Category Archive: 5.) Charles Hugh Smith

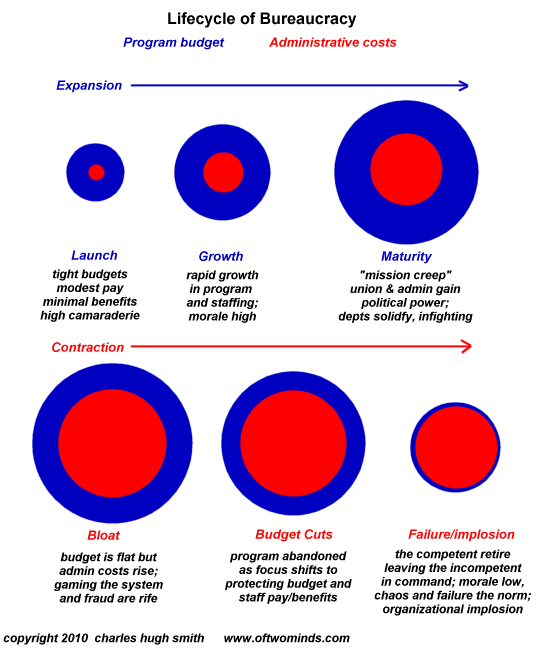

Here’s How Systems (and Nations) Fail

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America's broken healthcare system over a cheaper, more effective alternative?

Read More »

Read More »

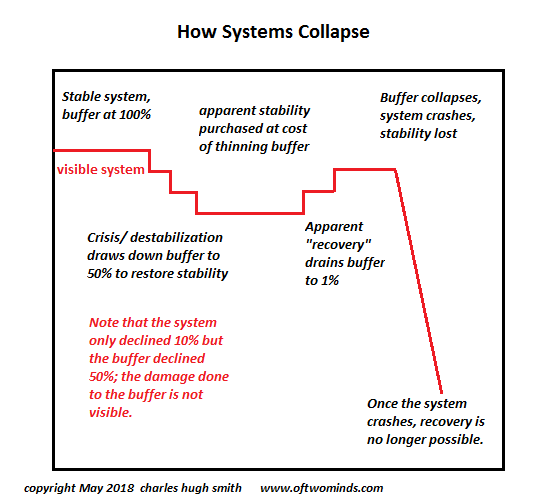

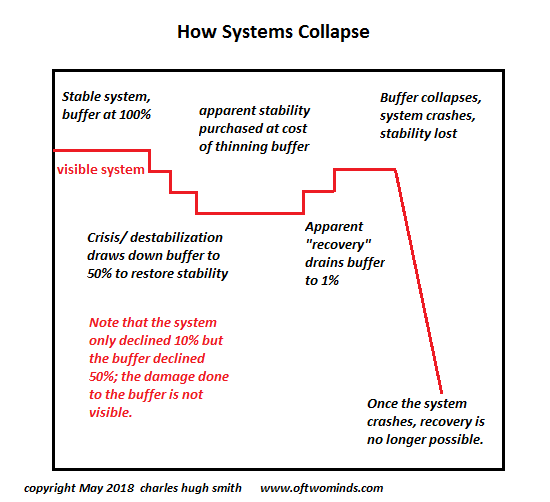

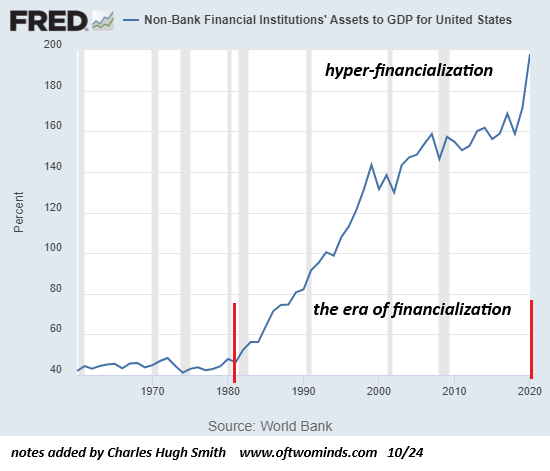

When Long-Brewing Instability Finally Reaches Crisis

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Read More »

Read More »

