Category Archive: 5) Global Macro

The World Is Awash in Oil, False Assurances, Magical Thinking and Complacency as Global Demand Careens Toward a Cliff

This collapse of price will manifest in all sorts of markets that are based on debt-funded purchases of desires rather than a warily prudent priority on needs. Since markets are supposed to discover the price of excesses and scarcities, it's a mystery why everything that is in oversupply is still grossly overpriced as global demand slides off a cliff: oil, semiconductors, Uber rides, AirBNB listings and many other risk-on / global growth stories...

Read More »

Read More »

European Data: Much More In Store For Number Four

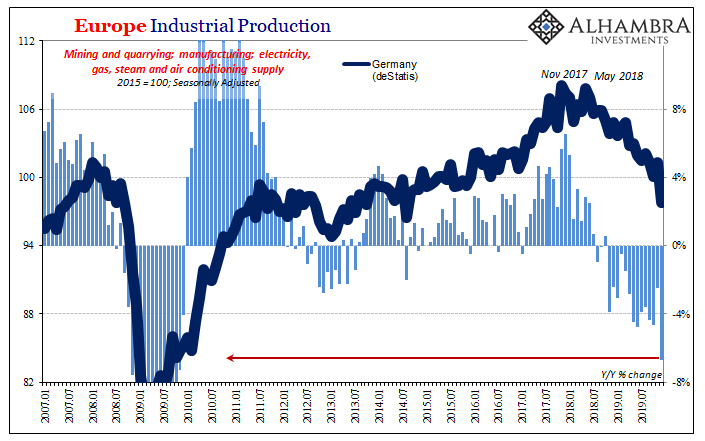

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way.

Read More »

Read More »

US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

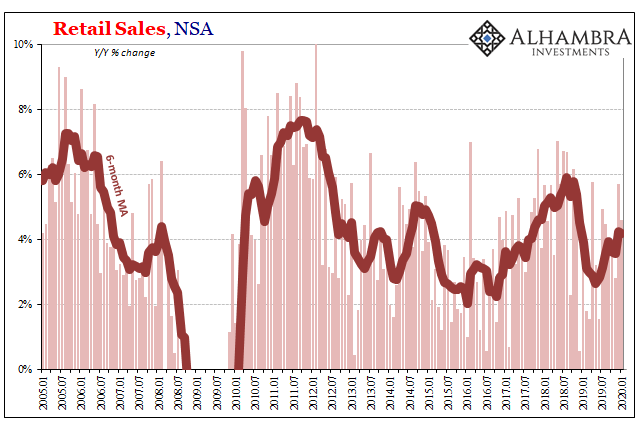

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s.

Read More »

Read More »

Drivers for the Week Ahead

We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday. Canada reports some key data this week. Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week.

Read More »

Read More »

The Fed Has Created a Monster Bubble It Can No Longer Control

The Fed must now accept responsibility for what happens in the end-game of the Moral-Hazard Monster Bubble it created. Contrary to popular opinion, the Federal Reserve didn't set out to create a Monster Bubble that has escaped its control.

Read More »

Read More »

You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes.

Read More »

Read More »

Virus Concerns Resurface

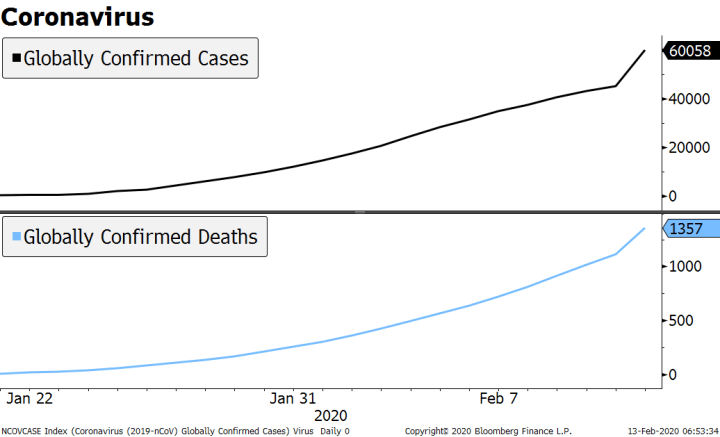

Markets are reacting badly to upward revisions to coronavirus cases in China. The euro fell to the weakest level since mid-2017 against the dollar. UK housing data adds to relatively upbeat figures since the December elections. Malaysia’s government is joining in the counter-cyclical fiscal effort.

