It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them.

What would a “united” European system do to try and fill in this massive hole?

The marathon bargaining session began on an ominously hot Friday in late July with birthday celebrations and was expected to breezily wrap up by the following Sunday. By the Monday morning, however, the gloves had come off and high-level talks were often replaced by mid-level staff meetings to hammer out details the bosses, apparently, could no longer directly negotiate.

|

They had been busy calling each other names in the press. By Tuesday, July 21, leaders had forged a deal…or the broad outlines for one which they could call a deal if still leaving behind the finer details for future decisions or exercises of executive discretion. Left with no other option, an historic €750 billion package which while borrowing much wouldn’t count on any individual member’s budget. The European bloc would borrow from the markets as a single unit rather than individual nationalities. Funds will then get disbursed to the hardest hit regions most of them as grants rather than loans. Even if that means double or triple portions for the old PIIGS of Club Med (no one wanted to relitigate Draghi’s 2012 promise, apparently, since nothing meaningful has changed ever since). With three quarters of a trillion in aid on the block for the European bloc, you know what that means: |

|

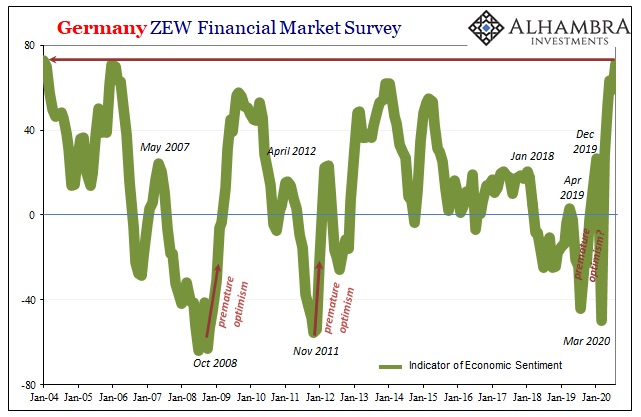

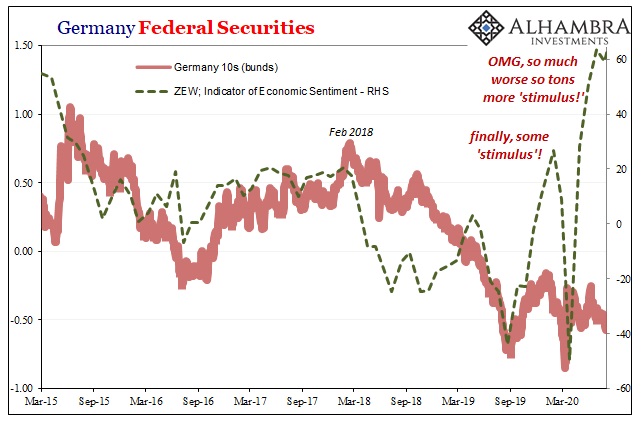

| Yeah baby! Party time. Widespread pure euphoria throughout Germany’s professional business sector. The ZEW Sentiment index for Germany (as well as the one for Europe as a whole) took off for another high. Rising an additional 12 points over July’s reading (taken a week before the stimulus summit), at a current 71.5 there hasn’t been this much optimism there since January 2004.

It’s an interesting juxtaposition for all bad reasons. The worse it gets, the more it starts to look like a real recovery? No, this is almost the cliché where bad news is interpreted as good news. The more this harsh reality set gets, the more panicked politicians become to the point they break long-established protocols – and that’s going to get the European economy and its people somewhere really good? |

|

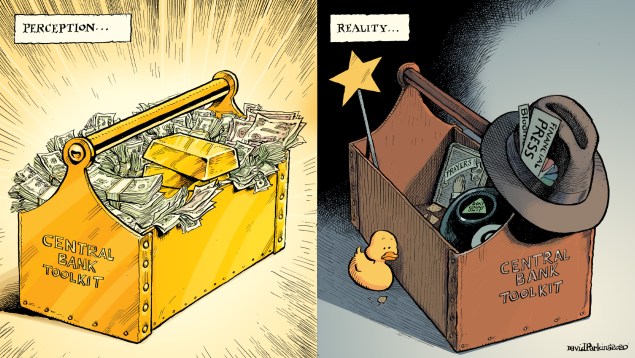

Of course not. The issue here specifically with the ZEW (like stocks) is pure Pavlov. The ECB’s already in a fit of “money printing” rage and now debt that looks like debt but is borrowed differently and will be accounted for as not debt. Practically magic!

