Monthly Archive: May 2022

Martin Schlegel wird neuer SNB-Vizepräsident

Schlegel (Jahrgang 1976) wird laut Mitteilung vom Mittwoch per Anfang August die Leitung des II. Departements der SNB übernehmen. Der neue Vize-Chef ist ein SNB-Urgestein. Er ist seit knapp zwanzig Jahren in verschiedenen leitenden Positionen für die SNB tätig, zuletzt seit September 2018 als stellvertretendes Mitglied des Direktoriums im I. Departement.

Read More »

Read More »

No, It’s Not the Putin Price Hike, No Matter What Joe Biden Claims

Politicians love their buzzwords and talking points, and the Joe Biden White House and the Democratic Party use them as much or more than when Donald Trump and the Republicans ran Washington’s freak show. Last year, the mantra from the Biden administration was that inflation was “transitory,” meaning that the inflation would not last long.

Read More »

Read More »

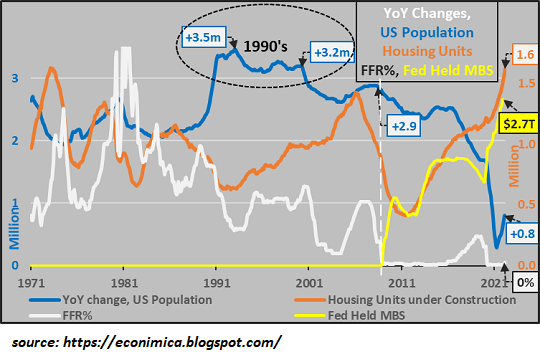

Is Housing a Bubble That’s About to Crash?

We are all prone to believing the recent past is a reliable guide to the future. But in times of dynamic reversals, the past is an anchor thwarting our progress, not a forecast. Are we heading into another real estate bubble / crash?

Read More »

Read More »

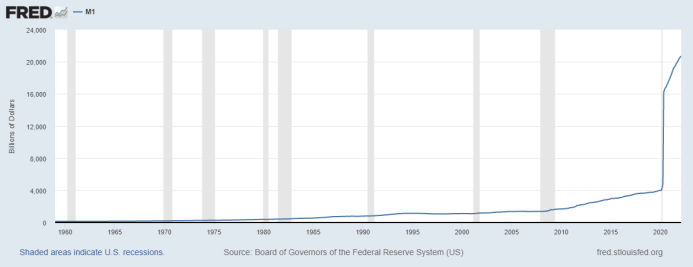

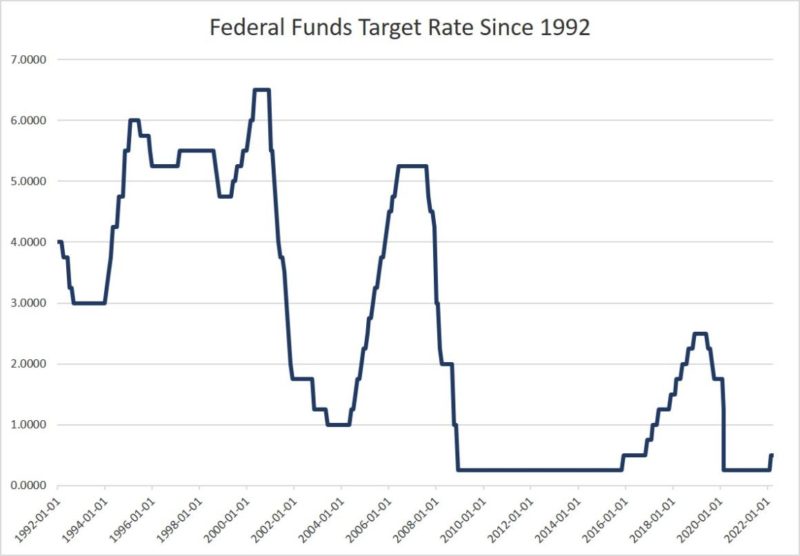

It’s Mid-2022 and the Fed Has Still Done Nothing to Fight Inflation

It was last August when Jerome Powell began to admit that inflation just might be a problem. But even then, he was only willing to say that inflation would likely be “moderately” above the arbitrary 2 percent inflation standard. Back in August, low inflation—not high inflation—was still perceived to be the “problem."

Read More »

Read More »

Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India.

Read More »

Read More »

Martin Schlegel appointed to SNB

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose.

Read More »

Read More »

SNB Governing Board: Federal Council appoints Martin Schlegel as Vice Chairman of the Governing Board

Petra Gerlach and Attilio Zanetti become Alternate Members of the Governing Board. At its meeting of 4 May 2022, the Federal Council appointed Martin Schlegel as Vice Chairman of the Governing Board of the Swiss National Bank with effect from 1 August 2022. He will succeed Fritz Zurbrügg on the Governing Board when the latter steps down at the end of July 2022.

