Category Archive: 1.) CHF

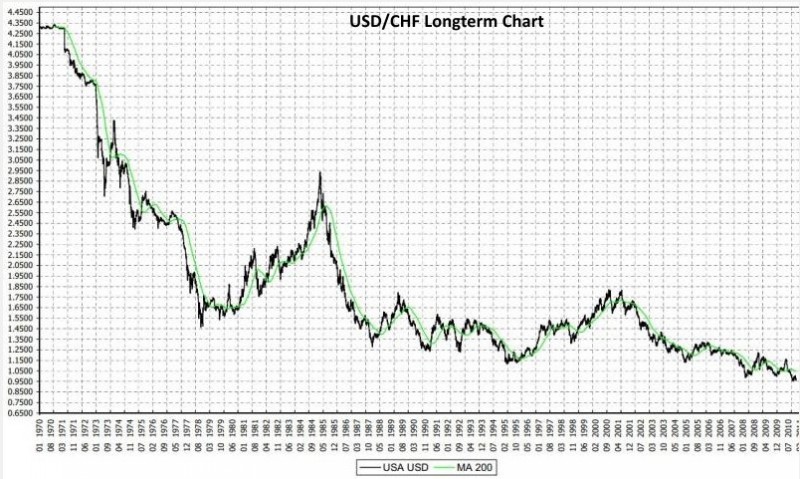

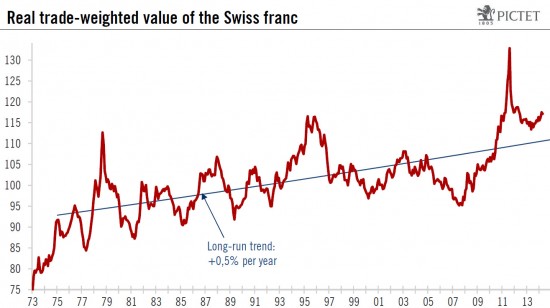

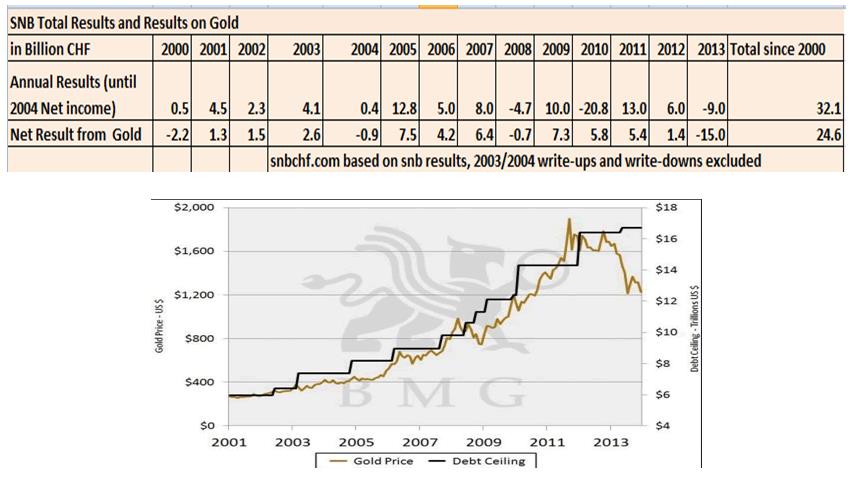

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

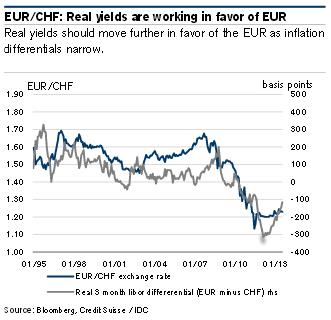

SNB Follows ECB? Pictet’s Negative SNB Interest Call

Pictet calls for negative interest rates in Switzerland in order to maintain rate differentials between the euro zone and Switzerland. Maintaining rate differentials would be useful for FX speculators and for money market funds that still invest in the euro zone.

Read More »

Read More »

Swiss Franc, Pseudo-Mathematics And Financial Charlatanism: Extended Version

We have published the extended version of “The Swiss Franc, Pseudo-Mathematics And Financial Charlatanism” on the investor site Seeking Alpha. The version is longer than the one published previously.

Read More »

Read More »

The IMF Assessment for Switzerland and our Critique

In the 2014 assessment for Switzerland by the International Monetary Fund several sentences caught our eyes; we will contrast them with our recent critique. The most important one was that for the IMF is only "moderately overvalued", this would have no negative effect for exporters.

