Category Archive: 4) FX Trends

FX Daily, April 23: Rising Rates Help Extend Dollar Gains

The new week has begun much like last week ended, with rising rates helping to extend the dollar's recent gains. The US 10-year yield is flirting with the 3.0% threshold. The two-year yield is firmer, and, like in the second half of last week, the US curve is becoming a little less flat. The market, as we had anticipated, was not so impressed with North Korea's measures, and Korea's Kospi edged lowed, and the region-leading KOSDAQ fell a little...

Read More »

Read More »

FX Weekly Preview: Markets and Macro

Worries about a trade war appear to have eased, at least for the moment, but that does not make investors worry-free. The concerns have shifted toward rising US interest rates, perhaps more than anything else, but general anxiety seems elevated.

Read More »

Read More »

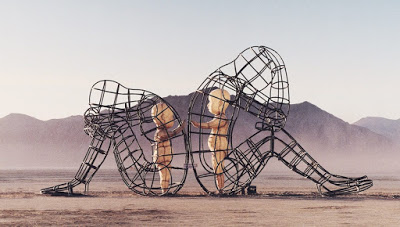

Don’t let fear crowd out your chance of success in your forex trading

Fear can get out of hand in your life and in your forex trading. If you let it get the best of you, your chance of success starts to dwindle. Don’t let it happen to you In this video, Greg Michalowski of Forexlive, discusses fear and ways that you can eliminate it from your trading. … Continue...

Read More »

Read More »

FX Daily, April 20: The Greenback is Alive

The US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just below 300 bp. It is the fourth consecutive advancing session for the Dollar Index, which is near a two-week high.

Read More »

Read More »

FX Daily, April 19: Markets Calm But Lack Immediate Focus

A light news stream and less trade rhetoric lend the equity markets a positive impulse amid a strong US earnings season while leaving the dollar narrowly mixed. The MSCI Asia Pacific Index rose 0.5% and is up 1% for the week with one session left. It would be the second consecutive weekly advance. The Dow Jones Stoxx 600 has edged higher for a third consecutive session. It is up about 0.7% for the week, and if sustained, would extend the advance...

Read More »

Read More »

Weekly Technical Analysis: 16/04/2018 – USD/CHF, USD/JPY, EUR/GBP, GBP/USD, USD/CAD

The USDCHF pair breached 0.9675 level and closed the daily candlestick above it, to open the way to achieve more rise in the upcoming sessions, paving the way to head towards 0.9790 as a next main station. Therefore, the bullish trend will be suggested, supported by the EMA50, noting that breaking 0.9675 and holding below it will push the price to test 0.9581 level before determining the next trend clearly.

Read More »

Read More »

What’s next for the Canadian dollar after the BOC decision

The Bank of Canada left interest rates unchanged on April 18 and didn’t offer any kind of clear indication about the May meeting. Adam Button from ForexLive talks about what’s next for Poloz,the BOC and the Canadian dollar.

Read More »

Read More »

FX Daily, April 18: Greenback is Firm, While Soft Inflation Drags Sterling from Perch

The US dollar is enjoying a firmer tone against major and most emerging market currencies. Sterling, which has become a market darling, hit an air pocket after softer than expected CPI. UK headline CPI rose 0.1% in March, while the market expected a 0.3% increase. The recently introduced preferred measure, CPIH slipped to 2.3% from 2.5%, the weakest in a year.

Read More »

Read More »

FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week's high near $1.24, and sterling rose through the January high to reach its best level since the mid-2016 referendum. Sterling rose through $1.4375 before the easing after the employment report.

Read More »

Read More »

FX Daily,April 16: Market Struggles for Direction

The Syrian strike over the weekend, and the official indication that "mission accomplished" and that was a limited one-off strike has spurred little market reaction. There is one more loose end, as it were, and that is that the US has indicated it will announce additional sanctions on Russia for its involvement in Syria's chemical weapon use. The ruble is volatile but slightly firmer to start the week, and while dollar-bond yields are firmer, the...

Read More »

Read More »

FX Weekly Preview: Still Looking for Terra Firma

The weekend strike by the US, British and French forces against Syria appear to have been conducted in ways that minimize the risks of escalation by Russia. The limited nature of the strike and objectives suggest that the impact on the constellation of forces in Syria will be minimal. There is unlikely to be much of an impact in the global capital markets, though thin markets in early Asia could see a knee-jerk effect.

Read More »

Read More »

Great Graphic: Loonie Takes Big Step toward Technical Objective

For a little more than two weeks, we have been monitoring the formation of a possible head and shoulders top in the US dollar against the Canadian dollar. The neckline broke a week ago. It is not uncommon for the neckline to be retested after the break. That was what happened yesterday. The US dollar recorded an outside down day yesterday.

Read More »

Read More »

FX Daily, April 13: Markets Struggle to Find Footing while News Stream Improves

It had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump's rhetoric on trade took a more constructive tone, and a divided Administration leaves Syria in a bit of a limbo. US equities rallied yesterday, and Asia and European bourses are advancing today, but the conviction may not be particularly strong.

Read More »

Read More »

Great Graphic: Aussie-Kiwi Approaches Trendline

Today is the fifth consecutive session that the Australian dollar has weakened against the New Zealand dollar. It has now fallen to test a three-year old trendline that we show on the Great Graphic, composed on Bloomberg. The last leg down in the Aussie actually began last October, and through today's low, it is off by a little more than 7%.

Read More »

Read More »

FX Daily, April 12: Geopolitics Overshadow the Fed, Greenback Steadies

The US dollar steadied at lower levels, while equities eased as investors remain focused on the preparations to strike Syria and still tense rhetoric on trade. Reports indicate that the US and France have moved warships into the area and the UK has moved submarines within striking distance as well.

Read More »

Read More »

FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Between Syria, trade tensions, and the US special investigator into Russia's attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%.

Read More »

Read More »

Understanding the Latest International Reserve Figures

At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist's forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for international investors.

Read More »

Read More »

FX Daily, April 10: XI’s Day, but Not So Good for Putin

It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump's lawyer's office, house and hotel were the subject of search warrants. A Bloomberg report citing people who knew said that China would consider devaluing the yuan.

Read More »

Read More »

US Jobs Data Optics Disappoint, but Signal Unchanged

The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped.

Read More »

Read More »

FX Daily, April 09: Asian and European Equities Shrug Off US Decline

US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing phase. No sanctions have gone to into effect. As the Economist points out, nearly 100 of the Chinese products the US proposed slap a tariff on are not currently being exported to the US. The US has a 60-day...

Read More »

Read More »