The macroeconomic and

geopolitical developments have not changed substantially over the past month. The

resilience of the US economy allows the Federal Reserve to put more emphasis on

achieving price stability. While the market favors a June cut (66% vs. 80% at the end of February), it has

not been fully discounted for over a month. The biggest event in March may have been the

well-telegraphed exit from negative interest rate policy and Yield Curve

Control by the Bank of Japan. Yet, over the course of last month, Japan's

two-year yield rose was virtually unchanged and the 10-year yield rose less than two basis points to 0.73%.

For all practical purposes, the eurozone and UK economies are stagnant, but the respective central banks also do not appear in any hurry to begin easing monetary policy. The base effect warns of a dramatic fall in the 12-month inflation, but European Central Bank officials have guided market toward a June cut. The Bank of England has encouraged a later cut, and the market favors August over June. However, the UK's inflation is set to fall sharply in the coming months and the market may bring forward the first cut. Indeed, the swaps market has about a 70% chance of a June cut discounted, up from a little less than 50% at the end of February.

The median forecast by Federal Reserve officials in last month's Summary of Economic Projections was still for three cuts this year. A May cut though is all but ruled out. Although it was a 10-9 split among Fed officials between three and more cuts and two or fewer, the market has nearly converged with the Fed and in the futures market, the odds-on favorite scenario is a cut in June, September, and December. However, we see the risk in April of downgrading the chances of a Fed cut in in June. The market also feels more comfortable about a similar trajectory for the Bank of Canada, with three cuts this year. Australia and New Zealand rates cuts are seen more likely to begin in Q3 than Q2. The swaps market sees a Swedish cut as early as next month, but Norway is not seen cutting until Q3.

Disappointingly, there were no specific meaningful stimulus announced at the conclusion of the Two Sessions in China last month. There continues to be pledges of supportive action. The economy appears to be off to a solid start this year but without more stimulus the risk is a repeat of last year when growth peaked in the first quarter. Although the deputy governor of the People's Bank of China suggested, in late March, that there was still scope to cut reserve requirements, other officials seem to suggest that banks are using the ample liquidity to buy bonds rather than lend. The property market doldrums persist, but other sectors, like technology and manufacturing are picking up the slack. As Q1 drew to a close, policymakers do not appear to feel a strong sense of urgency.

The broad geopolitical climate has not changed significantly. With limited supplies, Ukraine is reportedly struggling to sustain the front, but it can project power deeper into Russia. Its drone attacks have hit several Russian refiners and ships. Russia appears to be preparing for a significant offensive in the coming weeks. The US is pushing Europe to use the frozen reserves for military aid to Ukraine and/or the post-war reconstruction. The lion's share of Russian government assets is at Euroclear in Belgium. Lawyers can debate the precedent and legal justification for such a move. However, European leaders are balking on strategic grounds. They are concerned about the risk to the euro as an international currency. European officials have offered instead to have a special tax on the profits Euroclear would earn from its activity on behalf of Russia, which could be transferred to Ukraine. A proposal to use the frozen Russian assets as collateral for a reconstruction bond is also being discussed. A formal decision is hoped for at the mid-June G7 summit in Italy.

The tragic history of the Middle East is getting a new chapter. Hamas' blow last October was proportionately bigger than 9/11 in the US, which triggered for the first and only time Article 5 of the NATO treaty on collective defense. It is possible that out of the ruin of Gaza, a Palestinian state will emerge, as out of the ashes of WWII and the Holocaust, the state of Israel was born. Many countries in the region may also formally recognize Israel. Some of the region's challenges also grow out of the contradictions left by the end of British and French presence. Deterrence has failed, and the cost of trying to re-establish it is steep. At the same time, Red Sea traffic is off by an estimated 70% in Q1 23. Cargo ships from Asia to Europe now go around the Cape of Good Hope, extending the duration of the transit by two weeks, with increased fuel and crew costs. From another level of analysis, this is about Iranian surrogates.

China continues to engage wolf-diplomacy in the South China Sea. It is not just about Taiwan, which will now host a permanent US special operations force. China is pushing its controversial territorial claims against the Philippines, Japan, and Vietnam. Officials in the region understand China's frequent displays of naval and aerial power could evolve into a real attack. Meanwhile, the US is tightening its attempt to block China's technological development. It is dissuading older chip technology from being exported to the PRC, not just cutting-edge processes, and fabrication equipment. The US also wants European and Asian allies to join its restrictions on servicing banned Chinese companies. The EU is preparing to retroactively impose a tariff on Chinese-made EVs. Brazil, a fellow founding member of the BRICS, launched several investigations in the possible dumping of industrial products by Chinese companies. Washington has moved closer to banning TikTok unless its Chinese parent divests which Beijing could veto. Still, the bill must pass the Senate, and that may prove more difficult. Reports suggest Chinese investors and the founders own 20% of ByteDance, the parent. Employees own 20% and global investors own 60% of ByteDance.

