Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

On several recent posts we were quite sure of future Chinese growth. It would be strong enough to boost Brent prices to 200 US$ in the year 2020. Our argument – similar to Jim Rogers’ – was that rising Chinese consumption and increasing oil prices will put a drag on the U.S. economy and outweigh American growth, despite better U.S. competitiveness thanks to stagnating hourly U.S. salaries and a 15-20% stronger Renminbi.

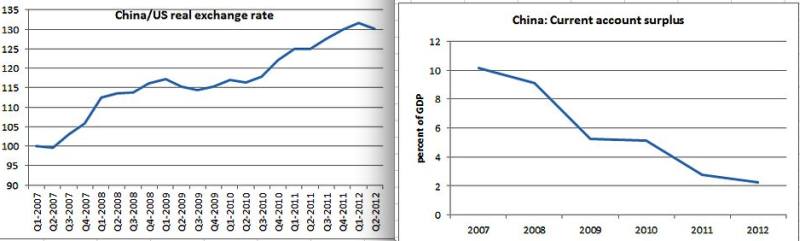

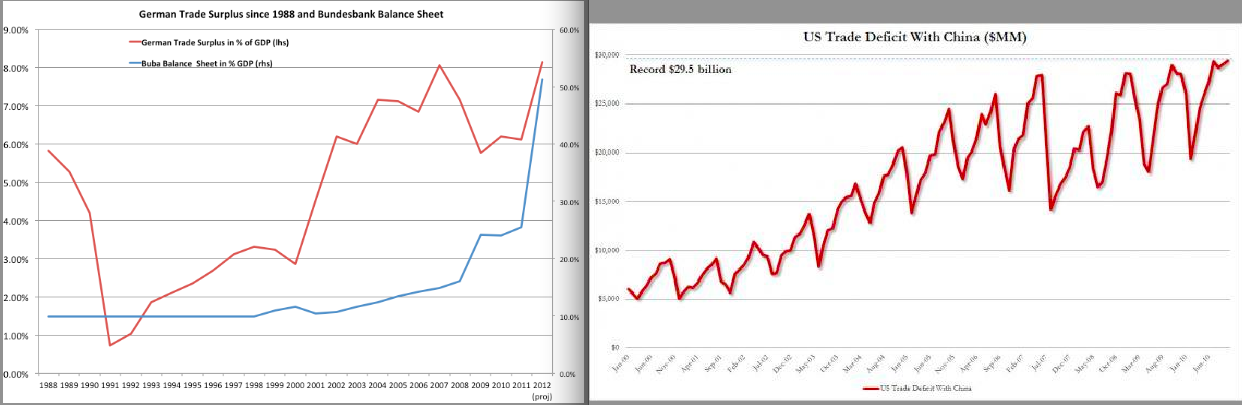

While China and some other emerging markets were the clear winners of the period between the year 2000 and 2010 thanks to cheap labor, it is now Germany, Switzerland and other Northern European countries, who take profit of the high availability of human capital , good infrastructure and shorter distances than in the U.S. These countries are able to generate trade surpluses even with the yellow giant while the U.S. is more and more in the red. The German trade surplus is 8% of GDP, while the Chinese one has fallen to 2%. The following graphs (click to expand) summarize our arguments:

(click to expand) Rising german trade surplus vs. Buba balance sheet and U.S. trade deficit with China

In the following we quote extracts of two papers of important authors, namely Nouriel Roubini and Deutsche Bank’s chief strategist Sanjeev Sanyal. Roubini is not satisfied with Chinese authorities and the state capitalism in the BRICS:

In the following we quote extracts of two papers of important authors, namely Nouriel Roubini and Deutsche Bank’s chief strategist Sanjeev Sanyal. Roubini is not satisfied with Chinese authorities and the state capitalism in the BRICS:

Roubini says: “Third, China has had to rely on another round of monetary, fiscal, and credit stimulus to prop up an unbalanced and unsustainable growth model based on excessive exports and fixed investment, high saving, and low consumption. By the second half of the year, the investment bust in real estate, infrastructure, and industrial capacity will accelerate. And, because the country’s new leadership – which is conservative, gradualist, and consensus-driven – is unlikely to speed up implementation of reforms needed to increase household income and reduce precautionary saving, consumption as a share of GDP will not rise fast enough to compensate. So the risk of a hard landing will rise by the end of this year.