Read More »

Read More »

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

How to do the most good possible | The Economist

Doing good is increasingly about more than giving away money. Living kidney donations are rising and a new movement is pushing altruistically minded people to choose careers in fields, such as AI, that will shape the world’s future. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ …

Read More »

Read More »

China’s Fatal Dilemma

Ending the limited quarantine and falsely proclaiming China safe for visitors and business travelers will only re-introduce the virus to workplaces and infect foreigners. China faces an inescapably fatal dilemma: to save its economy from collapse, China's leadership must end the quarantines soon and declare China "safe for travel and open for business" to the rest of the world.

Read More »

Read More »

Two Years And Now It’s Getting Serious

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

Controlling the Narrative Is Not the Same as Controlling the Virus

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms? It's clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets.

Read More »

Read More »

Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb. This is another big data week for the US; the US economy remains strong. Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday.

Read More »

Read More »

COT Black: German Factories, Oklahoma Tank Farms, And FRBNY

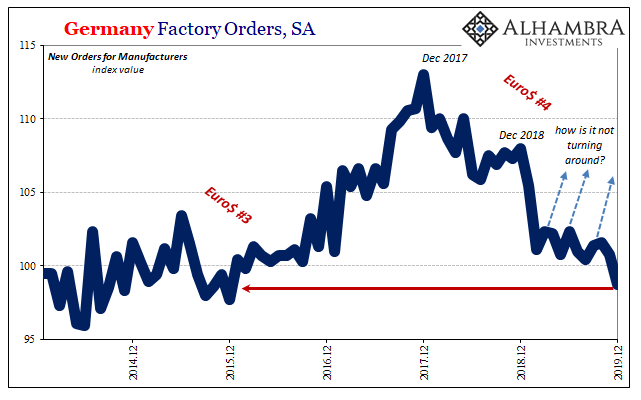

I wrote a few months ago that Germany’s factories have been the perfect example of the eurodollar squeeze. The disinflationary tendency that even central bankers can’t ignore once it shows up in the global economy as obvious headwinds. What made and still makes German industry noteworthy is the way it has unfolded and continues to unfold. The downtrend just won’t stop.

Read More »

Read More »

Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb. The January jobs data is the highlight for the week; Canada also reports jobs data. The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data.

Read More »

Read More »

Vaping: what people are getting wrong | The Economist

A youth vaping “epidemic” and a mysterious outbreak of lung disease in America has led to curbs on e-cigarette flavours. A backlash against vaping is perpetuating myths about nicotine-based e-cigarette products that are not backed up by scientific research. Read more here: https://econ.st/2vh0zP6 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading: …

Read More »

Read More »

Pandemic, Lies and Videos

Will we wonder, what were we thinking? and marvel anew at the madness of crowds? When we look back on this moment from the vantage of history, what will we think? Will we think how obvious it was that the coronavirus deaths in China were in the tens of thousands rather than the hundreds claimed by authorities?

Read More »

Read More »

Dollar Firm as Markets Await Fresh Drivers

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way. The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp. Germany reported very weak December factory orders; all is not well in the German state of Thuringia.

Read More »

Read More »

Don’t Forget (Business) Credit

Rolling over in credit stats, particularly business debt, is never a good thing for an economy. As noted yesterday, in Europe it’s not definite yet but sure is pronounced. The pattern is pretty clear even if we don’t ultimately know how it will play out from here. The process of reversing is at least already happening and so we are left to hope that there is some powerful enough positive force (a real force rather than imaginary, therefore...

Read More »

Read More »

All-Stars #92 Jeff Snider: Did anything really get “better” last September?

Please visit our website www.macrovoices.com to register your free account to gain access to supporting materials.

Go to : http://bit.ly/2Sg4W54 for Jeff's chartbook

Read More »

Read More »