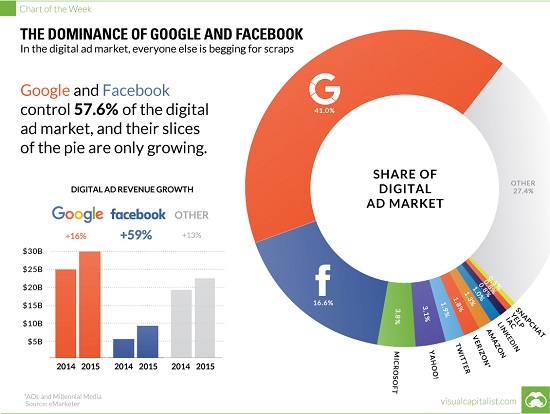

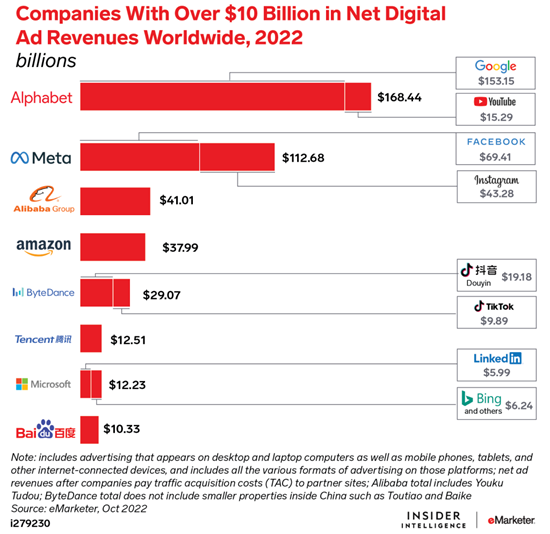

The Imperial Naivete of the American Public

The nation's premier corporate profit engines / social media giants are the ideal platforms for undermining the U.S. via the sowing of disintegration. Whether it's stated or not, one source of the inchoate outrage triggered by Russian-sourced purchases of adverts on Facebook in 2016 (i.e. "meddling in our election") is the sense that the U.S. is sacrosanct due to our innate moral goodness and our Imperial Project.

Read More »

Read More »

Solutions without Historical Templates: Cryptocurrencies and Blockchains

Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We're accustomed to three basic templates for system-wide solutions or improvements: 1. an individual "builds a better mousetrap" and starts a company to exploit this competitive advantage;

Read More »

Read More »

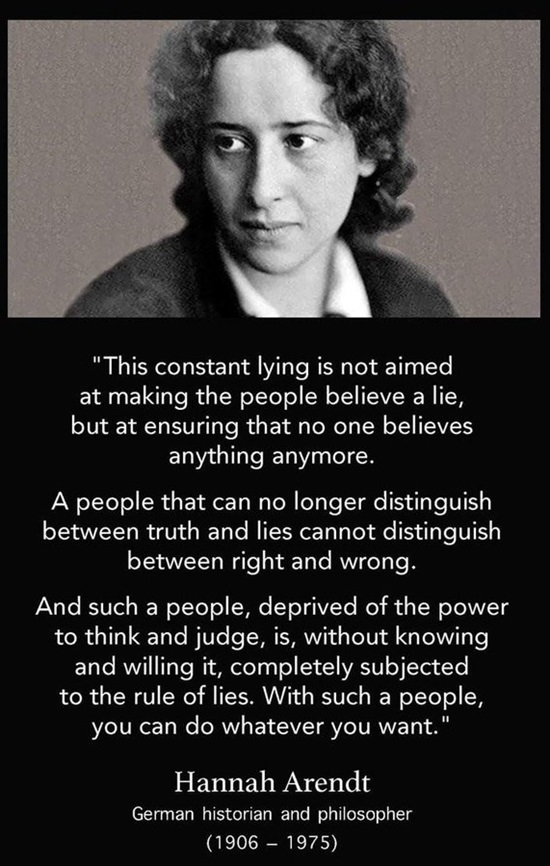

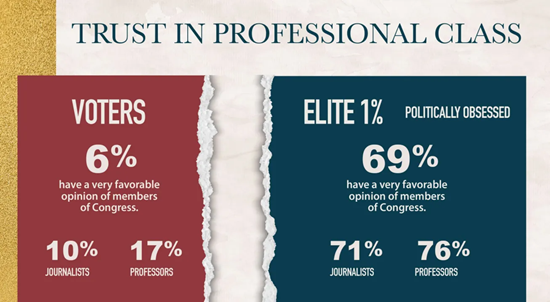

Our Institutions Are Failing

Our institutional failure reminds me of the phantom legions of Rome's final days. The mainstream media and its well-paid army of "authorities" / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual.

