Category Archive: 5) Global Macro

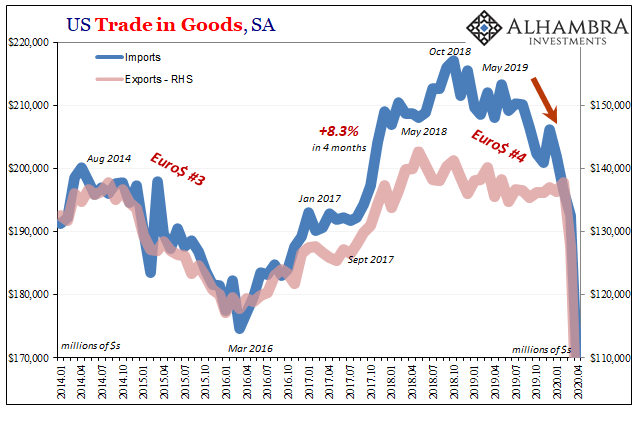

Someone’s Giving Us The (Trade) Business

The NBER has made its formal declaration. Surprising no one, as usual this group of mainstream academic Economists wishes to tell us what we already know. At least this time their determination of recession is noticeably closer to the beginning of the actual event. The Great “Recession”, you might recall, wasn’t even classified as an “official” contraction until December 2008 – a full year after the NBER figured the thing had begun.

Read More »

Read More »

$1bn to save the ocean | The Economist

We asked Sir David Attenborough and four other leading thinkers on ocean conservation how they would invest $1bn to protect the ocean. Some of their answers may surprise you. Film supported by @Blancpain https://www.woi.economist.com/

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

For more from Economist Films visit: http://films.economist.com/

Check out The Economist’s full video catalogue: http://econ.st/20IehQk...

Read More »

Read More »

$1bn to save the ocean | The Economist

We asked Sir David Attenborough and four other leading thinkers on ocean conservation how they would invest $1bn to protect the ocean. Some of their answers may surprise you. https://www.woi.economist.com/ Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk …

Read More »

Read More »

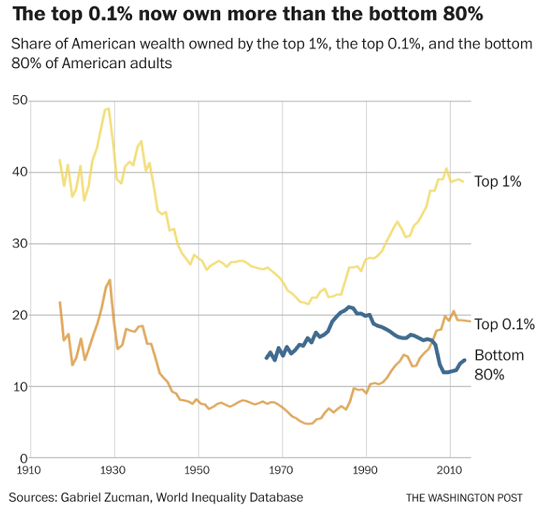

What Lies Ahead: Destabilizing Social Stratification

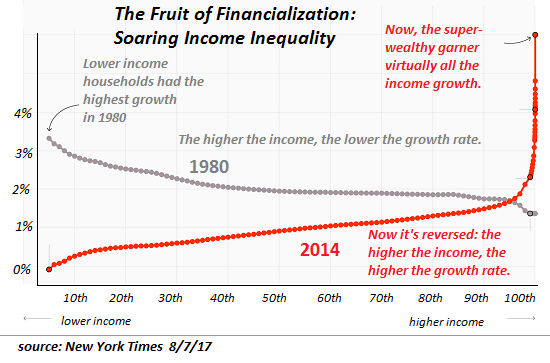

The bill for extreme wealth/income inequality is now overdue, and the penalties for ignoring the bill will be as extreme as the inequality. Our socio-economic-political system--let's call it the status quo--has been hollowed out by extremes of wealth/power inequality driven by financialization and globalization, which have enriched the top 5% and left everyone else behind.

Read More »

Read More »

