As the summer in the Northern Hemisphere gives way to the fall, monetary policy and politics will shape the investment and business climate. Even if history does not repeat itself, there are still insights to be gleaned. In the last few months of 2023, the market expected aggressive interest rate cuts this year. Although global rates fell, the dollar fell. In Q1 24, the markets moved more into line with the signals from the central banks. Global rates rose and the dollar recovered.

The Federal Reserve will likely be one of as many as seven G10 central banks that will cut interest rates in September. The Bank of England is unlikely to join them but is widely expected to cut rates at least another time before the end of the year. The Reserve Bank of Australia and Norway's Norges Bank signaled that it is premature for them to cut rates. The swaps market is discounting almost a 90% chance of a 10 bp hike by the Bank of Japan at the end of year.

The Dollar Index peaked in September 2022 at levels not seen in two decades. Before the end of 2022, the Dollar Index moved into a trading range that has dominated subsequent price action, roughly 100-107. With the slowing of the US economy, the likely trajectory of Fed policy (with accelerated rate cuts in 2025), we expect the Dollar Index to break out of its range to the downside. We look for a test on the 98.00 area in Q4. But before we get there, the dollar's sharp losses in July and August have stretched the technical indicators and much of the fundamental story has been discounted. Indeed, the risk is that the July US employment data overstated the slowdown and August job growth may have improved, with the unemployment rate falling for the first time since March. This may extend the upside technical correction in the dollar that began in late August, and give businesses and investors a better opportunity to hedge foreign currency liabilities.

The middle of July through early August saw what appears to have been a massive position adjustment, which, in different forms, was a preference for risk-assets and financed by selling the Japanese yen, Swiss franc, and the offshore yuan, and volatility, such as the VIX. The unwinding of these "carry-trades" sent ripples through the capital market. The yen was at the center of the maelstrom, and what began as a yen move at the start of the month morphed into a dollar move by the middle of the month. Initially, the yen's gains, for example, coincided with sharp losses of the Australian dollar and Mexican peso, and equities, which were thought to be among the favorites for the long side of the carry trades. Then, the yen seemed to rise as a function of the broader US dollar decline.

Japanese institutional investors, like pension funds and insurance companies have accumulated several trillion dollars of foreign bonds and stocks. There is always a concern that either financial calculations or some domestic event (catastrophe) would require massive repatriation, a sharp rise in the yen (which G7 have tried blocking in the past) and potentially destabilizing other asset classes. But these investments are not levered, and in this sense are in stronger hands. In fact, official data shows Japanese investors took advantage of the stronger yen that resulted and bought more foreign bonds and stocks in recent weeks.

In fairness, the change in the yen's exchange rate was breath-taking. It is not an emerging market currency that is thinly traded. The yen is the third most active currency with a daily turnover of around $1 trillion. In a four-day period from late July to early August, the dollar fell 8.7% against the yen. In a little less than a four-week period, the dollar fell nearly 12.5% against the yen. To be sure it was not just the yen that had sharp moves. In roughly that same 3–4-week period, the dollar covered half the year's range against the Canadian dollar. The Australian dollar tumbled from the six-month high in mid-July near $0.6800 to the low for the year near $0.6350 on August 5. Such "punctuated equilibrium" seems next to impossible to forecast, which is why managing foreign currency exposure is an important, even if often, a thankless task.

The destabilizing threat of powerful yen short squeeze came from leveraged accounts, and the futures market gives a sense of what was involved. Consider that in early July, non-commercials (speculators) had their largest net short yen position since the Great Financial Crisis, with a notional value of around $14.5 bln. It was completely covered in a few weeks. The buying was so strong that the speculators had their first net long yen position for nearly three-and-a-half years ($2 bln notional) as of August 20.

There may be many ways to lose many in the capital markets, but there seems to be only three ways to make money: either go with the trend (momentum), go against the trend (mean-reversion), or some type are arbitrage. The carry trade strategy in theory is to arbitrage between the cheap cost of yen and the higher yield in US Treasuries, Australian dollars, Mexican pesos, and the like. The dollar's sell-off in August was not a new carry trade, but a combination of mean-reversion of the longer-term trend and the momentum of built in recent weeks. Moreover, short-term rates (one- and three-month) are the highest in the US among the G10, which rules out carry.

After the UK, Japan may be the second new G7 government. Japan's Prime Minister Kishida announced he would not seek re-election as party leader in September and this replacement will be the next Prime Minister. Kishida's never seemed to enjoy high public support in the polls, and he took the blame for the party funding scandal, high inflation, and the weakness of the yen. We are not convinced that the trajectory of the Japan's policy mix will change, even if within it, there may be some variation. There appears to be a national consensus for the defense build-up, even if the precise way it is funded is subject to change. France may squeeze in ahead of Japan, if President Macron names a new prime minister following the legislative elections before the Olympics that resulted in a closely divided parliament.

