Category Archive: 5.) Brown Brothers Harriman

EM Preview for the Week Ahead

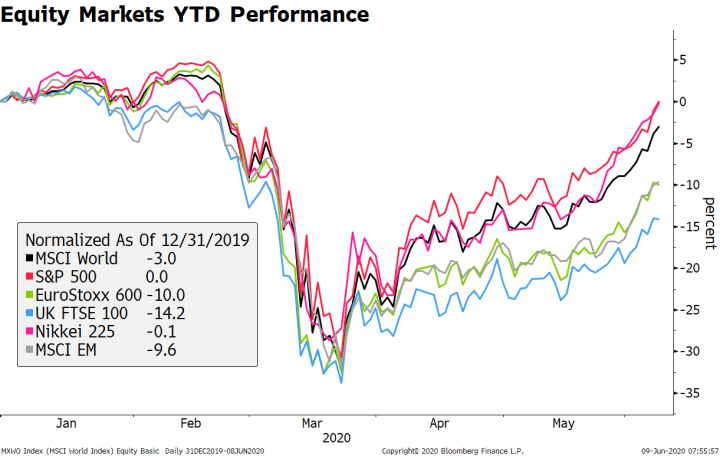

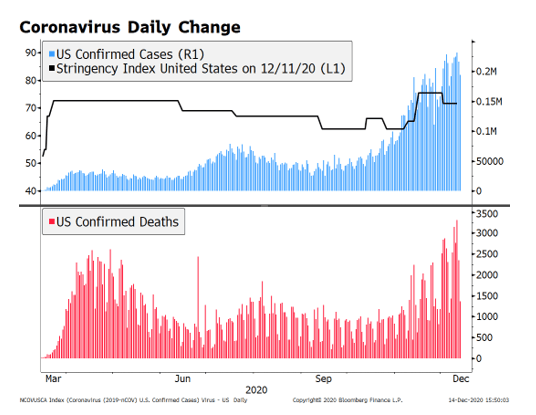

Risk assets came under pressure last week as the virus news stream worsened. It’s clear that large parts of the US will be forced to delay reopening until their virus numbers improve. Markets had gotten too bullish on the US recovery story and so this reality check soured sentiment. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US...

Read More »

Read More »

Recent Trade Developments Suggest Some Caution Ahead Warranted

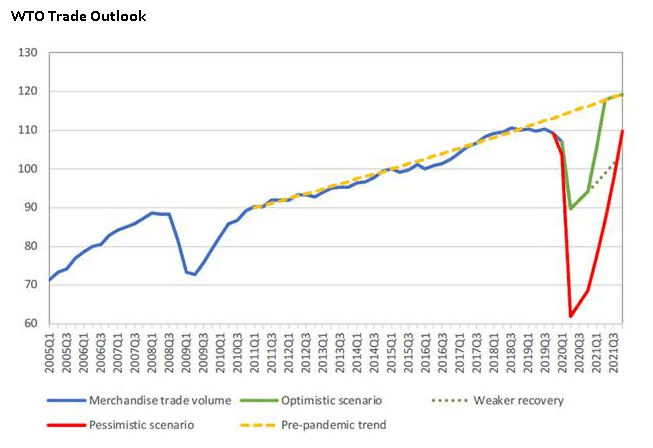

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Persists

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday. The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US. The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works.

Read More »

Read More »

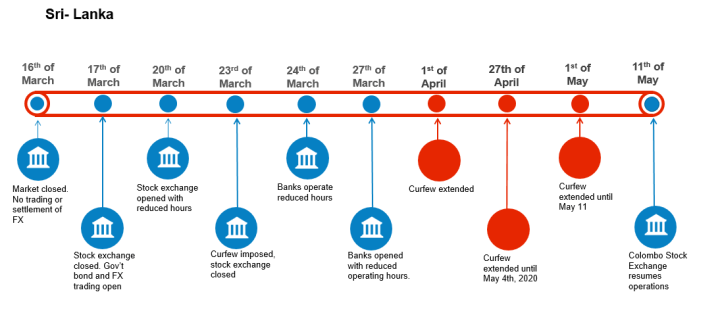

Restricted Market Trading Comments

There were minimal changes to the status quo as the week commences. Bangladesh has announced revised trading hours on the local exchanges. No change of status in Nigeria and Kenya as they both continue to face limited liquidity. Please see trading comments below.

