Category Archive: 5.) Charles Hugh Smith

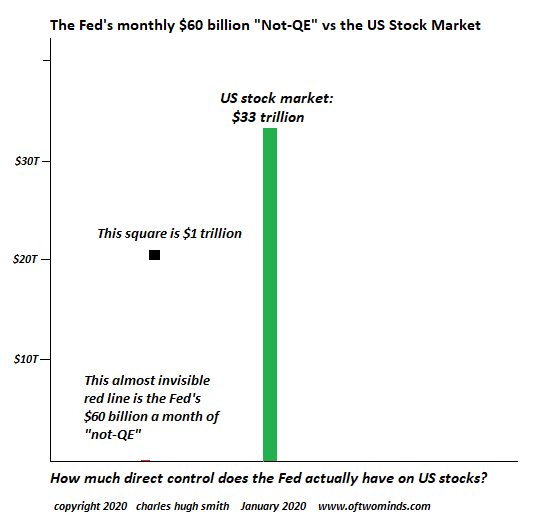

The Fed’s “Not-QE” and the $33 Trillion Stock Market in Three Charts

One day the stock market 'falcon' will no longer hear the Fed 'falconer', and the Pavlovian magical thinking will break down as the market goes bidless. The past decade has shown that when the Federal Reserve creates trillions of dollars out of thin air (QE), U.S. stocks rise accordingly. The correlation is very nearly perfect.

Read More »

Read More »

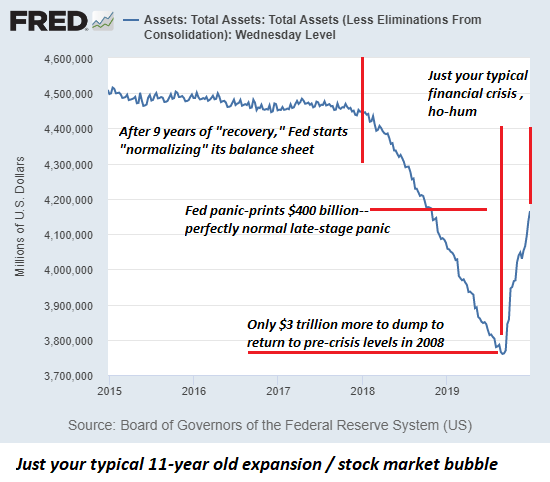

The Hour Is Getting Late

After 11 years of "the Fed is the market" expansion, the Fed has now reduced its bloated balance sheet by 6.7%. This is normal, right? So here we are in Year 11 of the longest economic expansion/ stock market bubble in recent history, and by any measure, the hour is getting late, to quote Mr. Dylan: So let us not talk falsely nowthe hour is getting lateBob Dylan, "All Along the Watchtower"

Read More »

Read More »

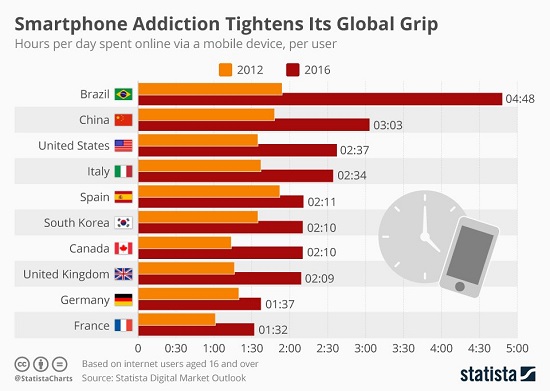

Is Social Media the New Tobacco?

If we set out to design a highly addictive platform that optimized the most toxic, destructive aspects of human nature, we'd eventually come up with social media.

