Category Archive: 4.) Marc to Market

FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee.

Read More »

Read More »

Great Graphic: Stocks and Bonds

The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015.

Read More »

Read More »

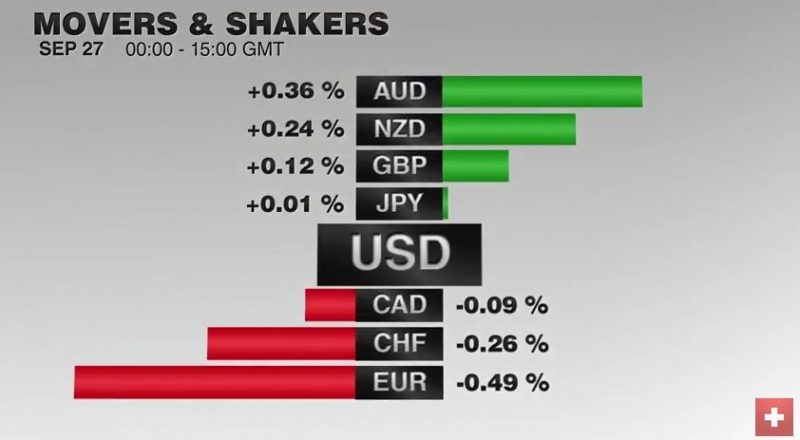

FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Since the monetary assessment meeting, the EUR/CHF is trending downwards. Sight deposits indicate that the SNB is intervening 0.9 bn per week. We emphasized that the preferred intervention corridor is between 1.08 and 1.0850. The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the...

Read More »

Read More »

FX Daily, September 26: Dollar Mixed while Stocks Slide to Begin Last Week of Q3

The US dollar is narrowly mixed. The euro, yen and Swiss franc are higher, while the dollar-bloc and sterling are softer. The moving element here is not so much the greenback, which serving more as a fulcrum, but idiosyncratic, country-level developments.

Read More »

Read More »

Great Graphic: Nearly Five-Month Uptrend in the Dollar Index Set to be Tested

DXY has been holding an uptrend since early May. It looks set to be tested near-term and technical indicators suggest it may not hold. Here are the two scenarios of penetration.

Read More »

Read More »

FX Weekly Preview: Politics to Overshadow Economics in the Week Ahead

The major central banks have placed down their markers and have moved to stage left. There are the late-month high frequency data, which pose some headline risks in the week ahead. The main focus for most investors will be on several political developments. The first US Presidential debate is wild card, in the sense that the outcome is unknown. In recent weeks, the polls have drawn close. In early August, Nate Silver’s fivethirtyeight.com, the gold...

Read More »

Read More »

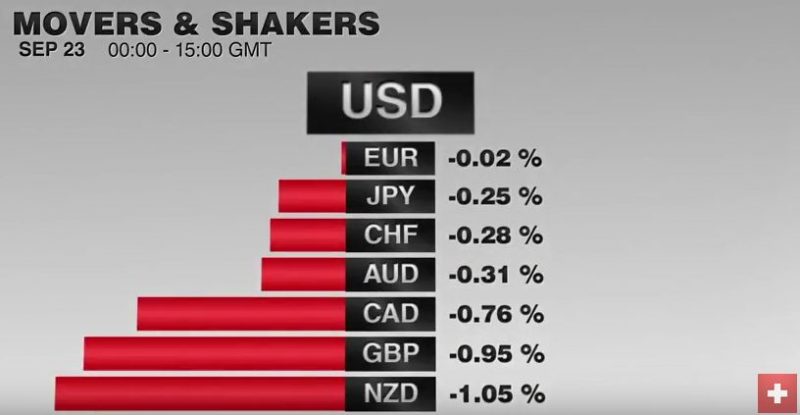

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

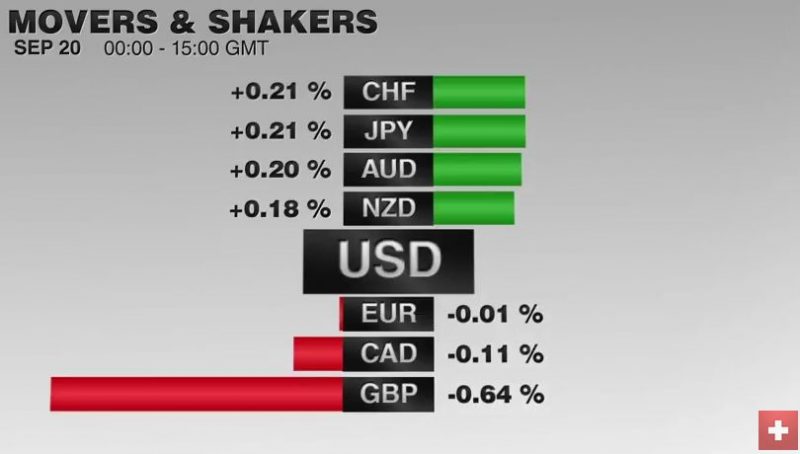

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

The EUR/CHF accelerated its decline since yesterday's strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged.

We know that the Swiss Franc has similar "counter-dollar" status as gold.

Read More »

Read More »

FX Daily, September 20: The Swiss Franc Continues To Rise.

