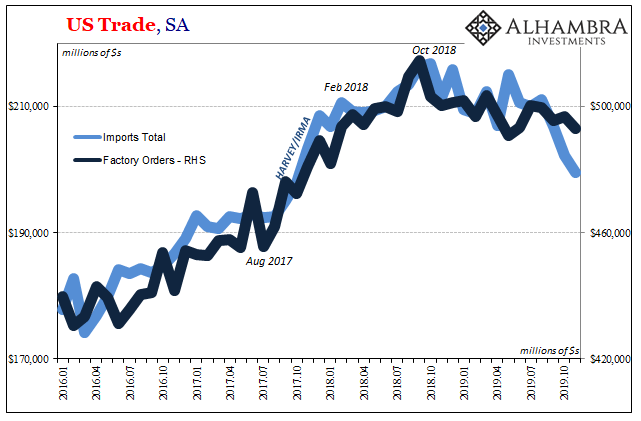

The Real Trade Dilemma

When I write that there are no winners around the world, what I mean is more comprehensive than just the trade wars. On that one narrow account, of course there are winners and losers. The Chinese are big losers, as the Census Bureau numbers plainly show (as well as China’s own). But even the winners of the trade wars find themselves wondering where all the spoils are.

Read More »

Read More »

More Trends That Ended 2019 The Wrong Way

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019.

Read More »

Read More »

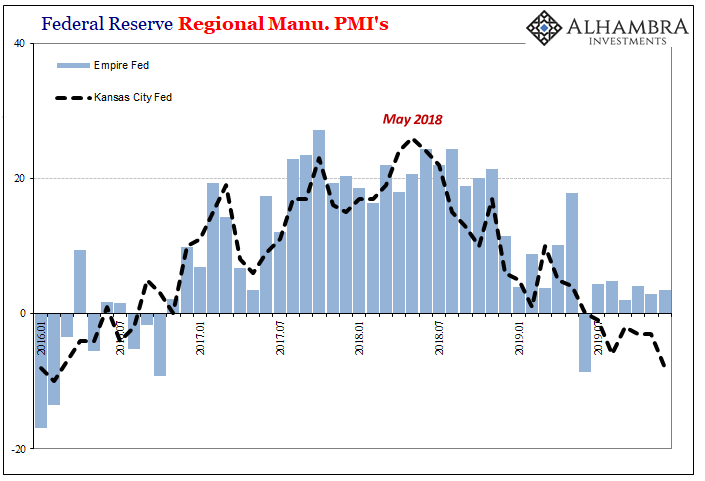

Manufacturing Clears Up Bond Yields

Yesterday, IHS Markit reported that the manufacturing turnaround its data has been suggesting stalled. After its flash manufacturing PMI had fallen below 50 several times during last summer (only to be revised to slightly above 50 every time the complete survey results were tabulated), beginning in September 2019 the index staged a rebound jumping first to 51.1 in that month.

Read More »

Read More »

WTF: What The Fed?! – Mike Maloney, Chris Martenson, Grant Williams, Charles Hugh Smith, A. Taggart

Watch the full event free at https://www.peakprosperity.com/wtf-what-the-fed/ “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a …

Read More »

Read More »

Is This “The Top”?

Parabolic moves end when the confidence that the parabolic move can't end becomes the consensus. The consensus seems to be that the stock market is on its way to much higher levels, and soon. The near-term targets for the S&P 500 (SPX, currently around 3,235) range from 3,500 to 4,000, with longer-term targets reaching "the sky's the limit."

Read More »

Read More »

EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe.

Read More »

Read More »

