Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Tag Archive: German

Yields Jump, Greenback Bid

Overview: Yields are surging. Canada and Australia's two-year yields have jumped 20 bp, with

the US yield up 10 bp to 2.37% ahead of the $50 bln sale later today. The US 10-year yield has risen a more modest three basis points to 2.50%, flattening the 2-10-year yields curve. The 5–30-year curve has inverted for the first time since 2016.

Read More »

Read More »

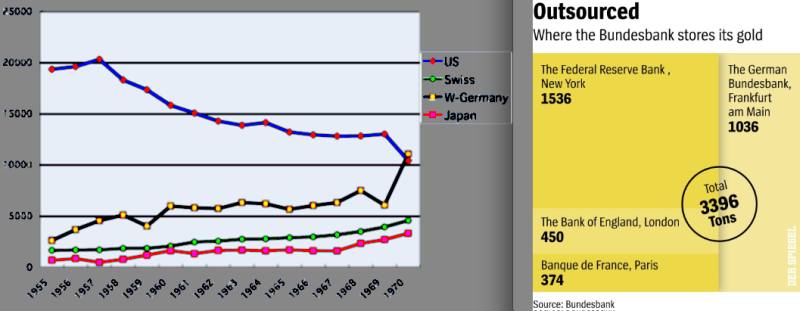

The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell.

Read More »

Read More »

High German Pay Rises: The End of the German Bunds Bubble

Yesterday’s German CPI has given a first insights of what is coming these years: German inflation. For years excessive risk averseness put pressure on German yields. Most recently, energy prices helped to push down inflation and on German yields possibly for a last time. But many ignore that the main reason for inflation are rising …

Read More »

Read More »

Roubini and Deutsche Bank’s Sanjeev Sanyal: Still Waiting for the Chinese Consumer

Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

Read More »

Read More »