Category Archive: 4.) Marc to Market

FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. FX Rates The risk that the UK votes to leave the EU next … Continue reading »

Read More »

Read More »

Democratic Deficit: Is the UK Referendum the Tip of the Iceberg?

One of the most profound criticisms of the EU that it remains, even at

this late date, primarily an elite

project. The democratic deficit has grown, according to the latest

Pew Research multi-country poll.

The Pew Research sur...

Read More »

Read More »

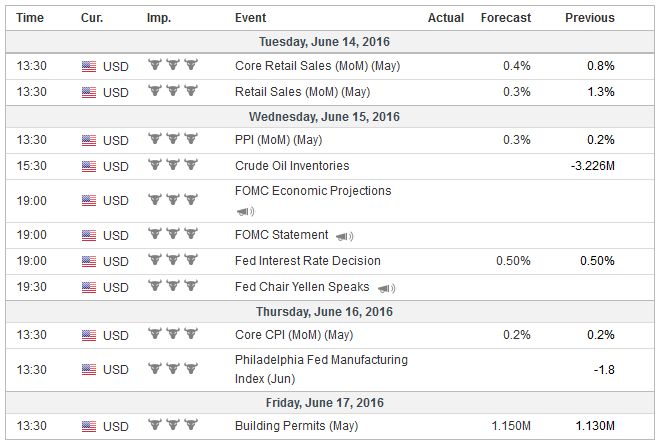

FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four

central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials

were preparing the market for a summer hike. Risks of a new downturn in

Japan spurred spe...

Read More »

Read More »

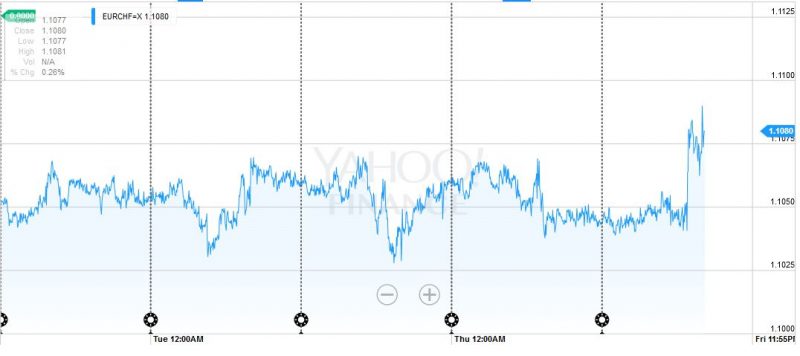

FX Weekly Review: June 06 – June 10: EUR/CHF Down 2 percent

Two main events that will drive the foreign exchange market. The first is the FOMC meeting.

The shockingly weak job growth dashed whatever lingering odds of a move next week. The EUR/CHF has fallen by 2%.

Read More »

Read More »

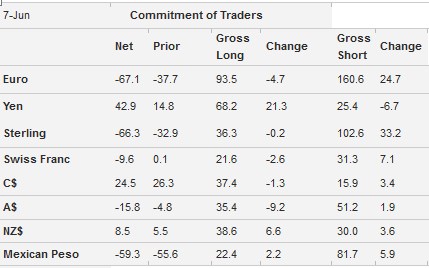

Weekly Speculative Positions after Uneventful ECB and Surprisingly Weak US Jobs

Price action shows a increase of the Swiss franc after the bad US payrolls report. Commitments of traders, however, indicate a move to a short CHF position of 9600 x 100k contracts against the dollar. We must separate speculative CHF positions from inflows into CHF cash, CHF stocks, bonds and real-estate, what we call "real financial flows". These will be revealed on Monday, with the SNB release of sight deposits, the counter-position of real...

Read More »

Read More »