Most emerging market currencies, like the G10, were not match for the dollar in March. The MSCI Emerging Market Currency Index fell nearly 2.7%. The JP Morgan Emerging Market Currency Index slipped by only 0.4%. However, through Q1, both benchmarks were off about 3.3%. The premium emerging markets pay over Treasuries narrowed by about 20 bp and is below 290 bp for the first time since Covid stuck. Last year, the premium peaked near 400 bp. The MSCI Emerging Market equity index rose nearly 2% in March after rising 4.6% in February. China has been a drag. Without it, the MSCI Emerging Market equity index rose 3.1% in March after a 3.3% gain in February. The MSCI World Index of developed market equities rose 3% in March after a 4.1% gain February. It has risen for five consecutive months, and over the span, has appreciated by slightly more than 24%.

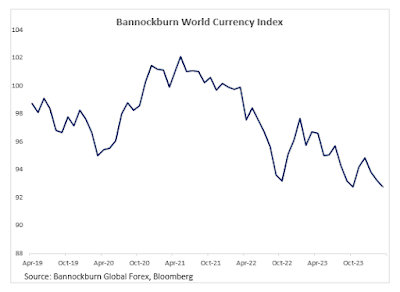

Bannockburn's World Currency Index, a GDP-weighted index of the

currencies from the dozen largest economies (evenly divided between high-income

and developing countries), suggests the US dollar is even stronger than the

nominal movement has suggests. The BWCI settled March a few tenths of a

percentage point above the multi-year low set last October. Of the currencies

from high-income countries, only the yen is weaker than it was in October. The

Chinese yuan, which is the second-highest weighting in the index (22.7%) is

trade at its lowest level since last November. The Indian rupee's 4.3% weight

is the fifth most important currency in the BWCI fell to marginal new record

lows. The South Korea won (2.1% weight) fell 1.2% in March and rivaled the

Russian ruble for the weakest performer in the index last month.

The Mexican peso continued to outperform. The nearly 3% gain in March put the peso at the top of the BWCI but also was the strongest currency in the world. The Colombian peso was the second best in the world with slightly less than a 2% gain, but within the index, the Australian dollar's almost 0.5% put it in second place. The yen's 0.80% loss was the most among the high-income currencies. The only other high-income currency in the index that did not gain against the dollar was the euro, which slipped less than 0.1%. We expect the Bannockburn World Currency Index to fall to new lows in first half of April before consolidating in the second half of the month.

U.S. Dollar: It seems that the number one driver of the dollar's exchange rate is not machinations in Beijing or the geopolitical tensions, but the direction of the US two-year note yield. As G10 rates trended lower in Q4 23, the dollar fell, and as rates recovered in Q1 24, so did the greenback. It has been quite remarkable that the Federal Reserve, under Chair Powell's leadership, has experienced a minimum of dissents despite the varied economic circumstances. Still, the latest Summary of Economic Projections showed a fissure. Nine officials said two cuts or fewer would likely be appropriate this year, while the other 10 thought three cuts or more would be necessary. The Fed funds futures strip has about 67 bp of cuts discounted this year, down from 85 bp at the end of February. At the risk of oversimplifying the complex forces and interactions, one is still paid to be long US dollars against the other major currencies. The March jobs report is expected to be solid with nonfarm payrolls rising by a little more than 200k and the March CPI is likely firm. This would seem to favor the Fed's hawks and dollar bulls. The Dollar Index scope to rise into the 106.00 area in the coming weeks but leave it vulnerable to weaker data as Q2 unfolds, which we expect to materialize.

Euro: The divergence between the US and the eurozone helped drive the euro to new lows for the month as March ended. The odds of an April cut are minor, but the swaps market is more convinced that the ECB will cut rates in June than the Federal Reserve. It is also pricing in nearly four ECB rate cuts this year compared with not quite three cuts in the US. Eurozone unemployment remained at 6.4% in February, the lowest during the monetary union, but growth is stagnant (+/- 0.1%) since the end of Q3 22. Among other things, it suggests weak productivity. Headline CPI rose by about 6% at an annualized pace in Q1 23 and appears have moderated to around 4.4% in Q1 24. The headline rate around 2.5% year-over-year at the end of Q1 24, down from 6.9% in March 2023. The base effect suggests there is scope toward around 2% by mid-year. Most EU countries have weak political leadership in the run-up to the June EU Parliament elections, and the far-right seems to be gaining in many countries. This has spurred several countries to take harder lines on immigration, offer more support to farmers, and some, like the Macron government in France, to cut welfare spending. Peripheral premiums to Germany trended lower in Q1 24 but have begun rising. If the widening continues, it could signal another source of pressure on the euro. After being turned back after the US February employment data ahead of $1.10, there is scope for additional euro declines in April. The risk may extend toward the $1.0665-$1.0700 area.

(As of March 29, indicative closing prices, previous in parentheses)

Spot: $1.0790 ($1.0835) Median Bloomberg One-month forecast: $1.0830 ($1.0880) One-month forward: $1.0800 ($1.0865) One-month implied vol: 5.0% (5.5%)

Japanese Yen: The Bank of Japan delivered its first rate hike in 17 years in March but it failed to lend much support to the beleaguered yen, which proceeded to make a marginal new 34-year low. It appears Japanese officials had leaked the rate hike, the end of Yield Curve Control, and the cessation of ETF purchases to the local media. The BOJ also sought to reassure investors that policy was still very accommodative. This, coupled with the fact that Japan remains the low yielder, and the yen a favorite short in carry-trade strategies, led to the muted market response. As the dollar approached JPY152, the BOJ/MOF verbal intervention escalated. This helped steady the greenback. Although they did not materially intervene in the foreign exchange market, it remains a palpable risk especially if, as we suspect, US labor market and inflation readings will remain firm in the coming weeks. A break above JPY152 could spur dollar gains toward JPY155. The swaps market is pricing in almost another 20 bp rate hike this year, though the two-year JGB yield settled in March less than a basis point higher on the month, slightly below 0.19%. The earthquake and auto scandal at the start of the year was a significant headwind on growth, but the 1.5% surge in February retail sales suggests a boost in consumption after three quarters of contraction. Subsidies for household electricity and gas are halved in May and end in June, as income tax cuts are implemented.

Spot: JPY151.35 (JPY150.10) Median Bloomberg One-month forecast: JPY149.15 (JPY148.45) One-month forward: JPY150.75 (JPY149.45) One-month implied vol: 7.7% (7.7%)

British Pound: Sterling began March like a lion, roaring from $1.26 to almost $1.29, the strongest it had been since last July. However, as the dollar came back and the Bank of England seemed less hawkish, sterling surrendered its gains and fell to new low for the month ($1.2575) in late March, finishing the month like a lamb. The swaps market boosted the chances of a June hike to around 70% from closer to 40% at the end of February. The market has 74 bp of cuts discounted for this year compared with 63 bp a month ago. After contracting in Q3 23 and Q4 23, the UK economy appears to be off to a more solid start in Q1. The base effect continues to warn that UK price pressures are going to moderate dramatically, and this could extend into Q3, even if June and July see a wobble. This may help bolster the market's confidence in the trajectory of BOE policy. Prime Minister Sunak ruled out holding national elections on May 9 at the same time as local elections, but a drubbing for the Tories may spur a leadership challenge. A recent YouGov survey showed that the Reform Party (the successor of the Brexit Party) has greater support among men than the Tory Party, which is still trailing Labour handily.

Spot: $1.2625 ($1.2655) Median Bloomberg One-month forecast: $1.2650 ($1.2670) One-month forward: $1.2630 ($1.2660) One-month implied vol: 5.6% (5.8%)

Canadian Dollar: The Canadian dollar rose by about 0.25% in March after falling around 2.5% in the January-February period. It leaves the Loonie off by about 2.25% for the year, and easily the best among the dollar-bloc currencies. The Canadian dollar accounts for only about 9% of the Dollar Index and has the lowest implied volatility of the G10 currencies, yet the rolling 30-day correlation between changes in the exchange rate and the Dollar Index rose to its highest level in more than a decade (0.85) in mid-March. That compares with slightly less than a 0.6 correlation with the changes in the S&P 500 (a proxy for risk appetites) and less than 0.1 correlation with changes in oil prices. The swaps market is discounting a 66% chance that the first cut is delivered in June, and that is little changed over the course of last month. The market feels more comfortable with three cuts this year now. In February, the market flirted with the idea of four cuts, and there was a patch in mid-March that the market had less than 75 bp of cuts discounted. The US dollar made a new high for Q1 near CAD1.3615 in the second half of March. A break of CAD1.3625 could spur a move toward CAD1.3700. The greenback has established support in the CAD1.3400-CAD1.3420 area.