The trade balance express if a currency is overvalued or not. The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued. And the franc continues to appreciate.

Read More »

Read More »

FX Daily, September 19: Dollar Begins Important Week on Softer Note

The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »

Read More »

Great Graphic: Median U.S. Income per Presidents

Median household income was higher in 2015 than in 2008, but still below 1999 peak in real terms. The bottom fifth of households by income have just recouped what was lost. Income growth did best under (Bill) Clinton and Reagan, including for top 5%. Origin of strong dollar policy means it will not be used as a trade weapon and it hasn't since Bentsen.

Read More »

Read More »

FX Weekly Preview: Punctuated Equilibrium and the Forces of Movement

Shifting intermarket relationships pose challenge for investors. The market is convinced the Fed will not raise rates. Greater uncertainty surrounds the BOJ; there seems less willingness to shock and awe.

Read More »

Read More »

Yellow Lights are Flashing

Bonds are not rallying despite poor US data. Greater chance that Trump gets elected than the Fed hikes next week. Berlin may be more important than Bratislava.

Read More »

Read More »

FX Daily, September 15: Early Update: Full Calendar but Little News

Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and two September Fed surveys. Yet the economic updates are unlikely change sentiment ahead of next week FOMC and BOJ meetings.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

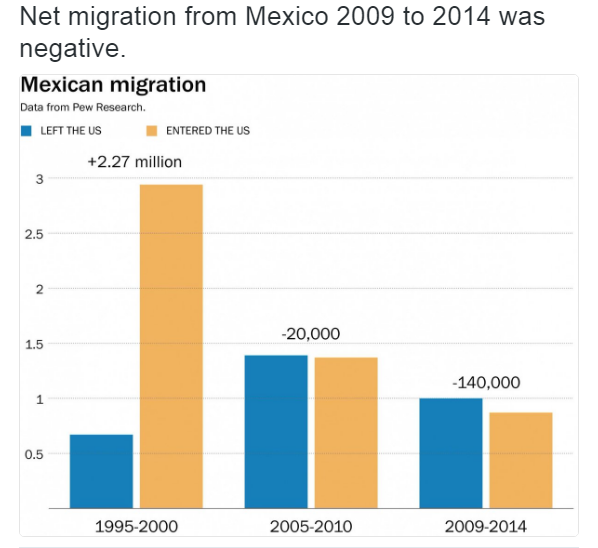

Great Graphic: Net Mexican Migration to the US–Not What You Might Think

Net migration of Mexicans into the US has fallen for a decade. The surge in Mexican migration into the US followed on the heels of NAFTA. Although Trump has bounced in the polls, and some see this as negative for the peso, rising US interest rates and the slide in oil price are more important drivers.

Read More »

Read More »

Thoughts on the Price Action

Global interest rates are rising. Something important is happening. It appears to be dollar positive.

Read More »

Read More »

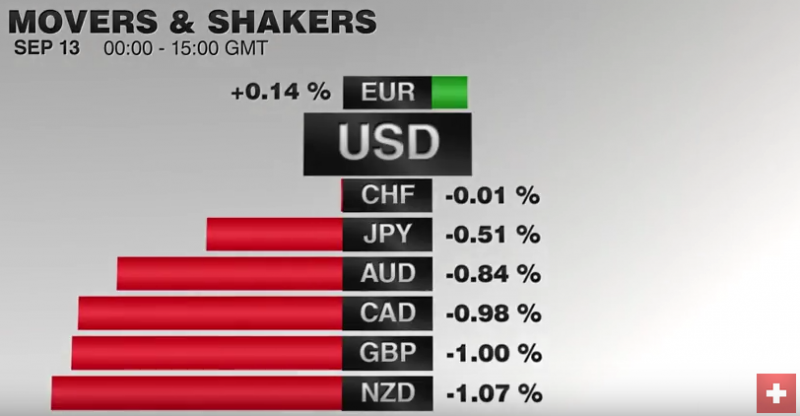

FX Daily, September 13: Much Noise, Weak Signal

The last ECB meeting and Dragh's hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth.

Read More »

Read More »

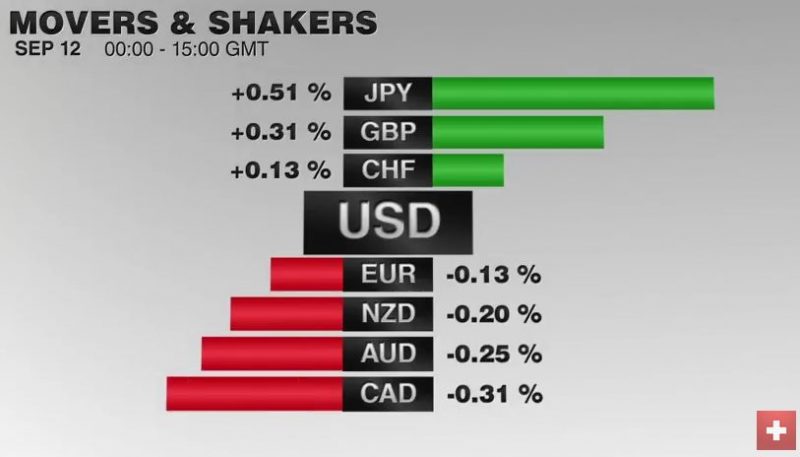

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »