Category Archive: 5.) Alhambra Investments

What Did Hamper Growth ‘In A Few Months’

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign.

Read More »

Read More »

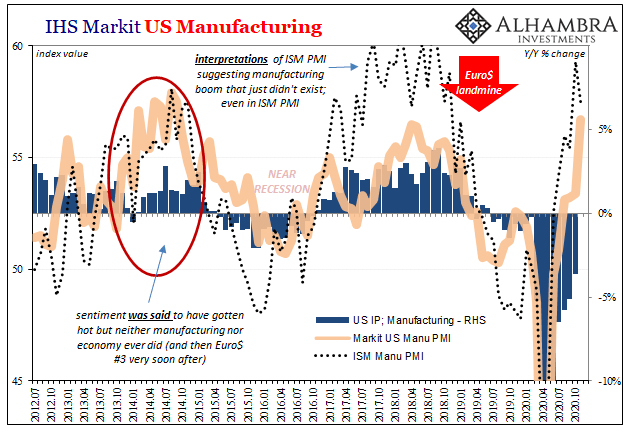

This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality.Oddly the same for 2017’s update heading into 2018 and...

Read More »

Read More »

Making Sense Eurodollar University Episode 37 Part 2

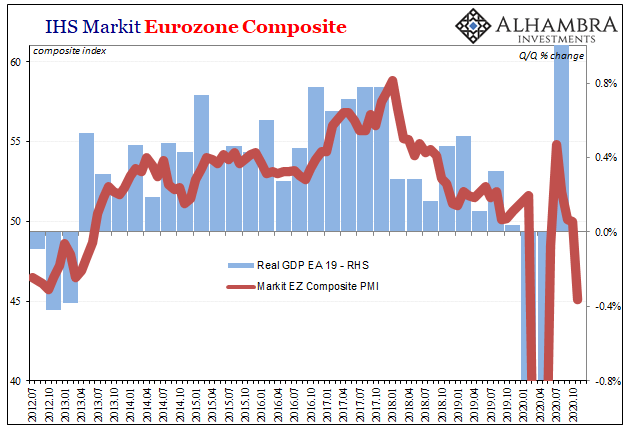

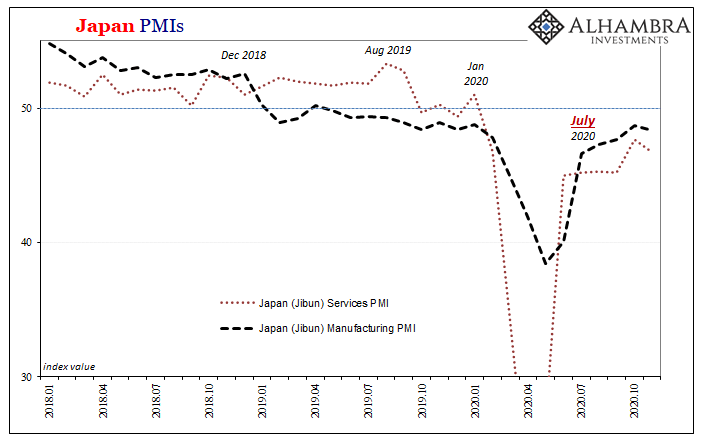

Europe's latest PMI scores tell us the continent is falling into re-recession, perhaps not unlike Japan. Where did the momentum disappear to? The USA has better PMIs but should that give us comfort?

Read More »

Read More »

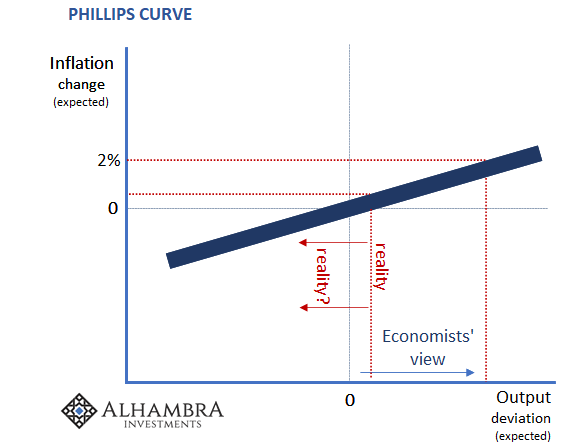

Inflation Hysteria #2 (Slack-edotes)

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them.