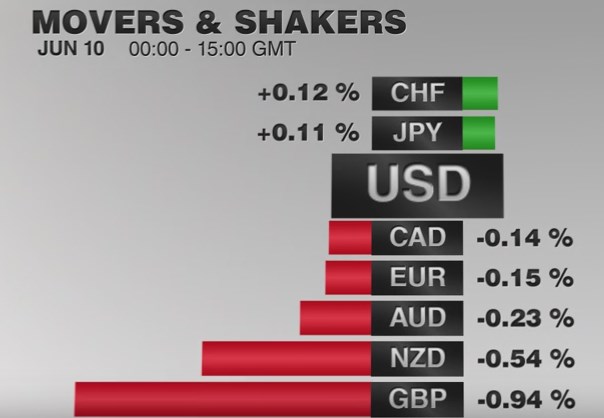

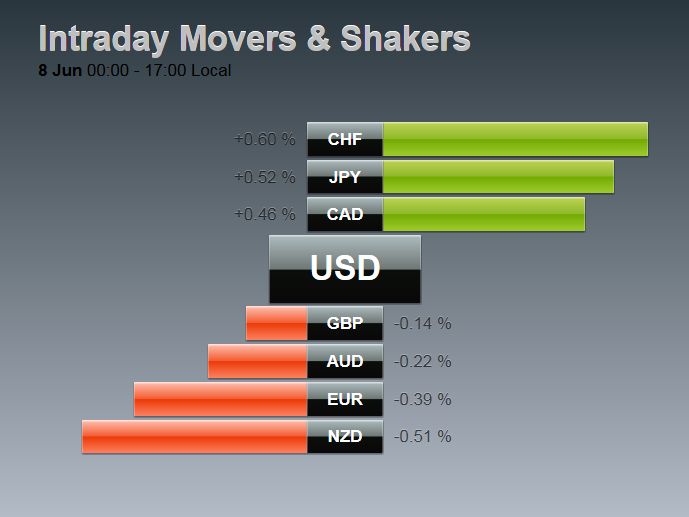

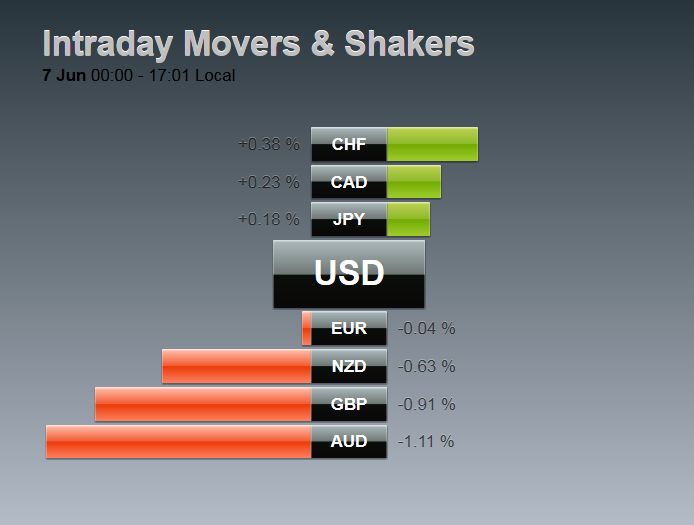

FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Once again, CHF was one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular "Weekly SNB sight deposits" report. For the week, it is the dollar-bloc and franc that have maintained weekly gains.

The US dollar weakened in the first half of the week as

participants continued to react to the shockingly poor jobs report and shift in Fed...

Read More »

Read More »

Politics and Economics

Many people understand politics and economics to be two different disciplines. I remember in graduate school more than two decades ago, many colleagues and professors operationally defined political economy as how politics, by which they meant the state, screws up economics. I spoke at the Fixed Income Leaders Summit earlier this week and teased that many seemed …

Read More »

Read More »

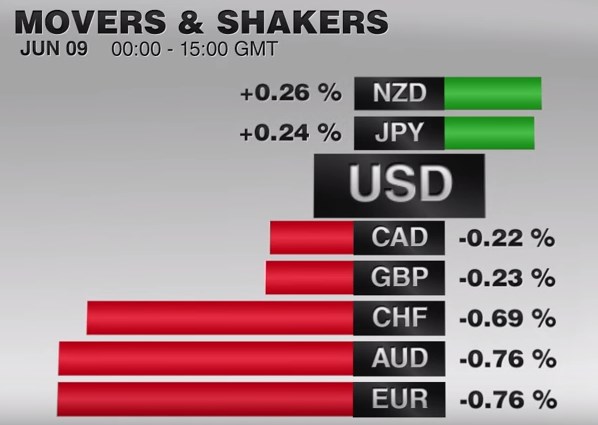

FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD.

The US dollar is posting modest upticks against most of the

European currencies and the Canadian and Australian dollars. However, it has fallen against the yen and taken out the

recent low, leaving little between it and the May 3 l...

Read More »

Read More »

FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

Once again the Swiss Franc appreciates both against EUR and USD.

The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596.

The foreign exchange market is quiet. The euro remains confined to the

narrow range seen on Monday between $1.1325 and $1.1395. We continue to

look for higher levels near-term as the

drop from May 3 (~$1.1615) to May 30 (just be...

Read More »

Read More »

Cool Video: Bloomberg Television–All about the Periphery

I am in Boston to attend the Fixed Income Leaders Summit and was invited to join Alix Steel, Joe Weisenthal, and Scarlet Fu on Bloomberg TV. We talked about the peripheral in Europe, especially Portugal, Italy and Spain. Each has a pressing issue. In Portugal, yields have not fallen as much as in other … Continue reading »

Read More »

Read More »

Presidential Elections and Fed Policy: How Close is Close?