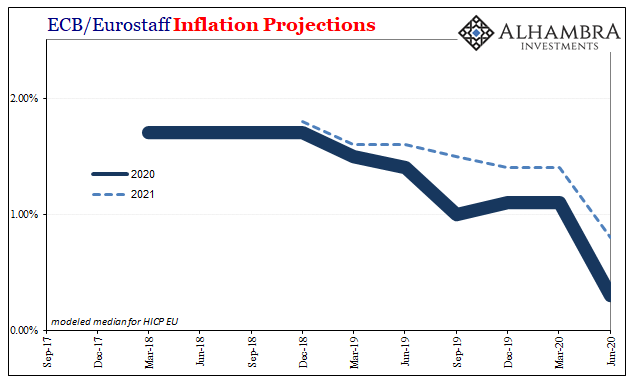

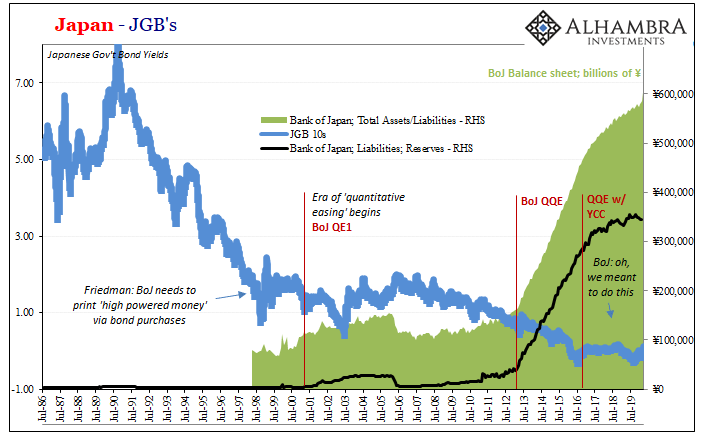

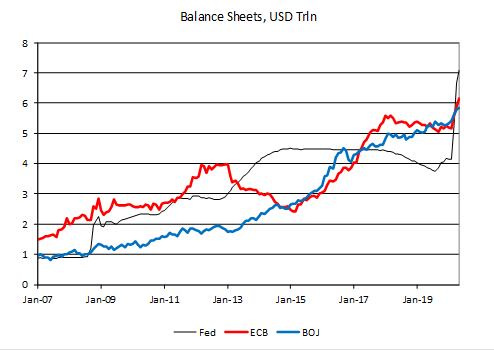

ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press.

Read More »

Read More »

What Did Everyone Think Was Going To Happen?

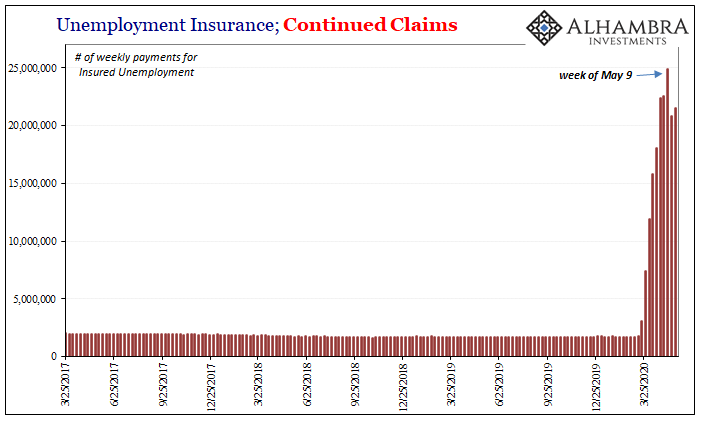

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign.The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this...

Read More »

Read More »

When Institutions Fail, Fragmentation and Decentralization Become Solutions

That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history.

Read More »

Read More »

CHARLES HUGH SMITH – Made, Spend and Stay ın The Local Economy

SUBSCRIBE For The Latest Issues About ; can economy grow forever, how indian economy can grow, can the economy ever recover, can the economy recover after covid, how did economy start, how do economy works #DEEP STATE #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH …

Read More »

Read More »

Covid-19: what’s really going on in Russia? | The Economist

Vladimir Putin claims Russia has covid-19 “under total control”, but whistleblowers say the official figures are fabricated. As well as leading to many more deaths, this could dent Mr Putin’s popularity for years to come. Read more here: https://econ.st/2z4BJV0

Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy

Further reading:

Find The Economist’s most recent coverage of covid-19 here: https://econ.st/2QXX9sJ

Sign...

Read More »

Read More »

Covid-19: what’s really going on in Russia? | The Economist

Vladimir Putin claims Russia has covid-19 “under total control”, but whistleblowers say the official figures are fabricated. As well as leading to many more deaths, this could dent Mr Putin’s popularity for years to come. Read more here: https://econ.st/2z4BJV0 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Further reading: Find The Economist’s most …

Read More »

Read More »

The Mirage of the Money Printer: Why the Fed Is More PR Than Policy, Feat. Jeffrey P. Snider

The conventional wisdom is that central banks are the most important economic actors in the world. Markets hang on their every word.

Yet, what if that power has less to do with actual monetary policy and more to do with how the performance of that policy creates a self-fulfilling prophecy as market actors respond to media coverage?

Jeff Snider is the head of global research at Alhambra Investments. In this conversation, he and NLW explore:...

Read More »

Read More »

Dollar Firm as Risk-On Sentiment Ebbs Ahead of ECB Decision

Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction. Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts.