Read More »

Read More »

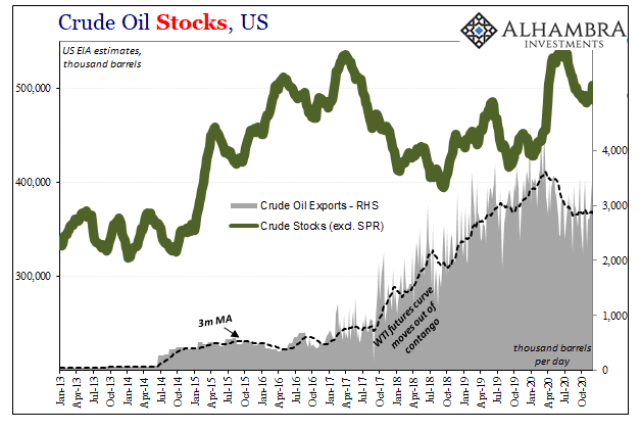

Inflation Hysteria #2 (WTI)

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously.

Read More »

Read More »

Ep 127- Jeffrey Snider “How Do Swap Lines Work?”

Jeff Snider is the Head of Global Research at Alhambra Investments, and here he explains how ridiculous the swap line system is. Swap lines don't work like how most people think they work.

Read More »

Read More »

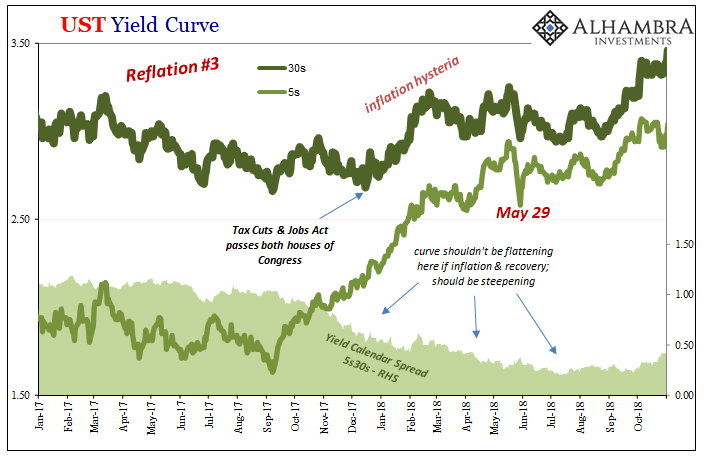

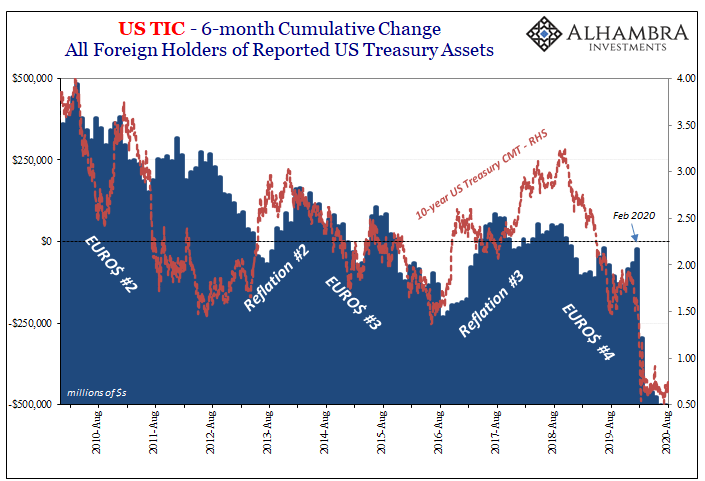

Inflation Hysteria #2 (Nominal UST)

What had given Inflation Hysteria #1 its real punch had been the benchmark 10-year Treasury note. Throughout 2017, despite the unemployment rate in the US, globally synchronized growth being declared around the world (and being declared as some momentously significant development), and whatever other tiny factors acceding to the narrative, longer-term Treasury rates just weren’t buying it.

Read More »

Read More »

Submit Questions for Jeffrey Snider on Liberty and Finance!

