Category Archive: 4) FX Trends

Trump and the Dollar

US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk.

Read More »

Read More »

How to trade the Trump White House right now

Way too many people have the Trump trade backwards, they’re focused on the wrong thing. Adam Button talks about what matters to the market and how to trade the US dollar in the first weeks of the Trump Presidency.

Read More »

Read More »

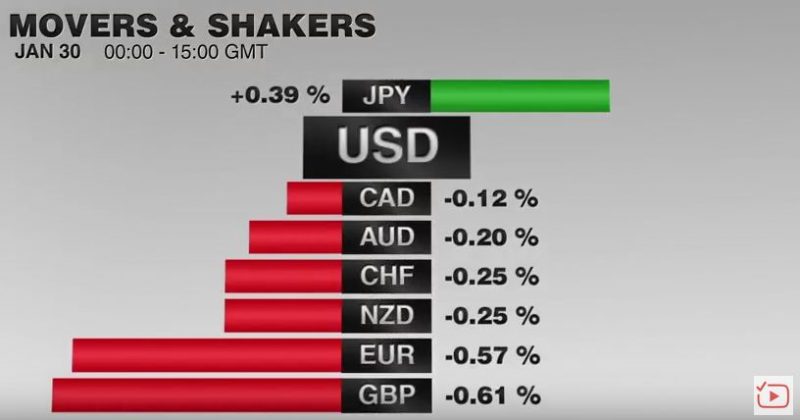

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

Weekly Speculative Position: Net Short Euro and Yen Are Falling. Short CHF Stable

Speculators are net short CHF with 13.6K contracts against USD. This is nearly unchanged. But net short of Euro and Yen are Diminishing.

Read More »

Read More »

FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China's PMI are among the data highlights.

Read More »

Read More »

FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

The US dollar spent the first month of the new year correcting lower after a strong advance in the last several months of 2016. We argue that the correction actually began in mid-December following the Federal Reserve's rate hike.

Read More »

Read More »

Great Graphic: Mexico and China Unit Labor Costs

Mexico has been gaining competitiveness over China before last year's depreciation of the peso. The depreciation of the peso, and other US actions can contribute to the destabilization of Mexico. An economically prosperous and stable Mexico has long been understood to be in the US interest.

Read More »

Read More »

Plan the trade: A technical look at the EURUSD for the trading week ahead

Non- trending transitions to trending The EURUSD traded in a 117 pip range in the last week. That represents the most narrow trading week going back to December 21, 2014. When ranges are narrow, the market is unsure of the direction it wants to go. That will logjam is eventually broken – one way or …

Read More »

Read More »

The Grand Strategy: Fixed Spheres of Influence or Variable Shares?

The US has a direct investment strategy for historical reasons. It competes against export-oriented strategies. The FDI strategy does make low-skilled domestic labor compete with low-skilled foreign worker, but skilled workers abroad complement the skilled domestic worker.

Read More »

Read More »

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »

US GDP Misses, but Final Domestic Sales Accelerate

Net exports was a large drag on growth. Inventories flattered growth. Underlying signal, final domestic demand, increased 2.5% after 2.1% in Q3.

Read More »

Read More »

Are Interest Rates No Longer Driving the Dollar?

Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust.

Read More »

Read More »

