Category Archive: 4) FX Trends

Great Graphic: Unemployment by Education Level

The US reports the monthly jobs data tomorrow. The unemployment rate stood at 4.4% in June, after finishing last year at 4.7%. At the end of 2015 was 5.0%. Some economists expect the unemployment rate to have slipped to 4.3% in July. Recall that this measure (U-3) of unemployment counts those who do not have a job but are looking for one.

Read More »

Read More »

FX Daily, August 07: Outlaw Mondays

The US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing against the Canadian dollar for the sixth consecutive session. The New Zealand dollar is weaker for the fifth time in six sessions.

Read More »

Read More »

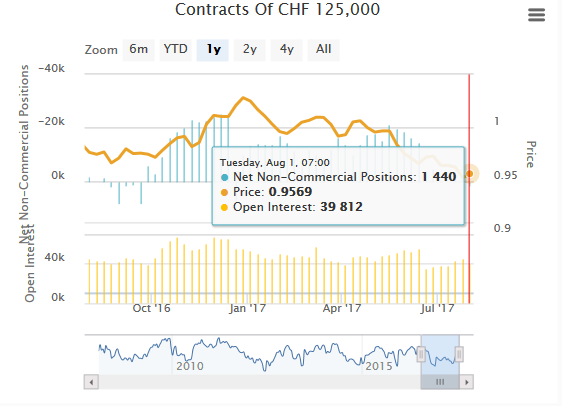

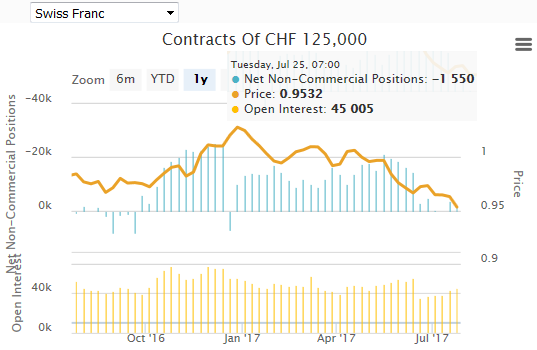

Weekly Speculative Positions (as of August 01): Speculators Press Ahead with Dollar-Bloc Currencies, but Hesitate with Euro and Yen

The net speculative CHF position has risen from -1.5K short to 1.4K contracts long (against USD). In the CFTC reporting week ending August 1, speculators in the futures market continued to build long exposure in the dollar-bloc currencies. In the three sessions after the reporting period closed, the dollar-bloc currencies have traded heavily.

Read More »

Read More »

FX Weekly Preview: Moving Toward September

The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France's Macron and Japan's Abe have sunk in the polls lower than Trump.

Read More »

Read More »

