Monthly Archive: April 2022

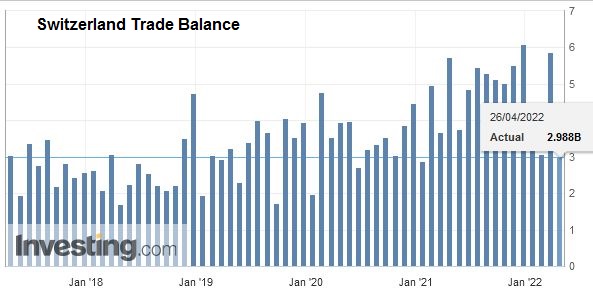

Swiss Trade Balance Q1 2022: foreign trade chain record upon record

Swiss foreign trade also grew in the 1st quarter of 2022, climbing to a record level. Imports strengthened further (+6.7%) while exports lost ground somewhat (+1.2%). Both at entry and exit, prices stood at very high levels. Due to different trends in the two directions of traffic, the trade balance surplus fell sharply (–2.8 billion francs).

Read More »

Read More »

How Did CNN+ Get Canned by Netflix? Austrian Economists Might Have an Answer

Days after Netflix reported bad earnings and an “unexpected” hit to their subscriber base, CNN announced that it had pulled the plug on its own brand-new streaming service, CNN+. Despite arguments to the contrary from the parent company, the CNN+ adventure turned out to be a costly mistake that attracted few subscribers and a paltry number of regular viewers.

Read More »

Read More »

Euro$ #5 in Goods

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one?

Read More »

Read More »

Elon Musk kauft Twitter und Crypto Twitter ist in aller Munde

Eigentlich galt Elon Musks Angebot an Twitter als primär politisch motiviert. Musk positionierte sich als Free Speech Aktivist, der Twitter übernehmen wolle, um den freien Austausch von Ideen wieder möglich zu machen. Kurz nachdem die Übernahme offiziell wurde, reagierte auch die Crypto Community euphorisch.

Read More »

Read More »

Geldcast update: calls for a more transparent Swiss National Bank

The Swiss National Bank (SNB) is very opaque by international standards. That has to change, says Yvan Lengwiler, professor of economics at the University of Basel. He explains his proposals in the latest Geldcast update.

Read More »

Read More »

Warum man „Inflation“ nicht messen kann

Über „die Inflation” wird viel Irreführendes geredet. Von Politikern, Zeitkommentatoren und selbst von manchen Ökonomen. Schon die am meisten verbreitete Definition ist falsch. So heißt es, „Inflation” sei ein anhaltender Anstieg der Preise. Weiterhin wird behauptet, dieser Anstieg ließe sich messen und demnach ergebe sich das „Preisniveau” und die „Inflationsrate”.

Read More »

Read More »

Crash Is King

This may be one of many revaluations of capital vis a vis labor and resources and core vis a vis periphery. You've heard the expression "cash is king." Very true. But it's equally true that "crash is king:" when speculative excesses collapse under their own extremes, the crash crushes all other narratives and becomes the dominant dynamic.

Read More »

Read More »

War in Ukraine – Week 8

4-year old Alisa is begging to be evacuated from under siege Mariupol. So are thousands of others after about 50 days underground. But russia won’t allow it. They are holding these people hostage, watching them die slowly and painfully one by one. Source: Nataliya Melnyk on Facebook

Read More »

Read More »

China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar.

Read More »

Read More »

Vietnam Should Have Been the End of US Foreign Intervention. It Wasn’t, and the World Is Worse Off

In 1975, after nearly a decade of outright conflict, the United States government abandoned its doomed escapade in Vietnam. It left a devastated country and over a million corpses in its wake. The corrupt South Vietnamese regime, already teetering on utter collapse, completely dissolved without American support.