Read More »

Read More »

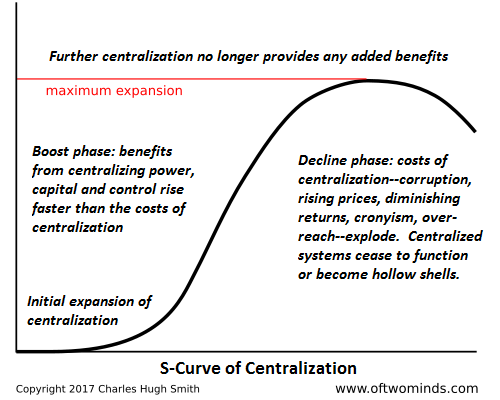

Will AI “Change the World” Or Simply Boost Profits?

The real battle isn't between a cartoonish vision or a dystopian nightmare--it's between decentralized ownership and control of these technologies and centralized ownership and control. The hype about artificial intelligence (AI) and its cousins Big Data and Machine Learning is ubiquitous, and largely unexamined. AI is going to change the world by freeing humankind from most of its labors, etc. etc. etc.

Read More »

Read More »

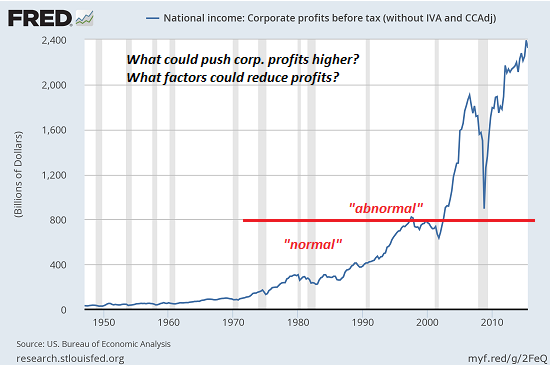

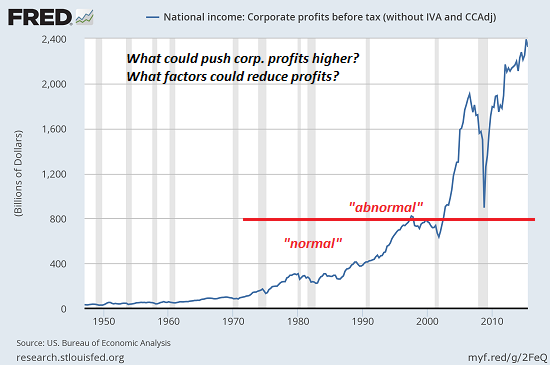

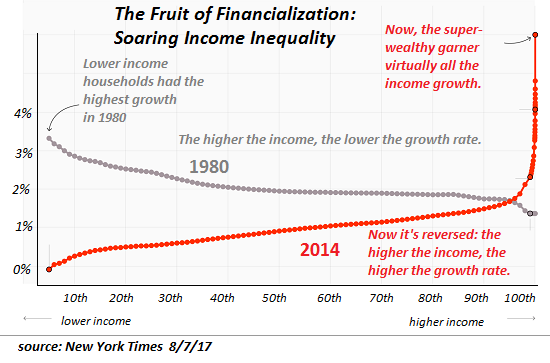

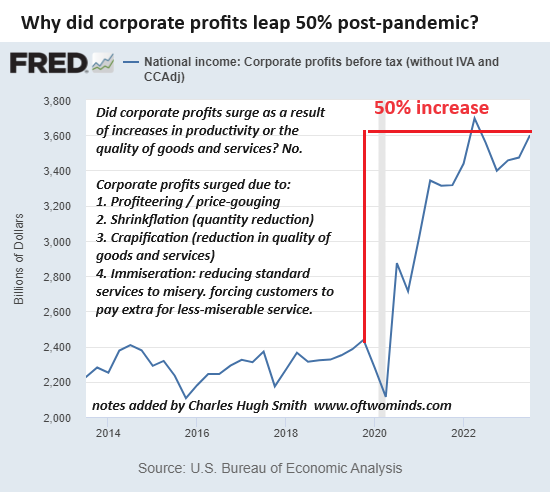

We Are All Hostages of Corporate Profits

We're in the endgame of financialization and globalization, and it won't be pretty for all the hostages of corporate profits. Though you won't read about it in the mainstream corporate media, the nation is now hostage to outsized corporate profits. The economy and society at large are now totally dependent on soaring corporate profits and the speculative bubbles they fuel, and this renders us all hostages: Make a move to limit corporate profits or...