Read More »

Read More »

Gold: A use case for the modern era

Part II of II

The big picture here is clear and it is essential to understand that it represents a very significant paradigm shift. Whether it is online or offline, whether it is through a mobile app, an exchange or even through physical contracts, ownership titles to gold holdings keep changing hands. And thus, no matter the vehicle that is used to facilitate these transactions, the fact of the matter is that it acts as a gold-backed...

Read More »

Read More »

Synchronized Manufacturing, Hopefully Not Mao

This is one of those cases when Inigo Montoya, the lovable if fictional rapscallion from the movie The Princess Bride, would pop into the scene to devastatingly deliver his now famous rebuke. Last week, China’s one-man Dear Leader said that the country was going to start up its own version of Build Back Better.

Read More »

Read More »

The Economic Sanctions against Russia Are Destructive and Counterproductive: We Must Oppose Them

Imposing economic sanctions upon Russia is tantamount to throwing gasoline on a raging fire. The sanctions will not end the Russian invasion of Ukraine and only will make things worse.

Original Article: "The Economic Sanctions against Russia Are Destructive and Counterproductive: We Must Oppose Them"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Aktien – Wie «Amateure» sich an der Börse selber helfen können

Credit Suisse und UBS liefern uns ein schönes Lehrstück. Die UBS verspekulierte sich in den USA derart, dass die Schweizerische Nationalbank deren faule Kredite in der Finanzkrise von 2008 übernehmen und somit die Grossbank vor dem Kollaps retten musste. Derweil vermochte die Credit Suisse die Verluste selber zu stemmen und erhielt dafür Anerkennung.

Read More »

Read More »

Covid loan claims fuel rise in suspected fraud cases

The number of reported suspicious financial transactions continued to rise in Switzerland in 2021, but at a lower rate than in the first year of the pandemic.

Read More »

Read More »

Coinbase CEO glaubt an eine Milliarde Crypto-Nutzer

Aktuell geht man von 200 Millionen aktiven Crypto-Nutzern weltweit aus. Laut Brian Armstrong, CEO von Coinbase, wird diese Zahl innerhalb der nächsten 10-20 Jahre deutlich ansteigen und sich mehr als verfünffachen. Crypto News: Coinbase CEO glaubt an eine Milliarde Crypto-Nutzer in dieser DekadeSeine Annahme untermauert er damit, dass sich der GDP (das Brutto-Inlands-Produkt) immer mehr im Cryptomarkt abspielt. Betrachtet man den relativen Anteil...

Read More »

Read More »

To Fight Russia, Europe’s Regimes Risk Impoverishment and Recession for Europe

Politicians have become accustomed to conjuring whatever they want through the “miracle” of printing money. But in the real world, it’s still necessary to produce oil and gas through actual physical production.

Original Article: "To Fight Russia, Europe's Regimes Risk Impoverishment and Recession for Europe"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

RBA Surprises with a 25 bp Hike

Overview: The large bourses in Asia Pacific except Hong Kong eased. Japan and China's mainland markets are closed for the holiday. Europe's Stoxx 600 is up about 0.6%. It gapped lower yesterday and has not entered the gap today. US futures are a little softer.

Read More »

Read More »

Gold: A use case for the modern era

Part I of II

For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or...

Read More »

Read More »

Wie das unsolide Finanzsystem extreme Kreditzyklen auslöst, die zum Kollaps führen

Ein staatliches Fiat-Währungssystem mit einer nur teilweisen Deckung des Geldumlaufs durch die Bankreserven macht es möglich, dass die Geschäftsbanken mehr Geld als in Umlauf bringen als sie an Bargeld halten. Das sogenannte Giralgeld wird als Bankeinlagen gleichsam aus dem Nichts geschaffen.

Read More »

Read More »

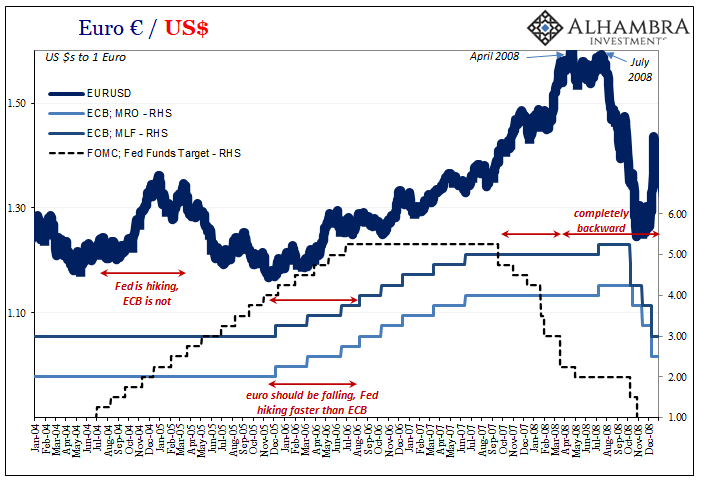

What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials.

Read More »

Read More »