Category Archive: 4.) Marc to Market

Chandler: Austria Vote a Bigger Risk Than Italy

Dec.01 — Marc Chandler, Brown Brothers Harriman head of currency strategy, discusses the Italian referendum and explains why he thinks the Austrian election may be more of a threat to markets. He speaks with Bloomberg’s Joe Weisenthal on “What’d You Miss?”

Read More »

Read More »

Cool Video: Bloomberg TV-Italy and Austria this Weekend

I was on Bloomberg Television with Joe Wisenthal this afternoon. I explain what I have been suggesting for the past couple of weeks, namely that the Austrian presidential election this weekend is the third point in the populist-nationalist wave, not Italy.

Read More »

Read More »

FX Daily, December 01: Dollar is on the Defensive, though Yields Rise

The US dollar is trading heavily against most of the major currencies, but the general tone appears consolidative in nature. Despite a disappointing UK manufacturing PMI (53.4, a four-month low), sterling is near a three-week high above $1.2600.

Read More »

Read More »

Brexit Minister Sends Sterling Higher

UK could pay for single market access. UK's position still seems fluid. The Supreme Court will hear the government's appeal next week.

Read More »

Read More »

Austrian Presidential Election is Important even if Overshadowed by Italy’s Referendum

Italy's referendum defeat is not simply a victory for populist-nationalist forces. Freedom Party victory in Austria is a victory for said forces. Even if Hofer wins, there are sufficient checks that make it difficult to hold EU or EMU referendum.

Read More »

Read More »

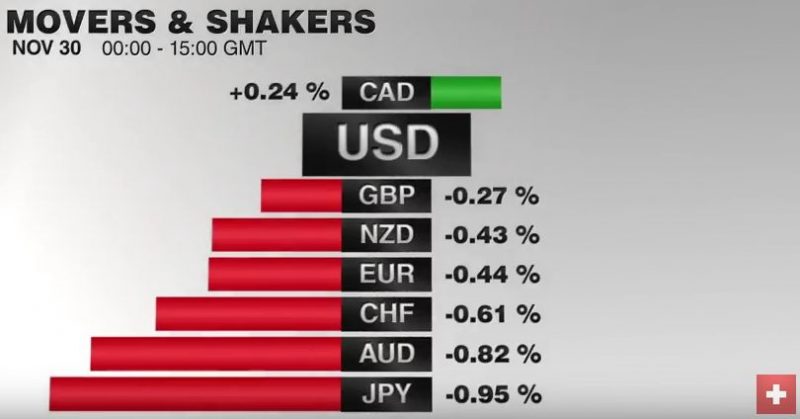

FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked government document titled Have cake and eat it, the markets and sterling were largely unphased.

Read More »

Read More »

Bernanke Suggests How to Use the Dot Plots

The dot plots are not FOMC commitments or an aggregate view of the FOMC. They are a collection of individual economic forecasts based on the most likely scenario and their view of appropriate policy. The SEP is useful for understanding how Fed officials view the long-term economic parameters, which appears to explain the downward shift in the long-term equilibrium rate for Fed funds.

Read More »

Read More »

Some Thoughts on Q3 US GDP

US Q3 was revised higher mostly due to consumption. Business investment was a drag. Profits rose to snap a five-quarter slide.

Read More »

Read More »

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

Great Graphic: Yen and Yuan Connection

The US dollar has rallied against both the Japanese yen and Chinese yuan since the end of September. Through today, the yen has fallen 9.8% and the yuan has fallen by 3.5%. What they have in common is the rise in US interest rates relative to their own. Since September 30, the US 10-year yield has from below 1.60% to above 2.40% at the end of last week. Japan's 10-year yield has risen from minus nine basis points at the end of September to five...

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

FX Weekly Preview: Shifting Portfolio Preferences Continue to Drive Capital Markets

Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows.

