Overview: The greenback's drop has been extended today against most of the G10 currencies, but not the growth-sensitive dollar bloc, which is underperforming today. Still, ahead of the US jobs report and Fed Chair Powell's speech on the economic outlook, all the G10 currencies have appreciated by at least 1% this week. The Swedish krona's 6.7% rise tops the board, but the euro's 4.7% rally is its best weekly performance since 2009. The Turkish lira has the dubious honor of being the only emerging market currencies to have fallen today, though most of Latam markets have yet to open. The JP Morgan Emerging Market Currency Index is up 1.85% this week. It has risen in seven of this year's first ten weeks. The on-again off-again US tariffs is a bit like Woody Allen's complaint about a restaurant: the food was poor, and the servings were small. Most economists regard the tariffs as risk to prices and growth and the uncertainty, and dare one say, whimsical nature of the announcements, seems to compound the worst elements, and in short run exacerbating the trade imbalances.

European 10-year bond yields have steadied today but are up around 35 bp this week. The 10-year US Treasury yield is softer near 4.27% and is up 11 bp this week, which is the same for the 10-year Japanese government bond yield, which is now near 1.51%, the highest since 2009. Equities in Asia Pacific and Europe are weaker, but the US index futures are posting a small gain. Gold is trading quietly but firmly and remains within the range set on Tuesday (~$2882-$2927). April WTI fell to six-month lows (~$65.20) in the middle of the and is now near $67.25, which still leaves it down about 3.6% this week, which is the seventh consecutive weekly decline.