Read More »

Read More »

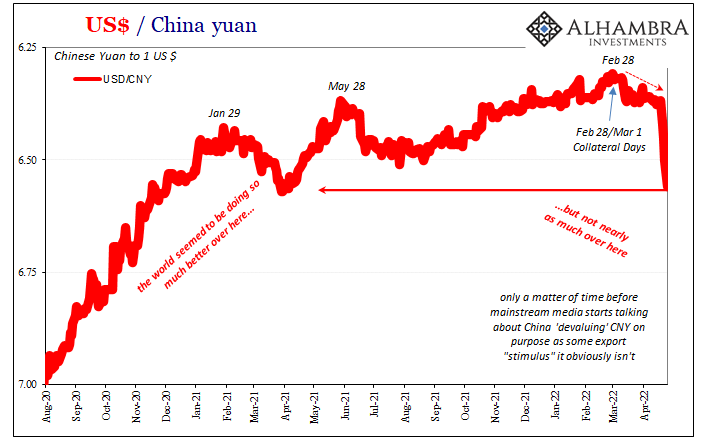

CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss.

Read More »

Read More »

The (less) Dollars Behind Xi’s Shanghai of Shanghai

What everyone is saying, because it’s convenient, is that China’s zero-COVID policies are going to harm the economy. No. Economic harm of the past is the reason for the zero-COVID policies. As I showed yesterday, the cracking down didn’t just show up around 2020, begun right out in the open years beforehand, born from the scattering ashes of globally synchronized growth.

Read More »

Read More »

Swiss technology foils Russian censorship

The Swiss software Kiwix enables the user to copy entire websites so they can be accessible offline. Now that Wikipedia risks sanction in Russia because of its content on the Ukraine war, downloads of the free online encyclopaedia using Kiwix are off the charts.

Read More »

Read More »

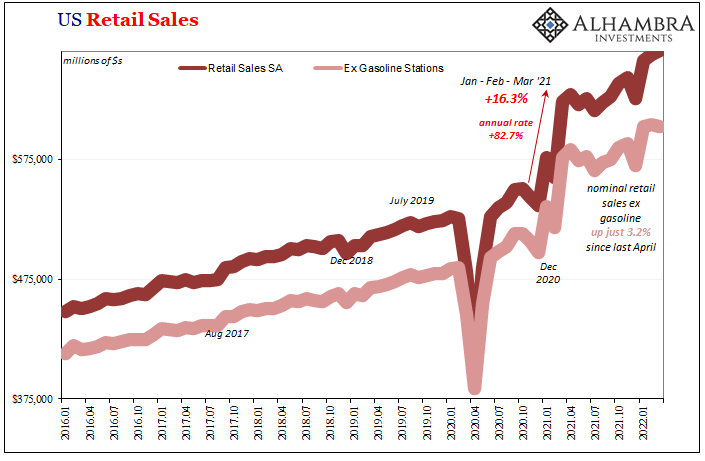

Not Good Goods

The goods economy in the United States is – maybe was – the lone economic bright spot. That in and of itself should’ve provoked more caution, instead there was the red-hot recovery to sell under the cover of supply shock pricing changes. The sheer spending on goods, and how they arrived, each unabashedly artificial from the get-go.

Read More »

Read More »

Mises in America

[William Peterson was the 2006 Schlarbaum laureate, and here is his acceptance speech, delivered October 8, 2005.]

Gary Schlarbaum, I thank you for this award and high honor from your grand legacy in loving memory of a genius in our time, Ludwig von Mises (1881–1973). But let me say up front, fellow Miseseans, meet me, Mr. Serendipity, Bill Peterson, here by a fluke, a child of fickle fate. For frankly I had never heard of the famous Mises when I...

Read More »

Read More »

Teilt Binance Nutzerdaten mit Russland?

Reuters hat gegen Ende der Woche gemeldet, dass die weltweit größte Crypto-Börse Binance Nutzerdaten mit staatlichen russischen Instituten teilen würde. Laut Reuters wurden diese Daten vor allem vom russischen Sicherheitsdienst genutzt, um Kriminalität im eigenen Land zu bekämpfen. Doch Binance verneinte diese Anschuldigungen nun. Crypto News: Teilt Binance Nutzerdaten mit Russland?In einem konkreten Fall ging es um finanzielle Unterstützung des...

Read More »

Read More »

Shanghai’s Current Plight Began in 2017

The first chapters to China’s new story now playing out in Shanghai were written down in October 2017. Planning for them had begun years earlier, their author Xi Jinping requiring more research before committing them to paper. Communist authorities there had grown increasingly concerned about the lack of growth potential for its political system by then utterly dependent for a quarter-century on the economy growing.

Read More »

Read More »

The ‘Friend- Shoring’ of Gold- A New World Order?

2022-04-24

by Stephen Flood

2022-04-24

Read More »