The apartment investment industry has experienced severe malinvestment over the last several years, resulting in a massive bubble that has only recently begun to deflate with rising interest rates. A tidal wave of easy money—enabled by the Federal Reserve and four consecutive United States administrations, from George W. Bush to Joe Biden—drastically lowered the barriers to entry. As a result, even those with no investment acumen have raised and used other people’s money for complex, high-risk projects like buying, developing, and managing apartment buildings. Bridge loans, a natural outgrowth of enormous amounts of liquidity searching for yield in an environment with a zero-interest rate policy, have facilitated this process. The results should not be surprising, and to some they aren’t.

Syndication and Bridge Loans

Scrutinizing Fed-driven malinvestment in the apartment industry involves highlighting two separate but closely related phenomena—syndication and bridge loans.

Syndication involves the pooling of capital from various sources to execute an investment. However, during the recent apartment bubble, this practice degenerated significantly. Syndicators often showed a lack of experience in the industry, raised money anonymously online, heavily relied on marketing and technology, and demonstrated limited risk awareness.

As opportunists in the world of easy money and widespread malinvestment, these syndicators took advantage of a nominally wealthy but unsophisticated investor pool to acquire properties that these syndicators intended to quickly flip, riding a wave of speculative asset inflation and earning substantial fees with each closed acquisition, refinance, or sale.

However, syndication, as described earlier, would not have been possible without the ubiquity of bridge loans. During the peak of the apartment bubble, which took place roughly from mid-2020 to early 2022, syndicators emerged as the primary users of bridge loans: short-term, floating-rate, high-leverage loans with essentially no lending criteria that were used to fund roughly 90 percent of the apartment acquisition activity during the period.

Syndicators rushed in to outbid for apartment properties and, with virtually no credit standards to meet, borrowed as much as they could using bridge loans. Ostensibly, the sole investment rationale at play was the “bigger fool” strategy, a bet that loose monetary policy would never go away, thus fueling continued asset inflation and allowing the syndicators to flip these properties to even bigger fools.

While they lasted, the bubble conditions and bridge loans enabled these aggressively rent-seeking but otherwise dim-witted syndicators to earn significant fees for themselves and build up massive assets under management.

Research published by Trepp, a leading provider of loan analytics for commercial real estate, has revealed insightful findings. Trepp analyzed the portfolios of five syndicators—Tides Equities, GVA Real Estate Group, Nitya Capital, ZMR Capital, and Rise48 Equity—and the results are both enlightening and utterly predictable.

The Chickens Come Home to Roost

Across the five syndicators mentioned, Trepp provided several noteworthy data tables.

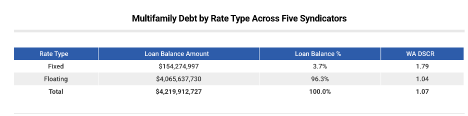

The table below shows the proportion of each type of debt employed by these syndicators in their apartment acquisitions.

Figure 1: Multifamily debt by rate type across five syndicators

Source: Emily Yue, “Multifamily Syndicators Come Under Scrutiny—Everything to Know About Exposure to CRE CLOs and Floating-Rate Debt,” Trepp, July 20, 2023.

The table’s third column shows that 96.3 percent of these loans were taken on a floating-rate basis. These syndicators were either ignorant of the risks associated with increasing interest rates or simply assumed that rates would stay at all-time lows for the foreseeable future.

However, interest rates did not stay at all-time lows, as the Fed began raising them in mid-2022.

Looking at the rightmost column of the chart illustrates the impact of those rate increases. At the time of Trepp’s research, the investments that used floating-rate loans were barely covering interest and principal payments (“debt service”) on those loans. A weighted average debt service coverage ratio (“WA DSCR”) of 1.04 means that for every $1.04 generated in income, the investment pays $1.00 of debt service. These numbers are certainly worse today, since benchmark interest rates have increased further since the Trepp research was performed.

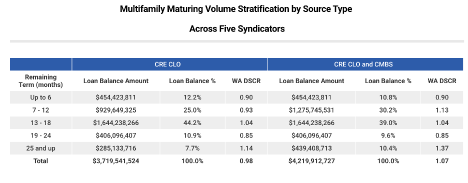

Moving deeper into the Trepp report, one can start to gauge the broader effects this distress might have on the apartment industry. The table below shows the maturity profile of the syndicators’ loans, or when these loans come due.

Figure 2: Multifamily maturing volume stratification by source type across five syndicators

Source: Yue, “Multifamily Syndicators Come Under Scrutiny.”

What’s apparent here is that nearly 40 percent of these loans mature in the next twelve months and over 80 percent in the next eighteen months. The drastically lower transaction volume in the apartment market today is, at least partially, a product of smart money waiting on the sidelines for this distress to play out in the near term, potentially offering compelling value to those who wish to pick at these carcasses.

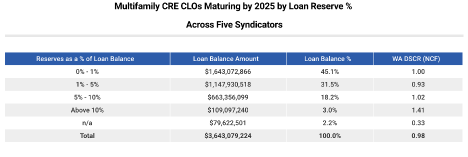

Lastly, Trepp has compiled data related to cash reserves held by these syndicators. Just like families maintain savings accounts or rainy-day funds, apartment investors also maintain cash reserves in the event revenue generation suffers and harms their ability to make loan payments out of current income. Just like the prudent family reduces current consumption to keep their savings high, the more experienced and risk-conscious investors do the same with cash reserves. A healthy reserve balance is equal to around 10 percent of the loan amount.

Figure 3: Multifamily CRE CLOs maturing by 2025 by loan reserve percentage across five syndicators

Source: Emily Yue, “Multifamily Syndicators Come Under Scrutiny.”

In the case of these five syndicators, 45.1 percent of the loans have reserves of less than 1 percent of the loan balance, while approximately 77 percent of the loans have reserves of less than 5 percent of the loan balance. Furthermore, lenders are likely to draw down any available reserves in the meantime to service debt until loan maturity, meaning most or all of those reserves will be gone by the time loan maturity rolls around.

Lacking any significant reserves while unable to service debt, fully half of these loans appear to be unsalvageable, amounting to over $600 million in investor equity wiped out by just these five syndicators when the lenders ultimately foreclose the underlying properties.

Summary

As Warren Buffett observed, “Only when the tide goes out do you learn who’s been swimming naked.”

Syndicators like those mentioned here were always swimming naked. However, they were never meant to be real estate investors in the first place. Bridge loans—a spawn of the easy-money zero-interest-rate era—allowed and enabled the individuals with the highest time preference to engage in activities that, done properly, require distinctly low time preference combined with a set of technical skills. The result is an industry turned upside down, chock full of bad loans that will take years to unwind.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter