Monthly Archive: June 2022

In Defense of Defaulting on the National Debt

With the acknowledged national debt now a politically and economically unpayable $30 trillion (in reality, its unfunded liabilities are far greater), Americans should start to become acclimated to the realities of the United States’ eventual, inevitable default.

Read More »

Read More »

Juneteenth and Secular Holidays as Tool of the Regime

Last year Congress officially declared Juneteenth a federal holiday. While Very Serious talking heads attempted desperately to convince those that would listen that Juneteenth was a long-celebrated American holiday, the reality is that it was largely unknown around the nation prior to congressional action. The episode is a useful illustration of how the state weaponizes secular holidays to promote a larger cultural agenda.

Read More »

Read More »

„Bitcoin is Dead“ mit neuem Spitzenwert in Google Suche

Nach dem spektakulären Absturz in der letzten Woche, verlor der BTC zum Wochenende nochmals und stürzte sogar unter die Marke von 20K. Auf Google wurden darauf Höchstwerte für den Suchbegriff „Bitcoin is Dead“ registriert.

Read More »

Read More »

Equities Jump, Dollar Slips, and European Yields Drop

Stocks are rallying. Nearly all the large bourses in the Asia Pacific region rose with China being the noted exception.

Read More »

Read More »

Long shadow of Russian money raises tricky questions for Swiss bankers

January used to be a big month for Swiss bankers and their Russian clients. Many of the Moscow elite had made a tradition of coming to the Alps for the orthodox new year, skiing with their families, then catching up with their financial consiglieri.

Read More »

Read More »

SNB hebt Leitzinsen um 0,5 Prozentpunkte an

Die Schweizerische Nationalbank (SNB) hebt etwas überraschend den Leitzins deutlich an. Das letzte Mal hat sie das vor 15 Jahren getan, zu Beginn der Finanzkrise im September 2007.

Read More »

Read More »

Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system.

Read More »

Read More »

Die neue Zweiklassengesellschaft

Der Zweiklassengesellschaft kommt im sozialistischen Denken eine wichtige Funktion zu. Eingriffe in das Privateigentum bis hin zur kompletten Enteignung – gern auch als „Vergesellschaftung“ begrifflich verschleiert – erscheinen vor diesem Hintergrund in anderem Licht.

Read More »

Read More »

How Money Printing Destroyed Argentina and Can Destroy Others

The most dangerous words in monetary policy and economics are “this time is different.” Argentine politicians’ big mistake is to believe that inflation is multicausal and that everything is solved with increasing doses of interventionism.

Read More »

Read More »

US Holiday Facilitates Consolidative Tone

Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions.

Read More »

Read More »

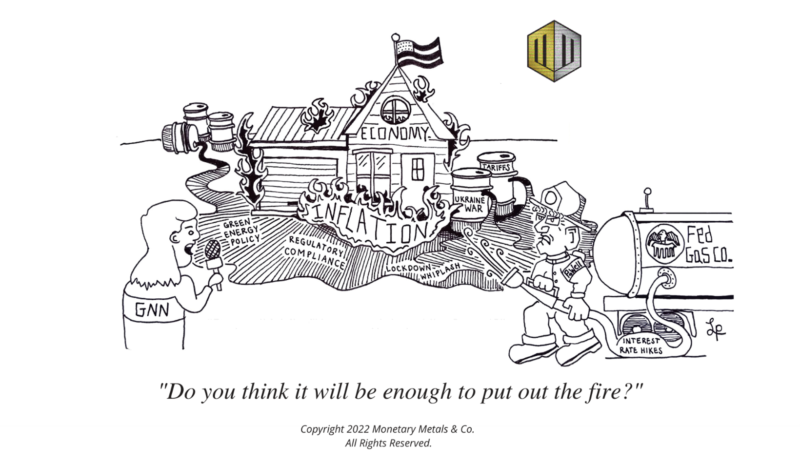

Powell’s “Soft Landing” Is Impossible

After more than a decade of chained stimulus packages and extremely low rates, with trillions of dollars of monetary stimulus fueling elevated asset valuations and incentivizing an enormous leveraged bet on risk, the idea of a controlled explosion or a “soft landing” is impossible.