Germany holds three state elections in September. Thuringia and Saxony's elections will be held on September 1 and Brandenburg's is on September 22. The SPD and Greens and alongside the FDP are part of the national coalition and participate in each of the three state governments. The risk is that disappointing economic performance costs the SPD and Greens support, and points to their vulnerability at next year's national contest. The cordon sanitaire around the Afd has held, even if challenged in Thuringia previously. However, its rising level of support will continue to press the issue. In the last iteration, the AfD was the second-largest party in each of the three states. Austria elects a new parliament on September 29. The People's Party (OVP) and the Green coalition is likely to give way to coalition led by the Freedom Party (FRO) but without its controversial leader Kurz.

With President Biden's decision not to run for a second term, the US presidential contest has tightened. Previously, after the first debate and the assassination attempt, some were even talking about a landslide for former President Trump. Harris has re-energized disaffected elements of the Democrats' national coalition and has tightened the race without extensive policy proposals. Trump appears to have tapped into an important current in the popular psychology of Americans to see themselves as victims of foreign friends and foes. Harris appears to have tapped into another current that is captured in the slogan: "We are not going back." It is a defensive posture trying to preserve and protect the gains thought to have been achieved earlier, like reproductive rights and family support (child-tax credit).

Many pollsters are trying to correct the problem that plagued results in the last two elections. It stems from Republican voters being less likely to participate in voter surveys. The takeaway is that Harris must run several percentage points ahead in the popular vote to compensate. The importance of the electoral college system has been underscored, and there are only a handful of states that are thought to determine the outcome and Wisconsin and Michigan stand out. The debate between Harris and Trump on September 10 may not be as momentous as the Biden-Trump debate turned out to be, but it may be memorable, just the same.

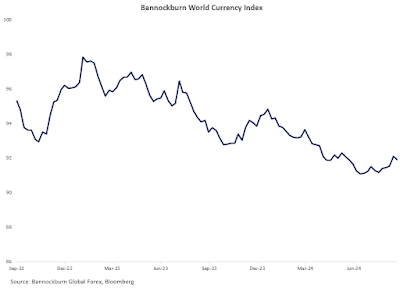

Bannockburn's World Currency Index, a GDP-weighted basket of the currencies of the 12 largest economies, rose by 2/3 of a percentage point in August, its strongest monthly performance of the year. This reflected the fact that all the major currencies rose by more than 2% against the dollar in August. The Australian dollar's 3.5% gain took top billing. Among the emerging market components, the South Korean won was the strongest, rising 2.7%. The Chinese yuan as the second highest weighting (~22.7%) in the basket after the dollar (32.1%), and it rose almost 2%. The Brazilian real (0.1%) and the Indian rupee (-0.2%) barely impacted BWCI's performance. The Russian ruble and Mexican peso have a combined weight of about 4.5% of the index and they both fell by about 5% in August.

In late July, the BWCI tested the multiyear low set at the start of the month. That it successfully held confirmed other technical signals that helped us identify the dollar's vulnerability. However, BWCI has curled lower in recent days, and this dovetails our understanding that the dollar was oversold from a technical perspective and can extend its near-term recovery. This, however, does not negate or challenge our view that the dollar's cyclical advance is over, and our expectation that it trends broadly lower in the coming quarters.

U.S. Dollar: Federal Reserve Chair Powell was as clear as possible at the Jackson Hole symposium. He validated market expectations that the easing cycle will commence in September. The updated Summary of Economic Projections (the "dot plot") will give a better sense of what Fed officials anticipate, but the market is confident that there will be at least one 50 bp cut in the last three meetings of the year. While inflation has not returned to the 2% target, Powell indicated that he was more confident that it was on a sustainable path toward it. Moreover, he was explicit that the balance of risks had shifted and that the Fed no longer "seeks or welcomes further cooling in the labor market." The July jobs report was distorted by the summer storm, and we look for sequentially better job growth in August and for the unemployment rate to tick down (4.2% vs. 4.3%) for the first time in five months. Since President Biden announced he will not be seeking reelection, the US president contest has tightened. The presidential debate between Harris and Trump on September 10 will draw much attention. The Dollar Index fell by a little more than 2.4% in August, which is the largest monthly decline in last November's 3% swoon. It approached 100.00, which it has not traded below since July 2023. Still, looks over-extended and there is scope for a technical correction that appears to have begun in recent days to continue. There may be scope back toward the 102.50 area.