Read More »

Read More »

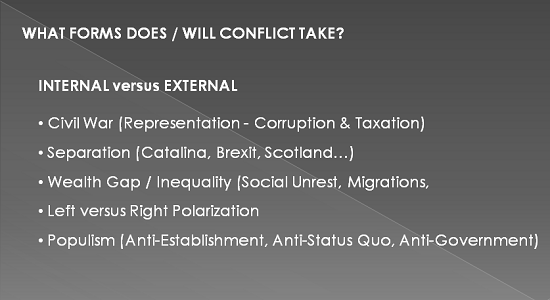

Welcome to the Era of Intensifying Chaos and New Weapons of Conflict

Geopolitics has moved from a slow-moving, relatively predictable chess match to rapidly evolving 3-D chess in which the rules keep changing in unpredictable ways. A declining standard of living in the developed world, declining growth for the developed world and geopolitical jockeying for control of resources make for a highly combustible mix awaiting a spark: welcome to the era of intensifying chaos and the rapid advance of new weapons of conflict...

Read More »

Read More »

Our Fragmentation Accelerates

As our fragmentation accelerates, shared economic interests are ignored in favor of divisive warring camps that share no common interests. That our society and economy are fragmenting is self-evident. This fragmentation is accelerating rapidly, as middle ground vanishes and competing camps harden their positions to solidify the loyalty of the "tribe."

Read More »

Read More »

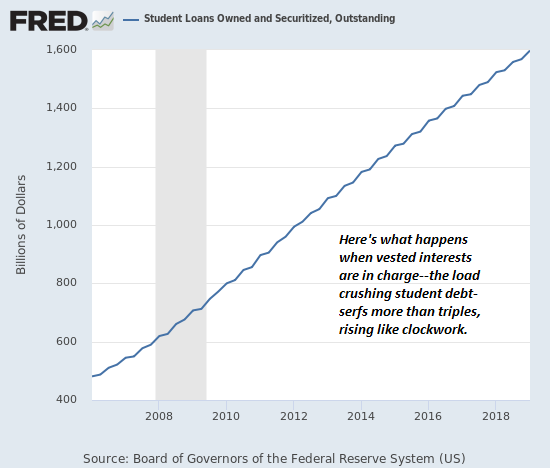

Skyrocketing Costs Will Pop All the Bubbles

The reckoning is coming, and everyone who counted on "eternal growth of borrowing" to stave off the reckoning is in for a big surprise. We've used a simple trick to keep the status quo from imploding for the past 11 years: borrow whatever it takes to keep paying the skyrocketing costs for housing, healthcare, college, childcare, government, permanent wars and so on.

Read More »

Read More »

OK Boomer, OK Fed

Eventually the younger generations will connect all the economic injustices implicit in 'OK Boomer' with the Fed. Much of the cluelessness and economic inequality behind the OK Boomer meme is the result of Federal Reserve policies that have favored those who already own the assets (Boomers) that the Fed has relentlessly pumped higher, to the extreme disadvantage of younger generations who were not given the opportunity to buy assets cheap and ride...

Read More »

Read More »

The “Trade Deal”: A Pathetic Parody, Credibility Squandered

Anyone who thinks this bogus "deal" has resolved any of the issues or uncertainties deserves to be fired immediately. Here's a late-night TV parody of a trade deal: The agreement won't be signed by both parties, though each might sign their own version of it, and the terms of the deal will never ever be revealed to the public, which includes everyone doing any business in the nations doing the "deal."

Read More »

Read More »

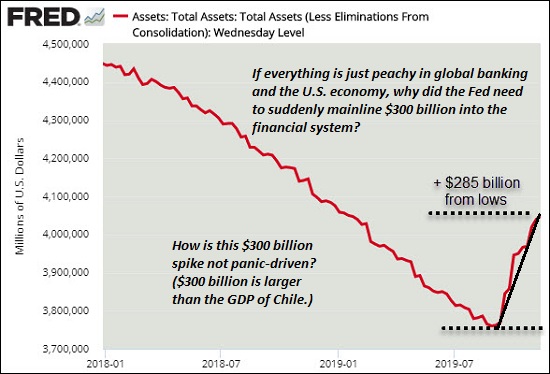

A “Market” That Needs $1 Trillion in Panic-Money-Printing by the Fed to Stave Off Implosion Is Not a Market

It was all fun and games enriching the super-wealthy but now the karmic cost of the Fed's manipulation and propaganda is about to come due. A "market" that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery?