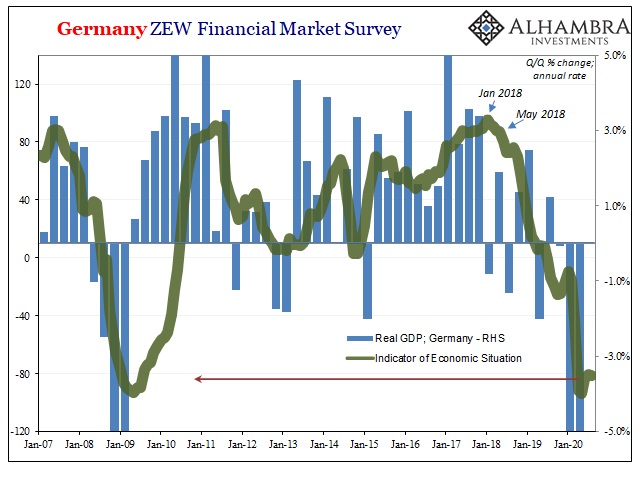

And while German ZEW survey respondents report their levels of future happiness up in the clouds they also report, get this, that nothing much has changed so far as the vastly more important current situation is concerned. The Situation Indicator hasn’t yet budged from the bottom – stalling near the lowest for another month – it was slightly lower in August after the historic accord was reached than it had been in July before the meeting. Months and months and months of “stimulus”, official promises, and, above all, practically unlimited official promises for “stimulus.” And not much has changed in the actual economy where action not words matters. Things are being reopened, sure, leading to some huge positive numbers, but beyond those you really have to start questioning sanity. It’s not just what is being promised, more of a problem is by whom. |

|

| While the ZEW results were being collected and tabulated for August’s publication, Germany’s deStatis had been working with Eurostat to update the annual benchmarks for German real GDP. Standard stuff.

