Category Archive: 5) Global Macro

Dollar Mixed as Some Risk Appetite Returns

The dollar continues to climb; one of side-effects of the virus has been a swelling of the amount of negative yielding debt globally. The US primary season got off to a rocky start for the Democrats. During the North American session, December factory orders will be reported; the US economy remains strong.

Read More »

Read More »

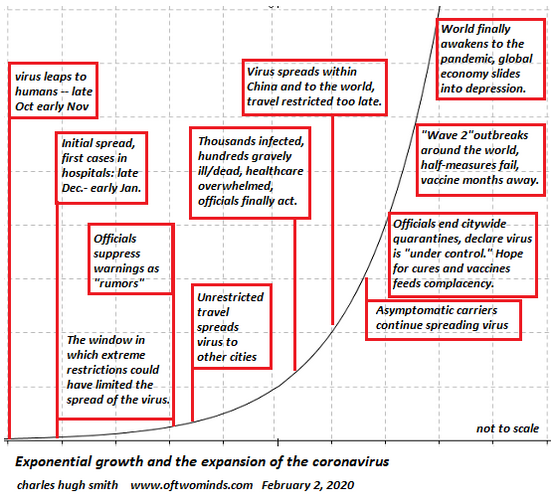

Brace for Impact: Global Pandemic Already Baked In

If we accept what is known about the virus, then logic, science and probabilities all suggest we brace for impact. Here's a summary of what is known or credibly estimated about the 2019-nCoV virus as of January 31, 2019: 1. A statistical study from highly credentialed Chinese academics estimates the virus has an RO (R-naught) of slightly over 4, meaning every carrier infects four other people on average.

Read More »

Read More »

EM Preview for the Week Ahead

EM remains vulnerable to deteriorating risk sentiment as the coronavirus spreads. China announced a series of measures over the weekend to help support its financial markets, but this may not be enough to turn sentiment around yet. China markets reopen Monday after the extended Lunar New Year holiday and it won’t be pretty.

Read More »

Read More »

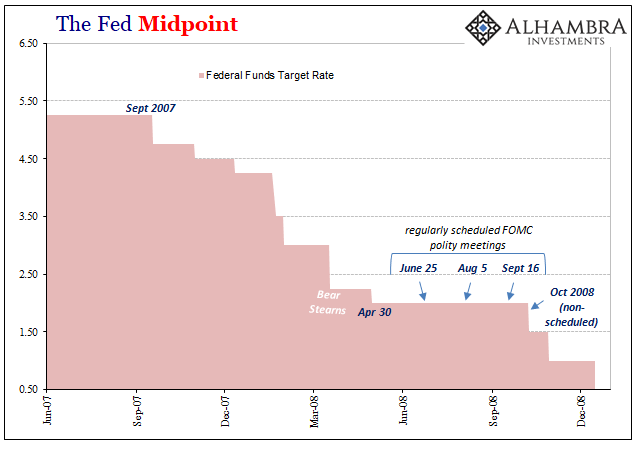

History Shows You Should Infer Nothing From Powell’s Pause

Jay Powell says that three’s not a crowd, at least not for his rate cuts, but four would be. As usual, central bankers like him always hedge and say that “should conditions warrant” the FOMC will be more than happy to indulge (the NYSE). But what he means in his heart of hearts is that there probably won’t be any need.

Read More »

Read More »

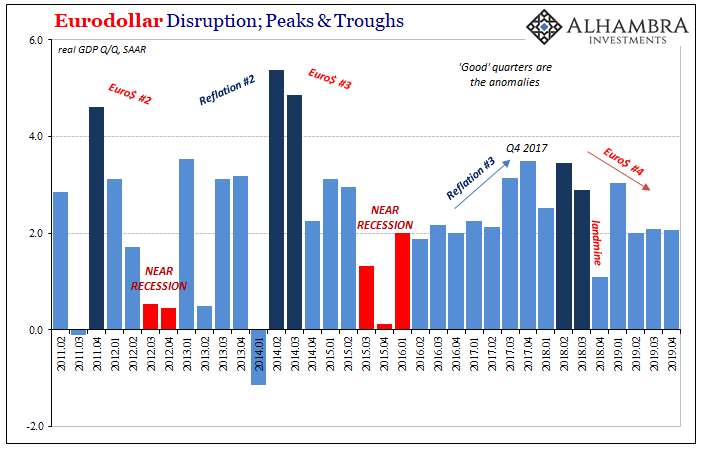

Three Straight Quarters of 2 percent, And Yet Each One Very Different

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013.

Read More »

Read More »

Second-Order Effects: The Unexpectedly Slippery Path to Dow 10,000

Dow 30,000 is "unsinkable," just like the Titanic. A recent Barrons cover celebrating the euphoric inevitability of Dow 30,000 captured the mainstream zeitgeist perfectly: Corporate America is firing on all cylinders, the Federal Reserve's god-like powers will push stocks higher regardless of any other reality, blah blah blah.

Read More »

Read More »

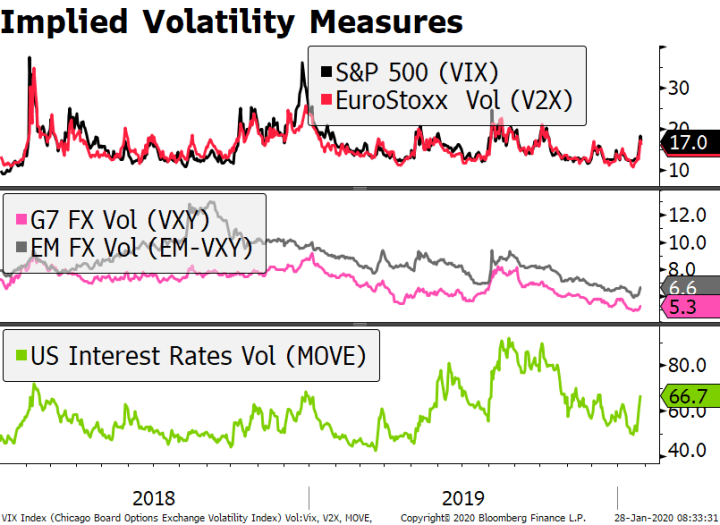

Dollar Firm Ahead of BOE Decision

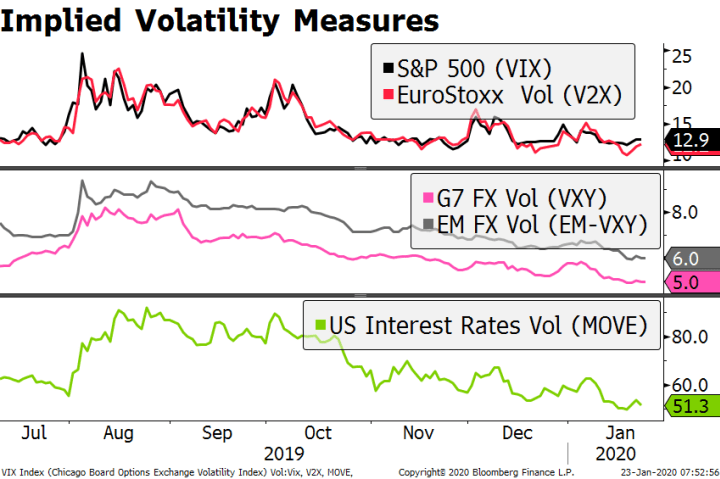

The World Health Organization called an emergency meeting today; the dollar continues to climb. The FOMC meeting was a non-event; US advance Q4 GDP will be reported. Risk-off sentiment has derailed curve steepening trades. Implied rates still suggest that today’s BOE meeting is a coin toss.

Read More »

Read More »

Charles Hugh Smith – Real Reason for Record Stock Markets: Front-running the Front-runners

Returning SBTV guest, Charles Hugh Smith, calls the Federal Reserve an evil organization. Their meddling in the economy results in the concentration of wealth to those at the top of the wealth pyramid and is fueling asset bubbles, creating widening wealth inequality. Charles Hugh Smith is the editor of the OfTwoMinds blog: https://www.oftwominds.com Discussed in …

Read More »

Read More »

Could the Coronavirus Epidemic Be the Tipping Point in the Supply Chain Leaving China?

Everyone expecting a quick resolution to the epidemic and a rapid return to pre-epidemic conditions would be well-served by looking beyond first-order effects. While the media naturally focuses on the immediate effects of the coronavirus epidemic, the possible second-order effects receive little attention: first order, every action has a consequence. Second order, every consequence has its own consequence.

Read More »

Read More »

With No Second Half Rebound, Confirming The Squeeze

It’s a palpable impatience. Having learned absolutely nothing from the most recent German example, there’s this pervasive belief that if the economy hasn’t fallen apart by now it must be going the other way. The right way. Those are the only two options for mainstream analysis (which means it isn’t analysis).

Read More »

Read More »

Charity: how effective is giving? | The Economist

Today’s super-rich are putting record sums into tackling the world’s most pressing problems. But how altruistic is this golden age of charitable giving? Read more here: https://econ.st/3aHRmjc Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Today’s super-wealthy are richer than ever. And they’re giving away their billions like never before. Philanthropists are putting …

Read More »

Read More »

Tentative Stabilization

Risk-off continues in Asia, but moves have been less dramatic. European market jittery but stable. Implied rates now pricing in a full Fed cut by September. The UK will announce its decision on Huawei’s access to the country’s 5G network.

