Monthly Archive: April 2022

And Now for a Really Bad Response to Political Calamity: Autarky

The invasion of Ukraine, the spike in inflation and the risks of supply shortages have made some politicians dust off some of the worst economic ideas in history: autarky and protectionism. Some believe that if our nation produced everything we needed we would all be better off because we would not depend on others. The idea comes from a deep lack of understanding of economics.

Read More »

Read More »

Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an "expeditious" campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower.

Read More »

Read More »

Meta plant Implementierung von Cryptocoins

Unter dem Namen „Meta“ hat Mark Zuckerberg erst vor kurzem sein Unternehmen neu aufgestellt. Das mit dem Unternehmen verbundene Metaverse soll nicht nur die Social Media Plattform Facebook beinhalten, sondern einer ganzen Familie an Apps ein Zuhause bieten. Für die Finanzabwicklung im Metaverse wird offenbar sogar an einem eigenen Cryptocoin gearbeitet.

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

75 percent of Swiss citizens living abroad have more than one nationality

07.04.2022 - At the end of 2021, more than one in ten Swiss citizens lived abroad. This was a 1.5% increase compared with 2020. Most of these citizens lived in Europe. Regardless of the continent in which they lived, the majority were aged between 18 and 64. Reflecting Switzerland's multicultural nature, many of them also had more than one nationality, according to the results of the statistics on the Swiss abroad from the Federal Statistical...

Read More »

Read More »

Ukraine war no threat to Swiss banks, says financial watchdog

Switzerland’s financial market supervisor FINMA says the Russian invasion of Ukraine isn’t a wide-scale threat to Swiss financial firms’ business ties to Russia.

Read More »

Read More »

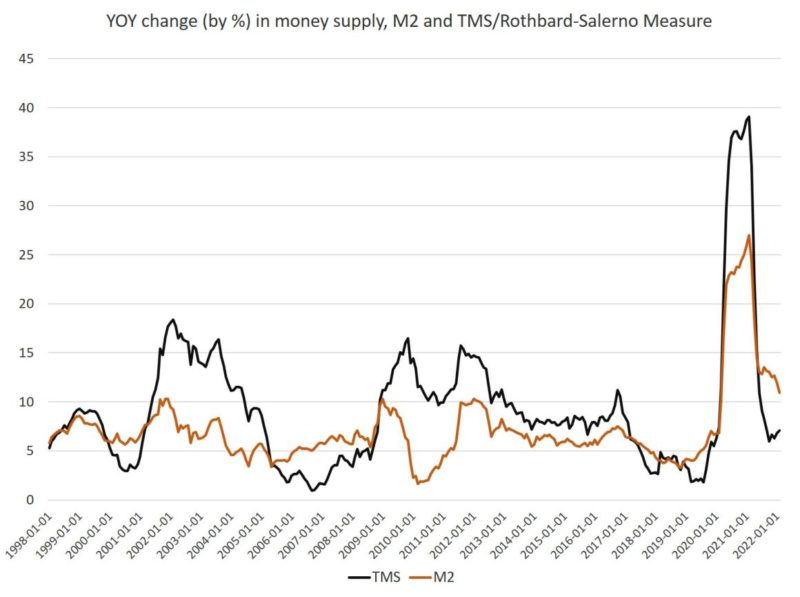

Money Supply Growth Heads Back Up: February Growth Up to 7 Percent

Money supply growth rose for the third month in a row in February, continuing ongoing growth from October's twenty-one-month low. Even with February's rise, though, money supply growth remains far below the unprecedented highs experienced during much of the past two years.

Read More »

Read More »

UBS-Präsident Axel Weber verabschiedet sich mit Genugtuung

"Ich habe vor zehn Jahren die Nachfolge von Kaspar Villiger angetreten, der die Bank in den Wirren der Finanzkrise übernahm", sagte Axel Weber am Mittwoch in einer Abschiedsrede an seiner letzten UBS-Generalversammlung zu den Aktionären.

Read More »

Read More »

Ukrainian refugees can benefit Swiss economy, says expert

Switzerland can cope with a large number of Ukrainian refugees, and their skills can benefit the economy, says migration expert Thomas Kessler. “The Ukrainian women will provide new impetus in this country,” he told the SonntagsBlick newspaper. “Especially in the IT sector, the Ukrainians are more advanced than Switzerland. In addition, it is normal in Ukraine for women to study natural sciences.”

Read More »

Read More »

Bitcoin: ein Freiheitsprojekt in Gefahr

Seit einigen Jahren herrscht ein Machtkampf zwischen Bitcoin (BTC) einerseits und dem Staat, den Banken und Zentralbanken andererseits. Die größte Gefahr für BTC ist der Staat mit seinen Gesetzen und Regulierungen. Geld ist Macht und Macht gibt der Staat nie freiwillig her. Leider verschiebt sich aber die Machtbalance mehr und mehr zum Staat.

Read More »

Read More »

Putin’s Inflation? Homegrown Modern Monetary Theory Is to Blame

Prices of goods and services in the economy seem to be going through the roof, and both consumers and producers suffer from the falling value of their money. Unfortunately, the public turns to politicians in Washington and economists around the world for answers.

Read More »

Read More »

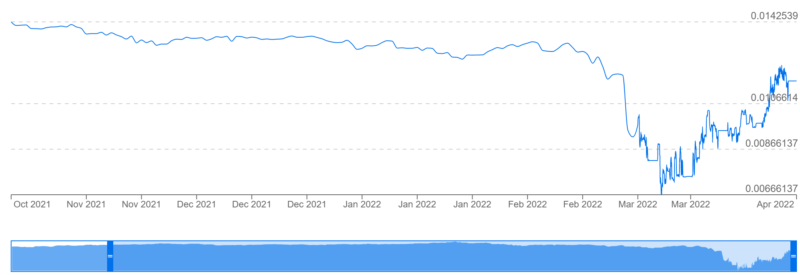

Elon Musk kauft Twitter und Dogecoin legt wieder zu

Der berühmte Unternehmer Elon Musk hat zu Beginn der Woche für einen Medien-Hype gesorgt. Er kaufte Twitter-Aktien in großem Stil. Als die Nachricht publik wurde, explodierte Dogecoin in der Hoffnung, Twitter könnte den Meme-Coin mit Musk’s Hilfe auf der Plattform implementieren. Crypto News: Elon Musk kauft Twitter und Dogecoin legt wieder zuDer Trend schaute für DOGE schon in der letzten Woche positiv aus, doch durch die Übernahme Twitters wurde...

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

Pointing the Accusatory Finger at Russia

I’m fascinated by the mainstream media’s overwhelming focus on Russia’s war crimes in Ukraine while, at the same time, remaining steadfastly silent about the horrific and disgraceful mistreatment and imminent extradition of Julian Assange to the United States. After all, one of the big reasons that U.S. officials have targeted Assange is his disclosure of war crimes by the U.S. military in Iraq.

Read More »

Read More »

Bankruptcies rise as coronavirus bail-outs phase out

The number of companies and individuals declaring bankruptcy rose 9.1% last year, which coincided with a gradual withdrawal of state-backed financial support during the Covid-19 pandemic.

Read More »

Read More »

Weekly Market Pulse: What Now?

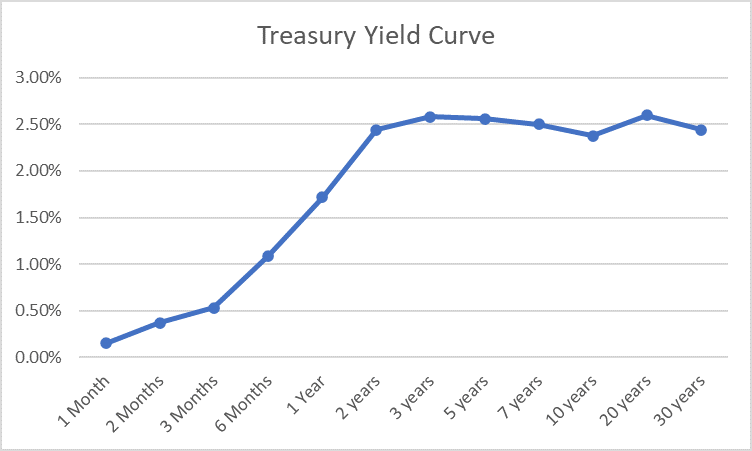

The yield curve inverted last week. Well, the part everyone watches, the 10 year/2 year Treasury yield spread, inverted, closing the week a solid 7 basis points in the negative. The difference between the 10 year and 2 year Treasury yields is not the yield curve though. The 10/2 spread is one point on the Treasury yield curve which is positively sloped from 1 month to 3 years, negatively sloped from 3 years to 10 years and positively sloped again...

Read More »

Read More »

Ukraine refugees struggle to exchange cash into Swiss francs

Thousands of Ukrainian refugees are finding that Swiss banks are refusing to convert the cash they brought with them into francs.

Read More »

Read More »

The Short, Sweet Income Case For Ugly Inversion(s), Too

A nod to just how backward and upside down the world is now. The economic data everyone is made to pay attention to, payrolls, that one is, in my view, irrelevant. As is the consumer price estimates from earlier this week, the PCE Deflator. That’s another one which receives vast amounts of interest even though it is already old news.

Read More »

Read More »