Monthly Archive: May 2022

Who’s Playing Puppetmaster, And Who Is Master of Puppets

Cue up the old VHS tapes of Bill Clinton. The former President was renowned for displaying, anyway, great empathy. He famously said in October 1992, weeks before the election that would bring him to the White House, “I feel your pain.”What pain? As Clinton’s chief political advisor later clarified, “it’s the economy stupid.”

Read More »

Read More »

Not the 1970s or the 1920s: We’re in Uncharted Territory

All of these similarities and differences are setting up a sea-change revaluation of capital, resources and labor that will be on the same scale as the extraordinary transitions of the 1920s and 1970s.

Read More »

Read More »

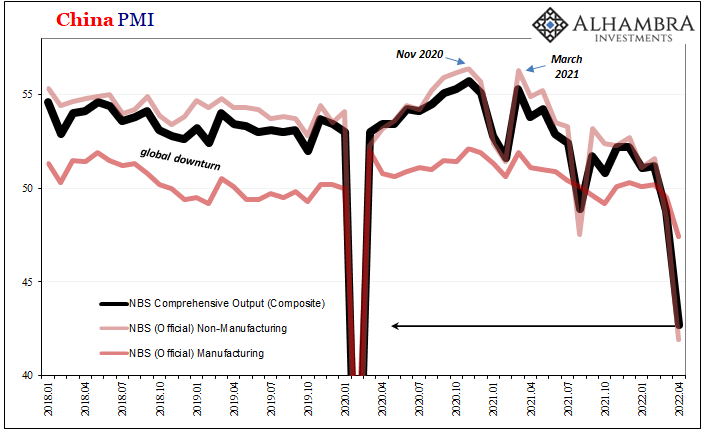

China Then Europe Then…

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious.

Read More »

Read More »

Is It “Disloyal” to “Side with Russia”?

Last week, I received an email from a conservative-oriented libertarian who suggested to me that it is disloyal to “side with Russia” because Ukraine was “just sitting there” when it was invaded by Russia.

Read More »

Read More »

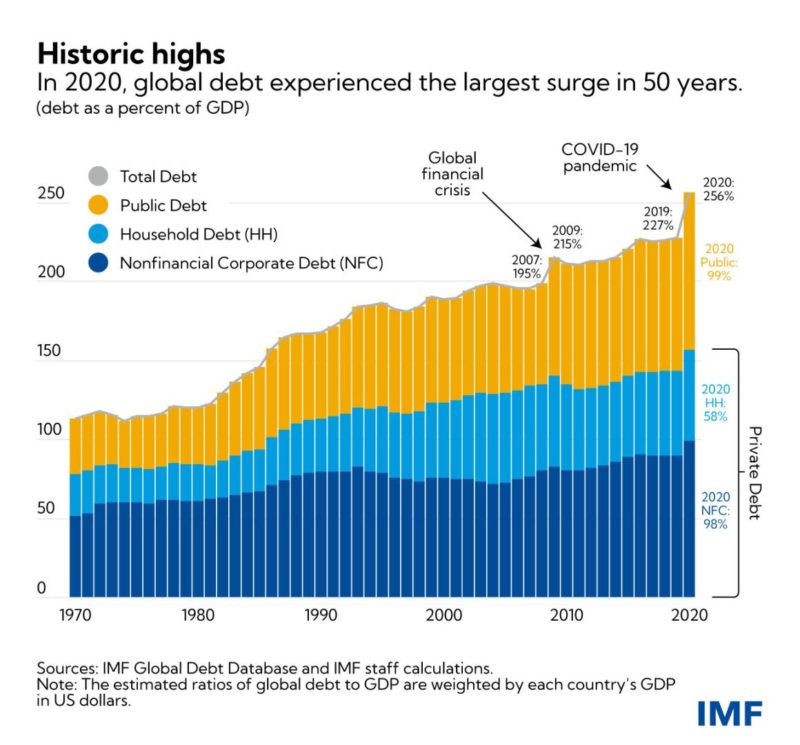

Roots of Our Current Inflation: A Deeply Flawed Monetary System

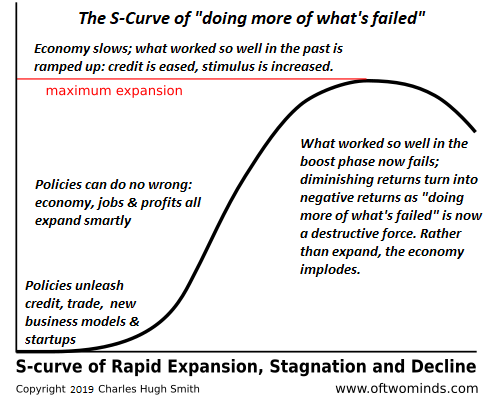

A monetary system that allows the creation of money out of thin air is vulnerable to the fits of credit expansion and credit contraction. Periods of credit expansion typically occur over many years and even decades while the phases of credit contraction happen like sudden implosions. The monetary policy makers tend to promote the prolongation of credit expansion because they fear deflation.