Read More »

Read More »

Immobilien – Remax-Schweiz-Chef Jöhl : «Die Zinserhöhung wird den Markt für privates Wohneigentum nicht in Schieflage bringen»

Wie werden sich die Preise für Schweizer Wohneigentum entwickeln, nachdem die Schweizerische Nationalbank (SNB) am Donnerstag die Zinsen erhöhte?

Read More »

Read More »

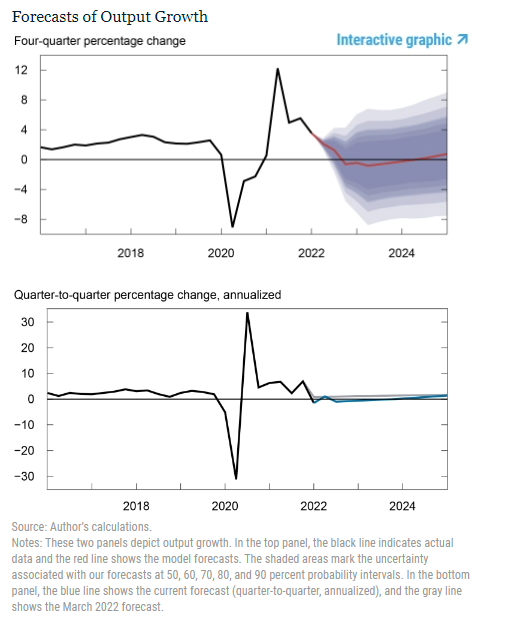

Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament.

Read More »

Read More »

With the Central Bank Pivots Discounted, Will the Forex Market Consolidate?

The dramatic moves in the money market were investors discounting the acceleration of the tightening cycle among the major economies.

Read More »

Read More »

Even after Admitting She Underestimated Inflation, Janet Yellen Still Doesn’t Understand What It Is

According to the June 1, 2022, Financial Times, Janet Yellen, the US Treasury secretary conceded she was wrong last year about the path inflation would take.

Read More »

Read More »

Huobi wird Lizenz in Thailand entzogen

Huobi, eine der größten Crypto-Börsen im asiatischen Raum, wurde die Lizenz in Thailand entzogen. Huobi ist auch außerhalb Asiens eine der größeren Börsen. Die Ursache für den Lizenzentzug sind Verstöße gegen staatliche Regulierungen.

Read More »

Read More »

On the Digital Future of Markets and Money

Thank you very much for the invitation. I am delighted to have the opportunity to share some thoughts with you on a topic I am very much interested in and that I believe is of the utmost importance to people around the globe—and that is “the digital future of markets and money.”

Read More »

Read More »

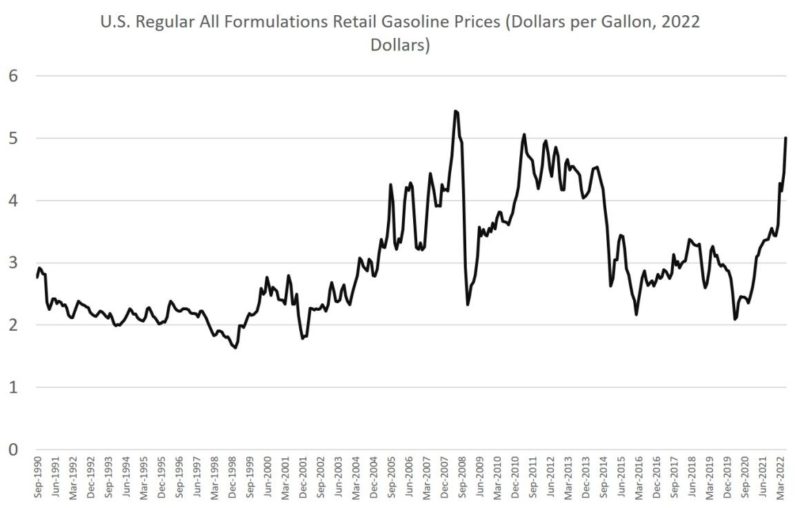

No, It’s Not “Greed” or “Price Gouging” that’s Driving up Gas Prices

Both consumer prices and producer rose near to multi-decade highs last month. Price inflation rose to 8.6 percent while wholesale producer prices rose by more than 10 percent. In both cases, a significant factor behind rising prices—but certainly not the only factor—was high energy prices. This has been reflected in prices related to transportation and shipping.

Read More »

Read More »

How Long Will Inflation Last 2022

2022-06-18

by Stephen Flood

2022-06-18

Read More »