Category Archive: 4.) Marc to Market

No Big Thoughts, but Several Smaller Observations

Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe.

Read More »

Read More »

FX Weekly Preview: After this Week, Does August Matter?

RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan's fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful.

Read More »

Read More »

Weekly Speculative Postions: Speculators Sell European Currency Futures

The euro bears added another 10.3k contracts to their gross short position, which brought it to 221.8k contracts., This is this is the largest grossshort position since early January.

Read More »

Read More »

Great Graphic: Relative Performance of Bank Stocks–US, Europe, and Japan

MSCI US Bank Index, MSCI European Bank Index and the Japan Topix Bank Index compared. Divergence in the health of the financial sector.

Read More »

Read More »

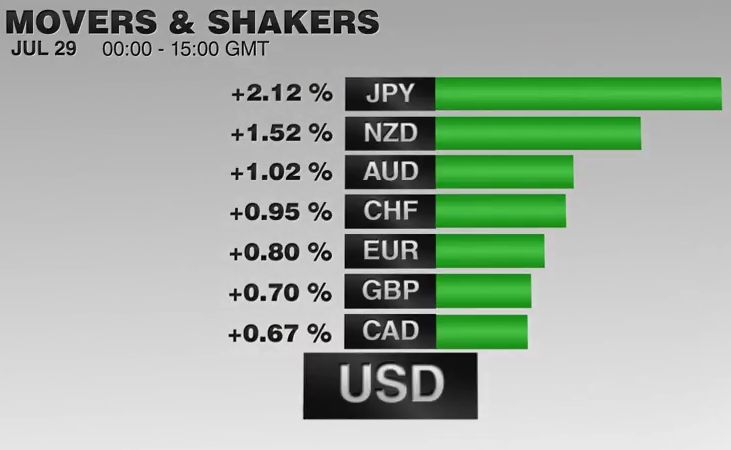

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »

Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP.

Read More »

Read More »

FOMC says What it Had To, No More or Less

Fed upgraded its assessment of the economy. Added that the downside risks to the economy have diminished. Only George dissents.

Read More »

Read More »

FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

Swiss Franc: The Euro kept on climbing, after yesterday's rapid rise. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Read More »

Read More »

Oil and Economy Pull the Canadian Dollar Lower

The decline in oil prices is a factor weighing on the Canadian dollar. US premium over Canada is rising, and may continue as the economies diverge. The general risk appetite is supportive for the Canadian dollar.

Read More »

Read More »

Great Graphic: How the US Recovery Stacks Up

The US recovery may have surpassed the 2001 recovery in Q2. Though disappointing, the recovery has been faster than average from a balance sheet crisis. Although slow, it is hard to see the secular stagnation in the data.

Read More »

Read More »

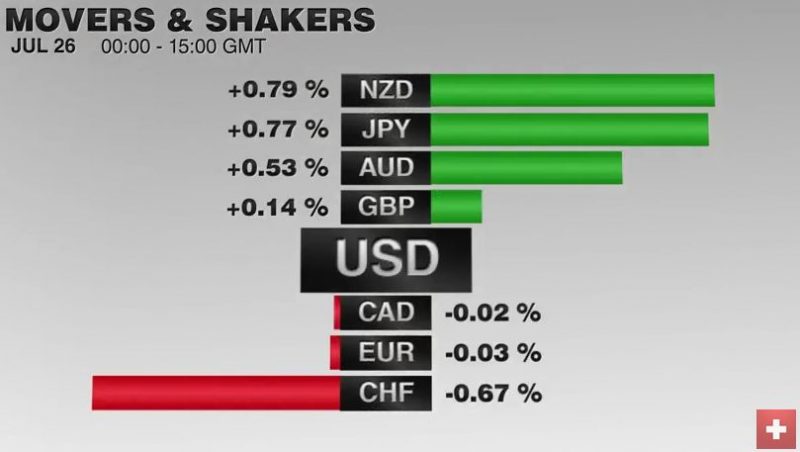

FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Read More »

Fed to Stand Pat, but Statement may be More Constructive

The Fed's nervousness in June has likely largely eased on the back of better economic data and stable international climate. The Fed may reintroduce its risk assessment. Who are the possible dissents?

Read More »

Read More »

European Banks Bad Loans and Coverage

European banks are worrisome. EBA's stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed.

Read More »

Read More »

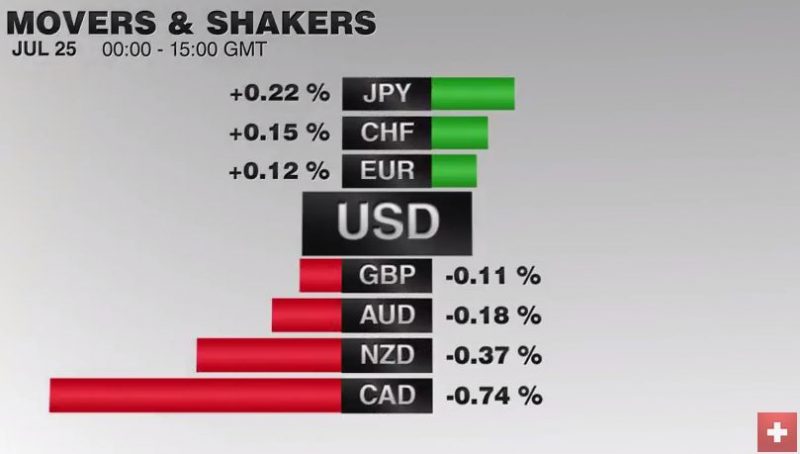

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »

Great Graphic: OIl Breaks Down Further

With today's losses the Sept contract has retraced 50% of this year's rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row.

Read More »

Read More »

European Bank Stress Test: Preview

European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries' banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules.

Read More »

Read More »

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

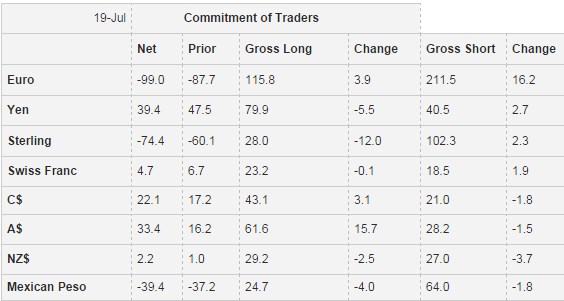

Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. They are more Bullish on Dollar and on the Dollar-Bloc currencies.

Read More »

Read More »

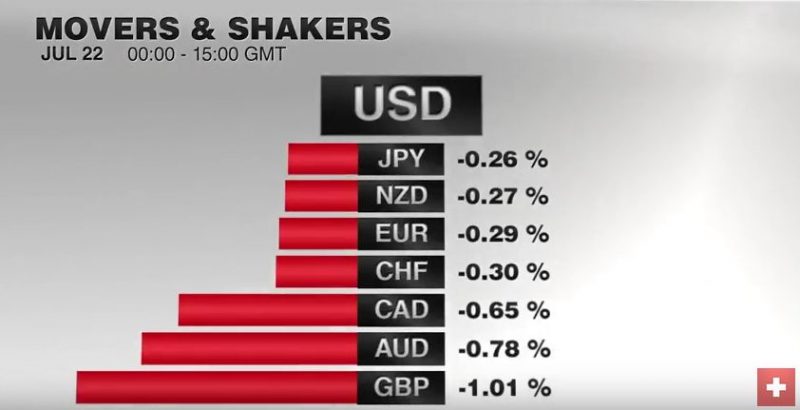

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »