Home › 1) SNB and CHF › 1.) Forex Live Based CHF SNB › SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

Previous post

Next post

SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

- Vulnerabilities have increased and Swiss real estate market

- Swiss apartments overvalued by 10% to 35%

- SNB continues to monitor developments in real estate market

- It is not roll of monetary policy to curb risk to financial system

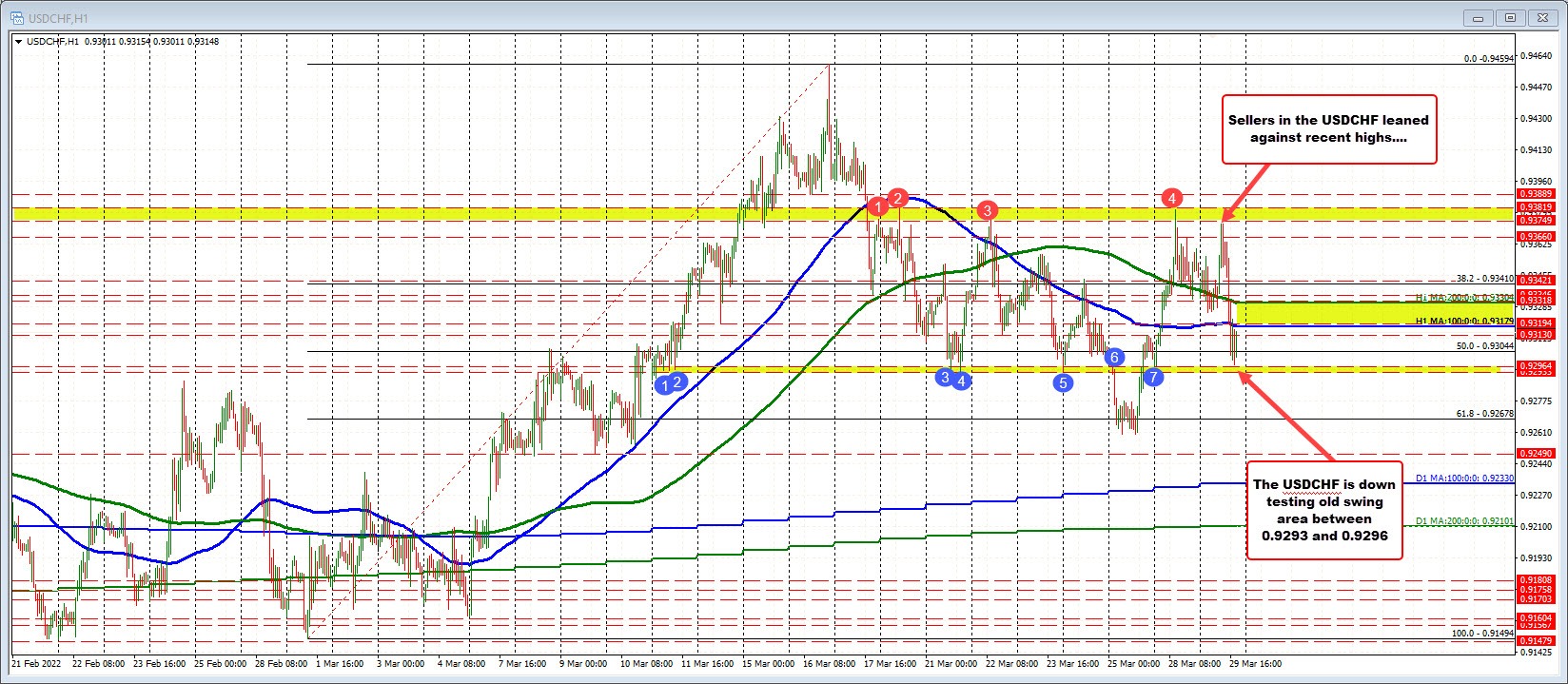

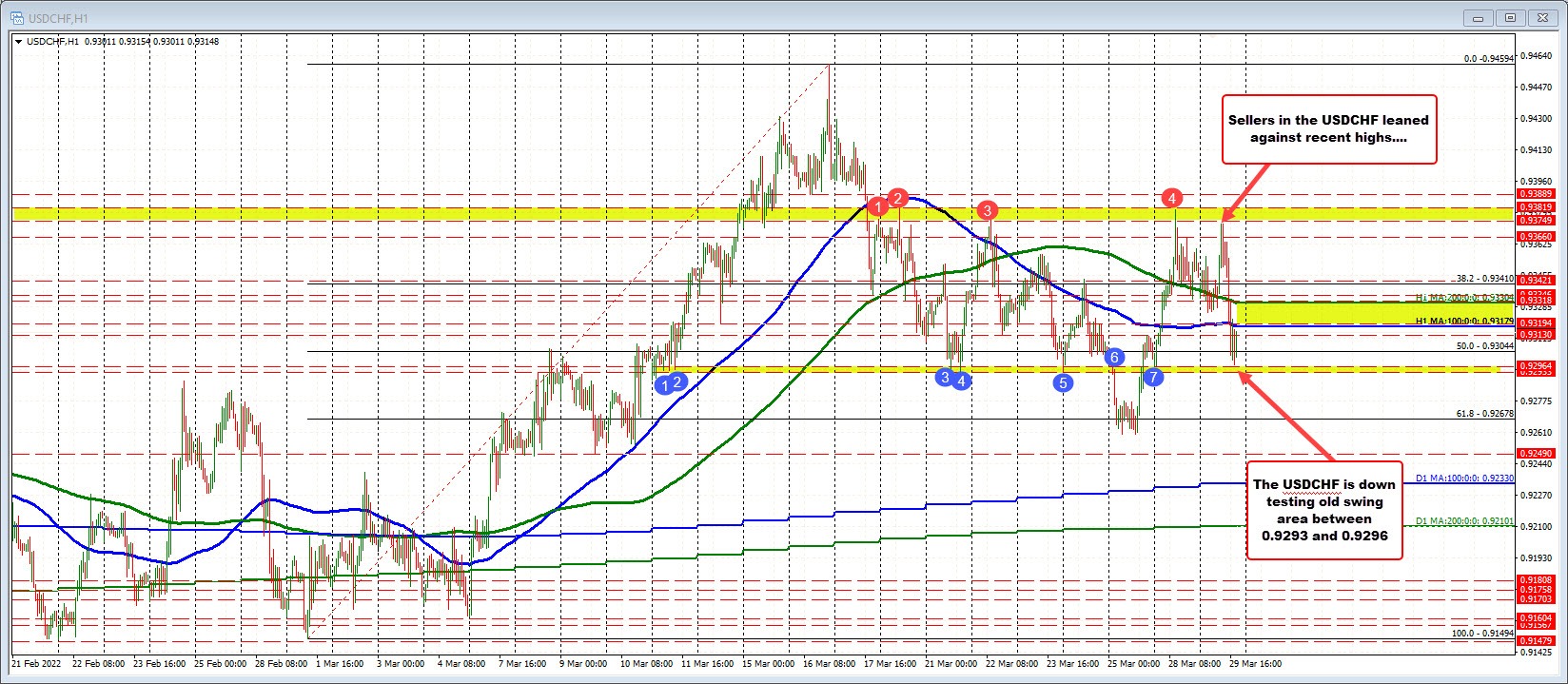

The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304.

However at the low today, the pair did find support against what has been a swing area between 0.9293 and 0.92964.

The price did move below that swing area last Friday, but rebounded and closed back above the level. On Monday, the low price stalled against the level and pushed higher reestablishing the area as support.

The high price today did find resistance against another swing area this time at the highs between 0.93749 and 0.93819.

|

USDCHF moves from an upper extreme to a lower extreme today |

Full story here

Are you the author?

Previous post

See more for 1.) Forex Live Based CHF SNB

Next post

Tags:

central-banks,

Featured,

newsletter

Permanent link to this article: https://snbchf.com/2022/03/michalowski-snb-zurbruegg-monetary-policy-risks-financial-system/