Read More »

Read More »

Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday. The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week.

Read More »

Read More »

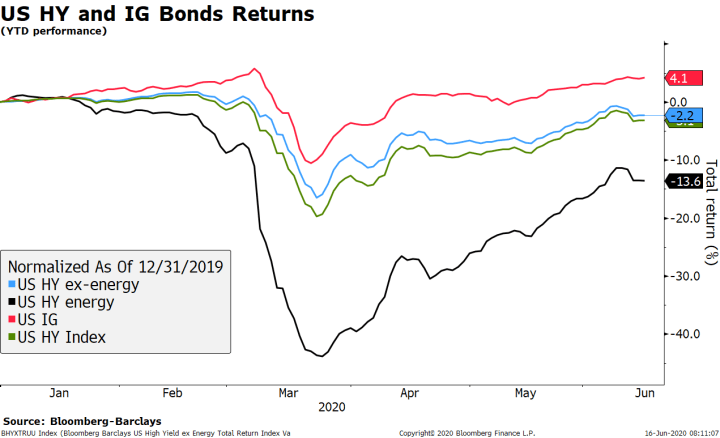

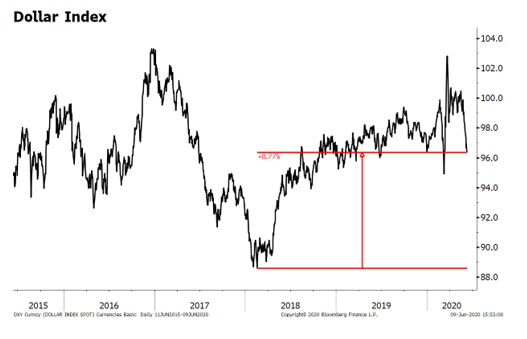

Dollar Suffers as Stimulus Efforts Boost Market Sentiment

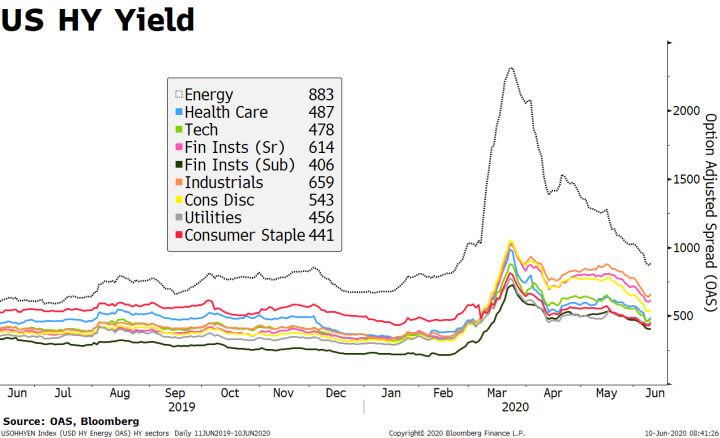

Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered. The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today. The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight.

Read More »

Read More »

EM Preview for the Week Ahead

EM and other risk assets stabilized to end the week after Thursday’s selloff, but remain vulnerable. The risks ahead are the same as before, which include a second wave of infections as well as a longer and shallower than expected recovery in global growth. The Fed’s message of low rates as far as the eye can see was balanced by Powell’s grim outlook for unemployment.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Intensifies After FOMC Decision

Concerns about still rising infection numbers and a second wave ofCovid-19 have contributed to today’s downdraft in risk assets; for now, the weak dollar trend is hard to fight. Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal; stocks have not reacted well to the Fed; weekly jobless claims and May PPI will be reported.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Takes Hold

Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction. The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus.

Read More »

Read More »

Dollar Broadly Weaker Ahead of FOMC Decision

The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar. Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation. We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m.