Read More »

Read More »

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

The Post-Covid Economy Will Be Very Different From the Pre-Pandemic Bubble Economy

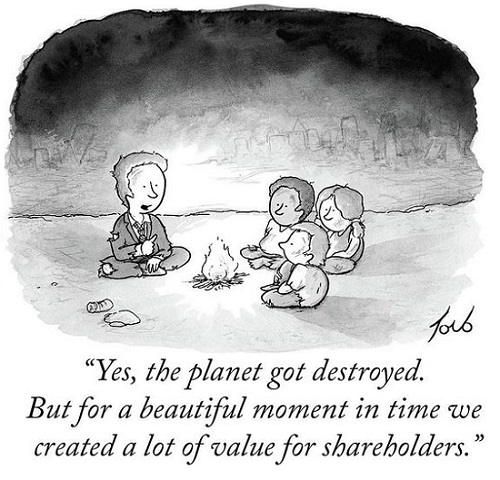

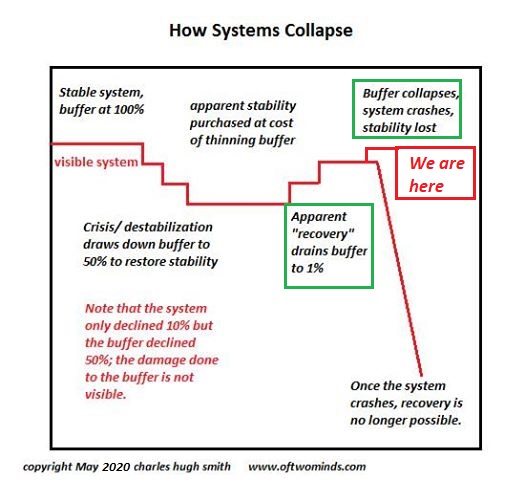

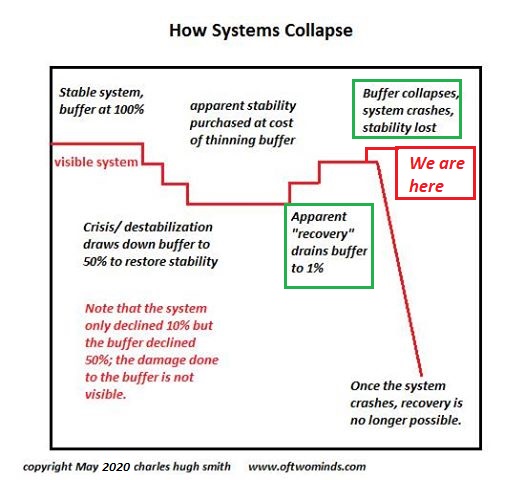

As the old models break down, opportunities for new models will arise. Unstable, unsustainable systems can lull observers into a comfy complacency as instability increases beneath a thin veneer of apparent stability. That's the systemic story of the past 20 years: all the extremes that were needed to maintain the veneer of stability have increased the instability building beneath the complacent confidence.

Read More »

Read More »

Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness. May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds. The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation.

Read More »

Read More »

We’re Living the Founding Fathers’ Nightmare: America Is Corrupt to the Core

Our ruling elites, devoid of leadership, are little more than the scum of self-interested, greedy grifters who rose to the top of America's foul-smelling stew of corruption. The Founding Fathers were wary of institutional threats to liberty and the citizenry's sovereignty, which included centralized concentrations of power (monarchy, central banks, federal agencies, etc.) and the tyranny of corruption unleashed by small-minded, self-interested,...

Read More »

Read More »

All-Stars #107 Jeff Snider: Huge Money Printing Speaks For Itself….

All-Stars #107 Jeff Snider: Huge Money Printing Speaks For Itself, So Why Is Jay Powell Trying To Sell It So Aggressively?

Download chartbook: https://bit.ly/3cppakW

Please visit our website https://www.macrovoices.com to register your free account to gain access to supporting materials.

Read More »

Read More »

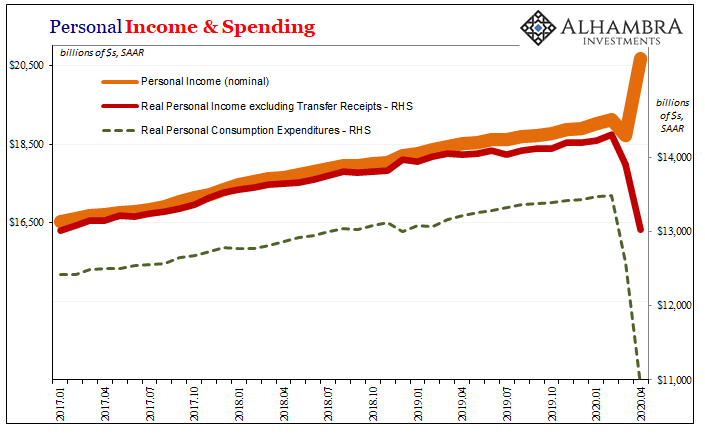

Personal Income and Spending: The Other Side

The missing piece so far is consumers. We’ve gotten a glimpse at how businesses are taking in the shock, both shocks, actually, in that corporations are battening down the liquidity hatches at all possible speed and excess. Not a good sign, especially as it provides some insight into why jobless claims (as the only employment data we have for beyond March) have kept up at a 2mm pace.These are second order effects.

Read More »

Read More »

This Is How Systems Collapse

Flooding the financial system with "free money" only restores the illusion of stability. I updated my How Systems Collapse graphic from 2018 with a "we are here" line to indicate our current precarious position just before the waterfall: For those who would argue we're nowhere near collapse, consider that over 20% of the Federal Reserve's $2 trillion spew of free money went directly into the pockets of America's billionaires.

Read More »

Read More »