Read More »

Read More »

Bitcoin verliert erneut an Boden

Die letzten Tage wirkte es, als hätte der Bitcoin einen stabilen Support in der Nähe von 40.000 US-Dollar gefunden. Doch gegen Ende der Arbeitswoche ging deutlich runter – der Kurs verlor in der Spitze fast 15 Prozent. Der gesamte Markt folgte dem BTC-Trend. Bitcoin News: Bitcoin verliert erneut an BodenHeute sind es immerhin noch ungefähr 7 Prozent Kursminus im Wochenvergleich, so dass der Bitcoin aktuell nur noch 36.000 US-Dollar wert ist. Der...

Read More »

Read More »

The Week Ahead: US CPI and PPI Set to Soften

The Fed's 50 bp rate hike is behind us. Another 50 bp hike is expected next month. The April

employment report will do little to calm the anxiety about the "too tight" labor market.

Read More »

Read More »

The Contrarian Curse

What if all the new consensus memes are as wrong as the ones they replaced? I have the Contrarian Curse, and I have it bad. The Contrarian Curse is: as soon as the herd adopts your previously contrarian view, you start questioning the new consensus, just as you questioned the previous consensus.

Read More »

Read More »

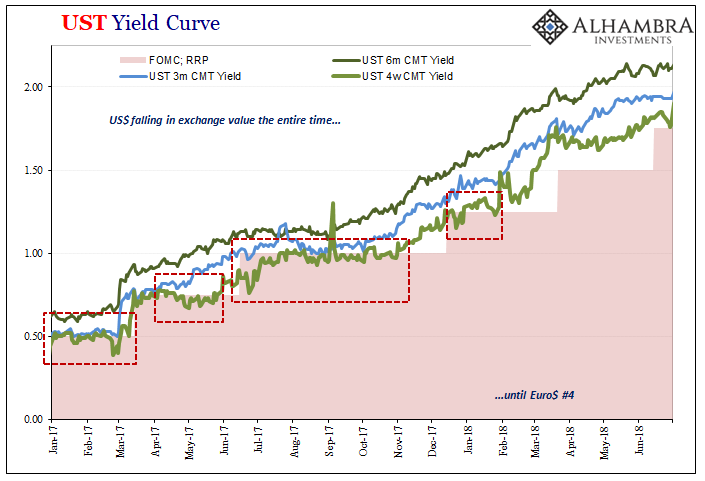

Collateral Shortage…From *A* Fed Perspective

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods....

Read More »

Read More »

Expect Washington to Throw a Fit over China’s New Deal with the Solomon Islands

Washington regards the entire world as its "sphere of influence." But now Beijing is looking to follow the US playbook on hegemony and expand Beijing's network of military bases abroad.

Read More »

Read More »

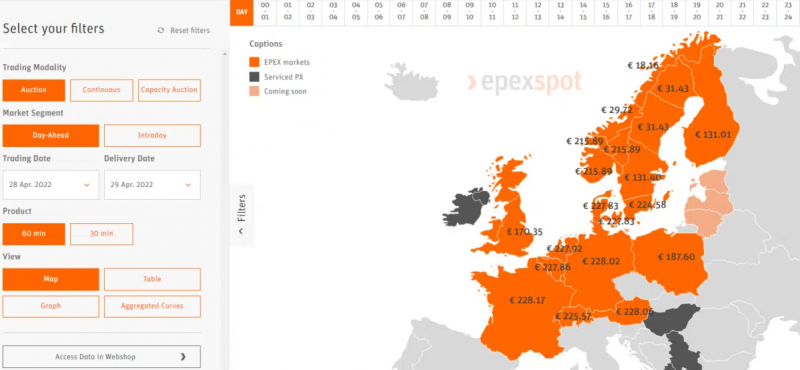

The EU energy price crisis – is the market design to blame?

The electricity prices reflect the supply and demand conditions in Europe and interfering with the price formation mechanism would have dangerous consequences.

Read More »

Read More »

Swiss central bank rejects ‘creative’ demands to change course

The Swiss National Bank (SNB) continues to beat off demands to fight inflation by raising interest rates and to distribute more reserves to cantons and other causes.

Read More »

Read More »

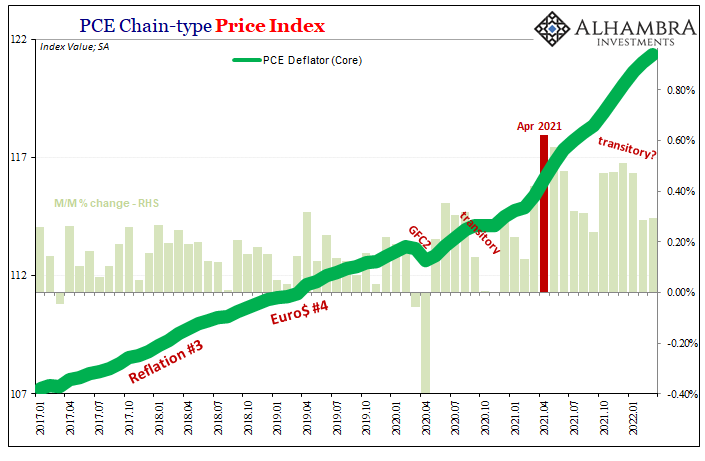

Some ‘Core’ ‘Inflation’ Difference(s)