Read More »

Read More »

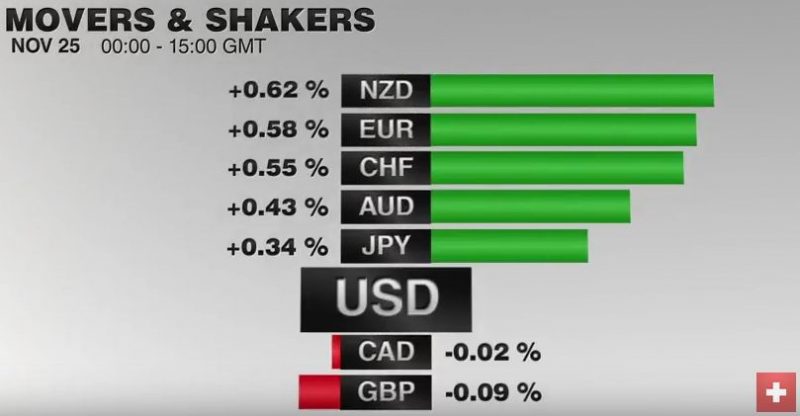

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

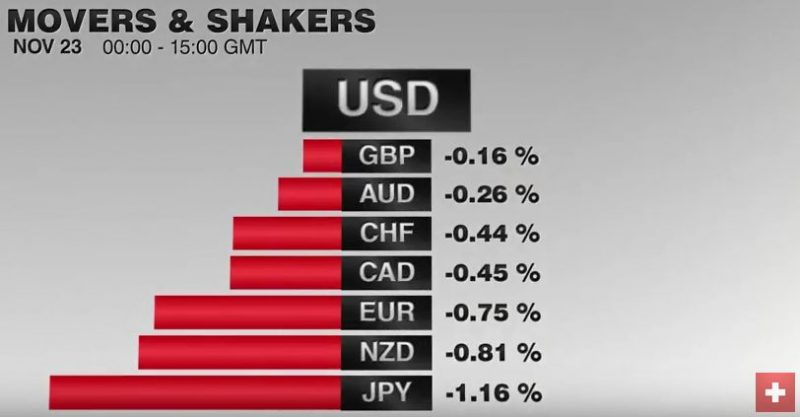

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

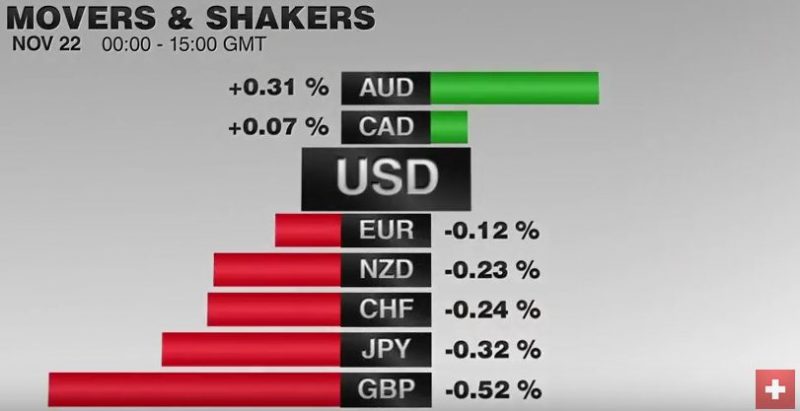

FX Daily, November 22: Bonds and Stocks Rally, Leaving Greenback to Meander

The US dollar entered a consolidative phase yesterday, and this carried into today's activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide.

Read More »

Read More »

FX Daily, November 21: Flattish Consolidation Hides Dollar Strength

The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most...

Read More »

Read More »

FX Weekly Preview: Shifting Paradigms and the Market Adjustment

Perceptions of two trends shape the investment climate: reflation and nationalism. Fed rate hike set for next month, barring significant surprise. Japan's trade surplus is growing even as imports and exports continue to contract.

Read More »

Read More »

The Italian Job

Italy is the epicenter of the next potential populist "shock." A defeat of the referendum is seen as intensifying the political risk. Renzi has wavered again regarding his political future if the referendum loses.

Read More »

Read More »

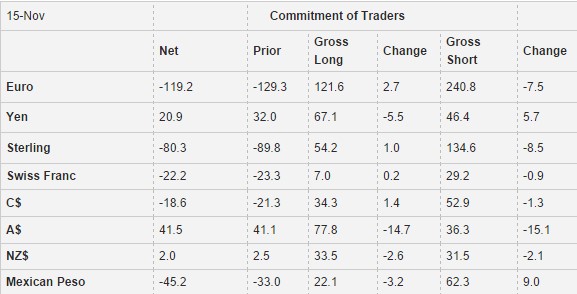

Weekly Speculative Positions: Dramatic Spot Currency Moves not Reflected

What is most noticeable about the CFTC Commitment of Traders report for the reporting week ending November 15 is what is not there: Activity. With the Australian dollar being the sole exception, we are struck by the apparent fact that dramatic spot price action and a what seemed like an impulsive trend move seemed not to be reflected in the futures position adjustments by speculators.

Given the strength of the US dollar after the election,...

Read More »

Read More »