Read More »

Read More »

Charles Hugh Smith on the Emerging Repo Crisis

Charles Hugh Smith on the Emerging Repo Crisis http://financialrepressionauthority.com/2020/01/27/the-roundtable-insight-charles-hugh-smith-on-the-emerging-repo-crisis/

Read More »

Read More »

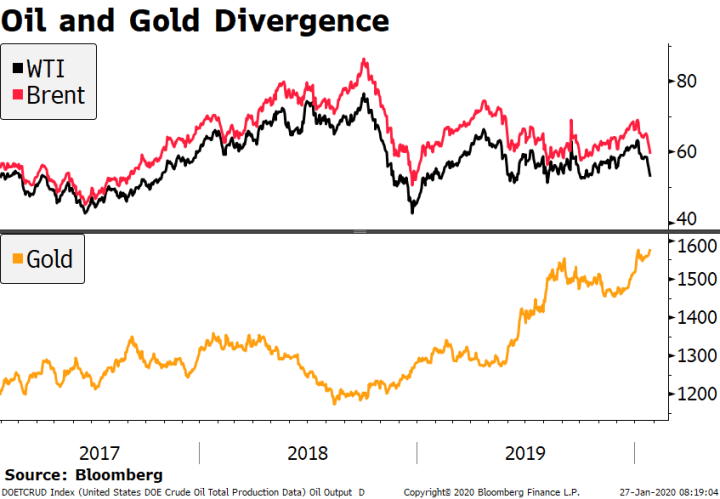

Sharp Sell-Off on Virus Concerns

Global stocks lower on virus fears, yen appreciates, and yield curves flatten. Oil prices continue to fall while gold rises. Italian assets outperform on favorable election results for ruling coalition. German IFO survey disappoints, trimming nascent green shoots.

Read More »

Read More »

EM Preview for the Week Ahead

The spread of the coronavirus continues and is likely to weigh on risk assets and EM. Most markets in Emerging Asia are closed for all or part of this week due to the Lunar New Year holiday. China has extended the holiday until February 2 as it struggles to contain the virus.

Read More »

Read More »

The Future of What’s Called “Capitalism”

The psychotic instability will resolve itself when the illusory officially sanctioned "capitalism" implodes. Whatever definition of capitalism you use, the current system isn't it so let's call it "capitalism" in quotes to indicate it's called "capitalism" but isn't actually classical capitalism.

Read More »

Read More »

Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus. US steps up trade rhetoric against EU and pushes back against UK digital tax plan. AUD stronger on solid Australian jobs report and pricing out of RBA easing. CAD weaker on dovish BOC communication yesterday.

Read More »

Read More »

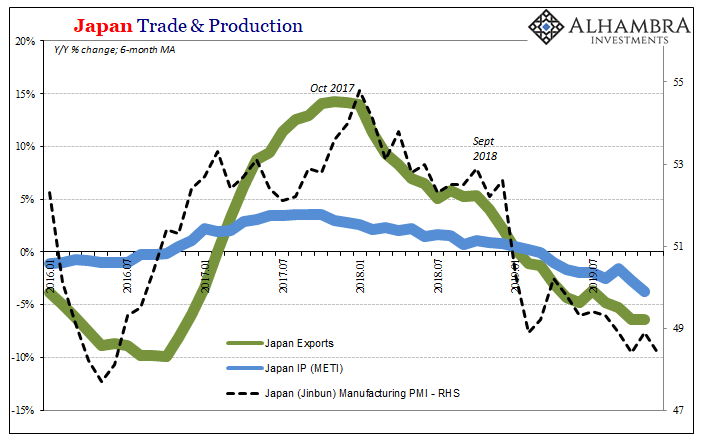

The Big And Small of Leading Japan

In the middle of 2018, Japan, they said, was riding so high. Gliding along on the tidal wave of globally synchronized growth, Haruhiko’s courage and more so patience had finally delivered the long-promised recovery. The Japanese economy had healed to a point that its central bank officials believed it time to wean the thing off decades of monetary “stimulus.”

Read More »

Read More »

How an obsession with home ownership can ruin the economy | The Economist

Many dream of owning their own home, and thanks to huge financial incentives in the rich world many have been able to so. But government policies to encourage home ownership were a huge mistake. Read more here: https://econ.st/2v6sHo6 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

Calling Things by Their Real Names

One does not need money to convey one's thoughts, but what money does allow is the drowning out of speech of those without money by those with a lot of money. In last week's explanation of why the Federal Reserve is evil, I invoked the principle of calling things by their real names, a concept that drew an insightful commentary from longtime correspondent Chad D.:

Read More »

Read More »