The Federal Reserve’s Federal Open Market Committee (FOMC) last week left the target policy interest rate (the federal funds rate) unchanged at 5.5 percent. This "pause" in the target rate suggests the FOMC believes it has raised the target rate high enough to rein in price inflation which has run well above the Fed's arbitrary two-percent inflation target since mid-2021. I say "believe," but perhaps the more appropriate word here is "hope."

That is: the Fed hopes it has raised the target interest rate high enough. Moreover, the Fed hopes this will both reign in price inflation and also avoid raising unemployment too high. (See below for what is meant by "enough" and "too high.")

After all, the Fed has no idea what the "correct" federal funds rate is to achieve the goals that the Fed has set for itself. Nor does the Fed know what the "neutral" interest rate is at any given time. As even chairman Jerome Powell admitted at this month's press conference, "you can’t identify [the neutral rate] with any precision in real time and we know that."

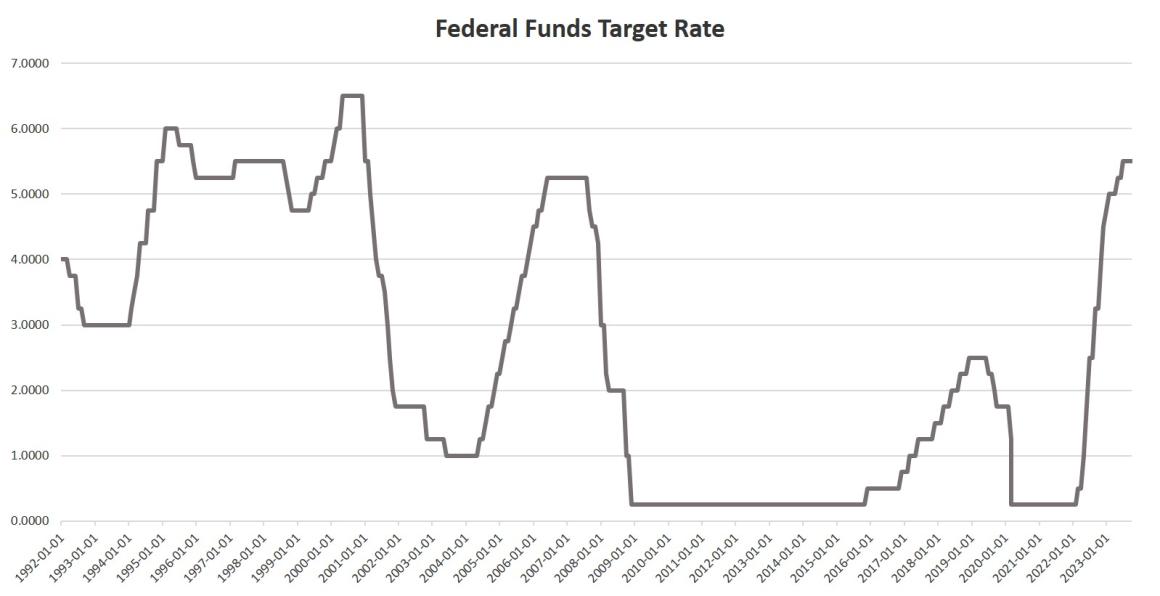

Nonetheless, we can see here that the target federal funds rate has been held steady by the FOMC since July of this year. The length of the pause is significant because once the target rate has been flat for more than two months in a tightening period, the Fed's next step is nearly always to begin lowering the target rate.

Whether or not the Fed does that this time is not a sure thing, and it has become increasingly obvious the voting members of the FOMC have no idea—or are unwilling to reveal—what they'll do next, either.

Gone are the days when the Fed repeatedly suggested that it had a long-term plan or any sort of clear strategy for manipulating economic conditions. Over the past several months, Powell has made it increasingly clear in his post-FOMC press conferences that the Fed is—if we believe what they say—playing it all by ear on a meeting-by-meeting basis. Its "strategy" consists of tinkering with its monetary policy and then crossing its fingers and waiting.

This month, the first hint at this came in the form of the FOMC's official press release which states:

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

This is just a fancy way of saying "we have no idea what will happen next." This may seem like just an admission of the obvious reality to many people, but this all contradicts the decades of propaganda we've been told about the Fed and its technocrats. We're supposed to believe the Fed has the nation's "best" economists and the "best" economic models and pursues policies based on apolitical economic science. Yet it all turns out that the Fed has nothing in its tool box other than tinkering each month with a few knobs and levers, and hoping price inflation goes down.

This was further revealed during this month's press conference's Q and A where Powell repeatedly emphasized the tenuous nature of the Fed's current policy. Here's a smattering of phrases Powell used to answer questions about whether or not the Fed has plans to raise or lower the target rate: "we’re monitoring. ... you know, things are fluctuating back and forth. ... we haven’t made any decisions about future meetings. ... We have not made a determination."

Some reporters tried to nail the Fed down on some sort of criteria for how the Fed determines policy. For example Nick Timiraos of The Wall Street Journal asked Powell "what makes you confident the tighter financial conditions will slow above trend growth when 500 basis points, the rate hikes, QT, and a minor banking crisis have not thus far?" Powell's sagacious response was "Well, I just—that’s—you know, the way our policy works is and sometimes it works with lags, of course, which can be long and variable."

Oh.

There are reasons for this utter lack of precision and planning. Some are economic and others are political.

The first reason is that the Fed is terrible at forecasting. FOMC members and chairmen are consistently behind the curve when it comes to understanding trends in price inflation and economic growth. For example, Chairman Bernanke was still insisting there was no recession coming as late as mid-2008. Months later, the nation was in a full-blown financial crisis. In mid 2021, Minneapolis Fed president Neel Kashkari claimed there was no price inflation in store and the Fed would keep the target rate near zero until 2023. Powell, of course, famously insisted throughout 2021 that price inflation was "transitory" and that there was no need to curb the Fed's relentless easy-money policies to rein in price inflation. In other words, there is no correlation between the Fed's economic forecasts and what actually happens in the economy.

Other reasons for the Fed's evasiveness are political. Contrary to the longstanding myth of Fed independence and political neutrality, the Fed is a deeply political organization committed to kicking the can down the road to get the regime through just one more election without a fiscal or monetary disaster. The Fed is also expected to ensure that the federal government has easy access to liquidity and deficit funding while also ensuring that price inflation and unemployment remain at levels politically palatable to the voters.

If the Fed allows price inflation to surge, this will undermine the regime's credibility and damage the administration. This is what the Fed is worried about when it is concerned that it has raised the target rate "enough." "Enough" is a political definition. On the other hand, the Fed doesn't want unemployment to rise to politically problematic levels. That would also be bad for both the Fed and the administration. This is what the Fed worries about in terms of raising the target rate "too much." What constitutes "too much" is a political question.

Meanwhile, the regime wants the Fed to help keep interest rates on government debt low so the costs of deficit spending don't get out of hand. That means pushing down the federal funds rate and other interest rates through its open market operations (but risking more price inflation).

Debt costs, unemployment, and price inflation are all political problems the Fed must manage at once. But the time horizon is strictly short-term. There is no long-term thinking here about building a sound economy, fostering investment, or helping the working man save for retirement. The Fed's concern is keeping up appearances, and this requires constant open-ended tinkering with policy rates (and the Fed portfolio) and hoping for the best.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter