Category Archive: 6b.) Acting Man

The Day They Killed the Dollar

LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered!

Read More »

Read More »

The World’s Central Banks Are Making A Big Mistake

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments.

Read More »

Read More »

Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization”

All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing of productive people for the benefit of unproductive people. They tax people, who have earned their income and accumulated their wealth by producing goods or services purchased voluntarily by consumers (and of course...

Read More »

Read More »

Bank of Japan: Destination Mars

Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical.

Read More »

Read More »

Three-Ring Circus

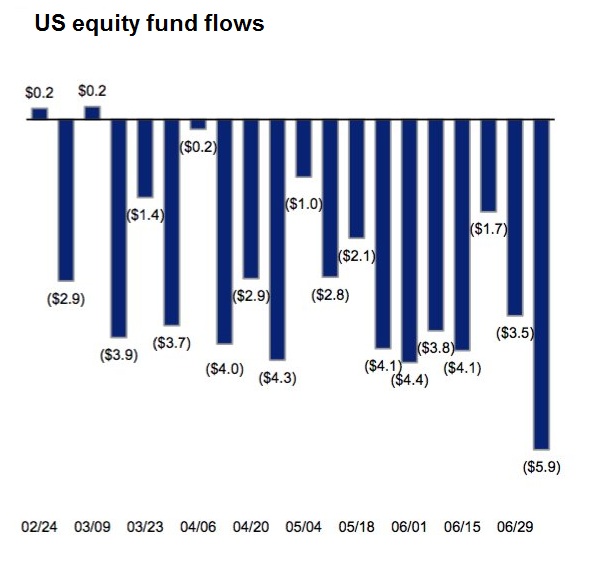

Speculator’s Market LOS ANGELES – Stocks were up again… Whoa! Hold on just a cotton-picking minute. Honest investors are getting out of the stock market. There have been net withdrawals of $80 billion from U.S. equity funds so far this year. Who’s buying?

Read More »

Read More »

Helping Robots Find Jobs…

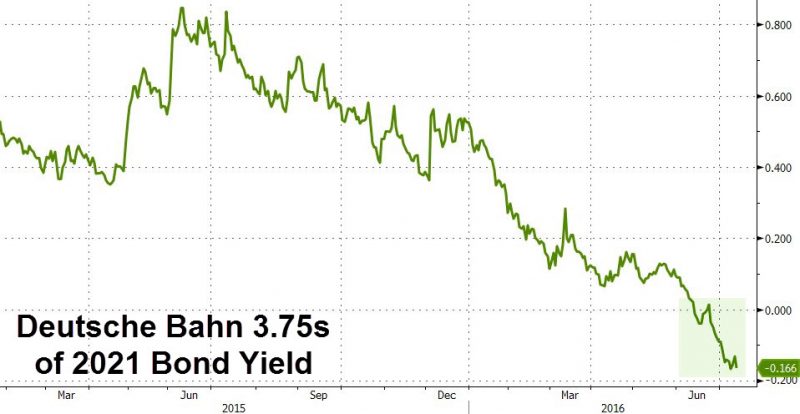

When the cost of capital goes down to zero, a company with access to that cheap – or even free – money can afford to pay almost an infinite amount of money to get rid of its employees and hire robots.

“Zero-interest-rate policy is really a full robot employment program.”

Read More »

Read More »

Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon.

Read More »

Read More »

EU Sends Obsolete Industries Mission to China

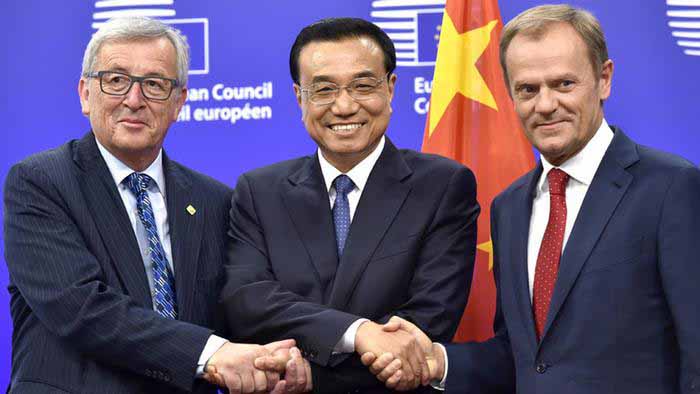

The European press informs us that a delegation of EU Commission minions, including Mr. JC Juncker (who according to a euphemistically worded description by one of his critics at the Commission “seems often befuddled and tired, not really quite present”) and European Council president Donald Tusk, has made landfall in Beijing.

Read More »

Read More »

Fat People for Trump!

BALTIMORE – One of the delights of being an American is that it is so easy to feel superior to your fellow countrymen. All you have to do is stand up straight and smile. Or if you really need an ego boost, just go to a local supermarket. Better yet, go to a supermarket with a Trump poster in the parking lot.

Read More »

Read More »

Larry Summers Wants to Give You a Free Lunch

Consequences of Central Bank Policies The existing capital stock continues to be frittered away at the expense of savers and retirees. Nonetheless, central bankers don’t give a doggone about it. This, after all, is one consequence of roughly eight years of near zero interest rate policy.

Read More »

Read More »

European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored.

Read More »

Read More »

Yahoo Finance Editor “We’re Suffering Of Too Much Democracy”

Following James Traub's mind-numbingly-elitist rebuttal of the democratic rights of "we, the people" in favor of allowing "they, the elite" to ensure the average joe doesn't run with scissors, "It's time for the elites to rise up against the ignorant masses."

Read More »

Read More »

Planet Debt

She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems.

Read More »

Read More »

Housing Affordability – A Dose of Reality

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US.

Read More »

Read More »

Mooning the Elite

Dow up 269 points. Was that all there was? Is the “Brexit” scare over? We don’t know… but we’re going to take a pause today. Instead of trying to connect the new dots, we’re going to take a look at the old dots we’ve already strung together

Read More »

Read More »

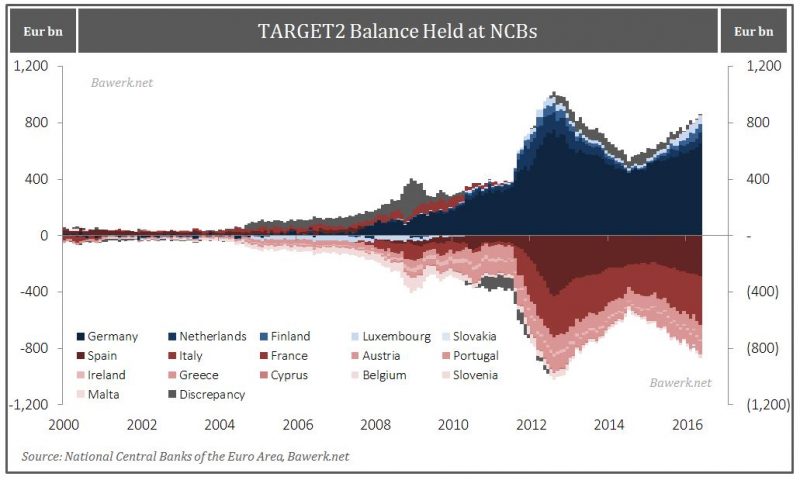

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »

The Coming End of the “Third Way” System

We recently discussed the post-Brexit landscape with a friend (in fact, our editor), who bemoaned that “the EU is led by a drunkard”. Our immediate reaction to this was to exclaim: “That’s the best thing about the EU!”

Read More »

Read More »