Read More »

Read More »

Why “This Sucker Is Going Down”

Once the contagion starts spreading, loose money won't put the fires out. As the nation's political and economic leaders struggled to contain the 2008 financial meltdown, President George W. Bush famously summed the situation up: "If money doesn't loosen up, this sucker will go down."Eleven years into the loose money recovery, this sucker is finally going down for reasons that have little to do with tight money and everything to do with the...

Read More »

Read More »

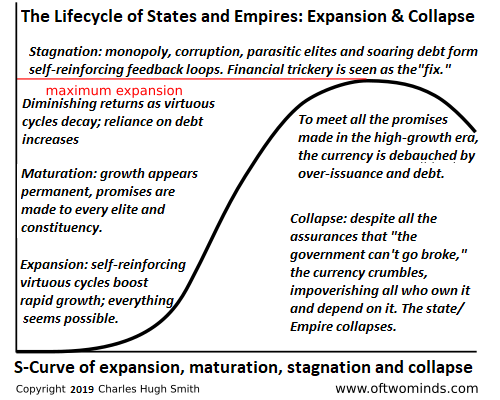

The Taxonomy of Collapse

The higher up the wealth-power pyramid the observer is, the more prone they are to a magical-thinking belief that the empire is forever, even as it is crumbling around them. How great nations and empires arise, mature, decay and collapse has long been of interest for a self-evident reason: if we can discern a template or process, we can predict when the great nations and empires of today will slide into the dustbin of history.

Read More »

Read More »

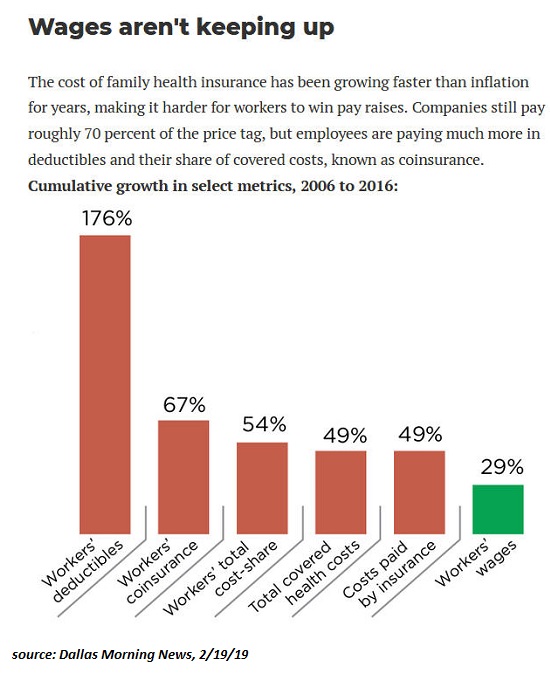

Costs Are Spiraling Out of Control

And how do we pay for these spiraling out of control costs? By borrowing more, of course. If we had to choose one "big picture" reason why the vast majority of households are losing ground, it would be: the costs of essentials are spiraling out of control. I've often covered the dynamics of stagnating income for the bottom 90%, and real-world inflation, i.e. a decline in purchasing power.

Read More »

Read More »

Crunchtime: When Events Outrun Plan B

Not only will events outrun Plan B, they'll also outrun Plans C and D. We all know what Plan B is: our pre-planned response to the emergence of risk. Plan B is for risks that can be anticipated, regular but unpredictable events such tornadoes, earthquakes, hurricanes, etc. In the human sphere, risks that can be anticipated include temporary loss of a job, stock market down turns, recession, disruption of energy supplies, etc.

Read More »

Read More »

Could America Survive a Truth Commission?

A nation that's no longer capable of naming names and reporting what actually happened richly deserves an economic and political collapse to match its moral collapse. You've probably heard of the Truth Commissions held in disastrously corrupt and oppressive regimes after the sociopath/kleptocrat Oligarchs are deposed.

