Category Archive: 1.) Forex Live Based CHF SNB

SNB’s Jordan: I’m not sure whether if the terminal rate has been reached

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Read More »

Read More »

CHF traders take note – SNB Chair Jordan is speaking on Tuesday

High risk warning:

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks...

Read More »

Read More »

While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention!

A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight:

ECB Knot: ECB can be expected to keep raising rates for quite some time after March

ECB can be expected to keep raising rates for quite some time after March

And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again

We can use interest rates but also sell foreign...

Read More »

Read More »

Week Ahead: Highlights include Fed, US CPI; ECB, BoE, SNB, Norges Bank

MON: UK GDP Estimate (Oct), Chinese M2/New Yuan Loans (Nov).TUE: OPEC MOMR; BoE Financial Stability Report; German CPI Final (Nov), UK

Unemployment Rate (Oct)/Claimant Count (Nov), EZ ZEW (Dec), US CPI (Nov),

Japanese Tankan (Q4), New Zealand Current Account (Q3).WED: FOMC Policy Announcement, IEA OMR; UK CPI (Nov), Swedish CPIF (Nov), EZ

Industrial Production (Oct), US Export/Import Prices (Nov), Japanese

Exports/Imports (Nov).THU: ECB, BoE,...

Read More »

Read More »

Barclays forecasts EURCHF trading around parity for the next few quarters

Barclays Research discusses CHF outlook and targets EUR/CHF around 0.97, 0.97, 0.98, and 1.00 by end of Q1, Q2, Q3, and Q4 of next year respectively.

Read More »

Read More »

SNB’s Jordan: Monetary policy is is still expansionary

SNB's Jordan, who has been chatting more in the NY session at least of late, is no the wires saying:monetary policy is a still expansionarywe have most likely to adjust monetary policy againinflation is very thorny and there is still a risk that inflation will rise furtherinflation rate is above our target now.

Read More »

Read More »

Federal Reserve speakers coming up on Wednesday, 9 November 2022 – Williams, Barkin

The talking heads at the US Federal Reserve have pivoted to talking about how high rates will go before they top out as against how quickly they will rise.

Read More »

Read More »

SNB’s Jordan: Central Bank Independence is crucial to fight inflation effectively

SNB Jordan is on the wires speaks in general terms:

Central bank independence is crucial to fight inflation effectively.

Read More »

Read More »

CHF traders – heads up for a SNB speaker Wednesday, 5 October 2022 – Maechler

Swiss National Bank monetary policymaker Andrea Maechler is speaking at 1130 GMT, at an event titled: After the interest rate change: high inflation, rising interest. How will it affect the Swiss economy?

Read More »

Read More »