Read More »

Read More »

Dollar Stabilizes as the New Week Begins

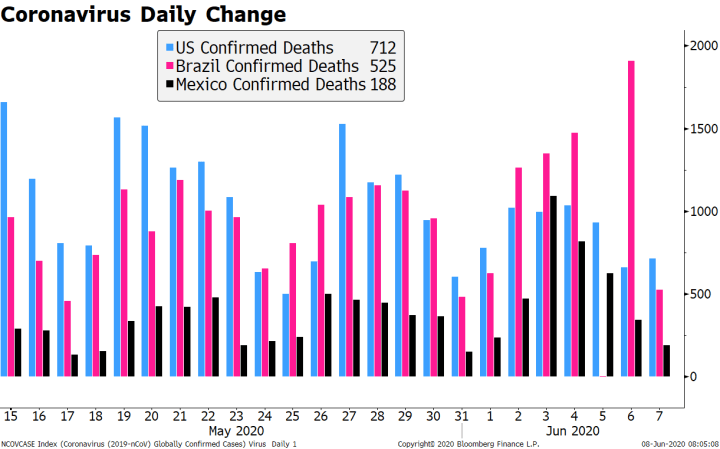

The dollar has stabilized a bit; Friday’s US jobs data could be a game changer. The US bond market selloff continues; for now, the weak dollar trend is hard to fight. The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics.

Read More »

Read More »

Our Latest Thoughts on the Dollar

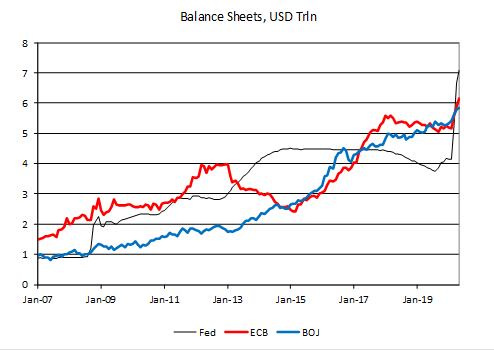

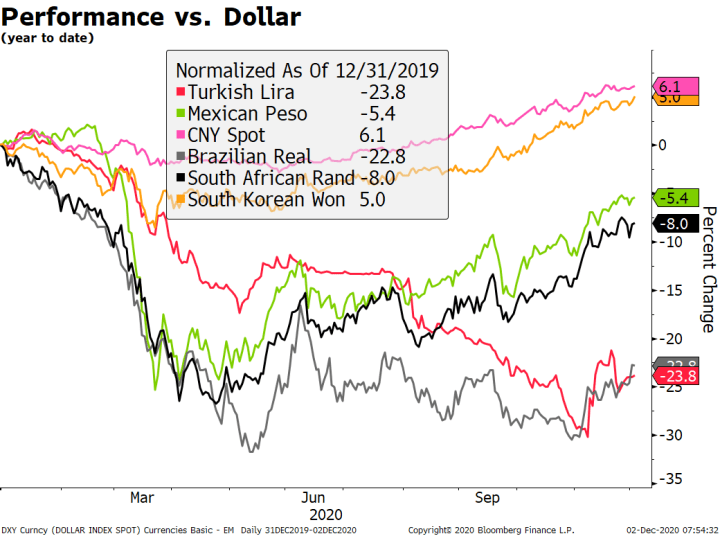

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows.

Read More »

Read More »

