Category Archive: 4.) Marc to Market

Are Dollar Fundamentals Lagging the Technical Improvement?

The US dollar extended its recovery that began on May 3. Its technical condition remains constructive, even though up until now, the gains are still consistent with a modest correction rather than a trend reversal. The details of the employment report, if not the headline, coupled with the 1.3% increase in retail sales, have boosted …

Read More »

Read More »

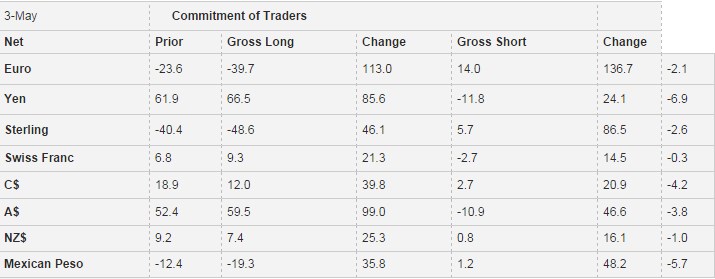

Weekly Speculative Positions: Significant Position Adjustments

The US dollar staged an impressive reversal against many of the major foreign currencies on May 3. In the following week, speculators in the currency futures market made significant adjustment in their holdings. We identified a change in the gross position in the currency futures of 10k contracts or more to be significant. In the week …

Read More »

Read More »

Dollar’s Technical Tone Improves, but No Breakout (Yet)

The US dollar continued the recovery begun May 3 and rose against most of the major currencies over the past week. A nearly 3.5% rally in oil prices, the fifth weekly gain in the past six weeks (a $9.5 advance over the period), helped the Norwegian krone turn in a steady performance. The Canadian dollar’s 0.2% … Continue...

Read More »

Read More »

Daily FX, May 13: Toward a New Mouse Trap

The Great Financial Crisis has exposed a deep chasm in economics and economic policy. No single institution is this crystallized more than at the Bank of Japan. The former Governor, Shirakawa brought policy rates to nearly zero to combat deflation. His successor, Kuroda, took the central bank in the completely other direction. He has introduced three …

Read More »

Read More »

FX Daily, May 12: Yen Recovers After Being Thrown for 2 percent

The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. Th...

Read More »

Read More »

Dollar Drivers in the Week Ahead

The key issue facing the foreign exchange market is whether the modicum of strength the US dollar demonstrated last week is the beginning of a sustainable move. It is possible that the market is again at a juncture in which the price action will...

Read More »

Read More »

Weekly Speculative Positions: Cutting Longs in Yen and Swiss Franc

Speculators in the futures market continued to pare short foreign currency positions but were cautious about expanding long positions in the CFTC reporting week ending May 3. In fact, two of the three largest adjustments were the cutting of gross long Japanese yen and Australian dollar positions. Yen Speculators took profits on 11.8k contracts of …

Read More »

Read More »

Key Dollar Developments Include Bottoming against the Dollar-Bloc

The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put … Continue reading...

Read More »

Read More »

Great Graphic: Non-Consensus Thinking on Trade

Low-skilled workers abroad do compete with low-skilled workers at domestic affiliates. However, employment of high-skilled workers abroad compliments (as in leads to more) high skilled domestic employment.

Read More »

Read More »

FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenbac...

Read More »

Read More »

Cool Video: Trump and the Dollar–Bloomberg TV

I was invited to discuss the potential impact of a Trump presidency on the US dollar with Bloomberg's with Joe Weisenthal, Oliver Renick, and Alix Steel on "What'd You Miss" show yesterday afternoon, Of course the topic lends itself to all sorts of partisanship. However, I put aside my own political axes and focused on two potential …

Read More »

Read More »

Political Crisis in Turkey is Not Good for Europe

It has been long recognized by the investment community that power in Turkey was concentrated in Erdogan’s hands. He enjoys incredible power in the ceremonial presidential post and brooks no rivals. Common among authoritarian leaders they habitually turn on hand-picked successors as they grow fearful of competitors. This is precisely what has played out …

Read More »

Read More »

Great Graphic: CAD Takes out Trendline

CAD BGN Curncy It has been painful trying to pick a bottom of the US dollar against the Canadian dollar. But now a 4-5 point downtrend from the secondary high in late-January is being violated today. It is found near CAD1.2785 today. Intraday penetration is one thing, but some models may take the signal on … Continue reading...

Read More »

Read More »

Great Graphic: Odds of President Trump Rise (Predictit)

TRUMP . USPREZ16 This Great Graphic is a 90-day history of the “betting” at PredictIt that Trump becomes the new US President. With Cruz suspending his campaign, the odds of Trump have risen just above 40%. The US national interests and challenges to those interests do not change much from year-to-year, and this may help …

Read More »

Read More »

Greenback Firmer, but has it Turned?

There is one question many investors are asking after noting that with Cruz dropping out of the Republican primary, Trump has secured the nomination, and that is whether the dollar has turned. The greenback has extended yesterday’s reversal higher. The euro had briefly poked through $1.16 and closed on its lows a little below $1.15. …

Read More »

Read More »

Two Decisions from Europe

It might not be on investors' calendars, but European officials will take steps toward addressing two issues tomorrow. First, the EC will make a preliminary recommendation of visa-free travel in the Schengen area for Turkish passport holders. S...

Read More »

Read More »

Dollar Continues to Push Lower

The US dollar’s downtrend is extending. The euro traded above $1.16 for the first time since last August. With Japanese markets closed for the second half of the Golden Week holidays, perhaps participants felt less hampered by the risk of intervention and pushed the dollar to almost JPY105.50. Despite an unexpectedly large fall in the …

Read More »

Read More »

Great Graphic:US Rents and Core Inflation

Shelter inflation in the U.S. is at 3.2% per year, but only 1% in Europe. It is 33% of the US CPI basket, but only 6.4% of the euro zone. This leads to massive distortions in CPI inflation, and to wrong bets of investors and FX traders.

Read More »

Read More »

China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach subject

Read More »

Read More »