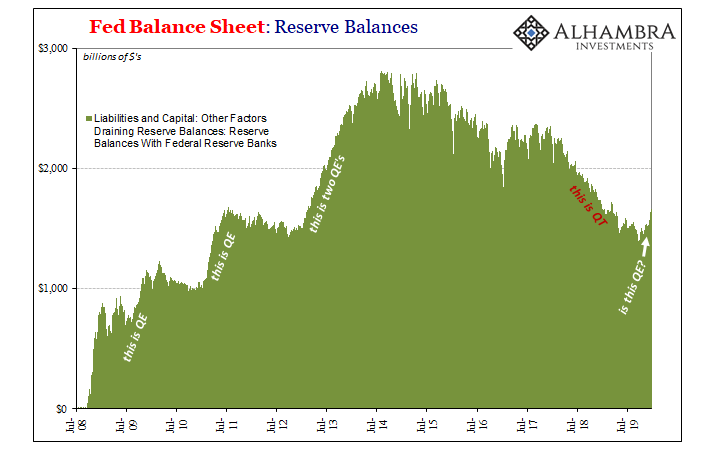

2019: The Year of Repo

The year 2019 should be remembered as the year of repo. In finance, what happened in September was the most memorable occurrence of the last few years. Rate cuts were a strong contender, the first in over a decade, as was overseas turmoil. Both of those, however, stemmed from the same thing behind repo, a reminder that September’s repo rumble simply punctuated.

Read More »

Read More »

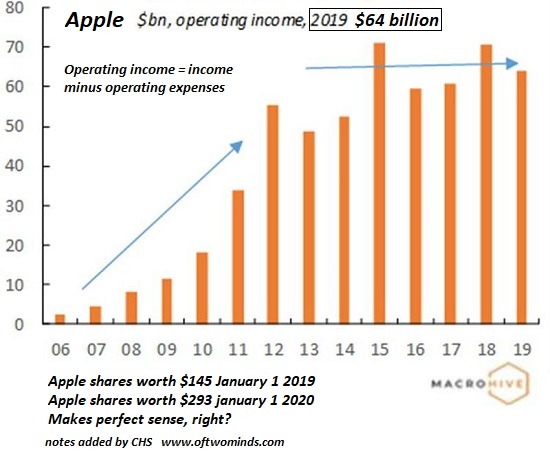

The Two Charts You Need to Ignore or Rationalize Away in 2020 (Unless You’re a Bear)

If you believe you've front-run the herd, you're now in mid-air along with the rest of the herd that has thundered off the cliff. We're awash in financial charts, but only a few crystallize an entire year. Here are the two charts that sum up everything you need to know about the stock market in 2020.

Read More »

Read More »

CHARLES HUGH SMITH – Huge Globalization Cycle Is Ending

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

What does gun violence in America look like? | The Economist

Mass shootings dominate the gun-violence debate in America, even though they account for less than 0.3% of gun-deaths. At The Economist’s Open Future festival in Chicago three leading campaigners against gun violence explored the problem and what should be done to stop it. Read more here: https://econ.st/37wOzH4 Click here to subscribe to The Economist on …

Read More »

Read More »

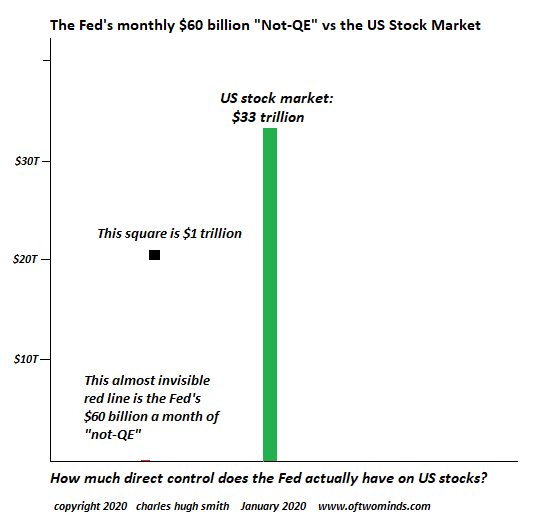

The Fed’s “Not-QE” and the $33 Trillion Stock Market in Three Charts

One day the stock market 'falcon' will no longer hear the Fed 'falconer', and the Pavlovian magical thinking will break down as the market goes bidless. The past decade has shown that when the Federal Reserve creates trillions of dollars out of thin air (QE), U.S. stocks rise accordingly. The correlation is very nearly perfect.

Read More »

Read More »

Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider explain why low yields...