Spot: CAD1.3540 (CAD 1.3560) Median Bloomberg One-month forecast: CAD1.3490 (CAD1.3515) One-month forward: CAD1.3435 (CAD1.3555) One-month implied vol: 4.6% (4.9%)

Australian Dollar: The Australian dollar recovered from around $0.6480 in early March to peak near $0.6670 before the US employment report on March 9. It returned erratically to $0.6485 toward the end of the month. Still, the Australian dollar was the best performer among the G10 currencies, gaining about 0.4% against the US dollar to snap a two-month drop of around 4.7%. That said, we are not impressed with the price action and suspect the risk is on the downside. A retest of the February low near $0.6445, and possible the $0.6400 area cannot be ruled out. The driver may be more about the US dollar than Australia. The US dollar has recovered against all the G10 currencies this year after its slide in Q4 23. Rate differentials mean one is paid to be long US dollars. The futures market has downgraded the chances of an Australian rate cut in June to about 35% from nearly 70% at the end of February. The odds of an August cut were tweaked higher (80% vs.70% at the end of February). The market had leaned strongly in favor of three cuts this year at the end of 2023, but scaled back and now has almost two cuts fully discounted. The central bank meets next on May 7.

Spot: $0.6520 ($0.6530) Median Bloomberg One-month forecast: $0.6580 ($0.6575) One-month forward: $0.6525 ($0.6535) One-month implied vol: 7.5% (7.9%)

Mexican Peso: The central bank delivered the first cut, a quarter-point move to 11.00%, and yet its caution, illustrated by the small upward revision to this year's inflation forecast, seemed to neutralize the effect on the peso. Others in the region began the easing cycle last year and have brought rates down more aggressively. January retail sales were unexpectedly weak (falling by 0.6% after dropping 1.0% in December. Except for last October, Mexico's retail sales have been fell throughout H2 23. Foreign demand has also softened, and Mexico's exports fell for the third consecutive month in January, though rebounded smartly in February (almost 21%). The weakness in consumption may begin impacting producers. Meanwhile, the moderation of inflation seems to have stalled and the base effect makes for difficult comparisons until Q3. The market leans toward another quarter-point cut at the next central bank meeting on May 9, drawing confidence from the strength of the peso. The peso appreciated by about 1% following the rate cut on March 21 to the end of the month, reaching a new nine-year high. The peso's low volatility and attractive rates make it favored long position in carry-trades. If/when carry trades are unwound, sometimes due to the appreciation of the funding leg, such as the Japanese yen, the peso is vulnerable.

Spot: MXN16.56 (MXN17.02) Median Bloomberg One-Month forecast: MXN16.74 (MXN17.12) One-month forward: MXN16.63 (MXN17.11) One-month implied vol: 7.4% (7.4%)

Chinese Yuan: The dollar's strength proved too much and after mounting what appeared to be a strong defense of CNY7.20, Beijing capitulated and allowed the greenback to rise to new highs for the year. It reached almost CNY7.23, a little shy of the old band we anticipated last month (CNY7.25-CNY7.30). The yuan fell by about 1.7% in Q1 24, performing better than all the G10 currencies but sterling, and better than most regional currencies, but the Hong Kong dollar, Indian rupee, and Philippine peso. In a strong dollar environment, the yuan is likely to fare better than most other currencies. Yet in the face of a large or sustained dollar rally, Beijing will allow the yuan to weaken. China's 10-year yield discount to the US is hovering around 190-200 bp. At the end of last year, the discount was about 125 bp and last April, it was briefly less than 45 bp. Until the dollar turns, Chinese bonds are not attractive for dollar-based investors. The Chinese stock market rally, apparently helped by government pension funds, carried over from February through most of March before stalling near four-month highs and the 200-day moving average. It has consolidated after rallying more than 16% off the early February lows.

Spot: CNY7.2225 (CNY7.1970) Median Bloomberg One-month forecast: CNY7.2065 (CNY7.1815) One-month forward: CNY7.1180 (CNY7.1070) One-month implied vol 4.8% (4.8%)

Tags: Featured,macro,newsletter