Read More »

Read More »

The USA Is Now a 3rd World Nation

I know it hurts, but the reality is painfully obvious: the USA is now a 3rd World nation. Dividing the Earth's nations into 1st, 2nd and 3rd world has fallen out of favor;apparently it offended sensibilities. It has been replaced by the politically correct developed and developing nations, a terminology which suggests all developing nations are on the pathway to developed-nation status.

Read More »

Read More »

The Gathering Storm

July 4th is an appropriate day to borrow Winston Churchill's the gathering storm to describe the existential crisis that will envelope America within the next decade. There is no single cause of the gathering storm; in complex systems, dynamics feed back into one another, and the sum of destabilizing disorder is greater than a simple sum of its parts.

Read More »

Read More »

Charles Hugh Smith Use Logic The Deal We Are At The End Of The Economic Cycle

All our reports and Daily Alert News are backed up by source links. We work very hard to bring you the facts and We research everything before presenting the report. Subscribe for Latest on Financial Crisis, Oil Price, Global Economic Collapse, Dollar Collapse, Gold, Silver, Bitcoin, Global Reset, New World Order, Economic Collapse, Economic News, …

Read More »

Read More »

Charles Hugh Smith: We Desperately Need Shared Values, Connection & Positive Social Roles

Full description and comments at: https://www.peakprosperity.com/podcast/114151/charles-hugh-smith-we-desperately-need-shared-values-connection-positive-social-roles We’ve recently published a series of commentary on PeakProsperity.com addressing the epidemic of disconnection, dissatisfaction and demoralization that society is increasingly suffering from today: – Feeling Isolated? (...

Read More »

Read More »

Make Capital Cheap and Labor Costly, and Guess What Happens?

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap.

Read More »

Read More »

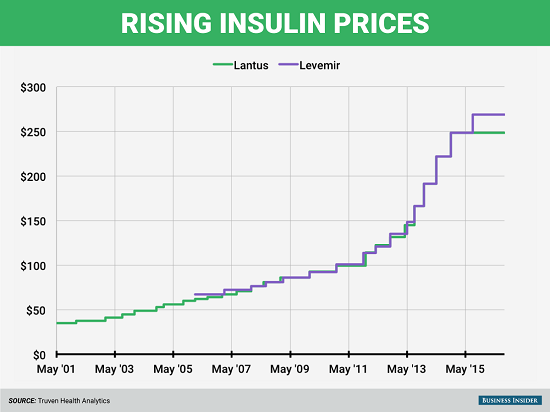

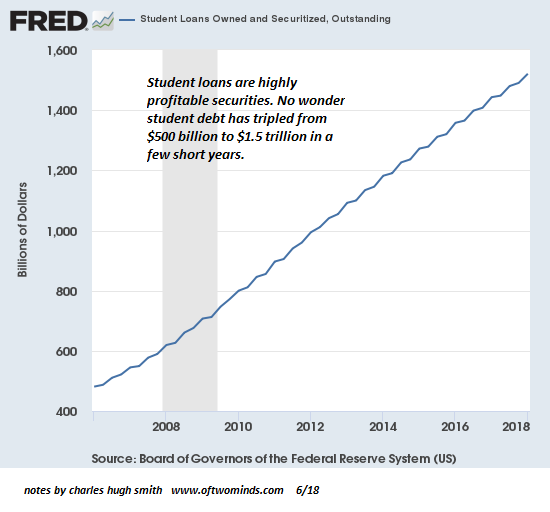

Dear High School Graduates: the Status Quo “Solutions” Enrich the Few at Your Expense

You deserve a realistic account of the economy you're joining. Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo. Here's the summary: the status quo is pressuring you to accept its "solutions": borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a "desirable" city, pay sky-high income and property...