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

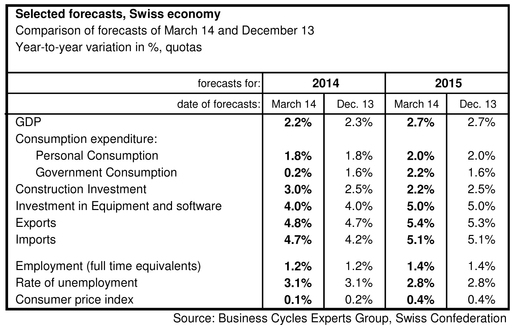

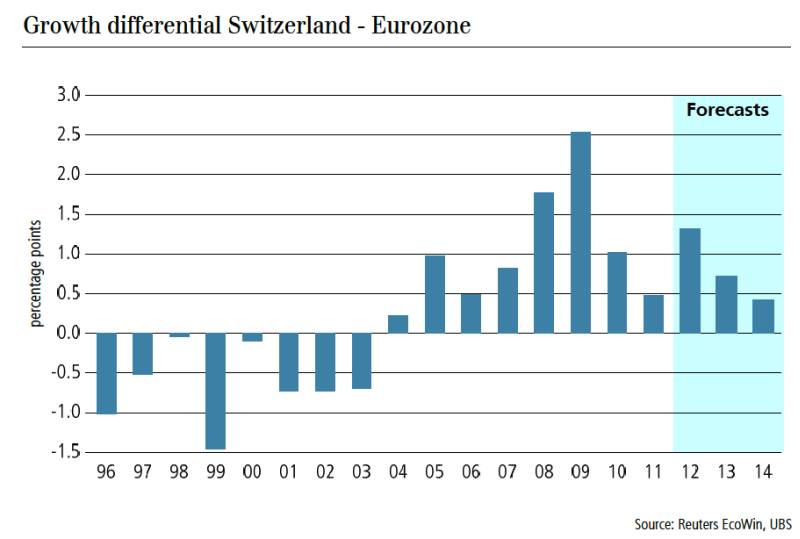

SECO expects 2.2% Swiss growth, further CHF strength ahead, understand why

The Swiss government see Swiss GDP growth at 2.2% in 2014 and 2.7% in 2015. Our estimate sees a divergence in the GDP components; we expects a lower trade surplus and higher spending. in both cases CHF should rise.

Read More »

Read More »

George Dorgan bei den Jungfreisinnigen Zürich, Teil 1: CHF und Schweizer Wirtschaft

Am 7. Februar hat George Dorgan eine Präsentation bei den Jungfreisinnigen Zürich gehalten. Themen waren die weitere Entwicklung des Frankens, die Schweizer Wirtschaft, die SNB und die Auswirkungen der Gold- und Masseneinwanderungsinitiativen.

Read More »

Read More »

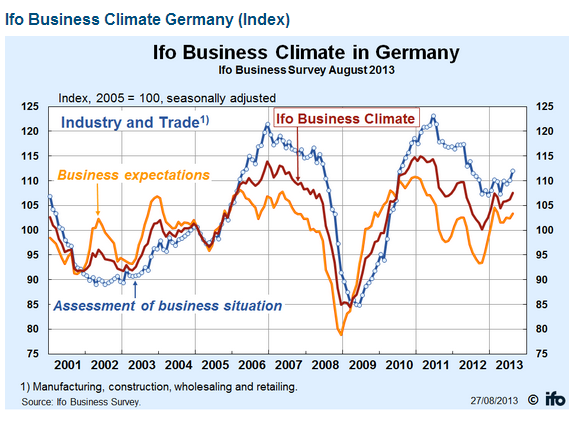

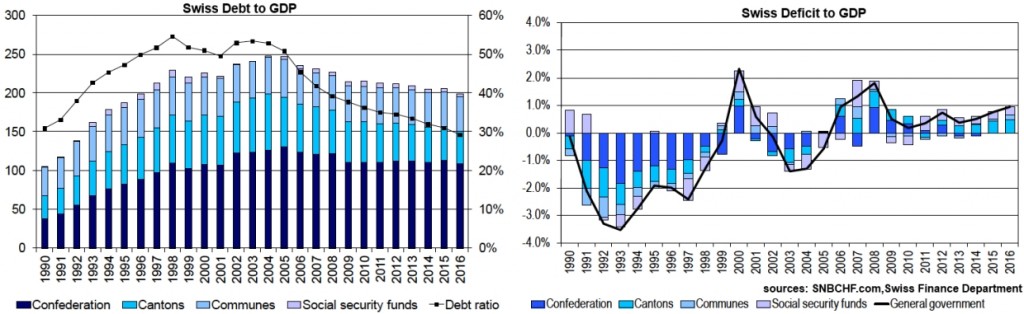

Debt Reduction, the new Financial Cycle, an Important Driver of EUR/CHF

In this analysis we describe why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this happens, then debt will be reduced and both public and private deficit spending will stop.

Read More »

Read More »

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »

Swiss Franc History, 2012: CHF becomes a “safe” Risk-On Currency

At the end of May, SNB president Jordan admitted that the EUR/CHF floor will not raised (here also cited by Bloomberg): “We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.”

Read More »

Read More »

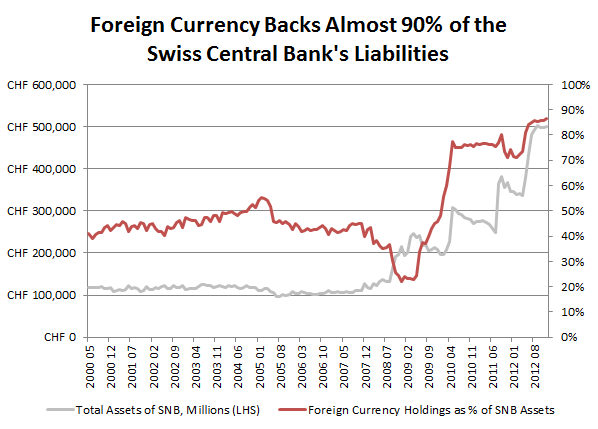

How Modern Monetary Policy Changed CHF from Gold-Backed to a USD and Euro-Backed Currency

we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling.... ECB and Fed interest rates seem to be nailed to zero for years.

Read More »

Read More »