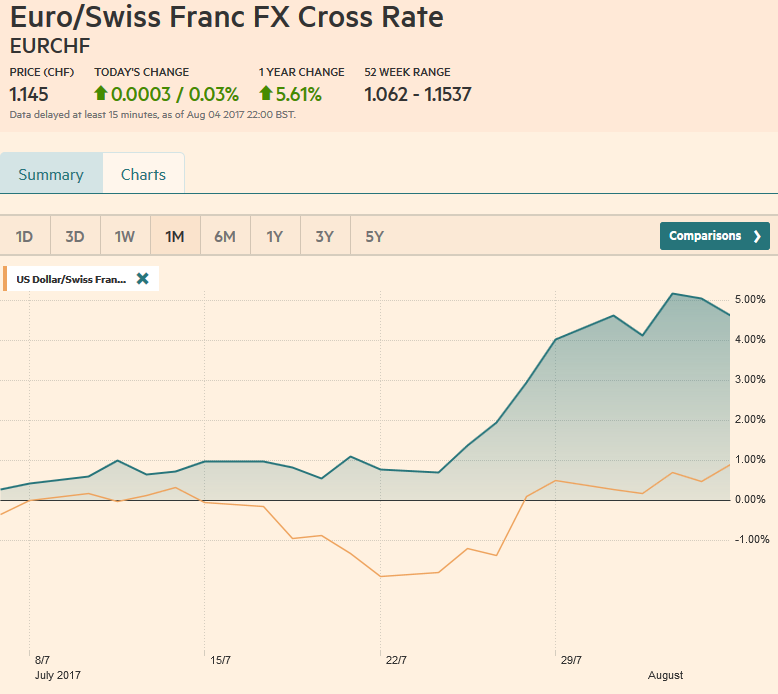

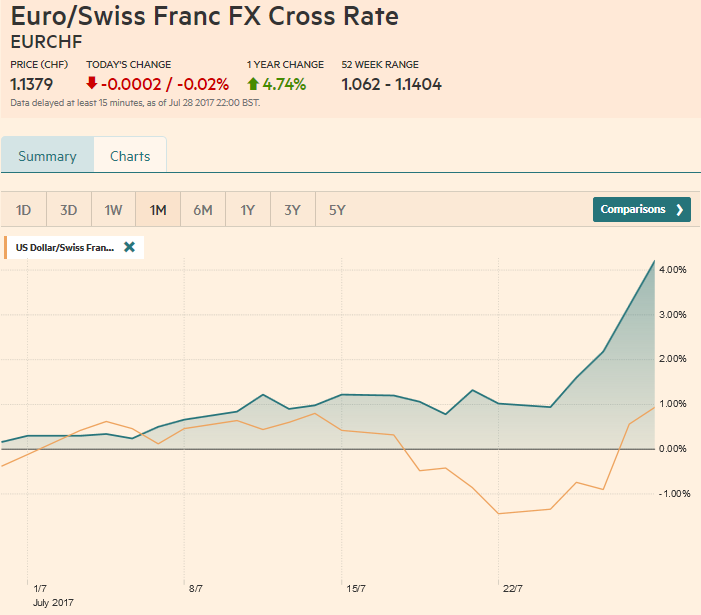

FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc 2% during this week.

Read More »

Read More »

Great Graphic: Italy-It is Not Just about Legacy

A little while back I was part of a small exchange of views on twitter. It was about Italy. I was arguing against a claim that Italy's woes are all about its past fiscal excesses. It is not just about about Italy's legacy.

Read More »

Read More »

Four vacation rules for traders

Adam Button from ForexLive talks about his four rules for forex traders on vacation. The market never stops but traders need to take a break sometime and here are four tips on how to get the most out of time away. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

Bank of England Crushes Sterling

Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day's low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week's low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low from the second half of July...

Read More »

Read More »

Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. The unemployment rate ticked down to 4.3%, matching the cyclical low set in May. This is all the more impressive because the participation rate also ticked up (62.9% from 62.8%).

Read More »

Read More »

FX Daily, August 04: Does the Employment Report Matter?

There are some chunky option strikes that could come into play today. There are 920 mln euros struck at $1.1850 that expire today. There are A$523 mln struck at $0.7950 expiring today. There are $680 mln struck at CAD1.2550 that will be cut.

Read More »

Read More »

FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625.

Read More »

Read More »

Cool Video: Dollar Drivers on Bloomberg

There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh consecutive month.

Read More »

Read More »

FX Daily, August 02: Euro Climbs Relentlessly, While Greenback is Mixed

The euro's strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors. The initial dollar losses at the start of the year was largely a correction that is common after a Fed hike. This is more or less what happened at the start of 2016 as well, following the Fed hike in December 2015.

Read More »

Read More »

FX Daily, August 01: The Most the Dollar Can Hope for on Turn Around Tuesday is Consolidation

After taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above $1.18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific yields were mostly higher, while European rates are a little lower. The US 10-year yield is flat just below 2.30%.

Read More »

Read More »

Strategist Chandler Sees Dollar in Long-Term Correction

Jul.31 -- Marc Chandler, head of currency strategy at Brown Brothers Harriman, examines the decline of the U.S. dollar and how the currency stacks up against the euro. He speaks on "Bloomberg Markets."

Read More »

Read More »

FX Daily, July 31: Monday Morning Blues

The euro is up by 0.15% to 1.1385 CHF. The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be more consolidative than corrective, and month-end adjustment provides an additional wrinkle.

Read More »

Read More »

Strategist Chandler Sees Dollar in Long-Term Correction

Jul.31 — Marc Chandler, head of currency strategy at Brown Brothers Harriman, examines the decline of the U.S. dollar and how the currency stacks up against the euro. He speaks on “Bloomberg Markets.”

Read More »

Read More »

Weekly Speculative Positions (as of July 25): Speculators Continue to Pour into Australian and Canadian Dollar Futures

The net speculative CHF position has risen from -3.7K short to -1.5K contracts short (against USD). Speculators were active in the currency futures in the CFTC reporting week ending July 25. In particular, speculative sentiment continues to be drawn to the Canadian and Australian dollars.

Read More »

Read More »

FX Weekly Preview: The Dollar may Need more than a Strong Employment Report

For the US jobs data to rally the dollar, it needs to increase the likelihood of a Fed hike in September, a high bar. The BOE will stand pat, a 6-2 vote would likely be accompanied by a hawkish inflation report. The RBA will also hold rates steady, and of course, it would prefer a weaker currency.

Read More »

Read More »

FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years.

Read More »

Read More »