Read More »

Read More »

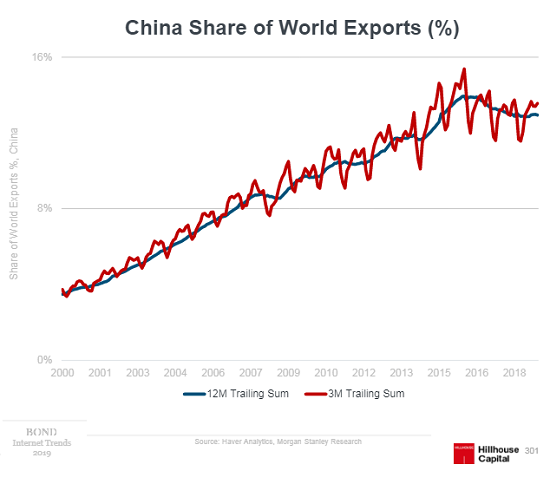

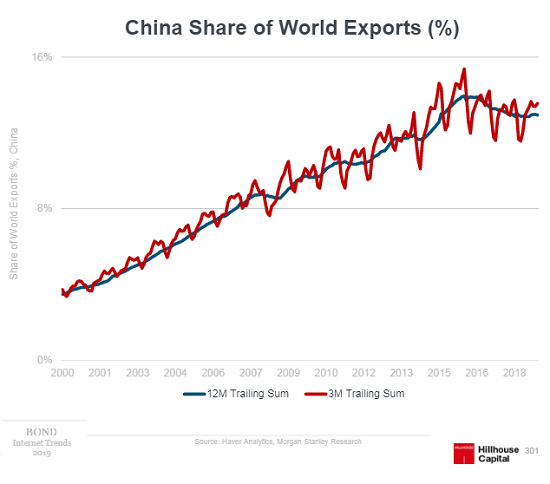

A China Trade Deal Just Finalizes the Divorce

Each party will continue to extract whatever benefits they can from the other, but the leaving is already well underway. Beneath the euphoric hoopla of a trade deal with China is the cold reality that the divorce has already happened and any trade deal just signs the decree. The divorce of China and the U.S. was mutual; each had used up whatever benefits the tense marriage had offered, and each is looking forward to no longer being dependent on the...

Read More »

Read More »

We Can Only Choose One: Our National Economy or Globalization

The servitude of society to a globalized economy is generating extremes of insecurity, powerlessness and inequality. Does our economy serve our society, or does our society serve our economy, and by extension, those few who extract most of the economic benefits? It's a question worth asking, as beneath the political churn around the globe, the issues raised by this question are driving the frustration and anger that's manifesting in social and...

Read More »

Read More »

Darn, This Is Inconvenient: Apple Is Destroying the Planet to Maximize Profits

Stripmining the planet to maximize profits isn't progressive or renewable--it's just exploitive and destructive. How do we describe the finding that the planet's most widely-owned super-corporation is destroying the planet to maximize its smartphone sales and profits? Shall we start with "inconvenient?" Yes, we're talking about Apple, famous for coercing customers to upgrade their Apple phones and other gadgets if not annually then every couple...

Read More »

Read More »

What’s Been Normalized? Nothing Good or Positive

What's been normalized are policies and cultural norms that seek to enrich and protect the few at the expense of the many. When the initially extraordinary fades into the unremarkable background of everyday life, we say it's been normalized. Put another way, we quickly habituate to new conditions, and rationalize our ready acceptance of what was previously unacceptable.

Read More »

Read More »

Political and Social Conflict Is Accelerating: Here’s Why

All the status quo "fixes" only hasten the collapse of the status quo. That economic, social and political conflict is accelerating is self-evident. What's open to debate are the core drivers of conflict / disorder /unraveling. Here's the core self-reinforcing dynamic in my view: 1. The status quo elites can no longer mask soaring costs of essentials nor soaring wealth / income inequality between the top .01% (Oligarchs), the top 9.99% who enrich...

Read More »

Read More »

If Not-QE Is QE, then is Not-a-Blowoff-Top a Blowoff Top?

Can $300 billion, or $600 billion, or even $1 trillion continue to prop up an increasingly risk-riddled, fragile $330 trillion global bubble in overvalued assets? When is "Not-QE" QE? When Federal Reserve Chairperson Jerome Powell declares QE is not QE. We can constructively recall the story that Abraham Lincoln famously recounted in 1862: 'If I should call a sheep's tail a leg, how many legs would it have?'

Read More »

Read More »