Euro: The euro poked above $1.12 in August for the first time since July 2023. It rose by about 2.25% in August, its best monthly performance of the year, but it did not reflect an improved economic outlook. In fact, the Germany locomotive is not firing, and for the past 10 quarters, it has alternated between expansions and contractions. Germany's trade surplus has returned to pre-Covid levels, but its biggest market is the US, not China. The German government lacks the public's confidence, and that is expected to be born out in the three state elections in September. Meanwhile, France still has a caretaker government. President Macron needs to appointment a prime minister who can secure a majority in parliament to pass year’s budget. Italy's budget challenges will also likely escalate in the coming months. The swaps market is confident of a 25 bp rate cut by the European Central Bank at its September 12 meeting. It will be the second cut in the cycle. After the move, the market has priced in 38 bp of cuts in the remainder of the year, which is a quarter-point move and a little more than a 50% chance of another. Looking through H1 25, the market is pricing in at least two cuts a strong chance of three cuts. The euro's 4.25-cent rally in August left momentum indicators over-extended and we anticipate that the downside correction that has already begun could extend into the $1.0950-$1.1000 area.

(As of August 30, indicative closing prices, previous in parentheses)

Spot: $1.1050 ($1.0910) Median Bloomberg One-month forecast: $1.0900 ($1.0845) One-month forward: $1.1065 ($1.0925) One-month implied vol: 6.1% (5.5%)

Japanese Yen: The 100-day correlation between changes in the exchange rate and the US 10-year yield is about 0.55, the highest since July 2023. That is a somewhat higher correlation than with the 10-year interest rate differential. Bank of Japan intervention, as in 2022, was successfully in breaking the yen's downside momentum because of the market-savvy timing of the coincided with a decline in US 10-year yields. Rather than mirroring the BOJ sales of dollars, Japanese investors took advantage of the yen's gains to buy more foreign assets. Indeed, they bought the most foreign bonds and stocks since Q1 23. On the other hand, non-commercials (speculators) in the CME currency futures went net long the yen for the first time since Q1 21. The Japanese economy grew by 3.1% at an annualized rate in Q2 after contracting by 2.3% in Q1. This probably overstates the case, and growth for the next several quarters is unlikely to surpass 2%. Still, with core inflation well above 2%, the BOJ appears committed to raising interest rates further. The swaps market has almost 10 bp of tightening discounted for the end of the year and leans toward another 10 bp increase in the first half of 2025. The dollar bottomed near JPY143.50 in late August, and we suspect it has potential to recover toward JPY148.50 area in the coming weeks.

Spot: JPY146.15 (JPY146.55) Median Bloomberg One-month forecast: JPY147.00 (JPY151.40) One-month forward: JPY145.55 (JPY145.85) One-month implied vol: 11.8% (11.8%)

British Pound: Sterling reached $1.3265 in late August, its best level since March 2022. The broad setback in the dollar helped but so did ideas that the Bank of England would be among a few G10 central banks that most likely will not cut rates in September. Still, BOE Governor Bailey has indicated scope for additional rate cuts and the swaps market is pricing in a cut in November and nearly 2/3 chance of another cut in December. Although sterling is easily the best performer in the G10 so far this year with a 3.2% gain against the US dollar (the euro's 0.25% gain puts it in second place), its 2.2% gain in August matched the euro's putting them at the bottom of the G10 leaders board. Corrective pressures could push sterling toward $1.2975-$1.3030 in the coming weeks. The UK economy was the strongest among the G10 in H1 24, and although it is expected to moderate, the early Q3 data suggests robust momentum. Meanwhile, Prime Minister Starmer and Chancellor of the Exchequer Reeves warned the new government discovered a GBP22 bln hole left by the last government. In the campaign, Labour ruled out increase income tax, VAT, or levy for national insurance, the focus is on capital gains. The UK taxes capital gains at a 10%-28%, which is lower than the tax on income (20%-45%).

Spot: $1.3125 ($1.2800) Median Bloomberg One-month forecast: $1.2800 ($1.2700) One-month forward: $1.3130 ($1.2810) One-month implied vol: 6.9% (6.3%)

Canadian Dollar: In the market turmoil that peaked in early August, the Canadian dollar was sold to a new low for the year. It recovered relentlessly in the following weeks to reach its best level since March before the end of the month. The US dollar posted a key reversal on August 5 after it reached almost CAD1.3945. It forged a shelf in late August near CAD1.3440. In the futures market, this coincided with a sharp reduction of short Canadian dollar position rather than the entry of new longs. The corrective forces we anticipate could see the greenback test the CAD1.3600 area. What had been support may now offer resistance. Meanwhile, the market remains confident that the Bank of Canada will cut rates at each of the remaining three meetings this year (September 4, October 23, and December 11). The swaps market anticipates at least two more cuts in the first half of 2025. The market has retreated to about a 40% chance of a third cut in H1 25. It has been nearly fully discounted. Canada's CPI has slowed from 3.7% at the end of Q3 23 to about 2.5% in July, but the central bank has cut the nominal overnight rate by 50 bp, suggesting the real rate may have increased. Still, going forward, the Federal Reserve is expected to be more aggressive, and the US two-year premium over Canada that peaked in June at 90 bp is now a little below 60 bp, a three-month low.