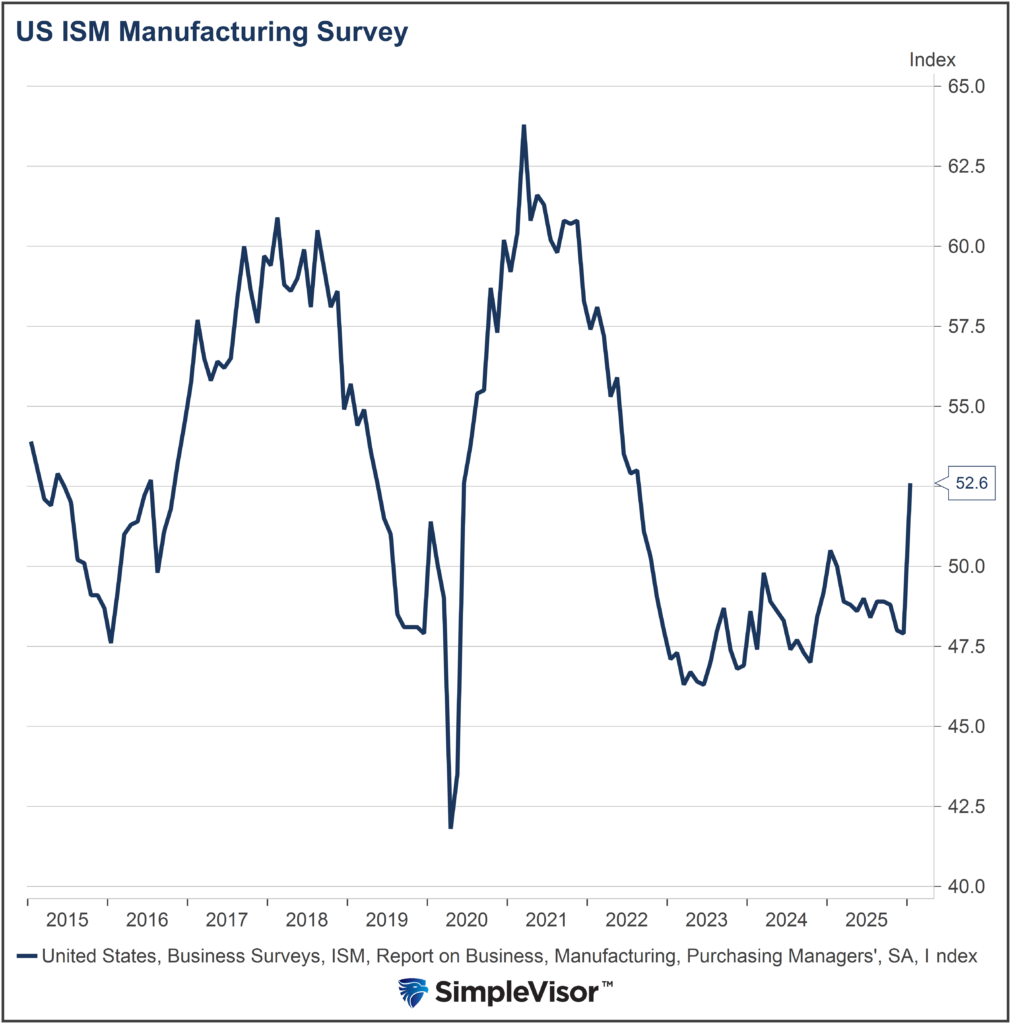

USD: The dollar's drop continues. In late February, the Dollar Index surpassed the (38.2%) retracement of its nearly 10% rally that began at the end of Q4 24. Yesterday, on an intraday basis, it took out the (61.8%) retracement objective near 104.00. It has reached 103.55 in Europe today. It has settled the past two sessions below the lower Bollinger Band and remained below it mostly today (~104.05). There does not appear to be much chart support ahead of 102.00, but the market is stretched. Today is jobs day. Also, several Fed officials speak, including Chair Powell (12:30 pm ET) while the Atlanta Fed's GDP tracker says the economy is contracting at a 2.4% annual clip. Still, most other data including the PMI, ISM, durable goods orders suggest the economy is still expanding. The US created an average of 166k jobs a month in 2024 and 216k a month in 2023. It filled 341k positions in January-February 2024. To match that, the US needs to have created about 198k jobs last month. The median forecast in Bloomberg's survey was 160k. Given the miss on ADP (77k vs. expectations for 140k), no doubt some newswire will claim the "whisper number" is lower. Given the tariff threats, the government layoffs, the deportations and cooling immigration, the downside risks are likely to materialize in the coming months. January consumer credit may draw attention later in the session after the record $40.8 bln surge in December, which was almost as much as the previous five months put together.

EURO: The euro made a new high after the ECB's rate cut and President Lagarde’s signal that policy is "meaningfully less restrictive." The euro reached almost $1.0855, its best level since November 6, the day after the US election. The euro has also surpassed the (61.8%) retracement of its Oct-mid-January 11-cent decline found near $1.08. It has extended its gains to about $1.0870 today. There is little chart resistance ahead of the $1.0935 area. Still, the move has been very sharp, and the single currency has settled above its upper Bollinger Band for the past three sessions (~$1.0795 today). The euro is up 4.7% this week, making it the best weekly performance since March 2009. The ECB seemed to confirm market ideas that the central bank will pause before cutting again, perhaps later in Q2. Following yesterday's ECB meeting, the economic calendar consists of an updated estimate of Q4 24 GDP (0.1% quarter-over-quarter and 0.9% year-over-year). More details were made available, but the news is too dated to spur much of a market reaction. The focus is on the US tariffs, its volte-face on Ukraine, and Germany and the eurozone's fiscal efforts.

CNY: The offshore yuan has risen by about 0.85% this week, its fourth weekly advance in the past five weeks. Still, the dollar has held barely above last month's low (~CNH7.2260). The PBOC set the dollar's reference rate at CNY7.1705, its first increase since Monday. It was set at CNY7.1738 last Friday. China reported strong trade figures. Exports rose 2.3% in Jan-Feb to $540 bln, while imports plunged by 8.4%, producing a trade surplus of about $171 bln. Exports to the US, partly to beat the tariffs, surged to almost $76 bln the largest Jan-Feb surplus since 2022. China reports CPI and PPI tomorrow. The median forecast in Bloomberg's survey expects deflation to have returned with a -0.4% year-over-year fall in the February CPI. It would be the weakest print and first negative reading since January 2024 (-0.8%). Produce price deflation may have eased to -2.0% from -2.3% in January. That would mark the highest reading since August 2024.