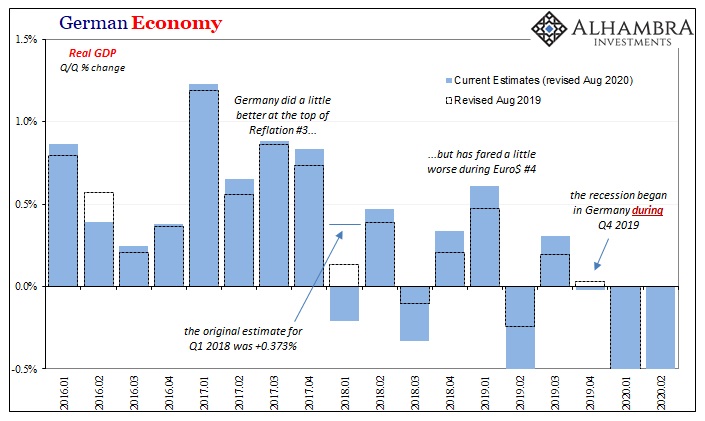

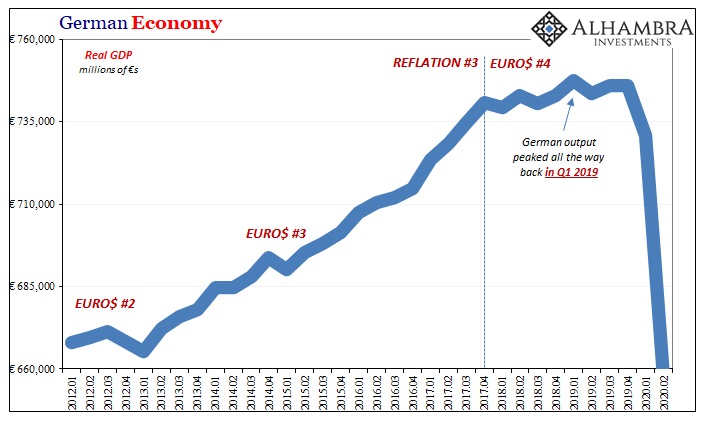

The new estimates suggest that economy fared a little bit better during Reflation #3 in 2017, but also how it is now very, very clear Euro$ #4 stopped it in its tracks. Where originally it had been thought Q1 2018 had been a mild slowdown from Q4 2017, updated data and estimates show that, no, Germany actually contracted to begin what we had been told was going to be, write it down in stone, 100% guaranteed, an unambiguously awesome year. |

|

| January 2018 was filled to the brim with the same kind of inflation hysteria that we see all around us right now. The idea that central banks and governments could get together and sort things out, maybe even do it too well. Their economy, indeed the whole global economy (globally synchronized growth), was supposedly ready to accelerate and achieve lift off for the first time since around, say, January 2004.

And it never happened. Not even close. Worse, these same people never saw it coming; they never realized the economy wasn’t behaving the way they had promised and kept predicting. The official line never wavered even though it became more and more obvious that the economy actually had. |

|

| Ever since the euro turned, meaning dollar, meaning eurodollar system, Germany and therefore all of Europe has at best struggled; to the point that the German economy peaked all the way back in Q1 2019! Bonds were right, of course, meaning that last summer’s recession scare wasn’t really a scare, at least not so far as this one global economic bellwether had been concerned.

With Germany in a recession before anyone had heard of COVID, and the seeds of that recession having been planted right at the outset of 2018, you have to go back and reevaluate the official stance throughout the whole period; how could they get everything so wrong? An acceleration and liftoff where instead downturn (globally synchronized) and truly recession. If they’ve been that wrong about everything to this point… Where the ZEW is concerned, that’s really the point. It is our control group in a way. While official economic projections were wildly optimistic throughout 2018 even this sentiment survey went against that cheery sentiment, the ZEW one of the first major indications that something was amiss. The index tanked, getting the economy right first in its change of second derivative (slowing) and then what that would mean (eventual full downturn into recession). |

|

| The situation hasn’t changed since 2018, only the levels of “stimulus” along the way have. And that alone is what has got the ZEW Sentiment Indicator’s attention. In other words, if Mario Draghi had re-upped QE in early 2018 rather than September 2019, the ZEW would’ve taken off back then. |  |

| It wouldn’t have accomplished a damn thing for the economy, of course, but we’re being led to believe, as we’ve been taught for a long time, that sentiment is actually what matters. This is, after all, the money-less expectations management policy. Even “stimulus” in the fiscal sense isn’t really about spending, the nuts and bolts or fine details of it, so much as it is intended to please lots of people in the business sector who think so positively of any kind of spending.

Because the numbers are bigger and they are doing “new” things (things that always sound new when they are first tried, that’s the point), we should all just forget how the last two and a half years have been a textbook case in bungling. Facing an even worse crisis, an epically worse crisis, politicians and central bankers, the prime bunglers, will suddenly get everything right? For once? |

All is not lost, I suppose. At least while the German, European, and global economy continues to languish closer to its recent deep, deep trough Germany’s business sector will be very, very happy about that. More “stimulus”, baby!

I know the Marxists have it all wrong but, boy, it’s really hard to argue against the idea of end-stage capitalism at times like this.

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,currencies,ECB,economy,Featured,Federal Reserve/Monetary Policy,fiscal stimulus,german bunds,Germany,Markets,newsletter,QE,sentiment,stimulus,ZEW