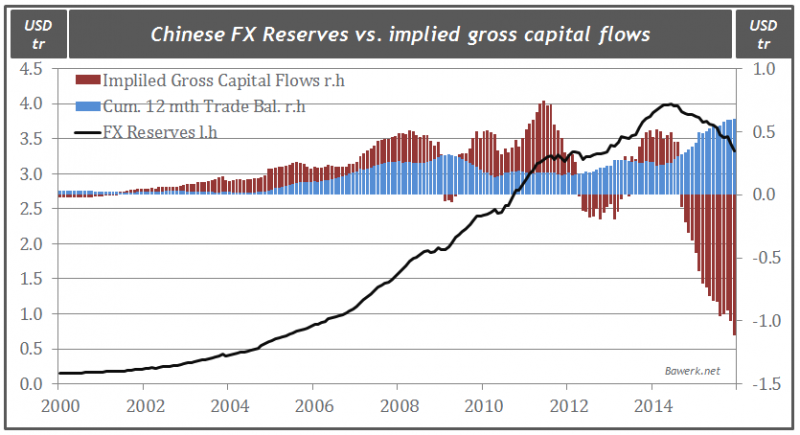

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the Unit...

Read More »

Category Archive: 5.) China

China, the SDR, and Toward a Less Euro-Centric World

(Here is a draft of a monthly column I write for a Chinese paper)

It is official. The Chinese yuan will be in the SDR. At a 10.4% share, it is a bit more than I expected, but less than the 14%-16% share that the IMF staff has intimated a few ...

Read More »

Read More »

China in Continuous PPI Deflation and No Depression In Sight?

Both Chinese PMI and the producer price index (PPI) are in deflation since 2012. This opens a lot of questions about the sustainability of Chinese economic growth, but also about the certain economic theories that consider deflation as a precursor of depression, as it did in the early 1930s. China's speed of economic growth simply slows, recently to 7%, according to China statistics "China’s Economy Showed Moderate but Steady Growth".

Read More »

Read More »

Democracies Like Bubbles, Totalitarian Regimes Hate Them

Totalitarian regimes, like China, fear bubbles and revolutions. Strangely, these regimes help to prevent asset bubbles, and the resulting unequal distribution of wealth between rich asset owners and the poor without assets. Today’s FT article shows how Chinese authorities fear the bubble and the revolution. China cash crunch deepens as PBOC withholds funding Short-term interbank …

Read More »

Read More »

Will the China Bubble Bust? Pros and Cons

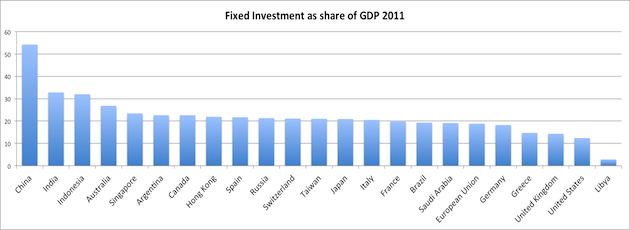

Economic experts and even rating agencies remain in dis-accord about the height of Chinese total debt and if this will continue to slow the Chinese economy.

Read More »

Read More »

The Cyclical and Exchange-Rate Induced Chinese Slowing

We believe in the Chinese economy, but it has just gone into a cyclical and a exchange-rate induced slowing. Any Cassandra views like recently by Charles Dumas, chief strategist of Lombard Research, but also some of Richard Koo’s earlier views, that there will be a burst of the Chinese housing bubble, are exaggerated. Markets Insight: …

Read More »

Read More »

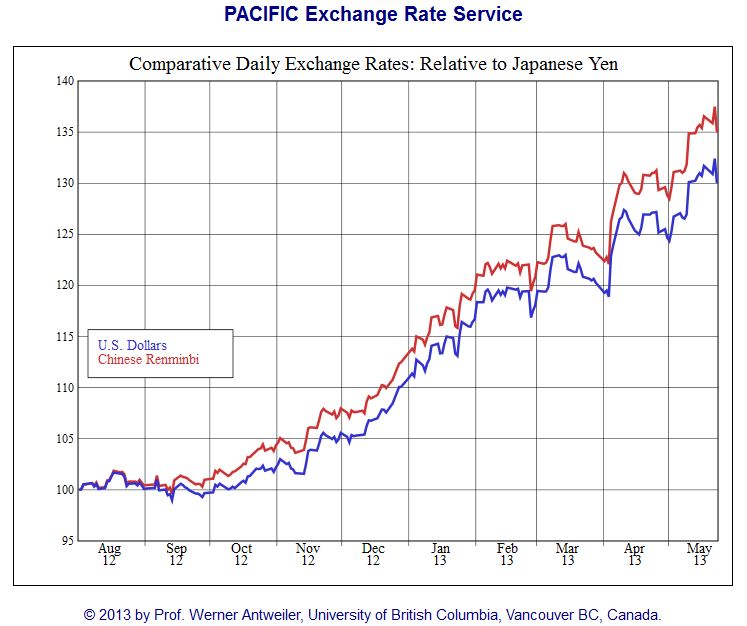

How 40% Renmimbi appreciation vs Yen Caused a Deflationary Commodity Price Shock for World Economy

Everybody is wondering why China is currently so weak, with a HSBC manufacturing in contractionary territory. No wonder, the main competitor in electronics and many more products,the Japanese yen has appreciated by nearly 40%. While China has to fight years-long appreciation of wages, the Japanese profit on years-long deflation and cheaper costs. At the …

Read More »

Read More »

Roubini and Deutsche Bank’s Sanjeev Sanyal: Still Waiting for the Chinese Consumer

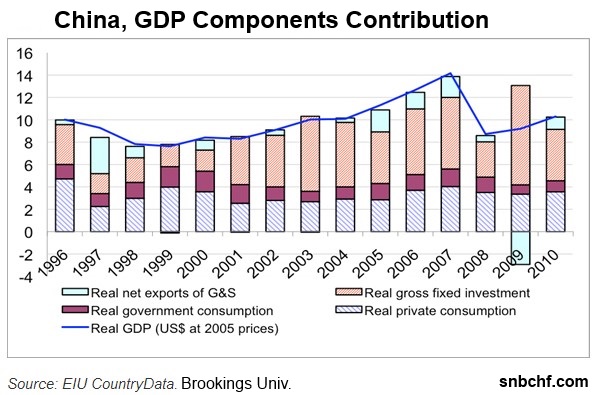

Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

Read More »

Read More »