Read More »

Read More »

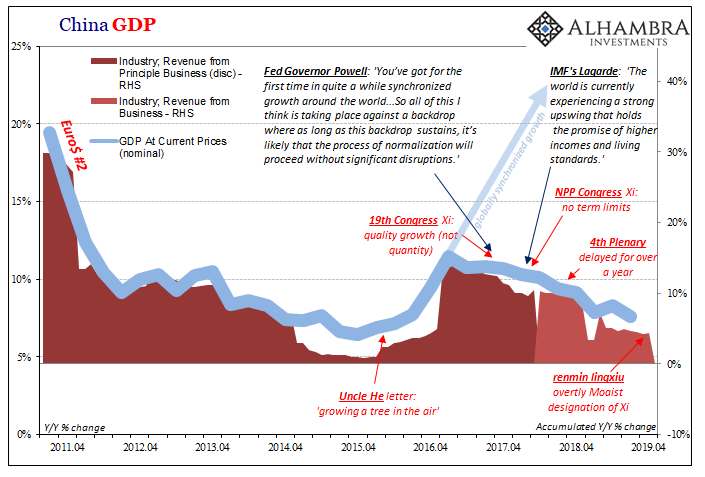

A Sour End To The 2010’s Doesn’t Have To Spoil The Entire 2020’s

It has been perhaps the most astonishing divergence in the first two decades of 21st century history. In late 2017, Western economic officials (mostly central bankers) were taking their victory laps. They took great pains to tell the world it was due to their profound wisdom, deep courage, and, most of all, determined patience, that they had been able to see their policies through to the light of day (no thanks to voters around the world).

Read More »

Read More »

The People Are Waking Up, The Elite Are No Longer In Control:Charles Hugh Smith

Prepare Today And Save $70 On A 2-Week Emergency Food Kit My Patriot Supply http://preparewithx22.com Today’s Guest: Charles Hugh Smith Website: Of Two Minds http://oftwominds.com Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject matter. The representative artwork included …

Read More »

Read More »

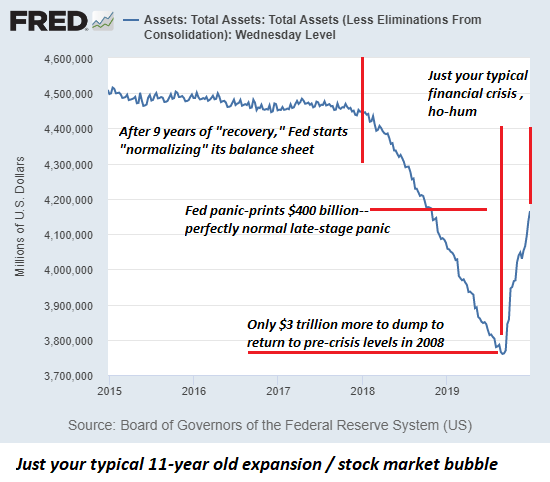

The Hour Is Getting Late

After 11 years of "the Fed is the market" expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right? So here we are in Year 11 of the longest economic expansion/ stock market bubble in recent history, and by any measure, the hour is getting late, to quote Mr. Dylan: So let us not talk falsely nowthe hour is getting lateBob Dylan, "All Along the Watchtower"

Read More »

Read More »

EM Preview for the Week Ahead

EM FX was broadly firmer last week, taking advantage of the dollar’s soft tone as well as another wave of risk-on sentiment. Bullishness on the global economy is quite strong, whilst we are perhaps a bit more skeptical given ongoing weakness in the UK, Japan, and the eurozone. Dollar bearishness may also be overdone given our more constructive outlook on the US economy, but technical damage has been done that must now be repaired.

Read More »

Read More »

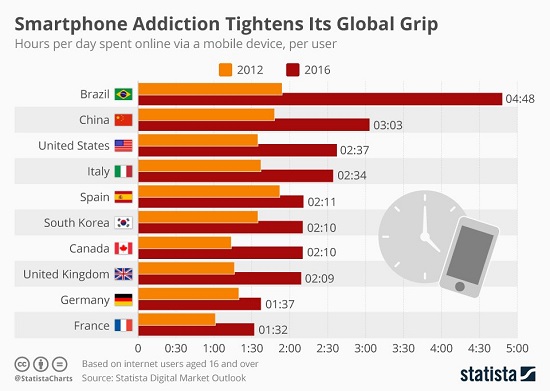

Is Social Media the New Tobacco?

If we set out to design a highly addictive platform that optimized the most toxic, destructive aspects of human nature, we'd eventually come up with social media.

Read More »

Read More »