The most important element in next week’s FOMC meeting may come from the dot plot and whether Fed officials back away from the two hikes thought appropriate in March. When looking the schedule of FOMC meetings, and understanding that when the Fed says “gradual” to describe the normalization process, it does not mean hiking at …

Read More »

Read More »

Great Graphic: Despite Higher Oil Prices, Middle East Pegs Remain Under Pressure

With today’s gains, the price of Brent has nearly doubled from its lows in January. Of course, the price of oil is still less than half of levels that prevailed two years ago. At the same time, many leveraged investors cast a jaundiced eye toward currency pegs. Many have concluded that the Middle East currency pegs …

Read More »

Read More »

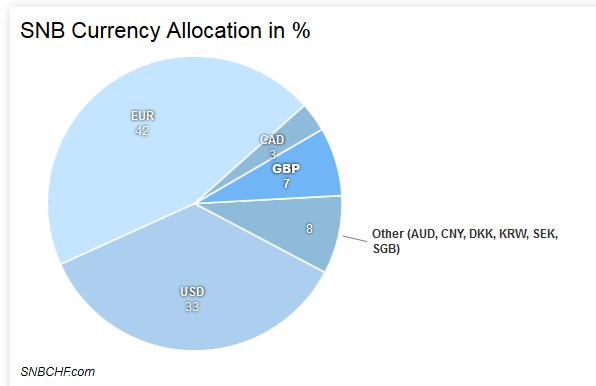

Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.

SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.

Read More »

Read More »

Great Graphic: Brexit Risks Rise

Brexit Predict This Great Graphic shows the price people are willing to pay to bet that the UK votes to leave the EU at the June 23 referendum on the PredictIt events markets. We included the lower chart to give some sense of volume of activity on this wager in this event market. Presently, one … Continue reading »

Read More »

Read More »

FAQ: ECB’s Corporate Bond Buying Program Starts

In March, the ECB decided to increase its asset purchases from 60 to 80 bln euros a month and to include corporate bonds. The corporate bond buying program begins this week. We use an FAQ format to discuss the key issues. What is the ECB doing? The ECB will buy euro-denominated, investment grade bonds … Continue reading...

Read More »

Read More »

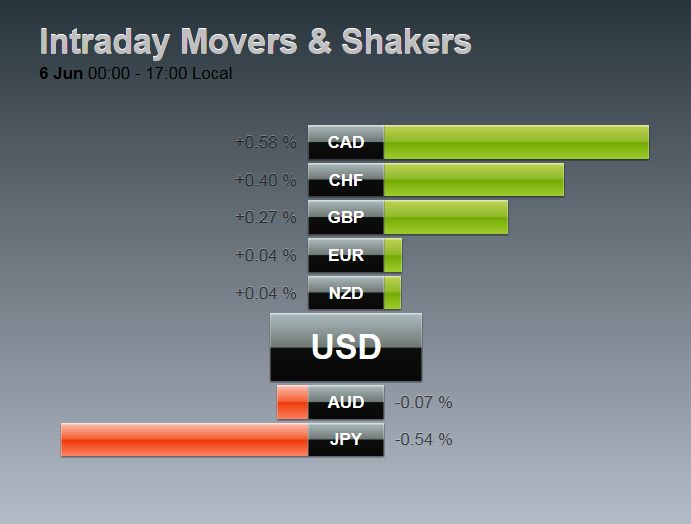

FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the …

Read More »

Read More »

FX Weekly Preview: Macro Developments Will Not Stand in Way of Dollar Move Lower

Through the first part of the year, the swinging pendulum of expectations for the trajectory of Fed policy has been a major driver in the foreign exchange market. This is true even though the ECB and BOJ continue to ease monetary policy aggressively. The Australian and New Zealand dollars appear to influenced more by the … Continue...

Read More »

Read More »

FX Weekly Review May 30 to June 3: Dollar’s Rally Ends with a Bang

The dollar peaked on May 30, but it was not clear until the poor US jobs report sent the greenback reeling on June 3. The EUR/CHF surprisingly increased, despite weak US data. No wonder, speculators had to cover their short EUR positions.

Read More »

Read More »

Weekly Speculative Positions: Little Adjustment ahead of ECB and US Jobs

The Swiss Franc net position was reduced from 4.0 contracts long to 0.1 thousand contracts long. Apart from the yen., other speculative position barely changed. We are keen on next week's data that should reflect the dismal US jobs report.

Read More »

Read More »