Category Archive: 4) FX Trends

FX Daily, November 5: Animal Spirits Remain Animated

The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August 2018. A small rate cut by China and catch-up by Tokyo, which was on holiday on Monday, helped extended the regional rally for the 14th session in the past 17.

Read More »

Read More »

November Monthly

Two main developments drove the foreign exchange market in October. First, the market grew more confident that a hard Brexit could be avoided. This drove sterling sharply higher. It rallied from $1.22 on October 10 to a little above $1.30 on October 21 before doubts grew about the likelihood that Parliament will approve the new agreement.

Read More »

Read More »

FX Daily, November 4: Investor Optimism Carries into the New Week

Overview: Investor optimism is reflected by the risk-taking appetite that is lifting equity markets and bond yields. With Japanese markets closed for a national holiday, the MSCI Asia Pacific Index was led higher by more than 1% gains in Hong Kong, Taiwan, South Korea, and Thailand. The regional benchmark advanced for the seventh session in the past eight and is approaching the year's high.

Read More »

Read More »

FX Weekly Preview: Synchonized Emergence from Soft Patch?

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone.

Read More »

Read More »

FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Overview: An unexpected increase in China's Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain.

Read More »

Read More »

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

FX Daily, October 30: All About Perspective

Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second consecutive session following a six-day rally.

Read More »

Read More »

FX Daily, October 29: Calm before the Storm

The more prominent events this week still lie ahead, and the capital markets are trading accordingly. The rally that lifted the S&P 500 to new record highs yesterday carried over into Asia, where most equity markets rose, though China, Hong Kong, and South Korea were notable exceptions. European shares are struggling in the early going after the Dow Jones Stoxx 600 set new highs for the year yesterday.

Read More »

Read More »

Cool Video: Dollar and Fed

I joined Tom Keene and Marty Schenker (chief content officer) on the set of Bloomberg TV this morning. Schenker discussed some of the geopolitical issues in the Middle East, and Keene asked about the impact on the dollar. I expressed my concern that the chief threat to the dollar's role in the world economy is the several administrations have increasing weaponized access to the dollar and the dollar funding market.

Read More »

Read More »

Fed to Cut Three More Times as Economy Is Rolling Over: Chandler

Oct.28 — Marc Chandler, chief market strategist at Bannockburn, discusses his expectation for three more interest rate cuts by the Federal Reserve and the state of the U.S. dollar. He speaks on “Bloomberg Surveillance.”

Read More »

Read More »

FX Daily, October 28: Politics Dominates Start of the Week before Yielding to Policy and Economics

Overview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe's Dow Jones Stoxx 600 took a five-day advancing streak into this week, but shares are struggling to sustain the upside momentum.

Read More »

Read More »

FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU.

Read More »

Read More »

FX Daily, October 25: Limping into the Weekend both Fighting and Talking

Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe's Dow Jones Stoxx 600 is little changed, and it too is closing in on its third weekly advance.

Read More »

Read More »

FX Daily, October 24: Flash PMIs Disappoint Despite Negative Interest Rates

Overview: As the UK awaits the EU's decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden's Riksbank retained a hawkish tone while keeping rates on hold, and Norway's Norges Bank also stood pat. The market expects Turkey to deliver a rate cut, while the ECB meeting is Draghi's last at the helm.

Read More »

Read More »

Cool Video: China Still Needs to Provide more Stimulus

The IMF projects that China will expand by less than 6% in 2020, but unless China provides more stimulus, it may be difficult to achieve. This is not only my view but also the view of Helen Qiao, the chief economist for Greater China at Bank of America. I was on the Bloomberg set with Alix Steele and Ms. Qiao earlier today.

Read More »

Read More »

Boris in a win-win situation and why boring is good in FX

Adam Button from ForexLive talks about the results of the Canadian election and how the lackluster move afterwards is a good sign for the future. He contrasts that with the UK where the political volatility is endless and why now is the time to buy the dip in the pound.

LET'S CONNECT!

Facebook ► http://facebook.com/forexlive

Twitter ► https://twitter.com/ForexLive

Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

Boris in a win-win situation and why boring is good in FX

Adam Button from ForexLive talks about the results of the Canadian election and how the lackluster move afterwards is a good sign for the future. He contrasts that with the UK where the political volatility is endless and why now is the time to buy the dip in the pound. LET’S CONNECT! Facebook ► http://facebook.com/forexlive …

Read More »

Read More »

FX Daily, October 23: Markets Lack Much Conviction, Await Fresh Developments

Overview: UK Prime Minister Johnson is neither dead in a ditch as he said he would prefer to be than request an extension of Brexit, nor will the UK leave the EU at the end of the month. Yesterday's vote rejected the attempt to fast-track the legislation needed to support the divorce agreement. It all but ensures that such a delay will be forthcoming.

Read More »

Read More »

FX Daily, October 22: Trudeau will Lead a Coalition Government in Canada, while the UK’s Johnson Fights Another Day

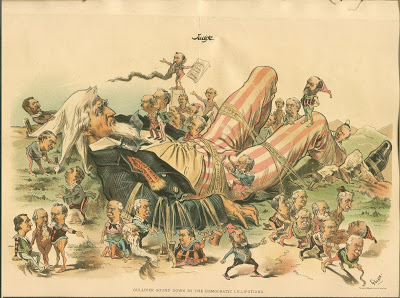

Overview: Bismark is said to have warned that laws were like sausages, and to respect them, one ought not to see how they are made. The UK had a non-binding referendum more than three years ago, and although it won by 52%-48% and the party leaders committed to adhering to the results, it still cannot figure out how to leave.

Read More »

Read More »

FX Daily, October 21: Dollar Soft, but Stage is being Set for Turn Around Tuesday

Overview: The UK's departure from the EU remains up in the air as a new attempt to pass the necessary legislation through Parliament continues today. Many market participants seem to remain optimistic that Prime Minister Johnson's plan will ultimately succeed. After slipping to $1.2875 initially, sterling briefly pushed through $1.30, which had held it back last week.

Read More »

Read More »