Project Tourbillon, an initiative led by the Bank for International Settlements (BIS) Innovation Hub Swiss Centre and supported by the Swiss National Bank (SNB), explored the feasibility of a retail central bank digital currency (CBDC), finding that it is possible to implement a CBDC design that provides anonymity to the payer and which is scalable and secure.

In a new report released in November 2023, BIS shares details of the project, outlining findings of their efforts.

Project Tourbillon, which had been running since at least late-2022, saw the development and testing of two CBDC prototypes based on the eCash design by American computer scientist, cryptographer and inventor David Chaum.

These prototypes were designed to address three features simultaneously: privacy, by enabling payer anonymity, security, by implementing quantum-safe cryptography (QSC), or algorithms that are resistant to attacks by both classical and quantum computers; and scalability, by testing these systems’ ability to handle a growing number of transactions using payment data.

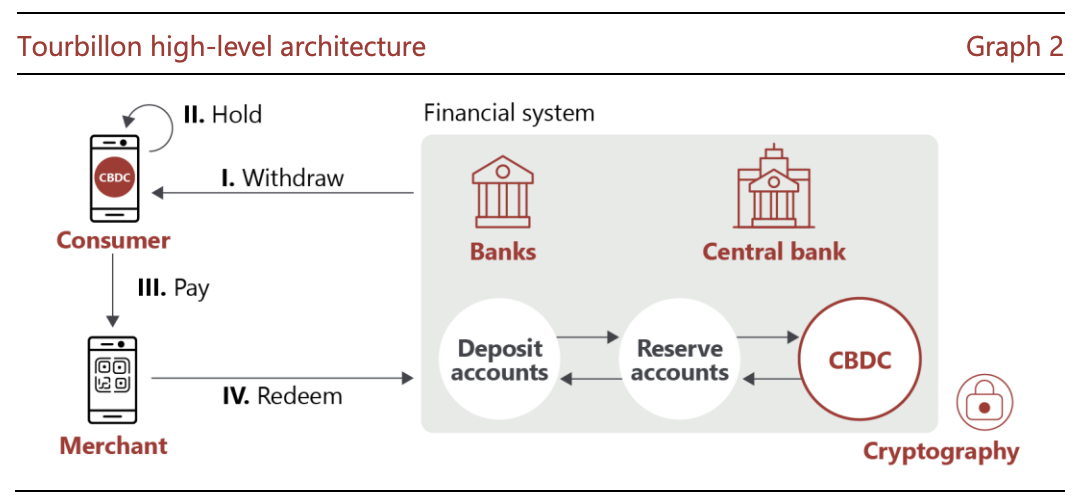

They leveraged the existing two-tier banking system and involved four parties: a central bank, commercial banks, consumers and merchants.

First, consumers and merchants were handed deposit accounts with banks, while banks were given reserve accounts with the central bank. Consumers and merchants were then required to be initially onboarded by their respective banks to ensure that know-your-customer (KYC) procedures were met.