Fourth, many emerging markets – including the BRICs (Brazil, Russia, India, and China), but also many others – are now experiencing decelerating growth. Their “state capitalism” – a large role for state-owned companies; an even larger role for state-owned banks; resource nationalism; import-substitution industrialization; and financial protectionism and controls on foreign direct investment – is the heart of the problem. Whether they will embrace reforms aimed at boosting the private sector’s role in economic growth remains to be seen.”

Between the year 2000 and 2010, the BRICs expanded very strongly thanks to cheap labor costs. Moreover, they took profit of the virtuous circle of BRICS growth and demand for commodities, but they did not promote sufficiently smart investments and human capital. We reckon that in ten years time, Germany, other Northern European countries and Russia (thanks to its commodities) will be the countries that finance the U.S. trade deficit.

Both Russia – that increases more and more its gold holdings and potentially even Germany – see the recent gold repatriation – are reluctant to finance the U.S. deficit. We see potential issues for the funding of the U.S. twin deficits and investments in the United States, while China and recently Japan follow a mercantilist strategy and weaken their currency and strengthen the dollar.

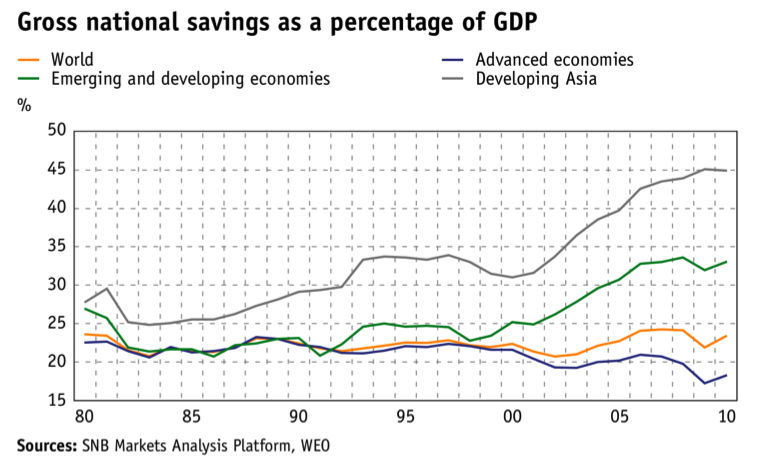

Savings Rate Emerging vs. Advanced Economies 1980-2011, source1

Deutsche Bank’s Sanjeev Sanyal is of a different opinion. Sanyal thinks that the shrinking of the Chinese current account surplus will be reversed, and that the United States will remain the global consumer in a scenario of continuing global imbalances.

Sanyal states: “In the years leading up to the Great Recession, the world economy was characterised by large macro-imbalances. The US ran large current account deficits and China ran large surpluses. Many newspaper columns and academic articles warned of the dangers of persistent global imbalances. For some, the Great Recession was itself a punishment for this sin. This debate has subsided in the last two years since China’s surplus and the US’ deficit narrowed. But have the imbalances really corrected? More fundamentally, is a balanced world economy necessarily a good thing?

The current account of any economy can be seen as the difference between its investment rate and its savings rate. In 2007, the US had a savings rate of 14.6 per cent of the gross domestic product ( GDP) but an investment rate of 19.6 per cent. This was the ultimate source of its current account deficit. In contrast, China had a fixed investment rate of 41.7 per cent of GDP and a savings rate of 51.9 per cent. This was reflected in a large surplus.

Since 2007, the US deficit has narrowed — but not because of better savings. The country’s overall savings rate has actually fallen below 13 per cent of GDP owing to worsening government finances. Instead, we have seen a collapse in investment activity. Meanwhile, China’s savings rate remains stubbornly high. The surplus has narrowed because the government’s encouragement ramped up investment even higher to around 49 per cent of GDP. In other words, the factors underlying the pre-crisis imbalances have not been unwound and, if anything, have been exacerbated. The US saves even less today and China invests even more.

Looking ahead, any recovery in the US economy will almost certainly trigger a revival in investment activity. American businesses have postponed heavy investment for so long that any recovery will require investment. The country also needs urgent investment in infrastructure. American airports and bridges are in appalling condition for a developed country. In other words, it is very likely that any recovery in growth will lead to larger current account deficits (even if savings rates improve somewhat).

In contrast, China has the opposite problem. It is now a $9 trillion economy and needs to keep investing half of it every year. This is no easy task for a country that already has brand new highways and airports. In fact, as China attempts to move up the value chain into services as well as adjusts to a shrinking workforce, its business investment requirements, too, will shrink. This will mean that China’s investment rate will fall sharply over the next decade. Of course, its savings rate could also decline but it will probably fall much more gradually. As a result, China will go back to running very large current account surpluses. This is not dissimilar to what happened to Japan in the last two decades. Since the eighties, Japan’s savings rate has declined and the yen has appreciated sharply. Yet, the country continued to run persistent current account surpluses because its investment rate kept dropping.

The prognosis is clear — a recovery in the world economy will not be characterised by balance but by a return to large macro-imbalances. Many economists will judge this as somehow disreputable but a survey of 2,000 years of history shows that almost all periods of global economic expansion have been characterised by imbalance. The world economy in Roman times was underpinned by trade between India and the Roman empire. Yet, Rome ran a persistent trade deficit with India for centuries. The resultant drain of gold caused monetary distortions in the Roman empire but Indo-Roman trade remained the backbone of the world economy. Similarly, the Spanish ran persistent deficits with the world in the 16th and 17th centuries and paid for it in Andean silver. The resultant flood of financial liquidity caused a global boom that benefitted economies from Elizabethan England to Mughal India. The period 1870-1913 was also a period of rapid growth and globalisation. Yet again, it was not a system in balance but one funded by Britain acting as “banker to the world”.

In the last 60 years, the US has underpinned global growth by running persistent current account deficits. Under the Bretton Woods system, the US ran deficits that allowed war-torn Europe and Japan to rebuild themselves. In return, Europe funded the US deficits. The system broke down when Europe, in particular France, decided to stop funding the US. However, it did not end the economic model. Instead, one by one, Asian economies used the US market to grow rapidly even as they funded back the US (reflected in the sharp increases in their foreign exchange reserves). China is the latest and largest beneficiary of this economic system. This symbiotic arrangement has been dubbed “Bretton Woods II”. Note that each of these episodes suffered from macro-distortions caused by the imbalances but the world lived with them for many years.

As one can see, periods of global growth are almost always characterised by symbiotic imbalances. The question is, what will the next generation of symbiotic imbalances look like? Given our earlier discussion, it is very likely that China will soon go back to running very large current account surpluses — perhaps in the range of half-a-trillion US dollars a year. This will have to be invested somewhere in the world. In the past, the Chinese have largely limited themselves to US government securities but, like the Japanese before them, they will eventually diversify into other assets. As this money cascades through the global financial system, it will re-inflate the world economy. China will go from being the “workshop to the world” to becoming the “investor to the world”. Like all imbalanced systems, it will cause its own distortions but the world will live with them. Welcome to “Bretton Woods III”…”

After two years of salary increases of 3%, finally the German consumer has woken up. The Markit German PMI has risen strongly to 53.6, while French PMI is with 42.7 at the lowest point since March 2009.

- Danthine, Jean-Pierre. 2012. ‘A world of low interest rates’ Swiss National Bank. Online, March 2012 [↩]

Tags: BRICs,China,current account,Deutsche Bank,German,Labor costs,labour costs,trade surplus