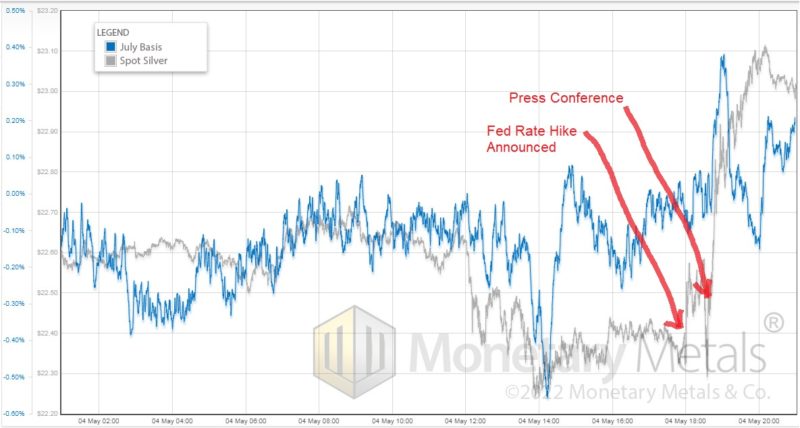

The FOMC meets next week, with everyone everywhere expecting a 50 bps rate hike to be announced on Wednesday. Yesterday’s “unexpected” and “shocking” negative GDP is unlikely to deter anyone on the committee.

Read More »

Read More »

What Determines Interest Rates? Comparing Mainstream Economics to the Austrian School

The conventional view among mainstream economists, as presented by Milton Friedman, is that three factors determine market interest rates: liquidity, economic activity, and inflationary expectations. In this viewpoint, whenever the central bank raises the growth rate in the money supply by buying financial assets such as Treasurys, this pushes the prices of Treasurys higher and their yields lower.

Read More »

Read More »

The Fed’s New “Tightening” Plan Is Too Little, Too Late

Since 2008, a key component of Fed policy has been to buy up mortgage-based securities and government debt so as to both prop up asset prices and increase the money supply. Over this time, the Fed has bought nearly $9 trillion in assets, thus augmenting demand and increasing prices for both government bonds and housing assets.

Read More »

Read More »

Erstes Land bietet Steuervorteile für Crypto Mining mit erneuerbarer Energie

Schon ab diesem Monat ist es möglich für Crypto Miner Steuervergünstigungen zu erhalten, wenn sie fürs Mining erneuerbare Energien nutzen – zumindest in Usbekistan. Damit versucht das Land die Miner von Kohleenergie wegzuholen und gleichzeitig grüne Politik zu unterstützen. Crypto News: Erstes Land bietet Steuervorteile für Crypto Mining mit erneuerbarer EnergieVor allem Solarenergieprojekte sollen so in Usbekistan finanziert werden.Länder in...

Read More »

Read More »

FIFA Announces Partnership With Blockchain Company Algorand

FIFA has teamed up with Zug based blockchain technology company Algorand to agree a sponsorship and technical partnership deal. The agreement means Algorand will become the official blockchain platform of FIFA and provide the official blockchain-supported wallet solution.

Read More »

Read More »

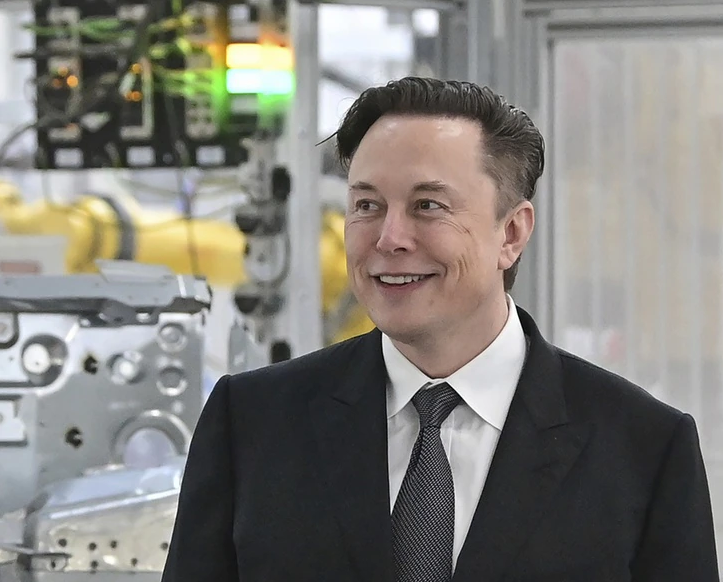

Historians trace Elon Musk’s Swiss roots to Emmental

Tesla CEO Elon Musk has roots in a small, picturesque farming region in central Switzerland. Using genealogy websites and local archives, historians have been able to connect Musk with the Haldimann name, which is still present in the Emmental region today.

Read More »

Read More »