Spot: CAD1.3490 (CAD 1.3875) Median Bloomberg One-month forecast: CAD1.3600 (CAD1.3775) One-month forward: CAD1.3480 (CAD1.3860) One-month implied vol: 5.3% (4.9%)

Australian Dollar: The Australian dollar was at six-month highs near $0.6800 in mid-July before the market turmoil and unwinding of carry trades drove it to the year's low in early August around $0.6350. It recovered smartly and reached $0.6825 in late August. The Reserve Bank of Australia hiked rates last November and has maintained a hawkish bias. Although Governor Bullock said that there may not be room for a cut this year, the market has been reluctant to abandon hope. Despite strong full-time job growth (almost 150k in the three months through July, the most in nearly two years), sticky underlying CPI (trimmed mean of 3.8% in July was unchanged from January), the futures market is pricing in almost an 80% chance of a cut at the end of the year. The market is also discounting three cuts in 2025. Nevertheless, there is little reason to expect a change in tone from the RBA at the September 24 meeting. The Australian dollar's 7.5% rally from the August 5 low has left momentum indicators stretched as it approached the year's high set near $0.6840 on January 2. There may be scope for corrective pressures to push it back toward $0.6680-$0.6700 in the coming weeks.

Spot: $0.6765 ($0.6520) Median Bloomberg One-month forecast: $0.6775 ($0.6625) One-month forward: $0.6770 ($0.6525) One-month implied vol: 9.0% (9.5%)

Mexican Peso: Amid the unwinding of yen carry trades and market turmoil, the Mexican peso was thumped. From July 12 through August 5, the peso depreciated by 13%. It recovered in through the middle of August but concern about the political reforms, and particularly the election of Supreme Court judges, is seen as removing a guardrail that protect investors' long-term interests sent the peso lower again. The US dollar did not take out the August 5 spike high (~MXN20.2180) but it did approach MXN20.00 at the end of August. Mexico-US relations have deteriorated over immigration, what appears to the US kidnapping and arresting of alleged Mexican drug lord, and US criticism of the judicial reforms. President-elect Sheinbaum has made many key appointments from the more moderate elements of the party, including several technocrats. The immediate focus is AMLO's agenda in September, when he has a strong majority in Congress, before Sheinbaum's inauguration on October 1. At the same time, the continued, albeit slow decline in inflation, with a moderating economic activity will allow the central bank, which has cut rates twice, to accelerate its easing in the coming months. The swaps market is discounting 75 bp of cuts over the next six months.

Spot: MXN19.73 (MXN19.18) Median Bloomberg One-Month forecast: MXN19.48 (MXN18.61) One-month forward: MXN19.82 (MXN19.27) One-month implied vol: 18.8% (15.3%)

Chinese Yuan: The yuan rose for the second consecutive month against the dollar, and its nearly 2% gain was the most since November 2023. The fuel for its rise was primarily the broad weakness of the US dollar and the unwinding of carry trades. The offshore yuan appears to have been used, like the yen and Swiss franc, to fund the purchases of other assets. The onshore yuan is virtually flat for the year (with the month-end surge, it is up nearly 0.2% in 2024), recovering six months of losses with the past two month of gains. The dynamism of the Chinese economy is missing, and more efforts will likely be forthcoming. The latest initiative under consideration for Q4 is allowing $5.4 trillion in mortgages to be refinanced at a lower rate, which ostensibly would boost consumption. Moreover, the refinancing activity could take place than the initial mortgage lender. The yuan's recovery and beginning of the easing cycle by the Federal Reserve may give the PBOC more scope to cut interest rates and possibly reserve requirements. The easing of stress in the currency market saw officials step up efforts to stem the rally in bond, ostensibly concerned about a possible bubble forming. There may have been concern that the bond buying was coming at the expense of lending, which contracted for the first time in almost two decades. Despite some high-level economic and security discussions between the US and China, Beijing is still pursuing extremely aggressive tactics toward Taiwan, Philippines, and Japan. And in response to the US continuing to tighten export restrictions for high-end technology, and especially advanced semiconductor chips and fabrication equipment, China export controls on germanium and gallium which are used for semiconductor applications and communication devices have seen prices double. China produces 90% of the world's gallium and 60% of its germanium. Beijing also announced export restrictions as of September 15 on antimony, a mineral used for armor-piercing weapons and precision optics. Previously, export restrictions on graphite and rare earth extraction and processing technologies.

Spot: CNY7.1915 (CNY7.17) Median Bloomberg One-month forecast: CNY7.2000 (CNY7.2150) One-month forward: CNY7.0620 (CNY7.11) One-month implied vol: 5.1% (4.9%)

Tags: Featured,macro,newsletter