Dollar Firm as Risk-On Sentiment Ebbs Ahead of ECB Decision

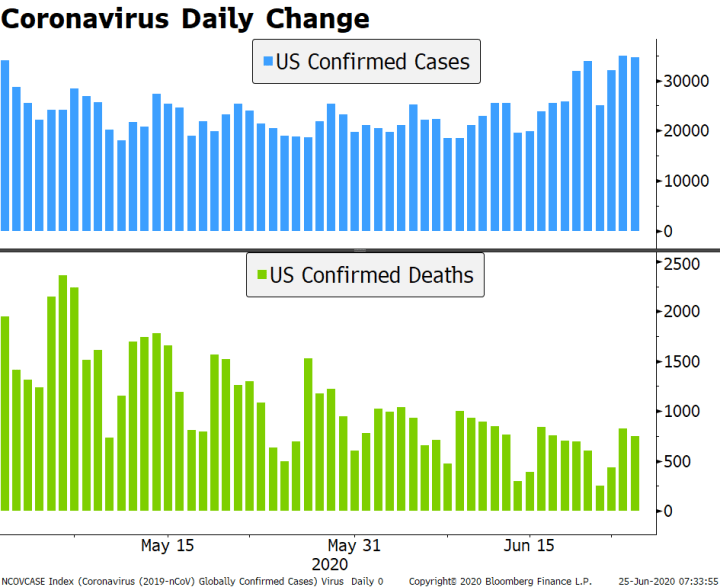

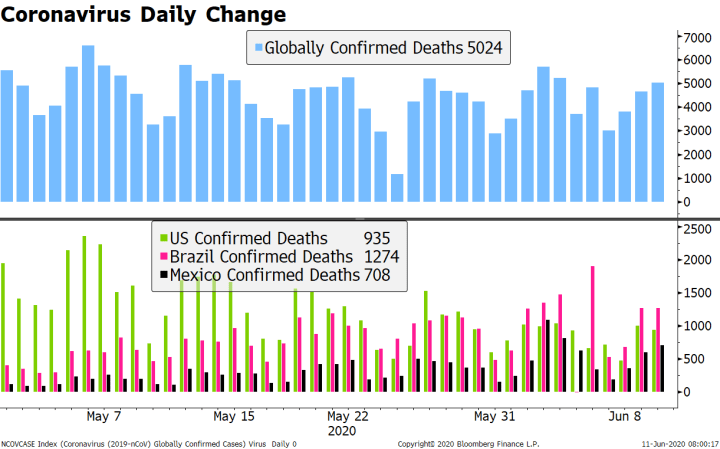

Risk sentiment is taking a breather today after a strong run; the dollar is getting some modest traction. Fed tweaked its municipal bond program; weekly jobless claims are expected to rise 1.843 mln; Brazil and Mexico are seeing record high daily death counts.

Read More »

Read More »

Dollar Broadly Weaker After Reports of Possible Brexit Compromise

The dollar remains under pressure; there is a debate as to the root causes of recent dollar weakness. May auto sales will be the only US data release today; protests in the US are further denting Trump’s re-elections prospects, at least according to betting odds. The G7 meeting planned at Camp David this month was postponed after German Chancellor Merkel declined his invitation.

Read More »

Read More »

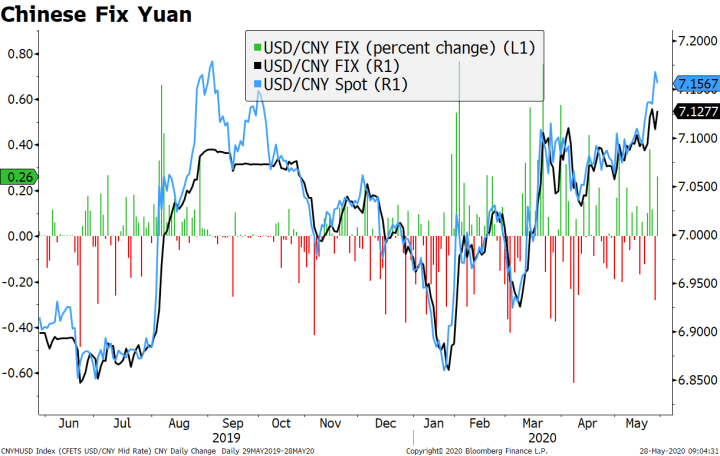

Dollar Firm as US-China Tensions Continue to Rise

Tensions between the US and China continue to rise; the dollar is finding some traction. Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week .

Read More »

Read More »

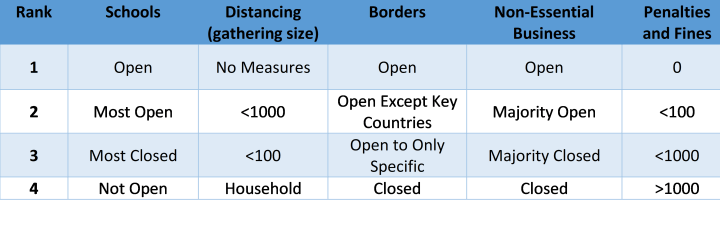

Asia Lockdowns vs. Re-Openings

We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a) schools/universities, (b)...

Read More »

Read More »

Hong Kong Turbulence Likely to Rise as US-China Relations Worsen

Recent moves by China call into direct question the “one country, two systems” approach. Hong Kong assets have held up surprisingly well but we see turbulence ahead as US-China relations are set to deteriorate further.

Read More »

Read More »

Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot, Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity.

Read More »

Read More »

Dollar Firm as China’s Hong Kong Gambit Triggers Risk-Off Trading

Legislation was introduced that allows Beijing to directly impose a national security law on Hong Kong; US-China tensions are still rising; the dollar is bid as risk-off sentiment takes hold. There are no US data reports or Fed speakers today; Canada reports March retail sales; Mexico reports mid-May CPI.

Read More »

Read More »