Submit Questions for Jeffrey Snider, Chief Investment Strategist for Alhambra Investments on Liberty and Finance!

Read More »

Read More »

Polar Opposite Sides of Consumer Credit End Up in the Same Place: Jobs

If anything is going to be charged off, it might be student loans. All the rage nowadays, the government, approximately half of it, is busily working out how it “should” be done and by just how much. A matter of economic stimulus, loan cancellation proponents are correct that students have burdened themselves with unprofitable college “education” investments.

Read More »

Read More »

Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it. Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness.

Read More »

Read More »

Don’t Really Need ‘Em, Few More Nails Anyway

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.”

Read More »

Read More »

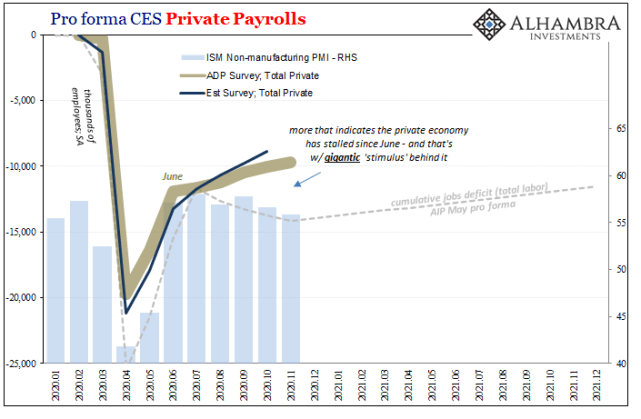

There Have Actually Been Some Jobs Saved, Only In Place of Recovery

The ISM reported a small decline in its manufacturing PMI today. The index had moved up to 59.3 for the month of October 2020 in what had been its highest since September 2018. For November, the setback was nearly two points, bringing the headline down to an estimate of 57.5.

Read More »

Read More »

Tesla Isn’t A Car Company

We have the luxury, the honor, of speaking to a lot of individual investors here at Alhambra. Whether they are clients or future clients (optimism is my default condition), the most common view of stocks is that they are overvalued and a fall – a large fall – is inevitable. And there is no stock that embodies that view more than Elon Musk’s Tesla Incorporated. It was once known as Tesla Motors but Musk changed the name in early 2017. There may...

Read More »

Read More »

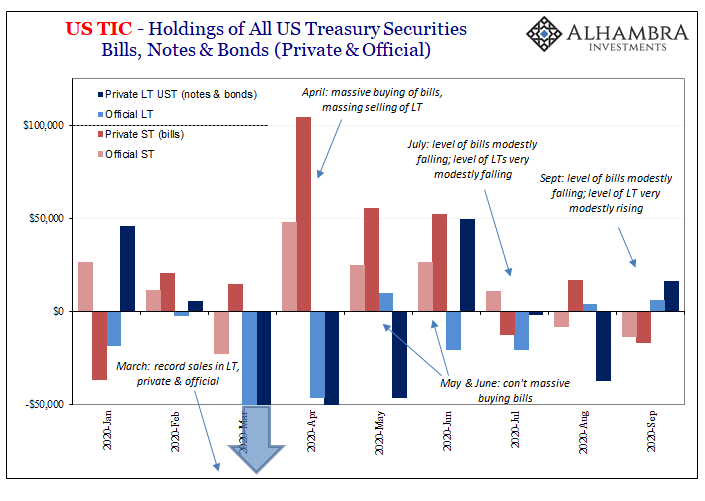

Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »

Making Sense Eurodollar University Episode 32 Part 3

The Chinese currency is gaining against the dollar. That SHOULD be an 'all-clear' signal that reflation, global trade, and positive momentum are in place. But we DO NOT see corroborating evidence on the People's Bank of China balance sheet. Maybe the move is an engineered feint?

Read More »

Read More »

A Lesson In PMIs: Relative vs. Absolute

The bid for “decoupling” has never been stronger, and, unfortunately, this time actually represents the weakest case yet for it. According to the mainstream interpretations of the most recent sentiment indicators, the US and European economies appear to be going in the complete opposite directions.

Read More »

Read More »

Deflation Returns To Japan, Part 2

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic.

Read More »

Read More »

Extending the Summer Slowdown

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer

Read More »

Read More »