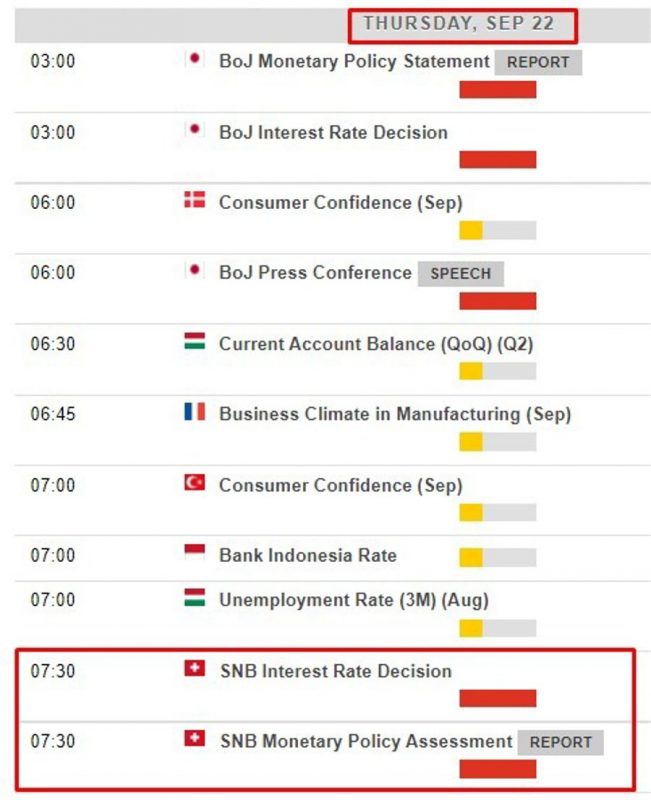

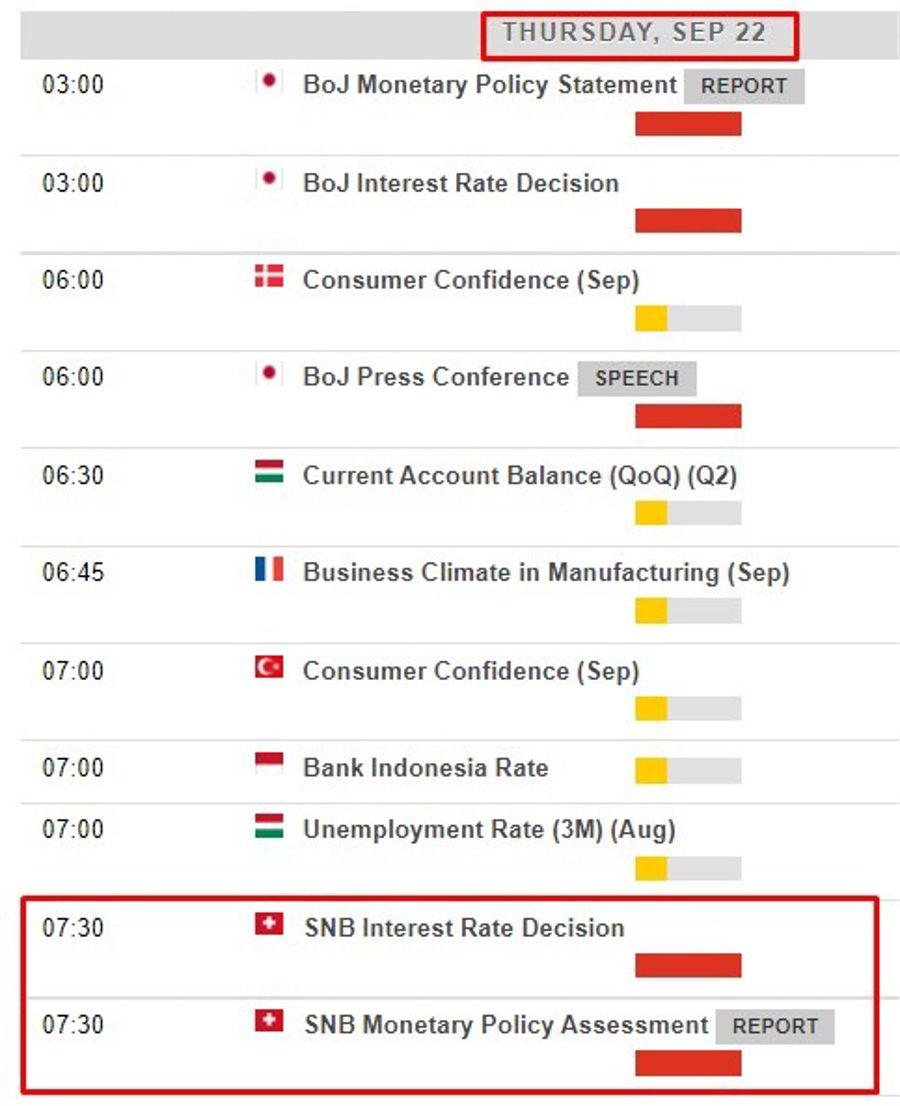

Swiss National Bank meet this week, a 100bp rate hike on the table – CHF impact

The SNB policy decision is due on Thursday. Via MUFG Bank:CHF has been the top performing G10 currency so far this month as it has strengthened sharply against both the EUR (+2.2%) and USD (+1.5%). It has regained upward momentum against our equally-weighted basket of other G10 currencies after a period of consolidation at higher levels between July and August.

