Category Archive: 4) FX Trends

FX Weekly Preview: It was Supposed to be a Quiet Week

It was supposed to be a quiet week. The economic data and event calendar was light. There were three features, and none would likely disrupt the markets much. The first two are in Europe. The eurozone flash PMI for July, the first insight into how Q3 has begun. The PMI is expected to paint a mostly steady economic activity.

Read More »

Read More »

Euro, Yen, and Equities: Reviewed

US equities and the dollar appear to be moving higher together. The greenback is near its best level this year against most of the major and emerging market currencies. The Chinese yuan is not an exception to this generalization. At the same time, the S&P 500 is at its best levels since the downdraft February, and the NASDAQ set a new record high earlier in the week.

Read More »

Read More »

One big risk to the Canadian economy has faded

If the housing bubble was going to pop, it would have imploded by now. Adam Button from ForexLive talks about the Canadian economy and why it’s in better shape than the headlines suggest. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, July 20: Dollar Consolidates after Trump Wades In

The US dollar is little changed but mostly softer as the week draws to a close. The market is digesting the implications of yesterday's comments by President Trump about interest rates and foreign exchange, and without fresh economic data, are content to go into the weekend. Since Trump's comments yesterday, the euro has not been below $1.1625 nor above $1.1680.

Read More »

Read More »

FX Daily, July 19: Greenback Extends Gains

The US dollar is extending its recent gains against most of the world's currencies. We continue to see the most compelling case for the macro driver being the diverging policy mixes. There are also more immediate factors too. The surprisingly poor UK retail sales report, for example, managed to do what the Brexit chaos and softer than expected CPI fail to do.

Read More »

Read More »

FX Daily, July 18: Greenback Extends Gains-For Now

After softening in Europe yesterday, the dollar recovered in the North American session with the help of assurances by Fed Chair Powell who reaffirmed the path gradual path despite clear recognition that tariffs threaten wages and growth. The greenback has extended those gains today and is higher against all the emerging market currencies, expected the Turkish lira, which is slightly firmer.

Read More »

Read More »

Great Graphic: Fed Raising Rates, but Yields Still Negative

The yield on the 3-month US Treasury bill is pushing above 2% today for the first time since 2008. The yield had briefly dipped below zero as recently as late 2015. Although today's yield seems high, this Great Graphic shows the nominal generic three-month yield going back to 1990. Then the three-month bill yielded 8%. The peak in the last cycle (2006-2007) was a little above 5%.

Read More »

Read More »

FX Daily, July 17: Dollar on Back Foot Ahead of Powell

The US dollar eased in Asia session and the European morning. The greenback had appeared technically vulnerable, and the economic news stream is light. Sterling, unlike most of the other major currencies, remains within yesterday's range. Yesterday's high, a little above $1.3290, maybe reinforced a little today by the GBP245 mln $1.33 option that is expiring. Brexit concerns may also be acting as a drag.

Read More »

Read More »

Great Graphic: Two-year Rate Differentials

Given that some of the retail sales that were expected in June were actually booked in May is unlikely to lead to a large revision of expectations for Q2 US GDP, the first estimate of which is due in 11 days. Before the data, the Atlanta Fed's GDPNow projects the world's biggest economy expanded at an annualized pace of 3.9% in Q2.

Read More »

Read More »

FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today's key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local markets are closed for a public holiday, and the yen did initially strengthen (the dollar eased to ~JPY112.10) but surrendered those gains and consolidating its biggest loss last week in 10 months.

Read More »

Read More »

FX Weekly Preview: For the Millionth Time: Investors Exaggerate Trade Tensions at Their Own Peril

You would never have guessed it reading many of the op-eds and pundits pronouncing the end to globalization or the West, or liberalism. Global equities have rallied. Of course, stock prices are not the end all and be all, but it stands in stark contrast to the cries that the sky is falling.

Read More »

Read More »

Great Graphic: Two Stories for Two Trend Lines

The Dollar Index made a marginal new high for the year at the end of June a touch below 95.55. It fell through the start of this week when it reached nearly 93.70. With the earlier gains, the Dollar Index briefly traded above the 61.8% retracement of the pullback (~94.85). A move now below 94.20 would be disappointing.

Read More »

Read More »

Great Graphic: Is Mr Market Thinking About the First Fed Cut?

The US economy is among the strongest among the large economies. Goosed by the never-fail elixir of tax cuts and spending increases, the US economy is accelerating. Nevertheless, we continue to see the fiscal boost as short-lived, and a recent Fed paper suggested that fiscal stimulus in an upswing may not have the same multiplier as during a downturn.

Read More »

Read More »

FX Daily, July 13: Trump Trips Sterling, but Greenback Enjoys Broad Gains

President Trump weighed in on Brexit and spurred the largest drop in sterling in more than two weeks. Trump encouraged Brexit, but he indicated he "would have done it much differently" and that he "actually told Theresa May how to do it, but she did not listen." Trump cautioned that May's plan would mean it would still be too close to the EU and this would "kill" a free-trade deal with the US. In effect, Trump backed the harder Brexit camp...

Read More »

Read More »

FX Daily, July 12: Dollar Remains Firm as Risk Returns

The US dollar rallied yesterday as the escalating trade tensions between the world's top two economies choked off the animal spirits and a marked down in equities and risk assets. It remains firm today even as risk has come back. Equities are mostly higher today and bonds lower. Emerging market currencies, from Turkey to South Africa are firmer, as is the Chinese yuan.

Read More »

Read More »

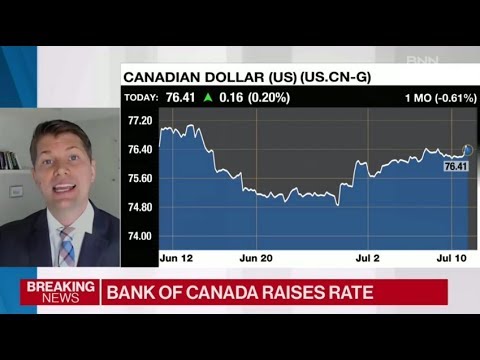

Bank of Canada hikes. What’s next for the Canadian dollar

Adam Button from ForexLive joins BNN Bloomberg immediately after the Bank of Canada decided to hike interest rates to 1.50% to talk about the outlook for the Canadian dollar and what’s coming next for interest rates. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new tariffs after the public comment period is completed at the end of next month. This time the list included numerous consumer goods, like digital cameras, baseball gloves, but have left off popular products, like...

Read More »

Read More »

What does England soccer, NBA basketball and Forex trading have in common?

What does England soccer, NBA basketball and Forex trading have in common? Set pieces. England’s manager Gareth Southgate came to the US to see how NBA teams create space on the congested basketball court. The goal was to see if what they do, could translate to the soccer pitch. That idea got me thinking about …

Read More »

Read More »

Forex Trading Education Video: Look for the easy shot in your trading

Each and every day, there tends to be some easy shots that you as a trader can look to take advantage of. Admittedly, some shots don’t work. You shoot and you miss. However, if you shoot where the risk is limited, you lose a little and the reward can be great. This video talks a … Continue...

Read More »

Read More »

Taking the easy shots in your forex trading

Each and every day, there tends to be some easy shots that you as a trader can look to take advantage of. Admittedly, some shots don’t work. You shoot and you miss. However, if you shoot where the risk is limited, you lose a little and the reward can be great. This video talks a … Continue reading »

Read More »

Read More »