Read More »

Read More »

RMR: Special Guest – Charles Hugh Smith – Of Two Minds (06/25/2018)

We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please subscribe for the latest shows daily! http://www.roguemoney.net https://www.facebook.com/ROGUEMONEY.NET/ https://twitter.com/theroguemoney

Read More »

Read More »

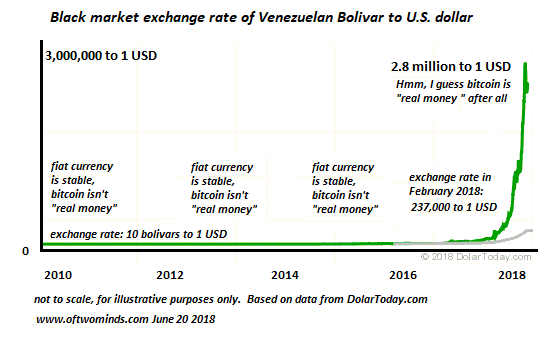

Gresham’s Law and Bitcoin

Rather suddenly, the state issued fiat currency bolivar lost 99% of its purchasing power. Gresham's law holds that "bad money drives out good money," meaning that given a choice of currencies (broadly speaking, "money" that serves as a store of value and a means of exchange), people use depreciating "bad" to buy goods and services and hoard "good" money that is appreciating or holding its value.

Read More »

Read More »

CHARLES HUGH SMITH Printing Money Will Not Save Us From Recession This Time

All our reports and Daily Alert News are backed up by source links. We work very hard to bring you the facts and We research everything before presenting the report. Subscribe for Latest on Financial Crisis, Oil Price, Global Economic Collapse, Dollar Collapse, Gold, Silver, Bitcoin, Global Reset, New World Order, Economic Collapse, Economic News, …

Read More »

Read More »

CHARLES HUGH SMITH – Printing Money Will Not Save Us From Recession This Time

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

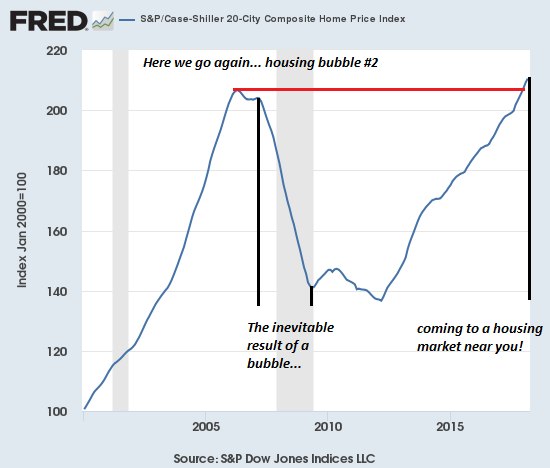

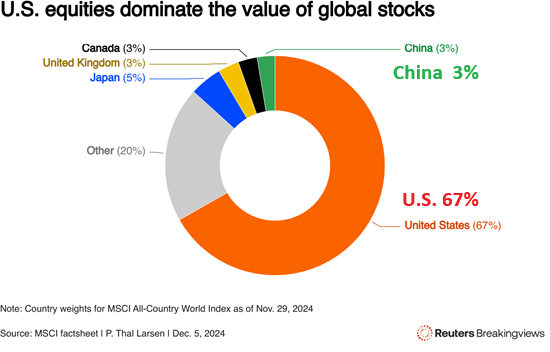

Here We Go Again: Our Double-Bubble Economy

The bubbles in assets are supported by the invisible bubble in greed, euphoria and credulity. Well, folks, here we go again: we have a double-bubble economy in housing and stocks, and a third difficult-to-chart bubble in greed, euphoria and credulity.

Read More »

Read More »

The Three Crises That Will Synchronize a Global Meltdown by 2025

We're going to get a synchronized global dynamic, but it won't be "growth" and stability, it will be DeGrowth and instability. To understand the synchronized global meltdown that is on tap for the 2021-2025 period, we must first stipulate the relationship of "money" to energy:"money" is nothing more than a claim on future energy. If there's no energy available to fuel the global economy, "money" will have little value.

Read More »

Read More »

Does Anyone Else See a Giant Bear Flag in the S&P 500?

We all know the game is rigged, but strange things occasionally upset the "easy money bet." "Reality" is in the eye of the beholder, especially when it comes to technical analysis and economic tea leaves.

Read More »

Read More »