JPY: The dollar was sold to almost JPY147.30 yesterday and made a marginal new low today near JPY147.20, its lowest level since early last October, and near the (61.8%) retracement of the rally from mid-September 2024 to the mid-January 2025 high, which is seen around JPY147.00. That is also where the lower Bollinger Band is found today. Japan will report labor earnings first thing Monday. A strong rise could see market pull forward the next hike, which is not fully discounted until October. Japan also reports January current account balance, and a small deficit is expected. It would be the first monthly current account deficit since January 2023. The deficit appears to reflect a sharp rise in the trade deficit to -JPY2.55 trillion (JPY62.3 bln surplus in December 2024 and a -JPY1.52 trillion deficit in January 2024.

GBP: Sterling rose to almost $1.2925 yesterday, its highest level since last November and the (61.8%) retracement objective of sterling's 13-cent decline from last September through mid-January. It reached $1.2945 so far today. Sterling settled above its upper Bollinger Band on Wednesday but settled back under it (~$1.2890) yesterday. It is found near $1.2930 today. The UK's economic calendar is light. The main feature next week is the January GDP print and details on March 14. A YouGov poll published in the middle of the week found Prime Minister Starmer's popularity has risen to the highest level since last September and it has surpassed Farage's support for the first time since October. Starmer appears to have taken advantage of the vacuum created while Germany is trying to forge a new coalition government. Still, the UK prime minister is a natural leader of a European-led security coalition.

CAD: News that autos and parts and other goods covered under the USMCA agreement imported to the US from Canada will be exempt from the 25% tariff announced earlier this week helped the Canadian extend its recovery to a seven-day high. Potash, needed for fertilizer for agriculture will face the same 10% levy as Canadian energy. The greenback was sold to almost CAD1.4240 before recovering back above CAD1.4315. It is trading quietly ahead of today's employment report (~CAD1.4280-CAD1.4320). Nearby resistance is around CAD1.4350. Given the uncertain economic environment, the risk is on the downside of the jobs report. The median forecast in Bloomberg's survey is for economy to have grown 20k jobs (down from 76k in January and 30.6k jobs in February 2024). Canada created an average of 32k a month in 2024 and 44.5k a month in 2023. Of those jobs, an average of almost 25k in 2024 were full-time positions. In 2023, Canada filled an average of 35.6k full-time posts a month. The swaps market is discounting about an 80% chance of a rate cut by the Bank of Canada next week. It was about 50% discounted a week ago. Meanwhile, the Liberal Party leadership contest ends Sunday. Carney is expected to win handily. The key issue then is whether he calls for a snap election to get a popular mandate.

AUD: The Australian dollar rose to almost $0.6365 yesterday, its best level in eight sessions. Last month's high was about $0.6410, slightly shy of the (38.2%) retracement objective of the slide that began at the start of Q4 24. It was unable to sustain the forward momentum and settled slightly lower on the day. It slipped through $0.6300 today. Australia reported a 0.4% rise in household spending in January, but the December series was revised to 0.2% from 0.4%. Household spending rose by an average of 0.3% a month last year and 0.4% a month in 2023. The central bank has pushed back against market speculation of another rate cut. The market leans toward May (~80%), and it is fully discounted in July. The futures market has about 2.5 cuts (or ~62.5 bp) discounted for this year.

MXN: After imposing 25% tariffs on Mexico earlier this week, yesterday Trump said he would exempt Mexican goods and services under the USMCA agreement. That appears to cover about half of Mexico's exports to the US. Another 40% of Mexico's exports to the US were covered by some other arrangement, like most-favored nation status. Some of those goods were likely covered under the USMCA as well. The peso rose for the third consecutive session yesterday. The dollar fell to MXN20.2150 yesterday and has remains above it today. The dollar slipped through MXN20.23 briefly in European dealings today. Mexico reports February CPI today. The year-over-year headline rate is expected to tick up to about 3.75% from almost 3.60% in January. It would be the first increase since last October. Last February was at 4.40%. The core rate may slow to 3.62% from 3.66%, according to the median forecast in Bloomberg's survey. Given the peso's recovery, the odds still favor another 50 bp rate cut when Banxico meets on March 27.

Tags: Currency Movement,Featured,newsletter