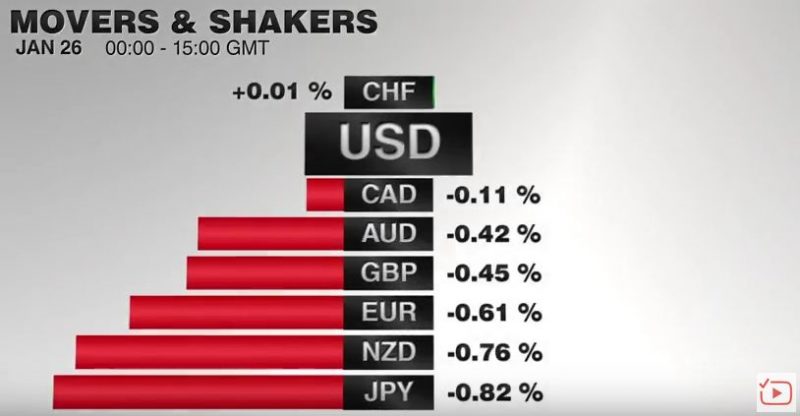

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

Cool Video: Bloomberg’s Daybreak–Trump and Rates

On what Trump's first working day as POTUS, I had the privilege to be on Bloomberg's Daybreak to talk about the wagers on US interest rates in the futures market. In the most recent CFTC reporting week, which ended on January 17, speculators in the 10-year note futures market reduced the record net short position. It is only the second week reduction since the end of November.

Read More »

Read More »

Forex Technical Analysis: 5 currencies in 5 minutes

Some key levels in the major currency pairs are broken today There were some key levels broken (or held) in some of the major currencies pairs in trading today. Knowing what they are and why they are important is helpful for your trading as they help define bullish or bearish bias as well as risk. … Continue reading...

Read More »

Read More »

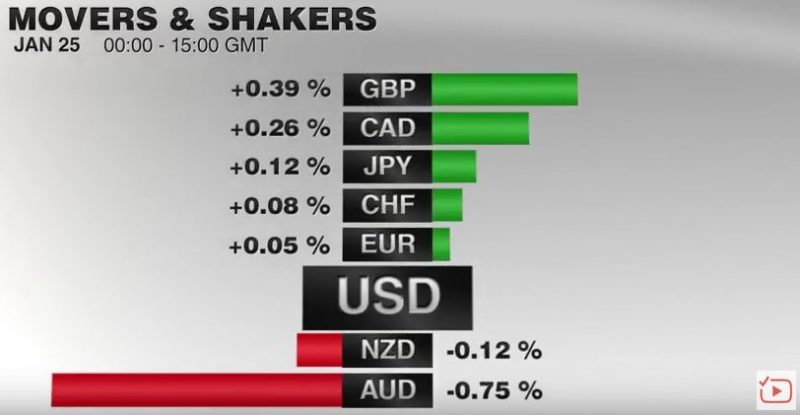

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

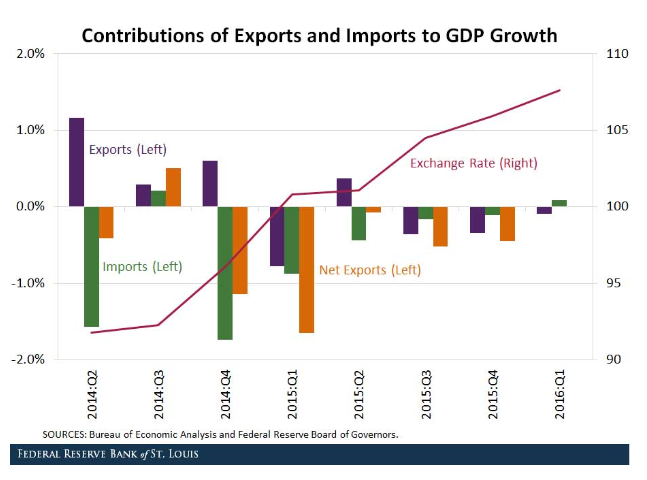

Great Graphic: How a Strong Dollar Weighs on Net Exports

Investors appreciate that a strong dollar can impact US growth through the net export component of GDP. The dollar's appreciation can push up the price of exports and lower the cost of imports. The St. Louis Fed took a look at how the strong dollar from 2014 to the beginning of 2016 impacted the net export function of GDP.

Read More »

Read More »

Forex trading video: The alternative facts in your forex trading

…and how to sift through them The phrase “alternative facts” are the latest and greatest buzz words thanks to Pres. Trumps counselor, Kellyanne Conway. The phrase is misleading in certain situations. How can there be alternative facts with regard to crowd size or something that is fairly obvious from a visual observation (or even factual …

Read More »

Read More »