Read More »

Read More »

Week Ahead Preview: FOMC is the highlight

MON: Japanese Respect for the Aged Day; EZ Construction Prices (Jul), Canadian Producer Prices (Aug), German Producer Prices (Aug). TUE: Chinese LPR, Riksbank Policy Announcement, RBA Minutes (Sep); Japanese CPI (Aug), EZ Current Account (Jul), US Building Permits/Housing Starts (Aug), Canadian CPI (Aug).

Read More »

Read More »

BOC’s Rogers: We are not where we were in July, but a long way from where we need to be

Bank of Canada's Senior Deputy Gov. Carolyn Rogers: We are not where we were in July, but we are a long way from where we need to be.

Read More »

Read More »

More from SNB’s Jordan: No comment on currency invention. We don’t rule anything out

Looks at series of models to gauge Swiss francs value; market has to live with some volatility, no comment on currency intervention.

Read More »

Read More »

SNB’s Jordan: We must ensure price stability over medium-term

SNB's Jordan is on the wires after the ECB hike rates by 75 basis points today:

ECB 75 basis point rate hike not fully surprising.

Read More »

Read More »

FX intervention watch – Swiss National Bank edition – too early for the CHF

This via the folks at eFX.

Credit Agricole CIB Research argues that it would be premature for the SNB to resume its intervention against CHF strength around current levels.

Read More »

Read More »

Swiss National Bank President Jordan warned of persistently higher inflationary pressure

Swiss National Bank President Thomas Jordan spoke at the Federal Reserve’s annual Jackson Hole symposium on Saturday.“Structural factors such as the transition to a greener economy, rising sovereign debt worldwide, the demographic transition and ultimately also the fact that globalization appears to have peaked -- at least temporarily -- could lead to persistently higher inflationary pressure in the coming years”

Read More »

Read More »

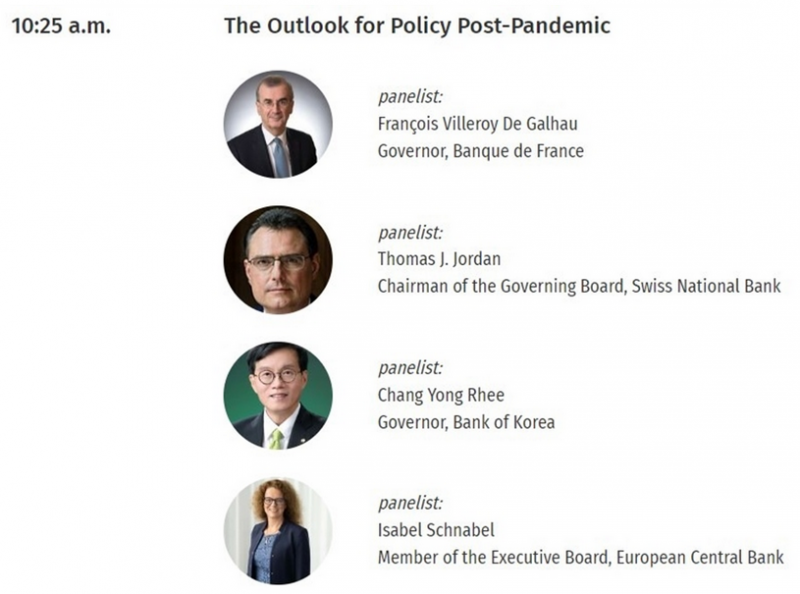

Heads up for ECB, SNB, BoK speakers over the weekend

On Saturday at the Jackson Hole symposium there will be speakers from the European Central Bank, Swiss National Bank and Bank of Korea.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

SNB’s Jordan: Inflation will temporarily rise above target then fall quickly

We take into account the higher inflation rates abroad when deciding monetary policy. We are ready to intervene in FX when necessary. Negative rates and currency interventions necessary for SNB to meet its mandate.

Read More »

Read More »