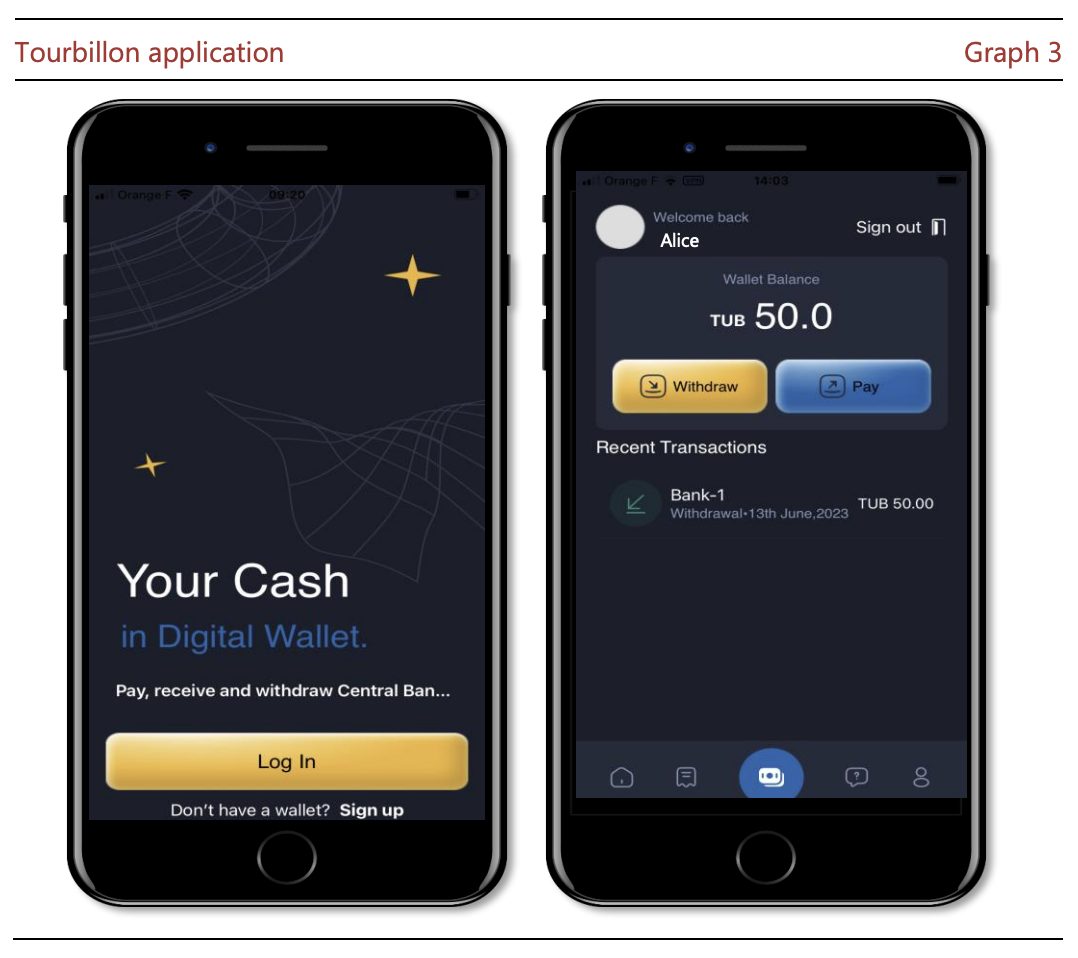

Once onboarded, consumers and merchants were able to install and use the Tourbillon apps on their mobile devices: the consumer Tourbillon app allowed consumers to withdraw, hold CBDCs via self-custody, and make payments, while the merchant Tourbillon app allowed businesses to request payments, receive payments and view the status of payments.

Tourbillon application, Source: Project Tourbillon: Exploring privacy, security and scalability for CBDCs, Bank for International Settlements Innovation Hub Swiss Centre, Swiss National Bank, Nov 2023

To use CBDCs, consumers were required to request a withdrawal through their bank, which debited their deposit account and forwarded the request to the central bank. The central bank then issued CBDCs, debiting the bank’s reserve account, and sending the CBDCs to the consumer.

Consumers could then hold the CBDCs and later use them to pay various merchants.

As of merchants, once they received CBDCs as payment, they submitted them to their bank, which forwarded them to the central bank. After verification, the central bank credited the merchant’s bank reserve account, and the merchant’s bank credited the merchant’s deposit account.

Tourbillon high-level architecture, Source: Project Tourbillon: Exploring privacy, security and scalability for CBDCs, Bank for International Settlements Innovation Hub Swiss Centre, Swiss National Bank, Nov 2023

Challenges and considerations

According to the report, Project Tourbillon concluded its experiment successfully, revealing that it is possible to develop a retail CBDC that’s anonymous, secure and scalable.

But despite its successful completion, Project Tourbillon also revealed three critical areas for further development.

Firstly, Project Tourbillon showed the challenges of implementing QSC and the ensuing reduction in transaction processing speed brought about these technologies. Hence, the report advises for further research and experimentation to enhance QSC functionality, efficiency, and to determine a safe transition from current cryptography to QSC.

Secondly, although Tourbillon confirms the feasibility of the eCash design, the report notes the potential for improvement in privacy, security, or scalability based on evolving requirements. Modeling the trade-offs between privacy, security and scalability and the extent to which they impact each other will be crucial for advancing the prototypes, it says.

Finally, future work should explore how an eCash-based design could be implemented. This includes considering additional use cases, such as offline payments, and exploring economic viability with a sustainable business model, the report concludes.

Project Tourbillon is the latest CBDC project led by BIS in which SNB is evolved. It follows initiatives such as Project Mariana, a collaboration that tested the cross-border trading and settlement of wholesale CBDCs developed jointly with Bank of France and the Monetary Authority of Singapore (MAS); Project Jura, a collaboration involving Bank of France, BIS, SNB and a private sector consortium that explored the direct transfer of euro et Swiss franc wholesale CBDCs between French and Swiss commercial banks on a single distributed ledger technology (DLT) platform operated by a third party; and Project Helvetia, a multi-phase investigation by BIS, SNB and Swiss financial infrastructure operator SIX on the settlement of tokenized assets in CBDC.

Building on findings of Project Helvetia, SNB launched this month a pilot project with a wholesale CBDC (wCBDC) on the SIX Digital Exchange (SDX). The pilot, which is scheduled to run from December 2023 to June 2024, allows for real bond transactions to be settled using a wCBDC. Several banks are taking part in the pilot, including Commerzbank, Hypothekarbank Lenzburg and UBS.

Despite a clear keenness in CBDC, the Swiss central bank has said that the initiative “does not constitute a commitment on the part of the SNB to introduce wholesale CBDC on a permanent basis.”

Featured image credit: Edited from freepik

The post Swiss-Backed CBDC Project Explored Feasibility of Cash-Like, Anonymous Digital Currency appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain/Bitcoin,Featured,newsletter,Switzerland